- Home

- »

- Electronic & Electrical

- »

-

Smart Toys Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Toys Market Size, Share & Trend Report]()

Smart Toys Market Size, Share & Trend Analysis Report By Product (Interactive Games, Robots, Educational Robots), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-906-6

- Number of Pages: 84

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Smart Toys Market Size & Trends

The global smart toys market size was valued at USD 12.37 billion in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030. The demand for smart toys is on the rise due to the increasing adoption of artificial intelligence (AI) and the Internet of Things (IoT). Parents are increasingly drawn to toys that not only entertain but also educate, contributing to the growing popularity of education-based toys. In addition, the rising trend of gamification in smart toys enhances the overall play experience, making learning interactive and enjoyable for children. These interconnected factors drive the demand for smart toys as they offer technologically advanced and educational playtime for children, aligning with contemporary parenting preferences. The rising market for smart toys is witnessing significant growth driven by a convergence of factors and evolving trends.

Parents, recognizing the paramount importance of early childhood development, are increasingly drawn to toys that seamlessly blend entertainment with education. Smart toys, integrating cutting-edge technology, provide interactive and educational experiences that align with modern parents' aspirations for their children. As the educational landscape transforms, the demand for toys that cultivate skills like problem-solving and critical thinking is on the rise. The immersive features of smart toys, including augmented reality (AR) and interactive storytelling, contribute to a captivating play experience, making learning enjoyable for children. Smart toys cater to a range of age groups, from toddlers to pre-teens, each with distinct developmental needs and preferences. Understanding the age demographics helps manufacturers design age-appropriate content, interactive features, and educational elements to ensure that smart toys align with the intended users' cognitive and emotional development stages.

The increasing demand from children for STEM content in their toys is a prominent trend shaping the market. Parents and educators understand the importance of fostering STEM skills from an early age. The demand reflects a desire for play experiences that entertain and contribute to cognitive development, problem-solving abilities, and a foundational understanding of STEM concepts. According to the Bayer STEM Toys Holiday Survey, despite the prevalent belief (among 90% of Americans) that STEM toys are packaged in a way that appears suitable for both boys and girls, there is a noticeable discrepancy in actual purchasing behavior. During the holiday season, consumers are nearly 20% more likely to buy STEM toys for boys than girls (34% vs. 29%). Women, in particular, show a 25% higher likelihood of purchasing STEM toys for boys rather than girls (37% for boys vs. 30% for girls). It suggests a gender preference in the market when selecting STEM educational toys.

Advancements in technology, particularly in robotics and AI, have created more sophisticated and interactive educational robots. These robots often feature programmable elements, allowing children to learn coding and problem-solving skills in a hands-on method. Integrating educational content with play enhances the overall learning experience, driving the adoption of educational robots by educational institutions. In February 2024, MatataStudio, a digital learning solutions provider, launched VinciBot, a cutting-edge educational robot kit. These robotics kits offer a highly educational experience and integrate programming, computational thinking, creativity, and exploration. MatataStudio aims to inspire children to grasp fundamental programming and computer science concepts by constructing and controlling robots hands-on, fostering their innovative thinking and problem-solving skills.

Market Concentration & Characteristics

The degree of innovation in smart toys is a compelling factor encouraging parents to invest in these products. Smart toys showcase advanced features, such as AI, interactive storytelling, and gamification, creating a dynamic and engaging play experience for children. The integration of technology not only entertains but also educates, aligning with the modern parent's desire for well-rounded developmental experiences. The continuous evolution of smart toys, incorporating cutting-edge advancements, enhances their appeal, fostering a sense of novelty and excitement that resonates with parents seeking innovative and enriching play options for their children.

The level of merger & acquisition (M&A) activities in the smart toys industry is currently moderate. As the technology matures and market demand grows, companies are increasingly exploring strategic partnerships, acquisitions, and collaborations to enhance their capabilities, expand their product offerings, and gain a competitive edge.

Product Insights

The smart interactive games segment accounted for a share of 76.9% in 2023. The continuous evolution and accessibility of technology, including smartphones, tablets, and gaming consoles, have significantly contributed to the rising popularity of interactive games among kids. The immersive experiences and engaging features offered by these platforms make interactive games appealing and easily accessible for children.The increasing demand for personalized and adaptive learning experiences significantly contributes to the popularity of interactive toys in the market. These toys use AI algorithms to tailor content and challenges based on a child's individual preferences, learning pace, and abilities. Interactive smart toys offer a personalized approach, ensuring that each child's educational journey is uniquely tailored to their needs, enhancing the overall effectiveness of the learning experience.

The smart educational robots segment is anticipated to grow at a CAGR of 14.5% from 2024 to 2030. The rising trend of homeschooling and alternative education methods influences the demand for educational robots. With an increasing number of parents choosing to educate their children outside of traditional school systems, there is a growing need for effective and engaging educational tools that complement home-based learning. Educational robots, with their ability to combine entertainment with educational content, align with the preferences of homeschooling families, driving their adoption as valuable learning aids.

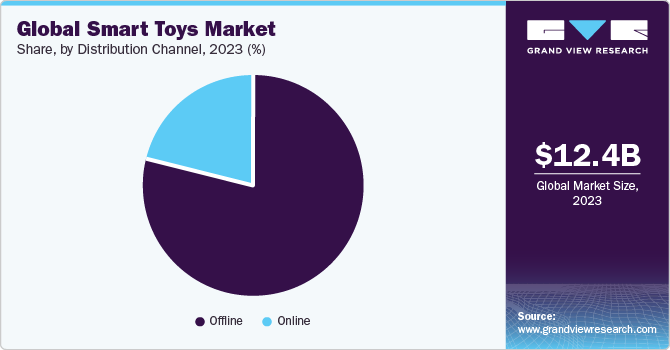

Distribution Channel Insights

The offline distribution channel segment accounted for a share of 78.8% of the global revenue in 2023. Offline stores, such as toy stores and department stores, allow consumers to physically interact with smart toys before purchasing. This hands-on experience provides a tangible understanding of the product's features and functionalities, catering to those who prefer a sensory connection with the toys before deciding to buy. The offline segment drives on the immersive and interactive nature of in-store shopping experiences. Brick-and-mortar retailers foster brand visibility and trust. The offline segment allows manufacturers to showcase their products prominently, build brand awareness through in-store displays, and leverage the expertise of trained sales staff who can guide customers through the features of smart toys.

This brand-building aspect contributes to the enduring significance of the offline segment in the market. According to a June 2022 YouGov survey, approximately 24% of parents in the U.S. and 19% of parents in Britain prefer traditional physical stores for purchasing toys and games. The online distribution channel segment is anticipated to register a CAGR of 14.7% from 2024 to 2030. The convenience and accessibility offered by online shopping have made it easier for consumers to explore and purchase a diverse range of smart toys from various brands. Online platforms provide a comprehensive space for manufacturers to showcase their products, reach a global audience, and capitalize on the digital landscape.

The emergence of online marketplaces has transformed the traditional retail model, offering consumers a seamless shopping experience and contributing to the overall expansion of the market. Around 30.6% of U.S. parents opt to buy toys for their children through online channels, as per information from the U.S. National Library of Medicine. Moreover, the growing global connectivity and cross-border trade facilitated by e-commerce platforms drive the online segment's growth. Consumers access a wide array of smart toys from different regions, providing them with exposure to diverse cultural and educational experiences. This globalization of product availability drives the growth of the online segment.

Regional Insights

The North America smart toys market accounted for a share of 39.3% in 2023. North America boasts a well-established network of toy stores, department stores, and electronic retail outlets that provide a diverse range of smart toys. This widespread availability, coupled with the region's strong consumer purchasing power, ensures that a broad demographic can easily access and purchase smart toys. In addition, the integration of voice-activated technology is driving the regional market growth. Voice-activated smart toys, equipped with virtual assistants or interactive features, offer children a hands-free and intuitive user experience. Voice technology trends create engaging and interactive products that cater to North American consumers’ preferences for convenient and innovative play experiences.

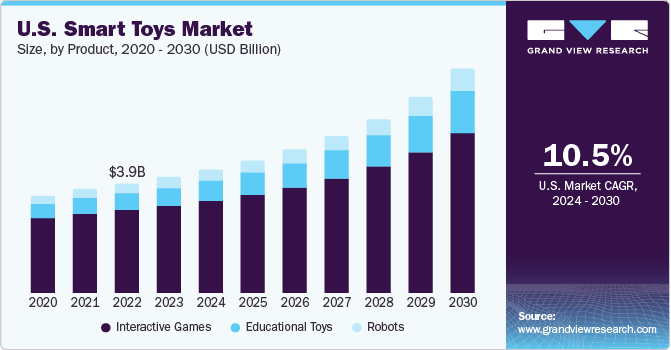

U.S. Smart Toys Market Trends

The smart toys market in the U.S. is expected to grow at a CAGR of 10.5% from 2024 to 2030. The influence of popular culture and media trends in the U.S. drives market growth. Licensing agreements with popular characters from movies, TV shows, and digital content contribute to the market's growth. Smart toys featuring characters often gain popularity, and partnerships with entertainment franchises allow manufacturers to create engaging and sought-after products that resonate with U.S. consumers. The rise of subscription-based models in the U.S. further drives industry growth. Subscription services for smart toys offer a continuous stream of new content, updates, and features to consumers. These models often include educational elements, creating a steady demand for smart toys as part of a subscription service and encouraging long-term engagement within the U.S. market. According to Argos in 2023, there is a growing trend of nostalgic shoppers purchasing iconic toys from the past, driven by increased interest following the release of the Barbie movie and a resurgence of classic toys. The demand for classic toys has surged, with sales of the original virtual pet Tamagotchi rising by 123% and the 90s toy Furby experiencing a substantial 371% increase in 2023.

Asia Pacific Smart Toys Market Trends

The Asia Pacific smart toys market is expected to grow at a CAGR of 12.9% from 2024 to 2030. Many countries in Asia Pacific, such as China, Japan, and South Korea, are major manufacturing hubs with well-established supply chains and production capabilities. Parents in Asia Pacific place a strong emphasis on educational products for their children. Cross-industry collaborations and partnerships also contribute to the dynamism of the smart toys market in Asia Pacific. Collaborations between technology companies, toy manufacturers, and entertainment franchises often result in the creation of innovative and licensed smart toys. These products, featuring characters from popular media, gain a competitive edge and attract a large consumer base, particularly among families and children. In September 2023, Microsoft Nonprofit Tech Acceleration collaborated with innovative educational toy company Brown Toy Box to integrate technology into its range of interactive, play-oriented, and inclusive educational toys. This collaboration was aimed at seamlessly translating Brown Toy Box's educational STEAM kits and engaging characters from the Dadisi Academy Crew universe into the digital sphere.

Europe Smart Toys Market Trends

The smart toys market in Europe is expected to grow at a CAGR of 11.7% from 2024 to 2030. The rising demand for smart toys in Europe is also influenced by the convenience they offer to parents to monitor and manage their children's playtime. Many smart toys come with companion apps that allow parents to track their child's progress, set usage limits, and even receive insights into the educational benefits of these toys. The integration of such monitoring features addresses parental concerns about screen time. It ensures a balance between technology-based play and other developmental activities, driving the adoption of smart toys for modern parents.

Key Smart Toys Company Insights

Hasbro, LEGO System A/S, Mattel, Inc., and Sega Toys Co. Ltd. are some of the dominant players operating in the smart toys market.

-

Mattel, Inc. engages consumers through its iconic products and brand range, such as Hot Wheels, Barbie, American Girl, Fisher-Price Thomas & Friends, Monster High, MEGA, Masters of the Universe, and UNO. In addition, Mattel’s offerings incorporate gaming and digital experiences, film and television content, live events, and music

-

LEGO System A/S, a subsidiary of Kirkbi A/S, designs, manufactures, and promotes an inclusive range of games and toys. Lego’s products focus on the theory of development and learning through play

Playmobil, Pillar Learning, and MindWare, Inc. are some of the emerging market players functioning in the smart toys market.

-

Pillar Learning offers interactive and adaptive learning applications for tablets and other digital devices. These applications cater to various age groups, offering diverse educational content that aligns with early childhood development milestones

-

MindWare's product line includes coloring books, educational toys, games, brainteasers, building sets, robot toys, and creative play activities

Key Smart Toys Companies:

The following are the leading companies in the smart toys market. These companies collectively hold the largest market share and dictate industry trends.

- Playmobil

- Pillar Learning

- Sega Toys Co. Ltd.

- LeapFrog Enterprises Inc. (Vtech Holdings Ltd.)

- Mattel, Inc.

- LEGO System A/S

- Hasbro

- MindWare, Inc.

- Sphero, Inc.

Recent Developments

-

In February 2024, Sega Toys launched KIMIT Ragdoll, a cat-like robot pet that uses AI technology to act like a real cat. It was developed in collaboration with Elephant Robotics, an industrial robot manufacturer. The robot cat has cat-like movements, such as wagging its tail and looking up in response to sound

-

In September 2023, Mattel, Inc. launched an innovative edition of Pictionary, the classic quickdraw game, called Pictionary Vs. AI. It marks the first instance of a board game seamlessly incorporating AI technology into its traditional gameplay. In this new version, the players draw while the AI guesses

-

In June 2023, Hasbro launched the Furby interactive toy, a highly engaging companion with five voice-activated modes and over 600 responses, including lights, sounds, and ten distinct songs. Furby reacts to gestures, such as hugs and pats. Children can nurture Furby by providing virtual food, styling its furhawk, and enhancing its appearance with the included clip-on beads and fashionable accessories

-

In April 2022, Mattel invested USD 50 million to expand a plant in Nuevo Leon, Mexico. The plant covers an area of 200,000 square meters and aims to create 3,500 new job opportunities. With the investment, the company aims to meet increasing toy demand and enhance its production capabilities

Smart Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.29 billion

Revenue forecast in 2030

USD 25.54 billion

Growth rate (Revenue)

CAGR of 11.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Playmobil; Pillar Learning; Sega Toys Co. Ltd.; LeapFrog Enterprises Inc. (Vtech Holdings Ltd.); Mattel, Inc.; LEGO System A/S; Hasbro; MindWare, Inc.; Sphero, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

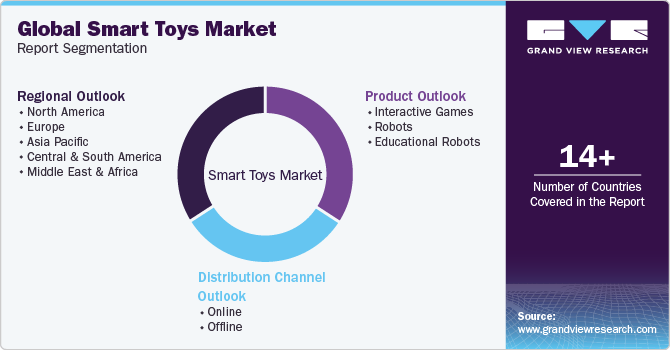

Global Smart Toys Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the smart toys market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Interactive Games

-

Robots

-

Educational Robots

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart toys market size was estimated at USD 12.37 billion in 2023 and is expected to reach USD 13.29 billion in 2024.

b. The global smart toys market is expected to grow at a compounded growth rate of 11.5% from 2024 to 2030 to reach USD 25.54 billion by 2030.

b. " Interactive games is growing at a significant rate with a share of 76.8% in 2023. The availability of interactive games on diverse platforms, ranging from dedicated gaming consoles to mobile devices, offers kids a wide array of options. The flexibility to play on different devices allows children to engage with interactive games in various settings, contributing to the widespread adoption of these games.

b. Some key players operating in smart toys market include Playmobil; Pillar Learning; Sega Toys Co. Ltd.; Leapfrog Enterprises Inc.; Mattel Inc.

b. Key factors that are driving the market growth include the rising adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies and growing adoption of education-based toys

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."