- Home

- »

- Next Generation Technologies

- »

-

Software Defined Perimeter Market, Industry Report, 2030GVR Report cover

![Software Defined Perimeter Market Size, Share & Trends Report]()

Software Defined Perimeter Market (2025 - 2030) Size, Share & Trends Analysis Report By Enforcement Point, By Deployment (Cloud, On-premise), By Organization Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-966-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Software Defined Perimeter Market Summary

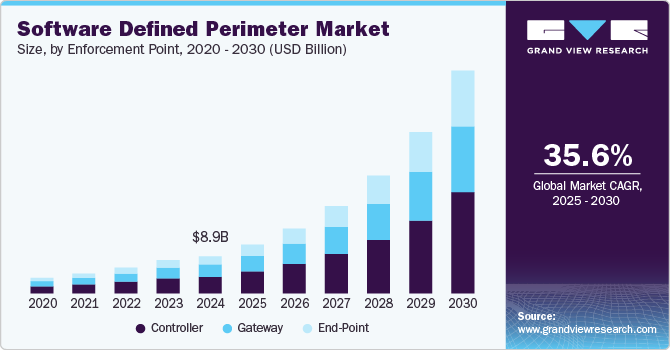

The global software defined perimeter market size was valued at USD 8.89 billion in 2024 and is projected to reach USD 53.66 billion by 2030, growing at a CAGR of 35.6% from 2025 to 2030. The growth of this market is mainly influenced by factors such as increasing demand for secured infrastructure, improved network sophistication, and reduced complexities. The rapid pace of digital transformation in industries has increased demand for secured networks, access control technologies, user identity verifications, and others.

Key Market Trends & Insights

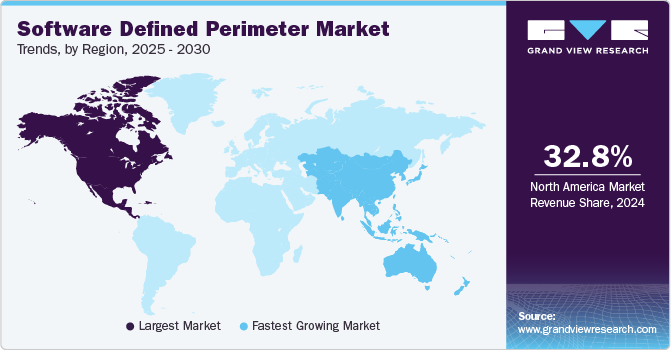

- North America dominated the global software defined perimeter industry with a revenue share of 32.8% in 2024.

- Asia Pacific software-defined perimeter market is projected to experience the highest growth during the forecast period.

- Based on enforcement point, the controller segment dominated the global software-defined perimeter industry with a revenue share of 45.1% in 2024.

- In terms of deployment, on-premise deployment held the largest revenue share of the global software-defined perimeter industry in 2024.

- Based on organization size, the large enterprises segment held the largest revenue share of the global software-defined perimeter (SDP) market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.89 Billion

- 2030 Projected Market Size: USD 53.66 Billion

- CAGR (2025-2030): 35.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In recent years, multiple organizations and government agencies have encountered numerous cases of data breaches, VPN security attacks, and more. This includes malware, session hijacking, denial of services (DDoS) attacks, DNS leaks, and phishing. These incidents might result in compromised networks, infections of client machines, manipulation of data transmissions, introduction of vulnerabilities in private networks, compromised credentials, unauthorized access to accounts, and others. In 2023, according to the Federal Bureau of Investigation Internet Crime Report 2023, the Internet Crime Complaint Center (IC3) received nearly 3,727 complaints of data breach, 659 complaints of malware, 19,778 complaints of identity theft, and approximately 298,878 complaints of phishing/spoofing.

To prevent such cases and protect data and infrastructure, software-defined perimeter (SDP) is extensively used, which enables software-based access control to internal networks and resources while following a determined process for user identity verification. Increasing adoption of cloud-based services, growing requirements for scalable security measures, and rising cyberattacks are contributing to the increasing application of software-defined perimeter (SDP) technology.

The emergence of modern technologies such as the Internet of Things (IoT) has resulted in an expanded attack surface, i.e., the total number of points through which unauthorized access can be gained for data extraction or other malicious purposes. The ability of software-defined perimeter (SDP) solutions to provide a flexible security framework necessary for IoT environments also plays a vital role in increasing technology adoption. Cost-effectiveness offered by the technology and assistance in compliance adherence with the provision of strong access control and data protection abilities is anticipated to generate greater demand.

Enforcement Point Insights

The controller segment dominated the global software-defined perimeter industry with a revenue share of 45.1% in 2024. Controller refers to software programs or hardware devices that manage the flow of transmissions between two distinctive systems. Controllers are equipped with high-level privileges to maintain a seamless flow of operations and access critical systems. This makes controllers the most vulnerable element during attacks such as bus off, DDoS attacks, clone attacks, and more. A software-defined perimeter controller performs authentication processes for users and devices and regulates communications, which makes it an integral part of the SDP architecture.

The end-point segment is projected to experience the highest growth during the forecast period. This is attributed to the increasing adoption of SDP solutions, the many cyberattacks recorded in previous years, and the significant rise in modern technologies such as IoT. Expanded attack surface, growing use of cloud computing technologies, an increasing number of customers for web-based applications, and a noteworthy rise in utilization of numerous devices such as laptops, smartphones, printers, servers, and others are expected to add lucrative growth opportunities for this market.

Deployment Insights

On-premise deployment held the largest revenue share of the global software-defined perimeter industry in 2024. This is attributed to the use of on premise deployment modules by organizations that need complete control over the processes, networks, infrastructure, and data. Often, government organizations, critical infrastructure management authorities, and high-security data-related companies utilize on premise deployments for complete control and no access to third parties.

Cloud deployment is likely to experience significant growth during the forecast period. Increasing adoption of cloud-based services and enhanced capabilities offered by cloud deployments, such as remote monitoring, scalability, reduced costs, ease of sharing, and improved access control, are expected to drive the growth of this segment. The changing nature of work, increasing integration of modern technologies, and large numbers of global transactions in multiple industries are adding to the growing adoption.

Organization Size Insights

The large enterprises segment held the largest revenue share of the global software-defined perimeter (SDP) market in 2024. Expanded attack surfaces caused by the use of multiple devices in large enterprises and the adoption of modern technologies such as IoT have developed a need for secure perimeters. Control over access, user identity verification, and endpoint security are vital in the seamless operations of large enterprises. Growth in communication among different users, devices, and organizations, as well as increasing transactions and a significant rise in cyber-attack incidents, are contributing to the development of this segment.

The small and medium enterprises segment is projected to experience the fastest growth rate from 2025 to 2030. SMEs cannot often invest large funds in security measures. Increasing transactions among individual users, institutional users, devices, and others have developed a need for robust access control and user identity verification requirements. The launch of SME-specific solutions by industry participants and the rising focus of SMEs on embracing advanced technologies for enhanced protection from potential threats are likely to add growth opportunities.

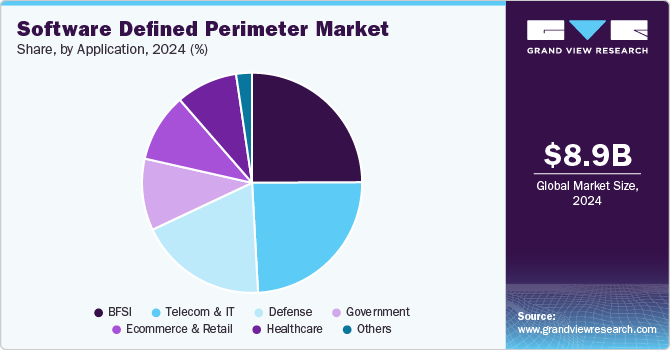

Application Insights

The BFSI segment dominated the global software-defined perimeter industry in 2024. An increasing number of cyberattacks on BFSI organizations, the growing dependability of industry on consumer data, the large-scale adoption of digital financial services in countries such as India, and the increasing use of devices for financial transactions are adding to the growth of this segment. Strict regulations and compliance requirements regarding data protection, the launch of BFSI industry-specific new solutions by market players, and seamless integration with existing systems are expected to contribute to growing demand.

The telecom & IT segment is anticipated to experience the highest CAGR during the forecast period. This segment is mainly driven by the increasing use of smartphones, a significant rise in demand for high-speed internet networks, and the rising dependability of industries on network availability and uninterrupted access to the internet. Demand for scalable security solutions in the industry is expected to generate lucrative growth opportunities for this market.

Regional Insights

North America dominated the global software defined perimeter industry with a revenue share of 32.8% in 2024. This is attributed to numerous large enterprises operating in various sectors such as telecom, IT, defense, BFSI, healthcare, and others in the region. The growing utilization of modern technologies such as IoT, Artificial Intelligence (AI), etc., is adding to the demand for software-defined perimeter solutions in various industries.

U.S. Software Defined Perimeter Market Trends

The U.S. dominated the regional industry in 2024. The robust information and communication technology industry operating in the country, large-scale adoption of modern technologies, increasing cyberattacks, and growing use of devices leading to expanded attack surfaces are key growth drivers for this market. Demand from BFSI, telecom & IT, and defense industry is anticipated to add lucrative opportunities.

Europe Software Defined Perimeter Market Trends

Europe was identified as one of the key regions of the software-defined perimeter market in 2024. This is attributed to factors such as the rapid pace of digital transformation in the region, growing cases of malware and other cyber-attacks, and demand for scalable security solutions from multiple organizations and government agencies. The robust services industry in Europe is expected to result in greater demand for software-defined perimeter solutions over the forecast period.

Germany software-defined perimeter market dominated the regional industry in 2024. The presence of a robust manufacturing industry, which has been focusing on technology adoptions such as automation, the increasing use of modern technologies, and the growing need for strong security measures to prevent potential data thefts are primary growth drivers for this market. Compliance requirements regarding data security measures, growing demand from the BFSI industry, and rising incidents of cyberattacks are likely to drive demand for software-defined perimeter solutions in the next few years.

Asia Pacific Software Defined Perimeter Market Trends

Asia Pacific software-defined perimeter market is projected to experience the highest growth during the forecast period. This market is mainly driven by the large number of outsourcing service businesses linked with the U.S. and Europe-based enterprises, increasing demand from telecom & IT, and growth in cyberattacks. A significant rise in modern technologies, especially in sectors such as BFSI, defense, healthcare, and retail, has resulted in the growing use of devices, data generation, and data transmissions. This has developed a need for robust security solutions to ensure data security and protection.

China held the largest revenue share of the Asia Pacific software-defined perimeter market in 2024. This is attributed to increasing demand from the defense, BFSI, and telecom sectors, the large number of information and communication technology companies operating in the country, and the growing use of technology devices.

Key Software Defined Perimeter Company Insights

Some of the key companies operating in the software defined perimeter industry are Akamai Technologies, Broadcom, Dell Inc. Zscaler, Inc., Fortinet, Inc. and others. Key companies are embracing strategies such as developing industry-specific solutions, including advanced technology, to address growing demand from various sectors and increasing competition.

-

Cisco Systems, Inc., is a technology company that develops networking equipment and provides software and services to multiple industries worldwide. Cisco’s portfolio is associated with vital business functions such as networking, security, cloud management, and more. The company offers Software-Defined Access (SD-Access) and other products that assist businesses in securing their networks.

-

Akamai Technologies, a cloud computing technology and cybersecurity enterprise, offers a wide variety of solutions to multiple industries. This includes products associated with security, content delivery, Edge computing, cloud computing, and others. Some of its offerings include Kona DDoS Defender, Feed Collection System, App & API Protector, Enterprise Application Access, Edge DNS, and others.

Key Software Defined Perimeter Companies:

The following are the leading companies in the software defined perimeter market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Broadcom

- Cisco Systems, Inc.

- Dell Inc.

- Zscaler, Inc.

- Fortinet, Inc.

- Intel Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.,

- Verizon, Inc

- Unisys Corporation

- Check Point Software Technologies Ltd.

Recent Developments

-

In November 2024, Akamai Technologies, a market participant in cybersecurity and cloud computing, announced the extension of Akamai Guardicore Segmentation. Additionally, it added novel features to its Zero Trust Network Access (ZTNA) offering, Akamai Enterprise Application Access.

-

In April 2024, Zscaler announced it has signed an agreement to acquire Airgap Networks, agentless segmentation provider for enterprise IT. The acquisition enabled Zscaler to combine its Zero Trust SD-WAN capabilities with Airgap to offer Zero Trust Exchange.

Software Defined Perimeter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.72 billion

Revenue forecast in 2030

USD 53.66 billion

Growth Rate

CAGR of 35.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Enforcement point, deployment, organization size, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Akamai Technologies; Broadcom; Cisco Systems, Inc.; Dell Inc.; Zscaler, Inc.; Fortinet, Inc.; Intel Corporation; Palo Alto Networks, Inc.; Proofpoint, Inc.,; Verizon, Inc; Unisys Corporation; Check Point Software Technologies Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software Defined Perimeter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global software defined perimeter market report based on enforcement point, deployment, organization size, application, and region.

-

Enforcement Point Outlook (Revenue, USD Million, 2018 - 2030)

-

Gateway

-

Controller

-

End-point

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On Premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense

-

Telecom & IT

-

BFSI

-

Ecommerce & Retail

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.