- Home

- »

- Next Generation Technologies

- »

-

Home Energy Management System Market Size Report 2030GVR Report cover

![Home Energy Management System Market Size, Share & Trends Report]()

Home Energy Management System Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By System, By Technology, By Application, By Deployment Type, By Residence Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-260-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

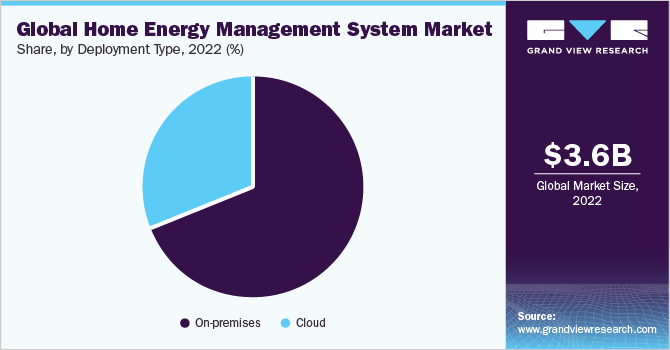

The global home energy management system market size was estimated at USD 3.64 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. Growing inclination towards efficient energy management is expected to play a key role in market growth. Moreover, reducing hardware and software costs and introducing smart utility meters provide several growth opportunities to market participants. The rapid progress in smart devices, energy-efficient appliances, and energy storage solutions has made home energy management systems (HEMS) more accessible and user-friendly.

Integrating the efficient home energy management system with smart grids enables consumers to optimize energy usage based on real-time grid data, thereby enhancing overall energy efficiency. The traditional energy grid faces challenges in meeting the ever-increasing demand for electricity, balancing supply and demand, and integrating renewable energy sources-smart grid technology, comprising advanced sensors, communication between the utility and consumers. Integrating smart grid features with HEMS enhances energy management capabilities at the household level, facilitating a more dynamic and responsive energy consumption. Smart grid-enabled HEMS can intelligently manage and store energy from renewable sources, such as solar panels and wind turbines, ensuring optimal utilization and reducing dependency on non-renewable energy.

Energy storage solutions are vital in addressing two critical challenges in ever-increasing energy consumption: the intermittent nature of renewable energy sources and peak demand management. The energy storage systems ensure a stable and reliable power supply by storing surplus energy during periods of low demand, releasing it during periods of low demand, and releasing it during peak hours. This enhances the system's overall efficiency and facilitates greater reliance on renewable energy sources like solar and wind power. Moreover, energy storage solutions provide backup power during grid outages, ensuring uninterrupted electricity supply and increasing the resilience of the energy management systems.

Energy storage systems support grid stability by absorbing excess energy during low-demand periods and injecting it back into the grid during peak demand, reducing fluctuations and ensuring a balanced power supply. Energy storage facilities enable the seamless integration of renewable energy sources into the grid. It stores surplus energy generated by renewables during periods of high production and releases it when generation is low, enhancing grid reliability.

Thermal energy storage (TES) is a crucial system component in HEMS, offering efficient and sustainable energy storage and management solutions. TES technologies store excess thermal energy during periods of low demand and release it when demand is high, providing a reliable and cost-effective way to optimize energy consumption. Traditional energy sources often need help meeting peak demand, resulting in higher electricity costs and grid strain. TES technologies offer a reliable and scalable solution to manage this disparity; by storing thermal energy during periods of low demand, such as night or off-peak hours, and releasing it during peak demand periods, TES optimizes energy consumption and reduces the need for expensive peak power generation.

Component Insights

Based on component, the hardware segment dominated the market in 2022 with a revenue share of more than 60%. The segment is likely to expand at a CAGR of 13.0% from 2023 to 2030, owing to changing and evolving demand for sustainable energy products such as smart meters, energy storage systems, smart thermostats, etc. Hardware components serve as the system's backbone, enabling real-time data acquisition, communication, and control of energy-consuming devices within a home. These components form a network that interacts with appliances, sensors, and energy storage solutions, facilitating intelligent energy management by monitoring electricity consumption, producing valuable insights, and enabling energy-efficient control strategies.

Software components have a market share of around 25.0% in 2022. Software's designed to analyze and optimize energy consumption patterns through data analytics and machine learning algorithms; these components can identify energy-intensive devices and activities, helping users understand their energy usage better. This information leads consumers to make informed decisions to reduce wastage and adopt energy-saving practices, leading to improved energy efficiency and reduced utility bills. Additionally, software-based energy optimization solutions can dynamically adjust energy usage based on real-time grid data, energy prices, and user preferences, enhancing overall efficiency. User-friendly interfaces are crucial for successful adoption and growth; software components enable intuitive and interactive interfaces that allow users to monitor and control their energy usage seamlessly.

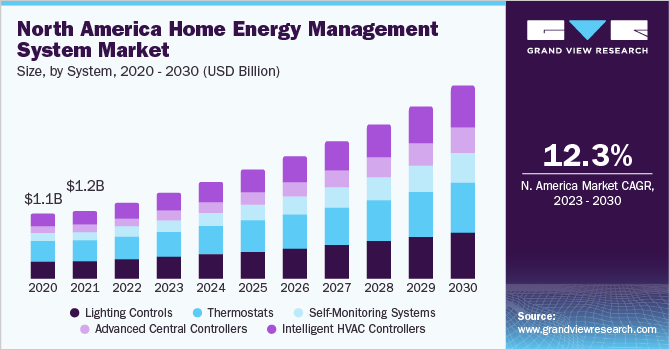

System Insights

In terms of systems, the thermostat system segment is anticipated to grow significantly and achieve a market share of around 27.0% in 2022. The rapid evolution of technology and the growing focus on sustainability have led to significant advancements in the market. Among the key components driving growth, thermostat systems are crucial in optimizing energy consumption and enhancing user comfort. It is an intelligent device that controls home and commercial HVAC systems (heating, ventilation, and air-conditioning). These smart thermostats use sensors, data analytics, and algorithms to regulate indoor temperature efficiently; integrating thermostat systems into the system allows users to monitor and manage their HVAC systems remotely and automate temperature adjustments based on occupancy patterns, weather forecasts, and user preferences. The ability to optimize heating and cooling operations ensures energy efficiency, cost savings, and increasing environmental sustainability.

Intelligent HVAC controllers are expected to grow at a CAGR of more than 14.0% during the forecast period of 2023 to 2030 due to improving energy efficiency within the system; by utilizing advanced sensors and data analytics, these controllers can optimize the heating, cooling, and ventilation system based on real-time conditions and user preferences. They can adjust temperature settings, airflow, and fan speeds to match the occupancy patterns of the home, thus reducing energy wastage during unoccupied periods.

Moreover, intelligent HVAC controllers can learn from user behavior and adapt their operations to ensure optimal energy consumption while maintaining a comfortable indoor environment. It also offers personalized comfort and convenience to homeowners. These controllers can create individualized schedules for different rooms or zones, allowing for personalized temperature settings based on occupant preference. Additionally, they can provide real-time feedback and energy usage insights, empowering homeowners to make informed decisions about their energy consumption and comfort levels.

Technology Insights

Based on technology, wireless protocols technology segment dominated the HEMS market with a revenue share of more than 40.0% in 2022. Wireless protocol technologies such as Wi-Fi, Zigbee, Z-Wave, and Bluetooth are crucial in ensuring seamless communication and interconnectivity among different devices and components within the HEMS system. These protocols allow smart devices, smart meters, energy management systems, and other components to communicate with each other and with the central control system without needing any physical wired connections. The wireless communication ensures real-time data exchange, enabling energy management solutions to collect and process energy consumption data from various devices and provide users with up-to-date information on their energy usage.

The hybrid technology segment is anticipated to grow at a CAGR of more than 15.0% from 2023 to 2030, owing to the integration of energy sources and storage technologies to create a comprehensive and adaptable energy management system. This approach allows it to leverage the strengths of various energy sources and storage solutions, mitigating the limitations of individual technologies. Hybrid systems typically combine renewable energy sources, like solar and wind, with conventional sources, energy storage solutions like batteries or thermal storage, and demand response capabilities. The integration of these components enables a dynamic and resilient energy ecosystem that optimizes energy consumption based on real-time conditions and user preference.

Application Insights

Based on HEMS application, the new construction segment accounted for a larger market share, exceeding 60.0% in 2022. Incorporating HEMS into new construction projects is vital to fostering energy-conscious communities; starting with an energy-efficient foundation, developers and homeowners can leverage innovative technologies to optimize energy consumption from the beginning. In new construction, the system provides a unique opportunity to implement sustainable building practices, which can significantly reduce operational costs and environmental impact throughout the building's lifecycle. Moreover, integrating the system during construction allows for seamless integration with building systems, making energy management more efficient and cost-effective overall. Cities continue to embrace smart technologies, and integrating energy management solutions in new construction plays a pivotal role in developing sustainable and resilient smart cities. Incorporating AI and machine learning algorithms are anticipated to enhance the intelligence and automation of the system, optimizing energy consumption based on user behavior and preferences.

Deployment Type Insights

In terms of HEMS deployment, cloud deployment segment is likely to witness growth at a fastest CAGR of 17.0% during the forecast period 2023 to 2030, owing to cloud deployment advantages including scalability, accessibility, and advanced data processing among others. Hybrid cloud deployment, combining both public cloud and private cloud infrastructure offer increased flexibility and control over sensitive data while leveraging the scalability and cost-effectiveness of public clouds. AI and machine learning technologies are expected to optimize the platform, enabling personalized energy management strategies and predictive energy consumption patterns. Cloud-based infrastructure provides ample storage and computing capabilities, allowing users to store and process large volumes of energy data efficiently. Additionally, cloud computation ensures real time data analytics and predictive insights, facilitating optimal energy consumption patterns to achieve sustainable energy goals.

Residence Type Insights

Based on residence type, the HEMS market is dominated by the multi-family residence type segment. Such residence differs significantly from single-family homes, presenting distinct challenges in implementing the solution. The limited access to individual units in such residences can make HEMS installation and maintenance complex. Multiple households within the same building with individual energy consumption patterns and preferences can make it challenging to achieve energy-sustainable goals.

However, the multi-family residence also offers unique growth opportunities, as the potential for energy savings in large-scale multi-family buildings is substantial, as implementing energy-efficient solutions can have a significant collective impact. Furthermore, property owners and managers can benefit from reduced energy costs, increased property value, and improved sustainability, enhancing their competitive edge in the real estate market.

Regional Insights

North America dominated the home energy management system market in 2022, with revenue share exceeding 36.0%, owing to an increasing focus on energy efficiency, environmental sustainability, and smart home technologies in the region. HEMS offers consumers a holistic approach to managing energy consumption and reducing utility costs. The market has witnessed significant growth attributed to rapid technological advancements, innovation in smart home devices, IoT technology, and data analytics in North America. Advanced HEMS technologies offer consumers real-time energy consumption data, automation of energy-intensive devices, and personalized energy optimization, enhancing overall energy efficiency and user convenience.

Asia Pacific is likely to grow at a CAGR of more than 16.0% over the forecast period. Governments across the region have recognized the significance of energy efficiency and sustainability, encouraging the formulation of supportive policies and incentives, including subsidies for energy-efficient appliances, tax incentives for residential energy management systems, and mandates for smart grid integration to facilitate and adopt these solutions. Such measures steer consumer interest in HEMS and create a conducive environment for energy service providers and technology developers in the region to boost investment and innovation in the market. Escalating energy costs and increasing environmental awareness have intensified the demand for energy-saving solutions in the APAC region.

Key Companies & Market Share Insights

The key market players operating in market are focusing on developing innovative solutions to attract large customer base and gain a competitive edge in the industry. Market players are prioritizing organic and inorganic strategies, including technological advancements, innovations, product offerings, collaboration, and mergers & acquisitions. For instance, in January 2023, Schneider Electric launched a home energy management system that combines the applications of solar storage, EV charging, and appliances. Schneider Electric combines diverse home energy technologies into a simplified, open, and integrated system managed by a single app with specific features. Some of the prominent players in the global home energy management system market are:

-

Honeywell International Inc.

-

Vivint Smart Home, Inc.

-

General Electric Company

-

Ecobee, Inc.

-

Panasonic Holdings Corporation

-

Ecofactor

-

Schneider Electric Se

-

Comcast

-

Alarm.Com

-

Robert Bosch Gmbh

-

Johnson Controls

Global Home Energy Management System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.18 billion

Revenue forecast in 2030

USD 10.38 billion

Growth rate

CAGR of 13.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, system, technology, application, deployment type, residence type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Mexico, UAE, Saudi Arabia, South Africa

Key companies profiled

Honeywell International Inc., Vivint Smart Home, Inc., General Electric Company, Ecobee, Inc., Panasonic Holdings Corporation, Ecofactor, Schneider Electric Se, Comcast, Alarm.Com, Robert Bosch Gmbh, Johnson Controls

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Energy Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home energy management system market report based on component, system, technology, application, deployment type, residence type, and regions:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Control Devices

-

Communication/Display Devices

-

Others

-

-

Software

-

Services

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Lighting Controls

-

Thermostats

-

Self-Monitoring Systems

-

Advanced Central Controllers

-

Intelligent HVAC Controllers

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wireless Protocols

-

Wi-Fi

-

ZigBee

-

Z-Wave

-

Bluetooth

-

Others

-

-

Wired Protocols

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Retrofit

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Residence Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Family

-

Multi-Family

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home energy management system market was estimated at USD 3.64 billion in 2022 and is expected to reach USD 4.18 billion in 2023.

b. The global home energy management system market is expected to grow at a compound annual growth rate of 13.9% from 2023 to 2030 to reach USD 10.37 billion by 2030.

b. North America dominated the global home energy management system market with a share of 36.5% in 2022. This is attributable to an increasing focus on energy efficiency, environmental sustainability, and smart home technologies in the region.

b. Some of the key players in the global home energy management system market include Honeywell International Inc., Vivint Smart Home, Inc., General Electric Company, Ecobee, Inc., Panasonic Holdings Corporation.

b. Key factors driving the market growth include increased connectivity and growing smartphone applications, demand for optimum energy management, and wider use of variable pricing schemes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."