- Home

- »

- Conventional Energy

- »

-

Small-scale LNG Market Size, Share & Growth Report, 2030GVR Report cover

![Small-scale LNG Market Size, Share & Trends Report]()

Small-scale LNG Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Liquefication Terminal, Regasification Terminal), By Mode Of Supply, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-396-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small-scale LNG Market Summary

The global small scale LNG market size was estimated at USD 52.31 billion in 2023 and is projected to reach USD 131.78 billion by 2030, growing at a CAGR of 14.1% from 2024 to 2030. Increasing demand for cleaner energy sources, particularly in remote areas and emerging economies is driving the growth of market.

Key Market Trends & Insights

- The small-scale LNG market in Asia Pacific dominated the market and accounted for the largest revenue share of over 38.0% in 2023.

- North America small-scale LNG market is projected to witness significant growth.

- Based on mode of supply, trucks segment registered largest revenue market share of over 53.0% in 2023.

- In terms of type, liquefaction terminal type segment accounted for the highest revenue market share of over 61.0% in 2023.

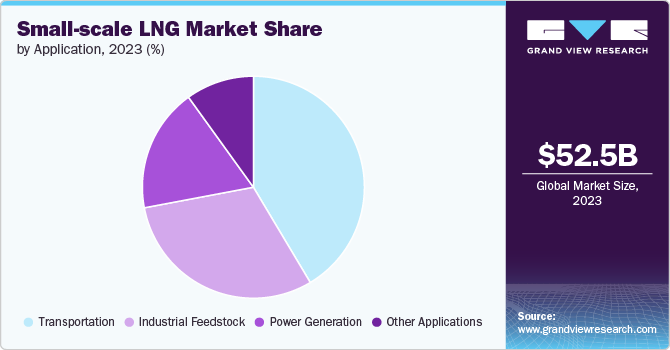

- Based on application, transportation application segment registered highest revenue market share of over 41.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 52.31 Billion

- 2030 Projected Market Size: USD 131.78 Billion

- CAGR (2024-2030): 14.1%

- Asia Pacific: Largest market in 2023

Besides, small-scale LNG facilities offer a flexible and environmentally friendly alternative to traditional fossil fuels, making them attractive for power generation, industrial applications, and transportation. Additionally, the development of infrastructure and technology that enables the efficient production, transportation, and distribution of LNG on a smaller scale is positively influencing the market. This includes advancements in modular liquefaction plants, small-scale storage tanks, and specialized LNG carriers.

The transportation sector has also been a significant driving force for the market. As environmental regulations become stricter, particularly in the maritime industry, many shipping companies are turning to LNG as a cleaner alternative to traditional marine fuels. This has led to the development of LNG bunkering facilities in ports around the world, such as Rotterdam in the Netherlands and Singapore, which can supply LNG to ships as fuel.

The growth of the market is further supported by government initiatives and policies promoting the use of natural gas and LNG. For instance, China has been actively encouraging the use of LNG in vehicles and small-scale power generation as part of its efforts to reduce air pollution. Similarly, countries in Southeast Asia, such as Indonesia and the Philippines, are exploring small-scale LNG solutions to provide power to their numerous islands where traditional gas pipeline infrastructure is not feasible.

Mode of Supply Insights

Trucks segment registered largest revenue market share of over 53.0% in 2023. Based on the mode of supply, the market is segmented into trucks, trans-shipment & bunkering, and others. Trucks segment involves the transportation of liquefied natural gas (LNG) using specialized cryogenic tanker trucks. These trucks are designed to maintain the extremely low temperatures required to keep natural gas in its liquid state. This mode of supply is particularly useful for delivering LNG to areas that are not connected to pipeline networks or for supplying smaller quantities to industrial customers, fueling stations, or remote power generation facilities.

Trans-shipment refers to the transfer of LNG from one vessel to another, often from larger carriers to smaller ships for regional distribution. Bunkering involves the fueling of ships with LNG as a marine fuel. This segment has grown in importance due to stricter environmental regulations in the shipping industry, prompting a shift towards cleaner fuels like LNG. Purpose-built bunkering vessels and terminals facilitate the transfer of LNG to ships in ports or at sea.

Type Insights

Liquefaction terminal type segment accounted for the highest revenue market share of over 61.0% in 2023. Based on the type, the market is segmented into liquefication terminals and regasification terminals. Liquefaction terminals enable the production and transportation of LNG to remote areas and smaller markets that are not accessible by large-scale LNG infrastructure. This flexibility makes them more attractive and necessary for expanding the LNG market.

Regasification terminals in the market are facilities that receive liquefied natural gas and convert it back into its gaseous state for end-use consumption. These terminals are typically smaller than traditional large-scale facilities and are often situated closer to end-users or distribution points.

Application Insights

Transportation application segment registered highest revenue market share of over 41.0% in 2023. Based on the application, the market is segmented into transportation, industrial feedstock, power generation, and other applications. Small-scale LNG is increasingly used as a cleaner alternative fuel for vehicles, ships, and trains. In the transportation sector, it offers lower emissions compared to traditional fuels such as diesel, making it attractive for fleets looking to reduce their environmental impact. LNG-powered vehicles are particularly popular in heavy-duty transport, such as long-haul trucks and buses, where battery electric options may be less practical due to range limitations.

Small-scale LNG serves as a valuable feedstock for various industrial processes. It can be used in manufacturing plants, chemical production facilities, and other industrial applications where natural gas is required as a raw material or energy source. The ability to deliver LNG in smaller quantities allows industries in remote areas or those not connected to pipeline networks to access this versatile fuel for their operations.

Moreover, Small-scale LNG plays a crucial role in power generation, especially in areas with limited access to traditional energy grids. It can fuel small to medium-sized power plants, providing electricity to remote communities, industrial sites, or as a backup power source during peak demand periods. LNG-based power generation offers a cleaner alternative to diesel generators and can help balance intermittent renewable energy sources in hybrid power systems.

Regional Insights

North America small-scale LNG market is projected to witness significant growth. The region has abundant natural gas resources, particularly with the shale gas revolution in the U.S. This has led to increased production and a surplus of natural gas, making it economically viable to liquefy and distribute LNG on a smaller scale. For example, the Marcellus and Utica shale plays in the Appalachian Basin have significantly boosted natural gas production, creating opportunities for small-scale LNG projects to serve local and regional markets.

Asia Pacific Small-Scale LNG Market Trends

The small-scale LNG market in Asia Pacific dominated the market and accounted for the largest revenue share of over 38.0% in 2023. Rapid industrialization and urbanization in many Asian countries have led to a surge in energy demand. Countries such as China, India, and Southeast Asian nations are increasingly turning to LNG as a cleaner alternative to coal and oil. Small-scale LNG facilities offer flexibility in meeting this growing demand, especially in areas where large-scale infrastructure is not feasible or cost-effective. For example, Indonesia, an archipelago of over 17,000 islands, has been investing in small-scale LNG to provide power to its remote regions.

Southeast Asia Small-Scale LNG Market Trends

Southeast Asia small-scale LNG market is driven by increased energy demand, particularly in industrial and transportation sectors. Small-scale LNG provides a cost-effective and efficient way to meet this growing demand. In countries such as Thailand and Malaysia, small-scale LNG is being used to fuel industrial processes and power generation in areas not connected to the main gas grid. Additionally, the potential for LNG as a marine fuel is gaining traction, with Singapore positioning itself as a key LNG bunkering hub for the region.

Europe Small-Scale LNG Market Trends

The small-scale LNG market in Europe is expanding at a considerable rate. It has been at the forefront of environmental policies and regulations aimed at reducing greenhouse gas emissions. The European Union's commitment to achieving carbon neutrality by 2050 has driven the adoption of cleaner energy sources, including LNG. Small-scale LNG facilities offer a flexible and relatively low-emission alternative to traditional fossil fuels, making them particularly attractive in Europe's stringent regulatory environment. Countries such as Norway, Sweden, and the Netherlands have been early adopters, using small-scale LNG for marine transport, heavy-duty vehicles, and off-grid power generation.

Key Small-scale LNG Company Insights

The market is characterized by intense competition and rapid growth. Key players in this market include major oil and gas companies, as well as specialized LNG technology providers. Factors influencing market share include technological innovation, cost-effectiveness, and the ability to provide end-to-end LNG solutions. Companies are focusing on strategic partnerships, acquisitions, expansion, and investments in LNG infrastructure to strengthen their market position.

Key Small-scale LNG Companies:

The following are the leading companies in the small-scale LNG market. These companies collectively hold the largest market share and dictate industry trends.

- New Fortress Energy (NFE)

- Pavilion Energy

- DESFA

- Berkshire Hathaway Energy

- Honeywell International Inc.

- Excelerate Energy, Inc.

- Chiyoda Corporation

- Linde PLC

- Nikkiso

- Crowley LNG

- Tianjin Sinogas Repower Energy Co., Ltd.

- Petronet LNG Limited

- Stabilis Solutions, Inc.

- Hangzhou ASIA Chemical Engineering Co.,Ltd

- Shanghai Lianfeng Gas Co., Ltd

Recent Developments

-

In July 2024, DESFA, the Greek gas transmission system operator, is set to launch a new small-scale LNG station in Aspro Skydras, aiming to enhance the supply of liquefied natural gas (LNG) in the region. This facility is anticipated to support various applications, including transportation and industrial uses, and is part of DESFA's broader strategy to promote cleaner energy solutions and diversify the energy supply in Greece. The project is expected to contribute to the country's energy transition and bolster its role in the regional energy market.

-

In July 2024, New Fortress Energy (NFE) agreed to sell its small-scale liquefaction and storage facility located in Miami, Florida. The sale is expected to close in the third quarter of 2024, subject to customary terms and conditions. The Miami facility is capable of processing 100,000 gallons of natural gas daily, serving commercial, industrial, and transportation customers across South Florida and the Caribbean. Hence, this sale is part of NFE’s strategy to reduce debt and reinvest proceeds into high-return downstream projects. The Miami facility was NFE's inaugural asset, and its sale marks a significant step in the company's asset management strategy.

-

In April 2023, Pavilion Energy, a subsidiary of Temasek, loaded its first small-scale LNG cargo for Zhejiang Hangjiaxin Clean Energy, a city gas distributor in China. This operation was part of a 2021 agreement to deliver up to 0.5 Billion tonnes per annum of LNG to the Jiaxing LNG terminal in Zhejiang, China. This initiative underscores Pavilion Energy's commitment to strengthening Singapore's role as a regional LNG hub.

Small-scale LNG Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 59.74 billion

Revenue forecast in 2030

USD 131.78 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Mode of supply, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

New Fortress Energy (NFE); Pavilion Energy; DESFA; Berkshire Hathaway Energy; Honeywell International Inc.; Excelerate Energy, Inc.; Chiyoda Corporation; Linde PLC; Nikkiso; Crowley LNG; Tianjin Sinogas Repower Energy Co., Ltd.; Petronet LNG Limited; Stabilis Solutions, Inc.; Hangzhou ASIA Chemical Engineering Co.,Ltd; Shanghai Lianfeng Gas Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small-Scale LNG Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global small-scale LNG market report on the basis of mode of supply, type, application, and region:

-

Mode of Supply Outlook (Revenue, USD Billion, 2018 - 2030)

-

Trucks

-

Trans-shipment & Bunkering

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liquefication Terminal

-

Regasification Terminal

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Industrial Feedstock

-

Power Generation

-

Other Applications

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global market for small-scale LNG was estimated at around USD 52.31 billion in 2023 and is expected to reach around USD 59.74 billion in 2024.

b. The global market for small-scale LNG is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030, reaching around USD 131.78 billion by 2030.

b. The transportation application segment registered the highest revenue market share of over 41.0% in 2023. Small-scale LNG is increasingly used as a cleaner alternative fuel for vehicles, ships, and trains. In the transportation sector, it offers lower emissions compared to traditional fuels such as diesel, making it attractive for fleets looking to reduce their environmental impact.

b. Key players in the market include New Fortress Energy (NFE); Pavilion Energy, DESFA; Berkshire Hathaway Energy; Honeywell International Inc., Excelerate Energy, Inc., Chiyoda Corporation; Linde PLC, Nikkiso; Crowley LNG, Tianjin Sinogas Repower Energy Co., Ltd.; Petronet LNG Limited; Stabilis Solutions, Inc.; Hangzhou ASIA Chemical Engineering Co.,Ltd; and Shanghai Lianfeng Gas Co., Ltd.

b. The global small-scale LNG market is growing in remote areas and emerging economies. Small-scale LNG facilities provide a flexible and environmentally friendly alternative to traditional fossil fuels, making them appealing for power generation, industrial applications, and transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.