- Home

- »

- Next Generation Technologies

- »

-

Southeast Asia Human Resource Software Market, 2030GVR Report cover

![Southeast Asia Human Resource Software Market Size, Share & Trends Report]()

Southeast Asia Human Resource Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Software Type (Core HR, Recruiting, Workforce Planning & Analytics), By Enterprise Size, By Deployment, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-524-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Southeast Asia HR Software Market Trends

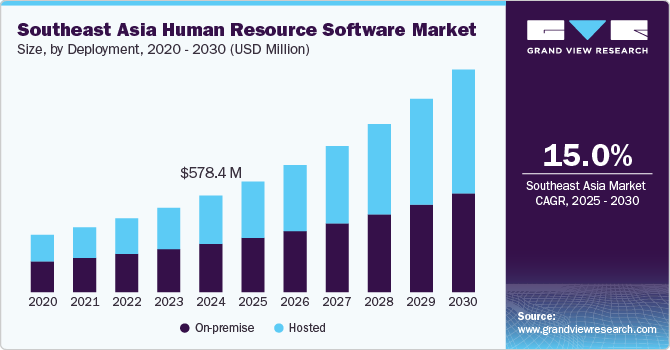

The Southeast Asia human resource software market size was estimated at USD 578.4 million in 2024 and is projected to grow at a CAGR of 15% from 2025 to 2030. This market growth is driven by the increasing adoption of digital solutions by businesses in the region to streamline human resource (HR) processes such as recruitment, payroll management, employee performance tracking, and talent development. The growth is further fueled by the increasing demand for efficient HR management solutions, which help businesses enhance their operational efficiency and improve employee experience.

The primary factor for market growth is the ongoing digital transformation across Southeast Asia. Businesses are moving away from traditional, manual HR processes and embracing cloud-based HR software to reduce operational costs and increase scalability. Cloud-based platforms offer enhanced flexibility, real-time data access, and the ability to manage HR operations seamlessly across multiple regions, making them ideal for businesses operating in geographically dispersed environments. The growth of automation, AI, and machine learning in HR functions, such as recruitment and performance management, contributes to the market's rapid growth.

Moreover, the increasing focus on improving employee experience is driving the demand for HR software in Southeast Asia. As companies realize the importance of employee engagement and retention, HR software solutions that integrate performance management, learning and development, and benefits administration are gaining popularity. These tools enable businesses to provide personalized career growth opportunities and real-time feedback, which improves employee satisfaction and also boosts overall productivity and organizational success.

Another factor contributing to the market growth is the role of the government in promoting digital transformation. Many governments in the Southeast Asian region have enacted measures that encourage businesses to use digital tools and solutions. For Instance, programs allowing subsidies and grants for the implementation of digital systems, including HR software, have helped to speed up the rate of adoption, especially in emerging markets with a high presence of SMEs. These government-backed initiatives are helping businesses overcome financial barriers and encouraging them to adopt HR solutions that can improve their efficiency and competitiveness.

Mobile-based HR solutions are increasingly becoming popular in Southeast Asia. Widespread smartphone and mobile usage are fueling this popularity. Employees and HR professionals can easily access information regarding HR matters at any given time, on-the-go, thus providing flexibility and convenience. An employee can use his smartphone to check payroll, request leave, and review his performance. Such solutions can prove to be of great benefit to businesses having a remote or distributed workforce.

Software Type Insights

Based on software type, the core HR segment led the market with the largest revenue share of 33.3% in 2024, owing to the growing reliance on core HR systems as the foundation for managing essential HR functions, including employee data, payroll, benefits, and compliance. As businesses seek to automate and streamline administrative tasks, the affordability and broad functionality of core HR software make it a staple across industries, from small enterprises to large corporations. Its integral role in day-to-day HR operations continues to drive its widespread adoption, solidifying its position as the leading segment in the market.

The talent management segment is expected to witness at the fastest CAGR of over 17% from 2025 to 2030. As businesses prioritize attracting, retaining, and developing top talent, demand for talent management software is surging. This trend reflects a growing emphasis on performance management, employee development, learning initiatives, and succession planning. With organizations recognizing the critical role of skill enhancement and workforce retention in maintaining a competitive edge, the adoption of talent management systems is accelerating, driving substantial market expansion in the coming years.

Deployment Insights

Based on deployment, the on-premise deployment accounted for the largest market revenue share in 2024, driven by the preference for greater data security, control, and compliance among enterprises. Many organizations, particularly in industries handling sensitive employee data, such as finance, healthcare, and government sectors, opted for on-premise solutions to meet strict regulatory requirements and ensure data privacy. In addition, larger enterprises with complex HR needs favored on-premise deployments for their high customization capabilities and seamless integration with existing IT infrastructure. Despite the growing shift toward cloud-based solutions, concerns over cybersecurity risks and the need for tailored in-house HR management continued to fuel the demand for on-premise HR software in the region.

The hosted segment is expected to witness at the fastest CAGR from 2025 to 2030, driven by the growing demand for scalable, cost-effective, and easily deployable HR solutions. As businesses across the region increasingly embrace digital transformation, cloud-based and hosted HR software is gaining traction due to its flexibility, remote accessibility, and lower upfront costs compared to on-premise solutions. Small and medium-sized enterprises are accelerating adoption, benefiting from reduced IT infrastructure requirements and automatic software updates. In addition, the increasing focus on workforce mobility, data-driven HR decision-making, and seamless integration with other business applications is further fueling the shift toward hosted HR solutions.

End-use Insights

Based on end use, the IT & telecom segment accounted for the largest market revenue share in 2024, driven by the need to manage a rapidly expanding and diverse workforce. This trend highlights the sector’s increasing reliance on talent management systems, performance monitoring, employee engagement, and recruitment tools to accommodate constant workforce growth. With a strong focus on efficiency, scalability, and data-driven insights, IT & telecom companies are accelerating HR software adoption to streamline operations, automate routine tasks, and optimize workforce management, reinforcing the sector’s leadership in digital HR transformation.

The healthcare segment is expected to witness at the fastest CAGR from 2025 to 2030, driven by the increasing complexity of workforce management, strict regulatory requirements, and the rising need for efficient HR processes. As the demand for healthcare professionals surges across Southeast Asia, organizations are turning to specialized HR software to streamline shift scheduling, training, certifications, and compliance management. This trend is further fueled by the sector’s ongoing digital transformation, where automated HR solutions are becoming essential for managing large, multidisciplinary teams, enhancing operational efficiency, and ensuring seamless workforce coordination.

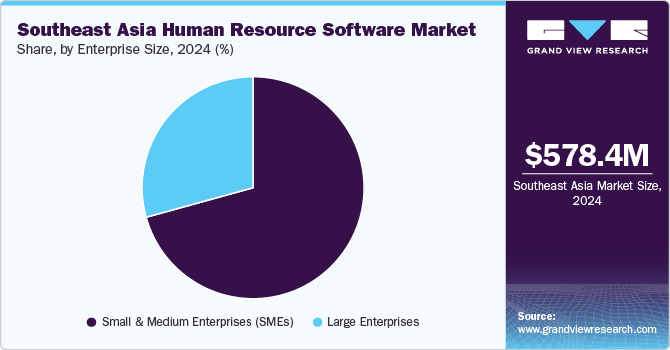

Enterprise Size Insights

Based on enterprise size, the SMEs segment accounted for the largest market revenue share in 2024, driven by the increasing adoption of cost-effective and scalable HR solutions. As small and medium-sized enterprises strive to streamline HR operations, improve employee management, and enhance productivity, they are turning to cloud-based and modular HR software that offers affordability, flexibility, and ease of implementation. In addition, the rising digital transformation initiatives across the region, along with government support for SME growth, have further fueled adoption. With the need to automate payroll, recruitment, compliance, and performance management, HR software has become a crucial tool for SMEs looking to optimize workforce efficiency and stay competitive.

The large enterprise segment is expected to grow at a significant CAGR during the forecast period. This trend reflects a growing emphasis on talent management, advanced analytics, and strategic workforce planning to address the diverse needs of large-scale organizations. As competition intensifies, these enterprises are leveraging sophisticated HR systems to enhance employee engagement, ensure regulatory compliance, and optimize HR operations across multiple regions and departments. The push toward data-driven decision-making and streamlined workforce management is set to accelerate HR software adoption in this segment in the coming years.

Regional Insights

Malaysia Human Resource Software Market Trends

The Southeast Asia human resource software market in Malaysia is expected to grow at a CAGR of over 15% from 2025 to 2030, driven by the increasing digital transformation of businesses and the growing demand for automated HR solutions. Organizations across industries are adopting HR software to streamline workforce management, improve operational efficiency, and enhance employee engagement. The rise of cloud-based solutions, offering scalability and cost-effectiveness, is accelerating adoption, particularly among SMEs. In addition, the integration of artificial intelligence and data analytics in HR systems is revolutionizing talent acquisition, performance management, and employee retention strategies.

Singapore Human Resource Software Market Trends

The Singapore human resource software market is expected to witness at the fastest CAGR of 15% from 2025 to 2030, owing to the rapid adoption of cloud-based HR solutions, as businesses prioritize scalability, cost-effectiveness, and flexibility. The ease of streamlining HR processes, enhanced data accessibility, and seamless integration with enterprise systems are accelerating cloud adoption. In addition, the rising focus on data analytics and artificial intelligence in HR software is transforming workforce management. Companies are leveraging AI-driven insights to optimize recruitment, enhance employee performance management, and improve talent retention strategies, ultimately driving smarter decision-making and better employee experience.

Indonesia Human Resource Software Market Trends

The human resource software market in Indonesia dominated the market with the largest market revenue share of 27% in 2024, fueled by emerging trends that are transforming human resources management for industries. One of the main trends is the growing use of cloud-based HR software. Most organizations in Malaysia are increasingly turning towards cloud-based HR solutions because of their capacity to centralize information, automate HR processes, and lower IT infrastructure expenses. The cloud offers companies instant access to HR tools from afar, which makes it especially attractive in a nation with an increasing number of digitally native organizations. This move towards cloud-based platforms also enables greater scalability, flexibility, and automation of HR activities.

Key Southeast Asia Human Resource Software Company Insights

Some of the key players operating in the Southeast Asia human resource software industry are Remote Technology, Inc., Oracle,and among others.

-

Remote Technology, Inc. provides cloud-based software solutions for companies managing remote teams. Its services help companies streamline HR processes, ensure compliance, and handle global payroll for distributed teams. This company has been growing significantly in Southeast Asia as more and more people seek solutions for remote work.

-

Oracle offers a wide range of software solutions, including cloud-based HR management systems. Oracle's PeopleSoft and HCM Cloud solutions are widely used in Southeast Asia to streamline HR operations and improve employee experience.

Talentsoft, and UKG, Inc. are some of the emerging market participants in the Southeast Asia human resource software industry.

-

Adaptive Pay offers payroll automation and management solutions. The company provides a complete suite of payroll processing and workforce management tools to help businesses comply with local regulations and automate payroll calculations for better operational efficiency.

-

Focus Softnet Pvt Ltd. is a provider of ERP and HR management software. The company’s HR solutions help businesses handle employee management, payroll, performance appraisal, and recruitment processes. Focus Softnet has built a solid client base in Southeast Asia due to its localized offerings and industry-specific solutions.

Key Southeast Asia Human Resource Software Companies:

- Remote Technology, Inc.

- Adaptive Pay

- QuickHR, Enable Business Pte Ltd.

- Focus Softnet Pvt Ltd

- Oracle

- Tricor Orisoft

- BOSS Solutions Global Sdn Bhd

- peopleHum Technologies Inc.

- Info Tech Systems Integrators (M) Sdn Bhd

- Harmony Cloud Systems Pte Ltd (KAMI Workforce)

Recent Developments

-

In January 2024, Remote Technology, Inc. launched Recruit AI, the new generation of AI-driven tools that help companies solve global hiring challenges. In the first round of releases are Matches, a tool designed to help employers find top global talent by sourcing candidates from Remote's active pool of job-seekers, factoring in such preferences as remote work, skills, and eligibility to work.

-

In August 2024, SAP SuccessFactors expanded its presence in Southeast Asia with a new regional office in Jakarta, Indonesia. The expansion aims to offer more localized support to customers in Indonesia, Malaysia, and Thailand, providing cloud-based HR solutions that help businesses improve employee experiences, optimize talent management, and streamline HR operations in the region.

-

In February 2025, Workday entered into a strategic collaboration with Singtel, a leading telecommunications provider in Southeast Asia. This partnership will bring Workday’s cloud-based HR management solutions to companies across the region, with a focus on improving talent management, workforce analytics, and employee experience through integrated solutions and local support.

Southeast Asia Human Resource Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 663.6 million

Revenue forecast in 2030

USD 1,335.9 million

Growth rate

CAGR of 15.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software type, enterprise size, deployment, end-use, country

Regional scope

Southeast Asia

Country scope

Philippines; Malaysia; Vietnam; Indonesia; Thailand; Singapore; Cambodia; Myanmar; Rest of Southeast Asia

Key companies profiled

Remote Technology, Inc.; Adaptive Pay; QuickHR, Enable Business Pte Ltd.; Focus Softnet Pvt Ltd; Oracle; Tricor Orisoft; BOSS Solutions Global Sdn Bhd; peopleHum Technologies Inc.; Info Tech Systems Integrators (M) Sdn Bhd; Harmony Cloud Systems Pte Ltd (KAMI Workforce)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Human Resource Software Market Report Segmentation

This report forecasts and estimates revenue growth at the regional and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the Southeast Asia human resource software market report based on software type, enterprise size, deployment, end-use, and country.

-

Software Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Core HR

-

Employee Collaboration & Engagement

-

Recruiting

-

Talent Management

-

Workforce Planning & Analytics

-

Others

-

-

Enterprise size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academia

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Philippines

-

Malaysia

-

Vietnam

-

Indonesia

-

Thailand

-

Singapore

-

Cambodia

-

Myanmar

-

Rest of Southeast Asia

-

Frequently Asked Questions About This Report

b. The global Southeast Asia human resource software market size was estimated at USD 578.4 million in 2024 and is expected to reach USD 663.6 million in 2025.

b. The global Southeast Asia human resource software market is expected to grow at a compound annual growth rate of 15.0% from 2025 to 2030 to reach USD 1,335.9 million by 2030.

b. The core HR segment dominated the Southeast Asia human resource software market, with a share of over 33.0% in 2024, owing to the growing reliance on core HR systems as the foundation for managing essential HR functions, including employee data, payroll, benefits, and compliance.

b. Some key players operating in the Southeast Asia human resource software market include Remote Technology, Inc.; Adaptive Pay; QuickHR, Enable Business Pte Ltd.; Focus Softnet Pvt Ltd; Oracle; Tricor Orisoft; BOSS Solutions Global Sdn Bhd; peopleHum Technologies Inc.; Info Tech Systems Integrators (M) Sdn Bhd; Harmony Cloud Systems Pte Ltd (KAMI Workforce).

b. Key factors that are driving the market growth include the increasing adoption of digital transformation by businesses, the growing demand for cloud-based automation solutions, and the rising focus on enhancing employee experience and workforce management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.