- Home

- »

- Healthcare IT

- »

-

Southeast Asia Telehealth Market Size, Industry Report 2030GVR Report cover

![Southeast Asia Telehealth Market Size, Share & Trends Report]()

Southeast Asia Telehealth Market Size, Share & Trends Analysis Report By Service Type (Remote Patient Monitoring, Real-time Interactions), By Delivery Mode, By Application, By Type, By End-use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-432-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Southeast Asia Telehealth Market Trends

The Southeast Asia telehealth market size was estimated at USD 8.07 billion in 2024 and is projected to grow at a CAGR of 18.1% from 2025 to 2030. Increasing penetration of the internet and the constant evolution of smartphones and tablets have made accessing telehealth services more convenient and are expected to contribute to the growing demand. Users are increasingly becoming aware of the

importance of monitoring health and fitness to control the incidence of chronic ailments and are using their smartphones to track the same. In addition, innovators are designing technologies to deliver quality care through various web and cloud-based platforms.

The emergence of the Internet of Things (IoT) in healthcare with integrated analytics, advanced wearable devices, and strong mobile connectivity has significantly transformed the healthcare industry and has enabled efficient patient monitoring, optimizing prescriptions, and chronic disease management. For instance, in August 2022, Qmed Asia, a Malaysia-based startup launched Qmed GO, a telehealth kiosk that can serve as a mini-clinic for corporate employers as it is connected to medical IoT devices that can track 16 vital parameters. Furthermore, deep learning and artificial intelligence functionalities enhance the personalization of healthcare. These advanced techniques are incorporated in telehealth to assist the conclusive disposition of patients through remote analysis. For instance, the Telehealth platform of Haldoc uses AI to provide its physicians with feedback on their performance and consultation and training for performance enhancement.

The shortage of healthcare personnel is increasing across Southeast Asian countries and is positively influencing the demand for telemedicine services. According to the OECD report published in 2022, the number of doctors per 1000 population varies widely across Asia-Pacific countries and territories, but it is generally lower than the OECD average. Across lower-middle- and low-income Asia-Pacific countries and territories, there are 1.1 doctors 1000 population. Telemedicine services are helping in improving healthcare accessibility in remote and rural areas and curb increasing healthcare costs.

Moreover, the growing geriatric population and increasing prevalence of chronic diseases in Southeast Asia are contributing to the growing demand for quality healthcare. According to the United Nations ESCAP, the population of individuals aged 60 and above in Southeast Asia was 85.7 million in 2023, accounting for 12.5% of the total population. In addition, according to the WHO report, the South-East Asia region is experiencing a rapid increase in its aging population. In 2017, 9.8% of the population was aged 60 or above. This percentage is projected to rise to 13.7% by 2030 and to 20.3% by 2050. Moreover, the growing government support and initiatives are boosting the growth of the telehealth market in Southeast Asia. For instance, in March 2019, the Thailand Public Health Ministry and the National Broadcasting and Telecommunications Commission (NBTC) introduced telemedicine programs in rural areas. Through this program, 32 hospitals were to be funded for setting up telemedicine equipment.

Furthermore, mergers and acquisitions, partnerships, and collaborative agreements are some of the crucial initiatives being undertaken by key players, which are expected to propel the growth of the market for telehealth in Southeast Asia. For instance, in April 2021, Prudential Life Assurance Public Company Limited announced their partnership with MyDoc in order to launch telemedicine & online consultation services to Thai people on Pulse by Prudential app. This will allow Pulse users access to video consultations, obtaining electronic prescriptions and certifications.

Market Concentration & Characteristics

The degree of innovation in the Southeast Asia telehealth market has seen remarkable growth in recent years, driven by rapid technological advancements and increasing demand for accessible healthcare services. This region has witnessed the emergence of various telehealth platforms that leverage mobile applications, artificial intelligence, and cloud computing to enhance patient care and streamline healthcare delivery. Startups and established players are continually developing solutions that address local health challenges, such as limited access to specialists in rural areas and the need for more efficient patient management systems.

The Southeast Asia telehealth market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for Southeast Asia telehealth. In October 2024, WhiteCoat Global, a digital health provider based in Singapore, is in the process of acquiring the telemedicine platform Good Doctor Indonesia.

Various countries are implementing specific legal frameworks to govern telehealth practices, focusing on areas such as licensing of healthcare providers, data privacy, and patient consent. For instance, some nations have established guidelines to ensure that telehealth services meet quality standards and comply with international best practices.

Traditional healthcare services, such as in-person consultations with doctors, remain a primary substitute for telehealth, particularly in areas with established healthcare infrastructure. Additionally, alternative digital health solutions, including wellness apps and self-diagnosis tools, offer consumers different pathways for managing health and wellness without the need for professional intervention.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising number of product approvals and funding are creating new opportunities for new entrants in the regions. In May 2023, in a Series A funding round, the telehealth company ORA, headquartered in Singapore, raised USD10 million.

Service Type Insights

In 2024, the real-time interactions segment dominated the Southeast Asia telehealth market and accounted for the largest revenue share of 44.1%. Increasing preference towards telemedicine amongst providers and patients have contributed to the growth. For instance, in April 2023, DOC2US a digital health provider based in Malaysia announced the launch of DOC2HOME, its new subsidiary, a digital health platform aimed to provide home-based personalized healthcare services to residents and homeowners through technology. Furthermore, these services enable patients in remote locations to access healthcare services at affordable prices.

The remote patient monitoring segment in the Southeast Asia telehealth market is anticipated to witness the fastest expansion over the forecast periodowing to technology advancements in video conferencing systems and the development of digital infrastructure. The growing geriatric population coupled with the increasing prevalence of chronic diseases is expected to positively influence segment growth. For instance, according to the Department of Disease Control, the diabetes situation in Thailand is progressively deteriorating, with 300,000 new cases reported in 2023. In 2022, there were 3.3 million new cases, which is 150,000 more than in 2021. Furthermore, remote patient monitoring allows real-time monitoring, improves patient engagement, detects activity patterns, and reduces healthcare costs.

Delivery Mode Insights

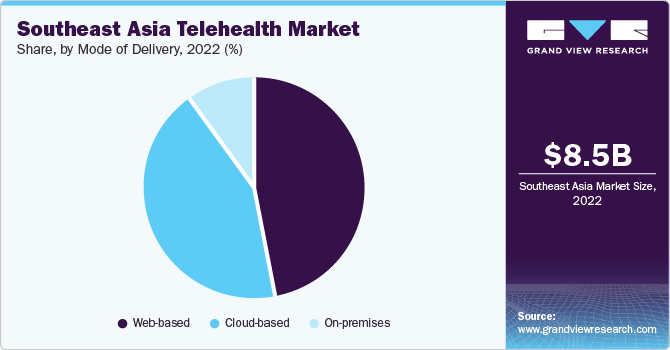

In 2024, the web-based segment dominated the Southeast Asia telehealth market and accounted for the largest revenue share of 46.5%. Web-based telehealth solutions are delivered to users through web servers using the internet protocol. Web-based solutions comprise four aspects, including Internet connection, data administrator, web server, and software coding system. Utilizing the Internet and web-based services provides access to the most remote areas using only one computer or monitoring device. Moreover, this data can be accessed and analyzed in real-time, thereby reducing decision-making time drastically. This mode also aggregates data at a central location, thereby reducing the time required to transfer data from one system to another.

The cloud-based segment in the Southeast Asia telehealth market is anticipated to witness significant growth over the forecast period. Cloud-based technology enables hosting applications, software & systems, and services remotely and can be freely accessed or used through the Internet. The utilization of cloud-based technology has increased owing to various security breaches in web-based and on-premises deployment. Moreover, with growing IT infrastructure needs & changing business requirements, sharing information with clients and other stakeholders is a key concern and therefore several players are using this technology. Benefits associated with cloud technology such as use of external web servers, remote access & authorization, information sharing across different stages of value chain, and immediate detection of security threats & lapses is further aiding its adoption.

Application Insights

In 2024, the diagnosis segment dominated the Southeast Asia telehealth market and accounted for the largest revenue share of 80.2% owing to the increasing number of smartphone users, rapid penetration of the internet, and increasing deployment of telehealth services. Patients and providers are increasingly becoming aware of the benefits of telemedicine and this is expected to drive the segment growth. In addition, telemedicine services enable flexibility in scheduling for the healthcare providers and are driving the adoption of these services.

The prevention segment in the Southeast Asia telehealth market is anticipated to witness significant growth over the forecast period owing to the increasing awareness levels regarding the importance of health and fitness. Shortage of healthcare personnel, increasing healthcare costs, burdened facilities, and resources, and increasing prevalence of chronic diseases are driving the adoption of telehealth services for earlier disease prevention. For instance, the CodeBlue report published in 2024, states that approximately 2.3 million Malaysian adults are affected by at least three non-communicable diseases, such as diabetes, hypertension, high cholesterol, or obesity. It is reported that 16% of adults have diabetes, 29% have hypertension, and 33% have high cholesterol.

Type Insights

In 2024, the tele-hospital type segment had significant revenue share in the market for telehealth in Southeast Asia owing to the constantly developing digital healthcare technologies, growing government support, increased healthcare IT expenditure. Additionally, the growing geriatric population increased health consciousness, and the rising demand for accessible and affordable healthcare services is driving market growth. According to DOSM's estimates, the proportion of the population aged 65 years and older (considered as old age) rose from 7.2% in 2022 to 7.4% in 2023. This age group includes 2.5 million people, highlighting the fact that Malaysia is currently undergoing population aging.

The tele-home segment in the Southeast Asia telehealth market is anticipated to witness significant growth over the forecast period due to enhanced affordability, accessibility, efficiency, and quality of care. Moreover, the growing number of smartphone users and improved internet connectivity is expected to drive the growth of this segment. Increasing penetration of 5G technology will further accelerate segmental growth. According to the report from Telefonaktiebolaget LM Ericsson, there were 61 million 5G subscriptions in Southeast Asia by the conclusion of 2023. It is anticipated that the number of 5G subscriptions in the Southeast Asia region will reach approximately 560 million by the conclusion of 2029.

End-use Insights

In 2024, the providers segment had significant revenue share of 49.1% in the market for telehealth in Southeast Asia owing to the rising adoption of telemedicine platforms by healthcare practitioners to reduce the growing burden on healthcare facilities and resources. Increasing demand for reducing hospital admissions and improvements in hospital workflow is propelling the adoption of digital health technologies among healthcare providers, which, in turn, contributes toward market growth. Moreover, the rise in the number of partnerships and collaborations among various public and private healthcare organizations to drive the adoption and accessibility of telehealth services is further aiding segment growth.

The patients segment in the Southeast Asia telehealth market is anticipated to witness significant growth over the forecast period owing to increasing tech-friendly users and active users on telemedicine platforms. Furthermore, telemedicine services have successfully overcome the communication gap between healthcare professionals and patients. Moreover, these services have enhanced healthcare accessibility and reduced patient healthcare expenditure.

Country Insights

Indonesia Telehealth Market Trends

Indonesia telehealth market in the held the largest share of 26.4% in 2024. In October 2023, in a Series A funding round led by MDI Ventures, Good Doctor, a healthtech company from Southeast Asia, raised USD10 million. Such increasing funding from government and non-nongovernment organization are fostering market growth.

Malaysia Telehealth market is anticipated to register the fastest growth during the forecast period owing to theincreasing strategic initiatives undertaken by market players. In May 2024, MEASAT, a satellite operator based in Malaysia, revealed that it had entered into a Memorandum of Understanding (MoU) with Mudah Healthtech, a local healthcare technology company, to introduce telehealth services to underserved areas.

Key Southeast Asia Telehealth Company Insights

Key participants in the Southeast Asia telehealth market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Southeast Asia Telehealth Companies:

- HALODOC

- HEYDOC INTERNATIONAL SDN. BHD.

- Grab

- MyDoc Pte. Ltd.

- Doctor Anywhere Pte Ltd.

- Teleme

- GOOD DOCTOR TECHNOLOGY (SINGAPOUR) PTE. LTD.

- DoctorOnCall

- Alodokter

- ClicknCare

Recent Developments

-

In May 2024, Mobile-health Network Solutions, which is also called MaNaDr, a top telehealth company in the Asia-Pacific region, has revealed the formation of a branch in Malaysia, demonstrating a major advancement in its expansion plan. This decision is intended to cater to the increasing healthcare requirements in Southeast Asia by offering convenient and cost-effective telemedicine services.

-

In September 2023, Doctor Anywhere (DA), a healthcare technology company based in Singapore, announced a collaboration with Allianz Partners, an insurance and assistance company operating in the B2B2C sector. The objective of this partnership is to offer telehealth services to Singapore, Malaysia, Thailand, and the Philippines.

-

In November 2021, Doctor Anywhere (DA) announced the acquisition of Doctor Raksa, a telemedicine platform in Thailand.

Southeast Asia Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.50 billion

Revenue forecast in 2030

USD 21.80 billion

Growth rate

CAGR of 18.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, delivery mode, application, type, end-use, country

Regional scope

Southeast Asia

Country scope

Indonesia; Thailand; Malaysia

Key companies profiled

Halodoc; Doc2Us; GrabHealth(Grab); MyDoc Pte Ltd; Doctor Anywhere Pte Ltd; TeleMe; Good Doctor Technology (GDT); DoctorOnCall; Alodokter; ClicknCare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Southeast Asia Telehealth Market Report Segmentation

This report forecasts revenue and volume growth at regional and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Southeast Asia telehealth market report based on service type, delivery mode, application, type, end-use, and country:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Remote patient monitoring

-

Real-time interactions

-

Store and forward

-

Other services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prevention

-

Examination

-

Diagnosis

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-hospital

-

Tele-home

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Indonesia

-

Thailand

-

Malaysia

-

Frequently Asked Questions About This Report

b. The Southeast Asia telehealth market size was estimated at USD 8.07 billion in 2024 and is expected to reach USD 9.50 billion in 2025.

b. The Southeast Asia telehealth market is expected to grow at a compound annual growth rate of 18.1% from 2025 to 2030 to reach USD 21.80 billion by 2030.

b. Indonesia dominated the market and accounted for the largest revenue share of 26.4% in 2024, owing to widespread adoption of telehealth services

b. Some key players operating in the Southeast Asia telehealth market include Halodoc; Doc2Us; GrabHealth(Grab); MyDoc Pte Ltd; Doctor Anywhere Pte Ltd; TeleMe; Good Doctor Technology (GDT); DoctorOnCall; Alodokter; ClicknCare

b. Increasing penetration of the internet and the constant evolution of smartphones and tablets have made accessing telehealth services more convenient and are expected to contribute to the growing demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."