- Home

- »

- Renewable Energy

- »

-

Solar Microinverter Market Size, Share, Industry Report, 2030GVR Report cover

![Solar Microinverter Market Size, Share & Trends Report]()

Solar Microinverter Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Single Phase, Three Phase), By Application (Residential, Commercial, Industrial), By Power Rating, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-382-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Microinverter Market Summary

The global solar microinverter market size was estimated at USD 3.01 billion in 2024 and is projected to reach USD 8.54 billion by 2030, growing at a CAGR of 18.8% from 2025 to 2030. This market's growth is driven by the increasing adoption of solar energy across residential, commercial, and industrial sectors.

Key Market Trends & Insights

- The Asia Pacific region dominated the solar microinverter market with a revenue share of 43.6% in 2024.

- Solar microinverter market in China accounted for the largest share in 2024.

- By type, the single-phase segment led the market and accounted for over 78.2% of the revenue share 2024.

- By application, the residential segment led the market and accounted for a significant revenue share in 2024.

- By power rating, the 250 W to 500 W segment led the solar microinverter market and accounted for significant revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.01 Billion

- 2030 Projected Market Size: USD 8.54 Billion

- CAGR (2025-2030): 18.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The demand for efficient and reliable solar energy systems has surged as the world shifts towards renewable energy sources to combat climate change and reduce carbon footprints. Microinverters, which convert direct current (DC) generated by solar panels into alternating current (AC) for use in the electrical grid, offer significant advantages over traditional string inverters.Microinverters improve the overall efficiency of solar energy systems by optimizing the power output of each solar panel. This particularly benefits installations where shading, orientation, or panel mismatches can impact performance. Additionally, microinverters enhance the monitoring capabilities of solar systems, allowing users to track the performance of each panel in real-time, which contributes to more efficient maintenance and troubleshooting.

Increasing investments and supportive policies from governments across the globe are the major factors driving the growth of the solar microinverter market. Many countries are implementing incentives such as tax credits, subsidies, and feed-in tariffs to promote the adoption of solar energy. According to the news published by Citizen Solar in February 2025, the Indian Ministry of New and Renewable Energy (MNRE) has introduced different financial assistance schemes for solar energy usage. In addition, the central government pays around 30% of the installation cost for PV systems as part of the subsidy program. Such policies make solar installations more financially attractive to consumers and businesses, boosting the demand for microinverters.

Advancements in microinverter technology have led to improved reliability, longer lifespans, and cost reductions, making them a more viable option for a wide range of applications. For instance, in May 2025, Enphase Energy, Inc. introduced the user-friendly, plug-and-play Enphase IQ Balcony Solar System in Germany. The innovative design of the inverter enables homeowners and apartment residents with limited roof space to produce clean energy using balconies, patios, and small outdoor areas. In addition, the rising awareness of the benefits of microinverters, such as increased energy yield, enhanced safety, and greater design flexibility, is also contributing to their growing popularity. As the global solar market continues to expand, driven by the need for sustainable energy solutions, the microinverter segment is poised for significant growth in the coming years.

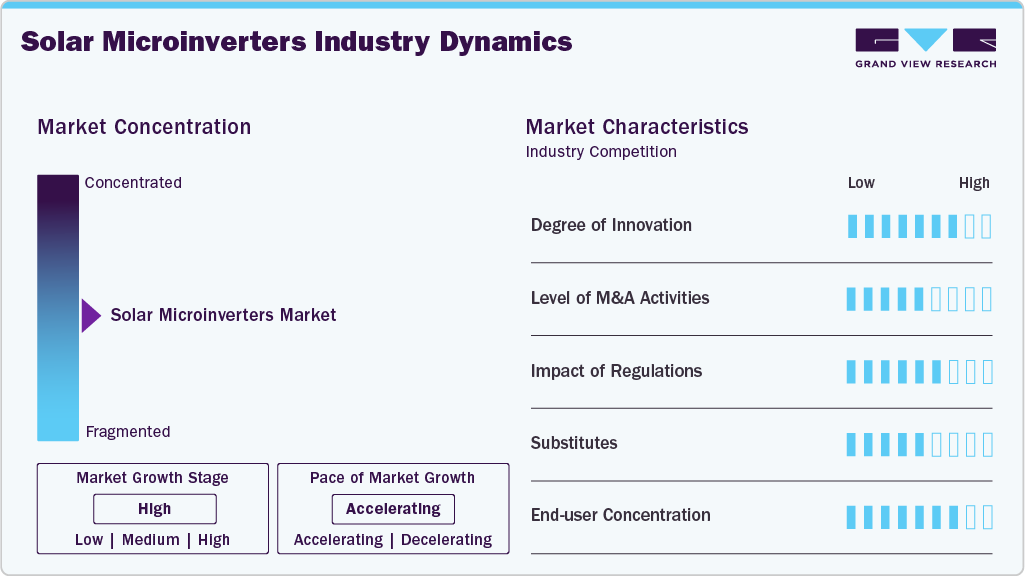

Market Concentration & Characteristics

The solar microinverter market is witnessing high growth. Intense competition characterizes the market as players employ innovative and diverse technologies to enhance their solar energy offerings. Consistently growing investments in infrastructure development and the increasing adoption of renewable energy in emerging economies further encourage new players to enter the competitive market.

Continuous product innovations, including next-generation microinverters with enhanced energy conversion rates and improved communication capabilities, characterize the solar microinverter market. Such innovations are leading to the development of advanced and efficient solutions for solar energy systems. For instance, in April 2024, Enphase Energy, Inc., one of the leading suppliers of microinverter-based solar and battery systems, launched IQ8P microinverters for high-powered solar modules with a peak alternating current (AC) power of 480 W in Spain and France. A key driver in this market is the increasing demand for higher energy yields and optimized performance in solar installations. These advanced microinverters offer longer warranty periods, reflecting improved reliability. Another significant trend is the growing integration of smart features, such as advanced monitoring and control functionalities, enabling better energy management and grid interaction.

The market is moderately fragmented, characterized by international players such as SMA Solar Technology AG, Canadian Solar, SolarEdge Technologies Inc., Complete Solaria, Delta Electronics, Inc., and some smaller local companies. The key players' strategies most often involve new product launches, partnerships, and regional expansion.

Type Insights

The single-phase segment led the market and accounted for over 78.2% of the revenue share 2024. The dominance of single-phase microinverters in the solar market is driven largely by their suitability for residential solar installations. Their compatibility with standard single-phase household electrical systems simplifies installation and reduces costs, making them ideal for residential applications. Fueled by environmental awareness, incentives, and energy independence goals, the booming residential solar market further drives their adoption. For instance, in June 2024, AP Systems launched a single-phase hybrid inverter for balconies. These microinverters come with integrated batteries with MC4 connectors, simplifying the installation process in residential spaces.

Technological advancements have enhanced their reliability, efficiency, and user-friendliness, with real-time monitoring and smart home integration features. In addition, single-phase microinverters optimize individual panel performance, maximizing energy harvest even with shading. Besides, the availability and new launch of compact design ease installation and maintenance. With the continued growth of residential solar, supported by net metering and feed-in tariffs, single-phase microinverters are poised to maintain their large share in the solar microinverters industry.

The three-phase segment is projected to witness the fastest growth of 20.7% over the forecast period. The rapid growth of the segment is attributed to the robustness and high system uptime offered by three-phase microinverters, which are crucial in commercial and industrial applications. Furthermore, the increasing demand for higher power output in these sectors has propelled market growth. This trend aligns with the growing adoption of solar energy by businesses and industries striving for sustainability and reduced electricity costs. This growth is further supported by government initiatives promoting solar energy adoption. For instance, PM Surya Ghar Muft Bijli Yojana, an initiative launched by the Indian government, aims to provide free electricity to one hundred million households installing rooftop solar systems. Such an initiative indirectly boosts the demand for efficient inverters, including three-phase microinverters for larger residential and commercial installations.

Application Insights

The residential segment led the market and accounted for a significant revenue share in 2024. The largest share is attributed to the factors such as homeowners seeking lower energy costs & energy independence, amid rising utility rates, and decreasing solar panel costs. In addition, government incentives and growing environmental awareness further drive the growth of the residential segment in the solar microinverter market. Microinverters are favored for maximizing individual panel output, offering higher energy yields and faster ROI, countering shading or obstructions. According to the article published by Ornate Agencies Pvt. Limited in November 2024, housing societies can save up to 80% on electricity costs. Moreover, technological advancements provide user-friendly features such as real-time monitoring and remote diagnostics. Their modularity allows for flexible system design and expansion, while enhanced safety features are a key advantage over string inverters in residential spaces. The trend towards sustainable living and smart home integration is expected to fuel the growth of the residential segment in the solar microinverter industry.

The industrial/utility segment is anticipated to witness the fastest growth over the forecast period. The fastest growth is attributed to the rapid global industrial expansion, the need for granular monitoring, and enhanced energy management in large-scale solar installations. In addition, microinverters offer crucial redundancy, ensuring a consistent power supply for critical industrial and utility operations, which is expected to drive the segment's growth. Furthermore, advancements in high-power microinverters, ideally suited for larger projects, coupled with government initiatives that encourage the integration of renewable energy, are significantly boosting adoption across this segment.

Power Rating Insights

The 250 W to 500 W segment led the solar microinverter market and accounted for significant revenue share in 2024. The 250 W to 500 W microinverters are highly favored for residential and small commercial solar installations due to their balance of efficiency, affordability, and compatibility with standard solar panels. These microinverters optimize energy conversion without overloading, offer easy installation, and support various panel types. Additionally, it helps in scaling production while reducing costs and maintaining high performance, which is expected to drive the segment's growth. The segment's growth is further strengthened by the new product launches made by key market players. For instance, in October 2024, Enphase Energy, Inc. launched IQ8X Microinverters in Australia. These inverters featured AC power of 384 W, designed to support high-power modules and cell counts. As solar adoption grows among homeowners and small businesses, this segment is expected to grow consistently during the forecast period.

The below 250 W power rating segment is anticipated to witness the highest CAGR during the forecast period. The segment's growth is attributed to the high adoption of these solar microinverters in small-scale residential applications. These microinverters are well-suited for compact rooftop systems, offering efficient energy conversion without overloading, thereby enhancing system reliability. Their compatibility with standard solar panels and ease of installation make them attractive for homeowners seeking cost-effective solar solutions. These factors are expected to drive the growth of the solar microinverters industry segment.

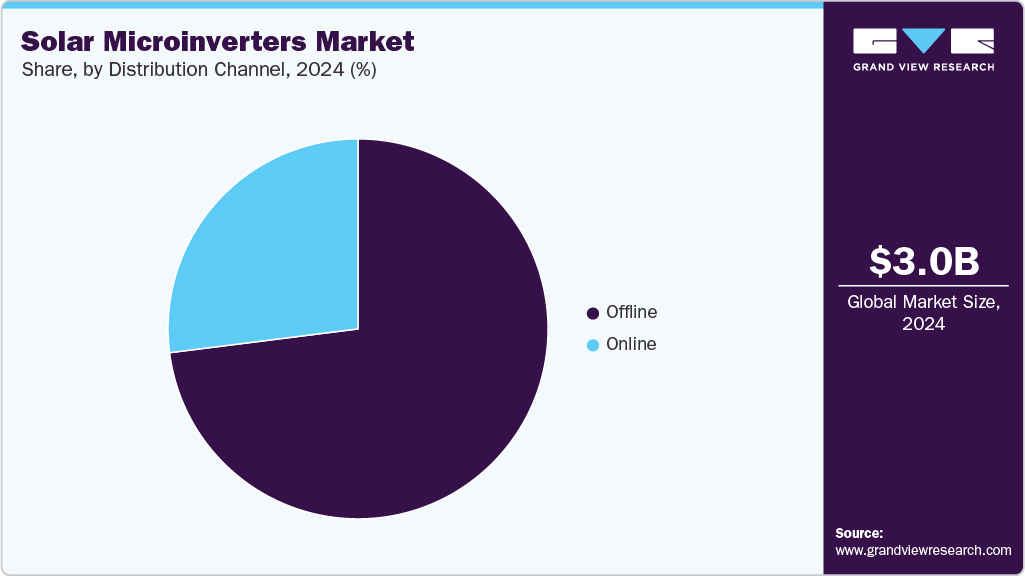

Distribution Channel Insights

Offline segment led the solar microinverter market and accounted for the largest revenue share in 2024. The offline segment gives customers an advantage regarding in-person product evaluation, builds trust, and increases purchase confidence. Knowledgeable sales representatives offer personalized guidance, clarify technical doubts, and provide valuable recommendations and details influencing the consumer's purchase decision. These channels often include essential services such as professional installation and after-sales support, which are crucial for comprehensive solar solutions. Traditional business practices and lower digital literacy in some regions, especially emerging markets, favor offline transactions. In addition, localized marketing and strong partnerships between manufacturers and distributors bolster offline sales. These factors, combined with their convenience and support, ensure the continued dominance of offline channels in the solar microinverter market.

The online distribution channel segment is anticipated to witness the highest CAGR during the forecast period. The segment’s growth is driven by the increasing adoption of e-commerce and the convenience it offers to consumers. In addition, online platforms provide various microinverter products from multiple manufacturers, allowing consumers to compare prices and features before purchasing. The ease of online ordering and the availability of detailed product information are key factors driving the growth of the online distribution channel. As the demand for efficient, reliable, and cost-effective solar energy solutions continues to grow, the online distribution channel is expected to register the highest CAGR during the forecast period.

Regional Insights

North America accounted for a significant share of the market in 2024 and registered the fastest growth of 19.7% over forecast period. The growth is fueled by increasing solar adoption, supportive government policies such as tax credits and rebates, and technological advancements. The focus on renewable energy in this region has significantly boosted solar installations. The demand for high-efficiency and reliable solutions has driven widespread adoption of microinverters, particularly in residential and commercial sectors. Major market players and ongoing innovations continue to strengthen this region's growth.

U.S. Solar Microinverter Market Trends

U.S. dominates the solar microinverter market in North America in 2024. The growth is attributed to the strong federal and state-level support for renewable energy. Programs such as the Investment Tax Credit (ITC) have incentivized homeowners and businesses to invest in solar energy systems. The residential segment, in particular, has seen a surge in microinverter adoption due to their superior performance, safety features, and ease of installation. According to the report published by the U.S. Environmental Protection Agency (EPA) in April 2025, 900,000 households and disadvantaged communities will benefit under the Solar for All program. Additionally, the trend towards smart homes and energy management systems has increased the demand for advanced microinverter technologies.

Solar Microinverter Market in Canada is expected to grow at a significant CAGR. Government initiatives promoting clean energy and reducing carbon emissions are driving the expanding Canadian solar microinverter market. For instance, Canada's government offers different solar energy adoption incentives, such as the home renovation saving program and the Save on Energy commercial/industrial/institutional solar incentive. The government offers rebates on solar panels and battery energy storage, up to 50% of the project cost in commercial or industrial settings. Canada's diverse sunlight conditions across its vast geography benefit from microinverter optimization. Provincial incentives and rebates encourage residential solar adoption, further propelled by increasing environmental awareness among Canadian consumers.

Europe Solar Microinverter Market Trends

Europe is a mature solar microinverter market characterized by strong regulatory support and high adoption rates of renewable energy. According to a report published by the European Environment Agency in 2023, renewable energy represented 24.5% of energy usage in the European Union. Countries including Germany and Italy lead in solar installations, with a significant share of residential and commercial systems utilizing microinverters. The European Union’s renewable energy targets and various subsidy programs have driven the growth of the solar sector in the region.

Solar Microinverter Market in Germany accounted for significant revenue share in 2024. supported by favorable government policies and a well-established solar industry. The country’s commitment to renewable energy and the Energiewende initiative have accelerated the deployment of solar systems. According to the article published by Sustainable Systems Ltd. In July 2024, solar energy accounts for 9% of the total electricity generation in the country. This shows the higher adoption of renewable energy across the country. In addition, microinverters are preferred in residential installations for their enhanced safety, ease of integration, and ability to maximize energy production in diverse climatic conditions.

Asia Pacific Solar Microinverter Market Trends

The Asia Pacific region dominated the solar microinverter market with a revenue share of 43.6% in 2024. The region's growth is fueled by increasing energy demand, government support, rising adoption of solar energy across countries, and declining costs of solar installations. For instance, in April 2025, Papua New Guinea started building large solar farms. The aim is to achieve 70% electrification with the help of solar energy by 2030. Due to their efficiency and adaptability, the diverse climate conditions and frequent shading issues in many parts of the region make microinverters an attractive option.

Solar microinverter market in China accounted for the largest share in 2024, and is experiencing substantial growth, supported by the government’s strong commitment to renewable energy and significant investments in solar infrastructure. The country’s large-scale solar farms and rooftop solar installations have seen a growing preference for microinverters to maximize energy yield and improve system reliability. According to the news published by Dezan Shira & Associates in November 2024, solar energy is the largest contributor to the country’s clean energy growth in 2023. The total value increased by 63.0% from 2022 to USD 345.03 in 2023. China's manufacturing capabilities and economies of scale also contribute to these technologies' affordability and widespread adoption.

Key Solar Microinverter Company Insights

Some of the key companies in the solar microinverter market include SMA Solar Technology AG, Canadian Solar, SolarEdge Technologies Inc., and Complete Solaria are concentrating on growing their clientele to obtain a competitive advantage in the market. Thus, significant participants are taking a number of strategic actions, including alliances with other large corporations and mergers and acquisitions.

-

SMA Solar Technology AG, founded in 1981, is headquartered in Niestetal, Germany. While primarily known for string and central inverters, their business segments include Residential, Commercial & Industrial Solutions, Large Scale & Project Solutions, Storage, and Digital Energy; they do not specifically list "solar microinverters" as a separate segment.

-

Canadian Solar, founded in 2001, has its global headquarters in Kitchener, Ontario, Canada. Their business operations are primarily divided into two segments: CSI Solar, which includes the manufacturing of solar modules and battery energy storage systems, and Recurrent Energy, which focuses on utility-scale solar and energy storage project development.

Key Solar Microinverter Companies:

The following are the leading companies in the solar microinverter market. These companies collectively hold the largest market share and dictate industry trends.

- SMA Solar Technology AG

- Canadian Solar

- SolarEdge Technologies Inc.

- Complete Solaria

- Delta Electronics, Inc.

- Yaskawa - Solectria Solar

- Sineng Electric Co., Ltd.

- Hitachi Hi-Rel Power Electronics Private Limited

- Sungrow

- Sensata Technologies, Inc.

Recent Developments

-

In June 2024, Hoymiles Power Electronics Inc., a Chinese manufacturing company, launched a 5 kW three-phase microinverter named MIT-5000-8T at the SNEC tradeshow in Shanghai, China. The company claims that the newly launched microinverter is around 20% cheaper than other smaller microinverters and can accommodate eight solar modules.

-

In March 2024, Altenergy Power System Inc. signed a partnership agreement to collaborate with Solarclarity BV at the Solarsolutions Amsterdam trade fair. Through this collaboration, Solarclarity BV can distribute Altenergy Power System Inc. manufactured inverters and batteries in multiple European countries.

Solar Microinverter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.60 billion

Revenue forecast in 2030

USD 8.54 billion

Growth rate

CAGR of 18.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, power rating, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, France, Germany, Italy, Spain, Russia, U.K., China, Japan, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE.

Key companies profiled

SMA Solar Technology AG; Canadian Solar; SolarEdge Technologies Inc.; Complete Solaria; Delta Electronics, Inc.; Yaskawa - Solectria Solar; Sineng Electric Co., Ltd.; Hitachi Hi-Rel Power Electronics Private Limited; Sungrow; Sensata Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Microinverters Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solar microinverters market report based on type, application, power rating, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Phase

-

Three Phase

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial / Utility

-

-

Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 250 W

-

250 W to 500 W

-

Above 500 W

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Direct Sales

-

Indirect Sales

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global solar microinverter market size was estimated at USD 3.01 billion in 2024 and is expected to reach USD 3.60 billion in 2025.

b. The global solar microinverter market is expected to grow at a compound annual growth rate of 18.8% from 2025 to 2030 to reach USD 8.54 billion by 2030.

b. Based on the application, the residential segment led the market and accounted for over 63.00% of revenue share in 2024. This dominance is largely attributed to the growing adoption of solar energy solutions by homeowners seeking to reduce electricity costs and enhance energy independence.

b. Some of the key players operating in this industry include SMA Solar Technology, Canadian Solar, SolarEdge Technologies, SunPower, Delta Electronics, Solectria Renewables, Sineng Electric, Hitachi Hi-Rel Power Electronics, Sungrow Deutschland GmbH, Sensata Technologies, Inc., among others.

b. Key factors driving the market growth include increasing demand for renewable energy and advancement in technology enhancing efficiency and affordability. Additionally, supportive government policies and incentives are boosting market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.