- Home

- »

- Next Generation Technologies

- »

-

Smart Home Security Market Size, Industry Report, 2030GVR Report cover

![Smart Home Security Market Size, Share & Trends Report]()

Smart Home Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Device Type, By Connectivity, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-552-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Home Security Market Summary

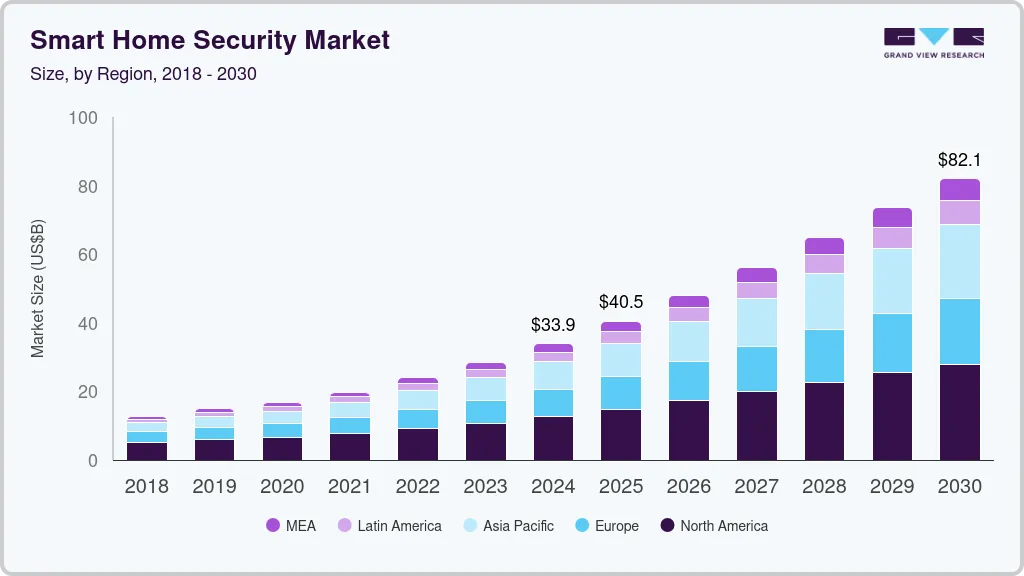

The global smart home security market size was estimated at USD 33.94 billion in 2024 and is projected to reach USD 82.07 billion by 2030, growing at a CAGR of 15.2% from 2025 to 2030. The market growth is primarily driven by the rising consumer demand for home automation, increasing concerns about safety and security, growing advancements in IoT and AI technologies, and the growing convenience of remote monitoring and control systems.

Key Market Trends & Insights

- North America smart home security market accounted for the largest share of over 37% in 2024.

- Europe smart home security are expected to grow at a CAGR of over 14% from 2025 to 2030.

- Asia Pacific smart home security market is expected to grow at the highest CAGR of over 17% from 2025 to 2030.

- Based on device type, the smart camera and monitoring system segment accounted for the largest market share in 2024.

- In terms of connectivity, the wireless segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.94 Billion

- 2030 Projected Market Size: USD 82.07 Billion

- CAGR (2025-2030): 15.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, smart doorbells and smart cameras are gaining traction in the smart home security industry, offering features such as video streaming and two-way communication. With consumers seeking more efficient and accessible ways to protect their homes, the smart home security industry is expected to present lucrative growth opportunities for market growth in the coming years.Consumers are increasingly adopting smart home security solutions that integrate seamlessly with voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri. This trend reflects a growing desire for convenience and hands-free control, allowing users to check camera feeds and manage other connected home devices with simple voice commands. The ease of use and enhanced accessibility offered by voice assistant integration enable consumers to monitor and control their home security systems without the need to interact directly with a mobile app or physical device, making it a key trend in the smart home security industry.

Additionally, AI technologies are transforming smart home security by powering smarter surveillance systems that can automatically detect unusual activities and minimize false alarms. Through advanced algorithms, AI enables features such as facial recognition, object tracking, and anomaly detection, enhancing the accuracy and reliability of security systems. This trend is largely driven by the demand for greater efficiency and precision in monitoring, as well as a reduction in the need for constant human oversight.

Furthermore, many companies are offering subscription-based security monitoring services, delivering around-the-clock professional surveillance, immediate emergency responses, and cloud storage for recorded footage. This trend is driven by consumers' increasing desire for continuous, reliable monitoring without the hassle of managing it themselves. This trend is expediting market growth by meeting the evolving needs of consumers who prioritize convenience, reliability, and continuous protection.

Moreover, the growing concerns over the vulnerabilities of traditional security methods, such as passwords and PINs, are driving a shift toward the integration of biometric authentication, such as facial recognition and fingerprint scanning, in smart home security systems. This trend reflects the increasing demand for more secure and advanced ways to safeguard personal spaces. As consumers seek stronger, more efficient ways to protect their homes, the adoption of biometrics in the smart home security industry is expected to grow significantly in the coming years.

Component Insights

The hardware segment dominated the market with a share of over 56% in 2024, owing to its critical role in providing the physical components needed for home security systems. This includes security cameras, sensors, smart locks, alarms, and motion detectors, which form the backbone of smart home security solutions. The demand for high-quality hardware is also driven by the increasing need for enhanced surveillance, monitoring, and control within homes. Additionally, advancements in hardware technology, such as improved image resolution in cameras, longer battery life in sensors, and the ability to integrate with various smart home platforms, are further driving the segmental growth.

The software segment is expected to witness the fastest CAGR of over 18% from 2025 to 2030. Software solutions, such as mobile applications, cloud storage, and AI-powered analytics, provide users with real-time monitoring, remote access, and the ability to automate and control various security devices. The integration of advanced features such as facial recognition, smart detection algorithms, and predictive analytics has made security software essential for enhancing the effectiveness of hardware devices. Additionally, the rise in subscription-based models for monitoring and software updates also contributes to the segment's high growth, further driving the segmental growth.

Device Type Insights

The smart camera and monitoring system segment accounted for the largest market share in 2024, owing to their fundamental role in providing real-time surveillance and peace of mind. These systems, which include features such as high-definition video recording, motion detection, night vision, and cloud storage, have become essential for homeowners looking to monitor their property remotely. The growing concern about burglary and property crimes has made security cameras a top priority for consumers, as they offer constant surveillance and instant alerts. Additionally, advancements in AI-powered features, such as facial recognition and smart detection, enhance the effectiveness of these systems, making them more attractive to users.

The smart locks segment is expected to witness the fastest CAGR from 2025 to 2030, owing to their growing popularity as convenient keyless access solutions. These locks, which use technologies such as Bluetooth, Wi-Fi, and biometrics, offer enhanced security features like remote unlocking, customizable access codes, and automatic locking, making them increasingly attractive to homeowners seeking convenience and control. The rise in smart home adoption, coupled with a shift toward contactless and remote management solutions, is driving the demand for smart locks.

Connectivity Insights

The wireless segment accounted for the largest market share in 2024, owing to its convenience, ease of installation, and flexibility. Wireless security systems, which use Wi-Fi or cellular networks to connect devices like cameras, sensors, and alarms, have gained widespread popularity because they require minimal wiring and are simple to set up, making them ideal for both DIY enthusiasts and professional installations. Additionally, these systems offer remote access via mobile apps, allowing users to monitor their homes from anywhere, which adds a significant level of convenience. These factors are expected to drive segmental growth in the coming years.

The hybrid segment is expected to witness a significant CAGR from 2025 to 2030. Hybrid systems offer the best of both worlds, providing the reliability and stability of wired systems with the flexibility and convenience of wireless solutions. This blend is particularly attractive to consumers who require the robustness of wired components for primary security functions but prefer wireless components for additional features like cameras or smart locks. Hybrid systems are highly scalable, making them suitable for both residential and commercial applications, which is expected to further drive segmental growth in the coming years.

Application Insights

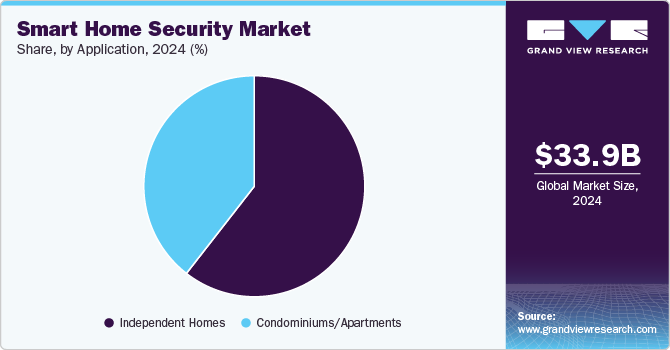

The independent homes segment accounted for the largest market share in 2024, primarily driven by the higher demand for security solutions in single-family dwellings. Homeowners in independent homes are more likely to invest in comprehensive, customized security systems that cater to larger properties and offer full perimeter coverage. The increased concerns over burglary and property crimes in suburban and rural areas, where independent homes are typically located, drive consumers to seek advanced surveillance technologies such as security cameras, motion sensors, and smart alarms.

The condominiums/apartments segment is expected to witness the highest CAGR from 2025 to 2030, primarily driven by the increasing urbanization and the growing preference for apartment living, especially in densely populated cities. As urban areas become more crowded, residents are becoming more concerned about personal security and are opting for smart home security solutions to address these concerns. Apartments often have unique security needs due to shared entrances, hallways, and smaller living spaces, making smart cameras, doorbell systems, and smart locks highly popular among tenants. The rapid adoption of mobile-driven technologies and the convenience of remote monitoring further boost the popularity of smart security solutions in this segment.

Regional Insights

North America smart home security market accounted for the largest share of over 37% in 2024. Consumers in North America, particularly in urban areas, are increasingly seeking flexible and cost-effective smart home security products that can be easily installed and managed through smartphones. The U.S. and Canada also have a strong presence of major tech companies, making it easier for consumers to access smart security solutions through large retail chains and e-commerce platforms.

U.S. Smart Home Security Market Trends

Smart home security market in the U.S. accounted for the largest share of over 80% in 2024, owing to the expansion of both suburban and urban areas, which increases the demand for reliable home security solutions. There is also a growing concern about safety, home burglaries, and personal security, especially in the wake of more people working remotely since the pandemic. This shift has led to a heightened interest in home security systems that offer advanced capabilities such as video surveillance, AI-powered facial recognition, and seamless integration with other smart home devices.

Europe Smart Home Security Market Trends

Europe smart home security are expected to grow at a CAGR of over 14% from 2025 to 2030, owing to increasing consumer awareness about home safety and the rise in demand for IoT-based devices. Factors such as a shift towards connected living, advancements in AI, and the need for more efficient, automated security systems are key drivers. The adoption of energy-efficient and smart technologies, including home security systems that are compatible with other smart home devices, is becoming more prevalent.

The UK smart home security market is expected to grow at a significant rate in the coming years, driven by the growing need for enhanced security solutions amidst rising crime rates and consumer concerns over home safety. With increasing urbanization and a tech-savvy population, British homeowners are increasingly adopting smart security products such as cameras, alarms, and sensors. Additionally, the UK’s strong interest in energy-efficient solutions and smart automation is prompting the growth of integrated smart home security systems.

Smart home security market in Germany is fueled by high consumer demand for advanced, reliable, and secure home automation products. A key driver is the country’s robust economy, which supports the adoption of high-tech home security systems. German consumers are increasingly opting for IoT-based security solutions that offer seamless integration with other smart home devices.

Asia Pacific Smart Home Security Market Trends

Asia Pacific smart home security market is expected to grow at the highest CAGR of over 17% from 2025 to 2030, owing to factors such as increasing urbanization, rising disposable incomes, and growing concerns about safety and security. The growing adoption of smart home security systems in countries like India, South Korea, and Singapore is expected to accelerate due to greater technological awareness and enhanced consumer trust in security innovations. Increasing penetration and adoption rate of smart security products is driving the growth of overall home security system market.

The Japan smart home security market is gaining traction driven by the country’s aging population and the need for enhanced elderly care and home monitoring systems. The growing demand for home automation technologies, along with Japan’s technological prowess, has spurred the adoption of advanced security solutions like smart cameras, sensors, and automation platforms.

Smart home security market in China is rapidly expanding driven by the country's increasing middle-class population and urbanization. The government’s focus on smart city development and infrastructure, along with advancements in 5G networks, has contributed to the expansion of the smart home security sector. Chinese consumers are increasingly interested in integrated, high-tech security solutions, with a growing preference for AI-powered surveillance, facial recognition technology, and smart cameras.

Key Smart Home Security Company Insights

Some of the key players operating in the market include Johnson Controls and ADT, Inc. among others.

-

Johnson Controls is known for its innovative building technologies and solutions. The company specializes in creating products that enhance safety, security, and sustainability in residential, commercial, and industrial settings. Johnson Controls integrates smart technologies like advanced security systems, climate control, and energy management, offering seamless solutions for smart home automation and energy efficiency.

-

ADT, Inc. is a prominent player in the smart home security industry, recognized for its comprehensive home monitoring services. The company provides security solutions including burglar alarms, video surveillance, fire safety, and smart home integrations. The company’s robust service network ensures that millions of households across North America receive 24/7 monitoring.

Ring LLC and SimpliSafe, Inc. are some of the emerging market participants in the smart home security market.

-

Ring LLC (acquired by Amazon.com, Inc.) is an emerging player in the smart home security market, widely recognized for its innovative video doorbell technology. The company has expanded its offerings to include a wide range of smart security products, such as cameras, motion sensors, and smart lighting. Ring's devices are designed to provide homeowners with enhanced security through real-time video surveillance and two-way audio, easily integrated into a broader smart home ecosystem, making it a popular choice for both security and convenience. The company's focus on community-driven safety and its integration with Amazon Alexa further bolster its presence in the market.

-

SimpliSafe, Inc. is known for its DIY (Do-It-Yourself) home security systems that are both affordable and easy to install. The company offers wireless home security solutions including cameras, motion sensors, alarms, and smart locks. Their customizable systems, paired with 24/7 professional monitoring services, make it a popular choice for homeowners seeking flexible, high-quality security without long-term contracts.

Key Smart Home Security Companies:

The following are the leading companies in the smart home security market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Systems, Inc.

- ADT Inc.

- Brinks Home Security

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International, Inc.

- Johnson Controls

- Resideo Technologies, Inc.

- Ring LLC (Amazon.com, Inc.)

- SimpliSafe, Inc.

- Vivint Smart Home, Inc.

Recent Developments

-

In March 2025, Abode Systems, Inc. expanded its smart home security system by releasing a new update that adds compatibility with Apple TV. This update allows users to control and monitor their Abode security system directly from their Apple TV, providing a more convenient and immersive way to manage home security. The integration enhances the user experience, offering easy access to live video feeds, system controls, and alerts on a larger screen, giving customers greater flexibility in keeping their homes secure.

-

In September 2024, ADT announced a new integration with Google Home, allowing users to control their ADT security system through Google Assistant. This partnership enables seamless voice command functionality, giving users the ability to arm or disarm their security system, check camera feeds, and manage other security features using Google Home devices.

-

In June 2024, Resideo Technologies, Inc. acquired Snap One, LLC, a prominent provider of smart home products and services. This acquisition enabled Resideo Technologies, Inc. to broaden its portfolio of connected home solutions and enhance its offerings in the smart home security market, delivering more integrated and innovative technologies for consumers.

Smart Home Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.46 billion

Revenue forecast in 2030

USD 82.07 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, device type, connectivity, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Adobe Systems, Inc.; ADT Inc.; Brinks Home Security;

Hangzhou Hikvision Digital Technology Co. Ltd.; Honeywell International Inc.; Johnson Controls; Resideo Technologies Inc.; Ring LLC (Amazon.com, Inc.); SimpliSafe, Inc.;Vivint Smart Home, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Smart Home Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart home security market report based on component, device type, connectivity, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Device Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Alarms

-

Smart Locks

-

Smart Sensors and Detectors

-

Smart Camera and Monitoring System

-

Other Device Types

-

-

Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wireless

-

Wired

-

Hybrid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Independent Homes

-

Condominiums/Apartments

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart home security market size was estimated at USD 33.94 billion in 2024 and is expected to reach USD 40.46 billion in 2025.

b. The global smart home security market is expected to witness a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 82.07 billion by 2030.

b. The hardware segment dominated the market with a market share of over 56% in 2024, owing to its critical role in providing the physical components needed for home security systems.

b. Some key players operating in the smart home security market include Adobe Systems, Inc., ADT Inc., Brinks Home Security, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc., Johnson Controls, Resideo Technologies, Inc., Ring LLC (Amazon.com, Inc.), SimpliSafe, Inc.,Vivint Smart Home, Inc.

b. The key factors driving the smart home security market is the rising consumer demand for home automation, increasing concerns about safety and security, growing advancements in IoT and AI technologies, and the growing convenience of remote monitoring and control systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.