- Home

- »

- Plastics, Polymers & Resins

- »

-

Smart Plastics In Precision Agriculture Market Report, 2033GVR Report cover

![Smart Plastics In Precision Agriculture Market Size, Share & Trends Report]()

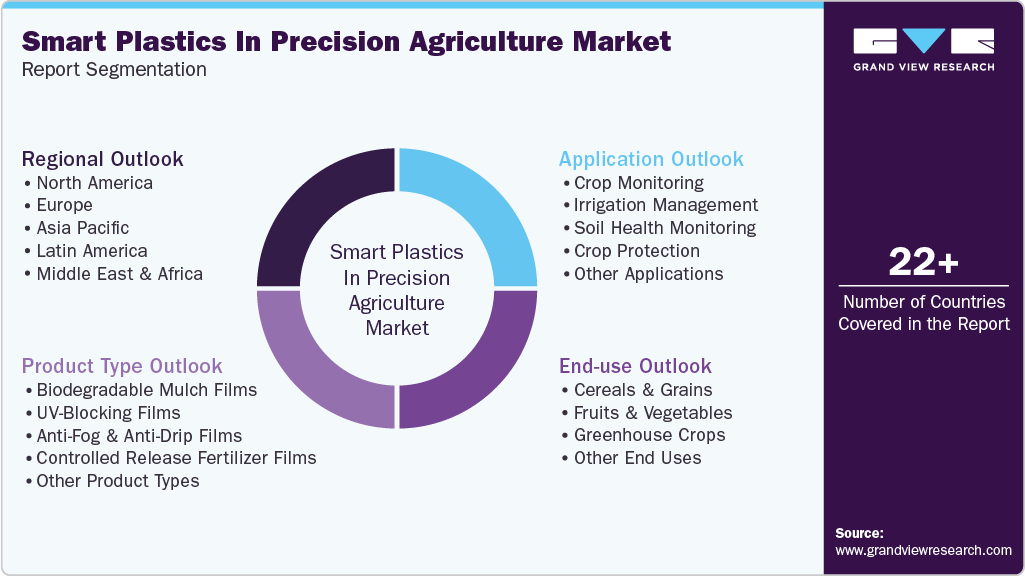

Smart Plastics In Precision Agriculture Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Biodegradable Mulch Films, UV-Blocking Films, Anti-Fog & Anti-Drip Films), By Application, By End-use (Cereals & Grains), By Region And Segment Forecasts

- Report ID: GVR-4-68040-627-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Plastics In Precision Agriculture Market Summary

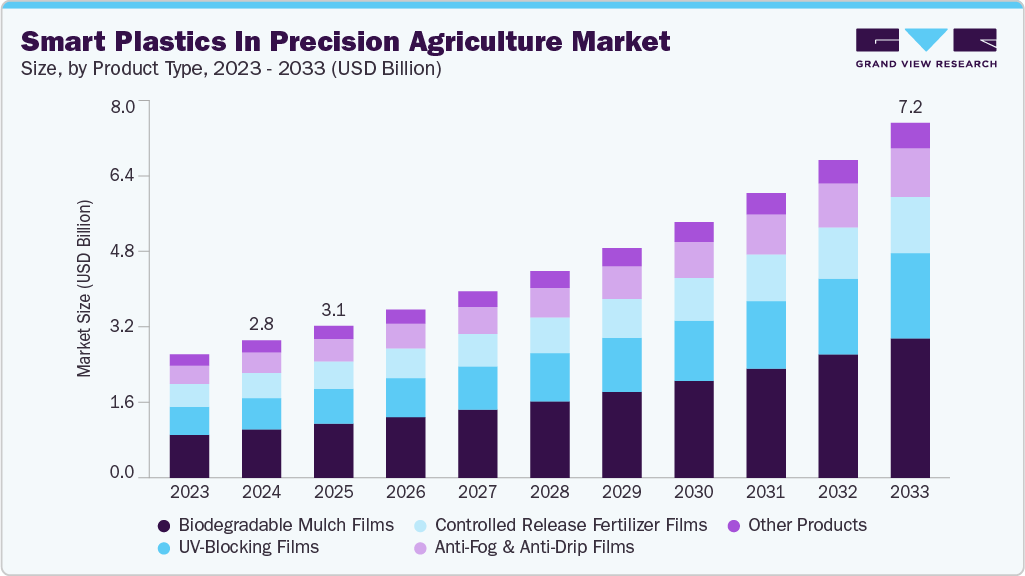

The global smart plastics in precision agriculture market size was estimated at USD 2.78 billion in 2024 and is projected to reach USD 7.18 billion by 2033, growing at a CAGR of 11.2% from 2025 to 2033. Rising input costs for fertilizers and water motivate farmers to use sensor-enabled plastics that optimize resource application.

Key Market Trends & Insights

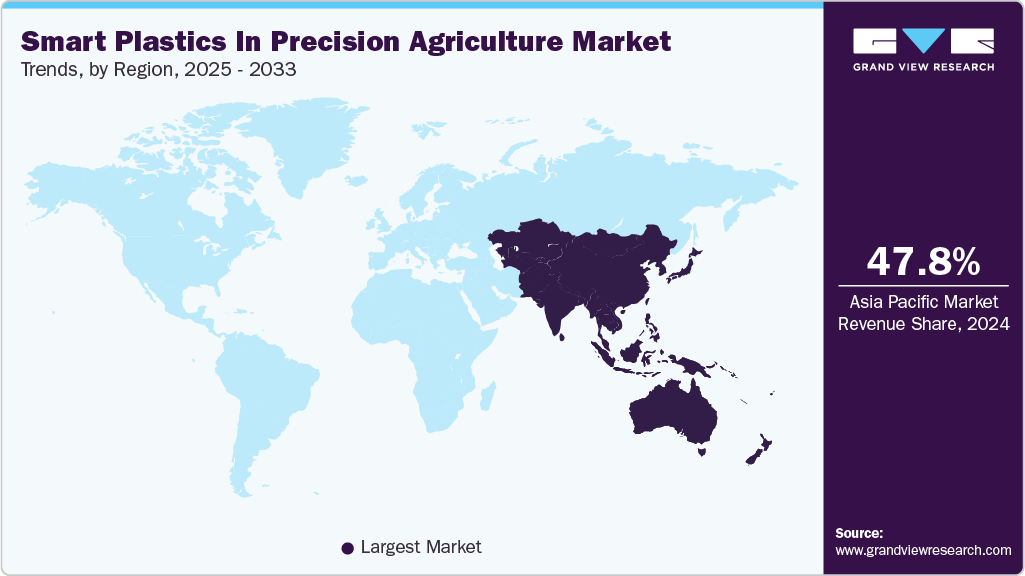

- Asia Pacific dominated the smart plastics in precision agriculture market with the largest revenue share of 47.78% in 2024.

- China’s 2024-2028 action plan to digitize agriculture is positioning smart plastics as a strategic priority to secure food production targets

- By product type, biodegradable mulch films segment dominated in terms of revenue, accounting for a market share of 35.25% in 2024.

- By application, the crop monitoring segment is expected to grow at a considerable CAGR of 12.0% from 2025 to 2033 in revenue.

- By end-use, the cereals & grains segment is expected to grow in revenue at a considerable CAGR of 12.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.78 billion

- 2033 Projected Market Size: USD 7.18 billion

- CAGR (2025-2033): 11.2%

- Asia Pacific: Largest market in 2024

This cost pressure drives investment in smart materials that deliver precise data and reduce waste. A notable trend shaping the smart plastics in precision agriculture market is the integration of biodegradable polymers with embedded nanosensors. These advanced materials are gaining traction for their dual capability-environmental sustainability and real-time data collection.

Farmers are adopting such solutions to monitor soil nutrients, moisture levels, and pesticide residues, enabling ultra-targeted field interventions. This convergence of materials science and IoT sets a new benchmark for sustainable precision farming.

Drivers, Opportunities & Restraints

The growing demand for data-driven agriculture is a primary driver behind the adoption of smart plastics in precision farming. As climate variability intensifies, farmers and agribusinesses seek solutions allowing micro-level monitoring and predictive analytics. Smart plastics embedded with sensors and RFID tags provide critical insights into plant health, soil conditions, and crop growth cycles, helping optimize inputs and reduce waste. This aligns well with global goals around food security and input efficiency.

Emerging markets in Latin America and Southeast Asia offer untapped potential for smart plastics, particularly in high-value crop sectors. These regions are experiencing a surge in precision agriculture adoption, supported by government incentives, digital infrastructure investments, and increasing private sector engagement. Companies introducing low-cost, scalable smart plastic solutions that address region-specific challenges, such as water scarcity or poor soil fertility, stand to capture significant market share in these geographies.

A key restraint lies in the high upfront cost and limited awareness among small and mid-sized farms. While large-scale agribusinesses may afford sensor-integrated films and biodegradable smart mulches, smaller farmers often perceive these innovations as economically inaccessible.

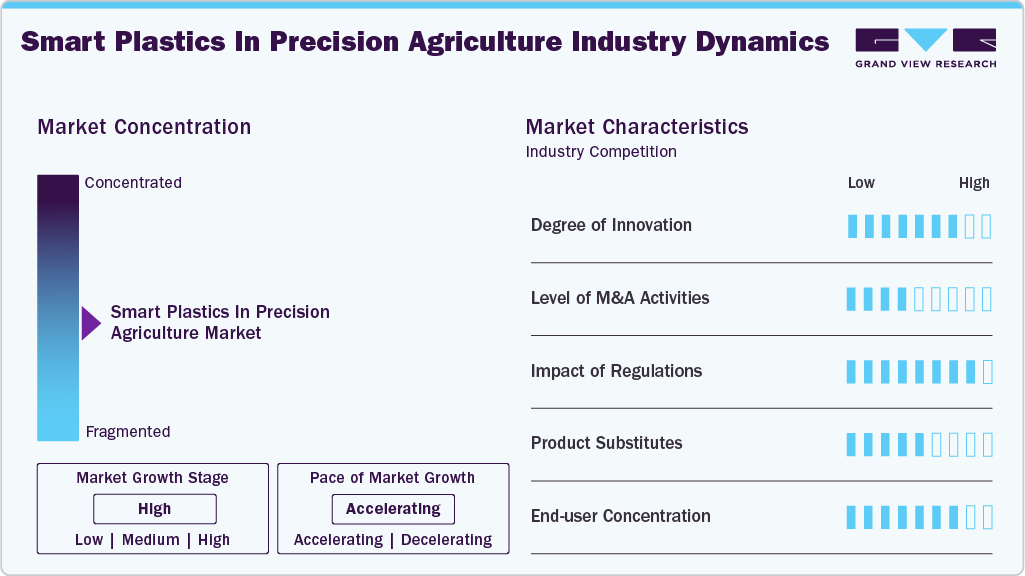

Market Concentration & Characteristics

The smart plastics market growth stage in precision agriculture is high, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like BASF SE, Berry Global, RKW Group, Armando Alvarez Group, Plastika Kritis, Novamont, AB Rani Plast, AEP Industries, Barbier Group, and others significantly shape the market dynamics. These leading players often drive innovation, introducing new products, technologies, and end uses to meet evolving industry demands.

Conventional plastic films and standalone IoT sensor platforms represent the primary alternatives to smart plastics in precision agriculture. While traditional polyethylene mulches offer low upfront costs, they lack data-capture capabilities and incur disposal liabilities. Pure software-driven monitoring systems bypass advanced materials but require frequent hardware installation and calibration. As a result, agribusinesses weigh the total cost of ownership, balancing sensor accuracy, installation complexity, and end-of-life management when evaluating substitutes.

Evolving environmental policies are reshaping the smart plastics landscape by mandating bio-based content and restricting single-use polymers. In Europe, the SUPD (Single-Use Plastics Directive) has accelerated approval pathways for compostable films, prompting manufacturers to reformulate products. Simultaneously, water-use restrictions in California and Australia incentivize the adoption of sensor-integrated materials that demonstrate quantifiable efficiency gains. Compliance-driven demand is thus driving R&D investment and fostering partnerships between material scientists and ag-tech providers.

Product Type Insights

Biodegradable mulch films dominated the smart plastics in the precision agriculture market across the product type segmentation in terms of revenue, accounting for a market share of 35.25% in 2024. Escalating environmental regulations and consumer demand for eco-friendly practices propel the adoption of biodegradable mulch films.

Agricultural stakeholders face mounting pressure to reduce plastic waste, and these films offer a compliant alternative with proven soil health benefits. As governments in Europe and North America introduce stricter disposal mandates, farmers are shifting budgets toward sustainable mulches that decompose after a single season, lowering lifecycle costs and environmental liabilities.

The UV-blocking films segment is anticipated to grow at a significant CAGR of 11.8% through the forecast period. Heightened concerns over UV-induced crop degradation, exacerbated by variable cloud cover and ozone layer fluctuations, drive demand for UV-blocking films.

These advanced polymers selectively filter harmful radiation while allowing beneficial light spectra, enhancing plant resilience and yield consistency. Agribusinesses invest in this technology to safeguard high-value crops against photodamage and extend harvesting windows in regions prone to intense solar exposure.

Application Insights

Irrigation management led the smart plastics in precision agriculture market across the application segmentation in terms of revenue, accounting for a market share of 30.14% in 2024. Persistent water scarcity and tightening irrigation regulations in arid regions are catalyzing the deployment of sensor-embedded plastics for precision water management.

Producers can execute real-time irrigation scheduling by coupling soil moisture sensors with smart drip-line films and reduce runoff by up to 30%. Investors are channeling capital into these systems to boost water-use efficiency, an imperative as aquifer levels decline and water costs escalate.

The crop monitoring segment is anticipated to grow at a significant CAGR of 12.0% through the forecast period. The need for early detection of biotic and abiotic stresses is driving the uptake of crop monitoring plastics integrated with nanophotonic sensors.

These low-profile films transmit multispectral data on plant health, enabling agronomists to identify disease onset or nutrient deficiencies days before visual symptoms appear. As AI-powered analytics platforms mature, stakeholders prioritize this technology to optimize input timing and safeguard margins amid volatile commodity prices.

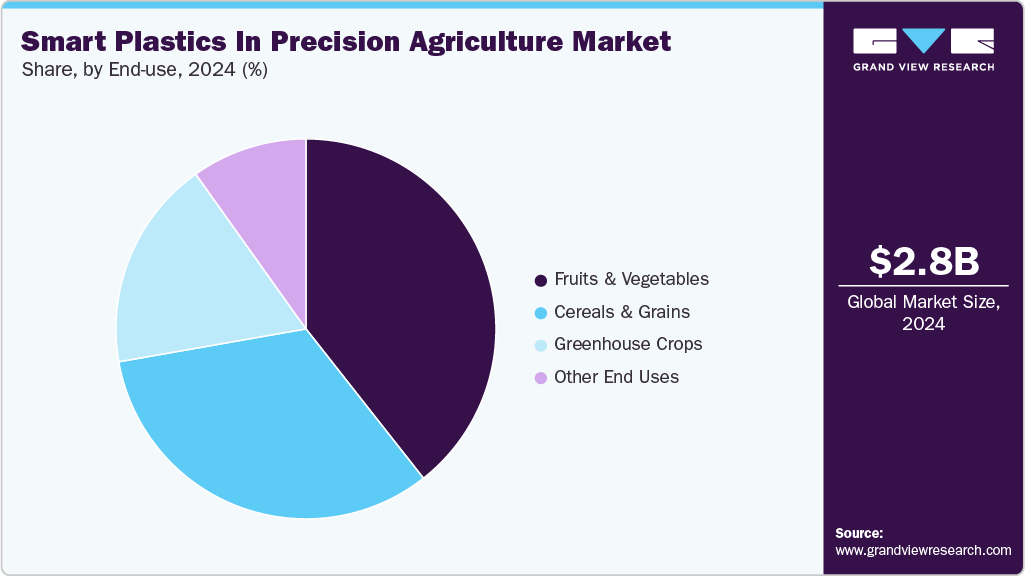

End-use Insights

Fruits & vegetables led the smart plastics in precision agriculture market across the application segmentation in terms of revenue, accounting for a market share of 39.39% in 2024. Premium fruits and vegetables, especially greenhouse-grown produce, are spurring investment in smart plastics to meet stringent quality and traceability standards.

Embedded RFID-enabled films allow for batch-level tracking of ripeness and storage conditions, supporting seamless cold-chain integration. Growers see these solutions as a means to command price premiums in organized retail and export channels where product integrity and provenance are non-negotiable.

The cereals & grains segment is expected to expand at a substantial CAGR of 12.4% through the forecast period. Large-scale cereal and grain operations are adopting smart plastics to enhance harvest predictability and storage management.

Sensor-infused grain bag liners monitor moisture and temperature, mitigating spoilage and mycotoxin risks during silo storage. With global grain stocks under scrutiny and supply chains stretched, these materials are viewed as strategic assets to preserve asset value and ensure contract compliance in commodity trading.

Regional Insights

Asia Pacific led the smart plastics market in precision agriculture with the largest revenue share of 47.78% in 2024. Government-backed digital agriculture initiatives across Asia Pacific, exemplified by India’s space-data partnerships through Cropin and Syngenta, are driving demand for smart polymers that integrate satellite-fed analytics.

With regional agritech investment growing at one of the world’s highest rates, producers are leveraging these films to translate real-time forecasts into precise irrigation and fertilization actions, boosting yields despite climatic volatility. Hence, Asia Pacific is projected to grow at the fastest rate of 11.7% in terms of revenue over the forecast period.

China Smart Plastics in Precision Agriculture Market Trends

China’s 2024-2028 action plan to digitize agriculture is positioning smart plastics as a strategic priority to secure food production targets. The plan’s goal to build a national agricultural big-data platform by 2028 includes piloting sensor-embedded biodegradable films that feed into AI-driven decision support systems. This top-down push rapidly scales deployments across the country’s major grain- and vegetable-producing regions.

North America Smart Plastics in Precision Agriculture Market Trends

Robust R&D investment catalyzes smart plastics uptake across North America’s precision agriculture sector. In August 2024, Canadian research teams secured USD 6.93 million in federal funding to develop sensor-enabled polymer films that optimize nutrient delivery and moisture retention. Coupled with venture capital inflows into agritech startups, this financial momentum accelerates the commercialization of next-generation biodegradable and sensor-integrated mulches throughout the region.

U.S. Smart Plastics in Precision Agriculture Market Trends

Federal incentives under the 2023 Farm Bill and recent NSF grants, such as the USD 35 million awarded in February 2024 for agricultural tech innovation, drive U.S. adoption of smart plastics. These programs lower entry barriers for growers by subsidizing trial deployments of sensor-laden films and data-analytics platforms. As a result, large-scale operations are rapidly integrating these materials to enhance water-use efficiency and input precision.

Europe Smart Plastics in Precision Agriculture Market Trends

Stringent environmental mandates from the European Green Deal and the EU’s “From Farm to Fork” strategy are compelling farmers to switch to compostable, sensor-embedded plastics. Targets such as a 50% reduction in nutrient losses by 2030 have prompted Horizon Europe to fund climate-smart agriculture R&D, fostering public-private collaborations that tailor biodegradable smart mulches to diverse EU agro-ecosystems.

Key Smart Plastics In Precision Agriculture Market Company Insights

The Smart Plastics in Precision Agriculture Market is highly competitive, with several key players dominating the landscape. Major companies include BASF SE, Berry Global, RKW Group, Armando Alvarez Group, Plastika Kritis, Novamont, AB Rani Plast, AEP Industries, and Barbier Group. The market is characterized by a competitive landscape, with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance their products' performance, cost-effectiveness, and sustainability.

Key Smart Plastics in Precision Agriculture Companies:

The following are the leading companies in the smart plastics in precision agriculture market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Berry Global

- RKW Group

- Armando Alvarez Group

- Plastika Kritis

- Novamont

- AB Rani Plast

- AEP Industries

- Barbier Group

Recent Developments

-

In April 2025, Sirmax Group, based in Cittadella, Italy, completed successful open-field testing of its biodegradable mulching film, BioComp, marking a significant step toward its market launch.

-

In April 2025, Hengrun Plastic Factory launched a fully biodegradable mulch film designed to address the issue of "white pollution" caused by traditional plastic mulch in farmlands. Natural microorganisms can completely decompose this new mulch film, eliminating plastic residue in the soil. It also offers benefits such as good thermal insulation, moisture retention, weed inhibition, pest and disease reduction, and promotes crop growth.

Smart Plastics In Precision Agriculture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.07 billion

Revenue forecast in 2033

USD 7.18 billion

Growth rate

CAGR of 11.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF SE; Berry Global; RKW Group; Armando Alvarez Group; Plastika Kritis; Novamont; AB Rani Plast; AEP Industries; Barbier Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Plastics In Precision Agriculture Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the smart plastics in precision agriculture market report on the basis of product type, application, end use, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Biodegradable Mulch Films

-

UV-Blocking Films

-

Anti-Fog & Anti-Drip Films

-

Controlled Release Fertilizer Films

-

Other Product Types

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Crop Monitoring

-

Irrigation Management

-

Soil Health Monitoring

-

Crop Protection

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Cereals & Grains

-

Fruits & Vegetables

-

Greenhouse Crops

-

Other End-uses

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart plastics in precision agriculture market size was estimated at USD 2.78 billion in 2024 and is expected to reach USD 3.07 billion in 2025.

b. The global smart plastics in precision agriculture market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2033 to reach USD 7.18 billion by 2033.

b. Biodegradable mulch films dominated the smart plastics in precision agriculture market across the product type segmentation in terms of revenue, accounting for a market share of 35.25% in 2024. Escalating environmental regulations and consumer demand for eco-friendly practices are propelling adoption of biodegradable mulch films.

b. Some key players operating in the smart plastics in precision agriculture market include BASF SE, Berry Global, RKW Group, Armando Alvarez Group, Plastika Kritis, Novamont, AB Rani Plast, AEP Industries, and Barbier Group.

b. Rising input costs for fertilizers and water are motivating farmers to use sensor-enabled plastics that optimize resource application. This cost pressure drives investment in smart materials that deliver precise data and reduce waste.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.