- Home

- »

- Plastics, Polymers & Resins

- »

-

Southeast Asia Plastic Pipe Market, Industry Report, 2030GVR Report cover

![Southeast Asia Plastic Pipe Market Size, Share & Trends Report]()

Southeast Asia Plastic Pipe Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE)), By Application (Irrigation, Water Supply), By End-use (Infrastructure), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-545-2

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Southeast Asia Plastic Pipe Market Trends

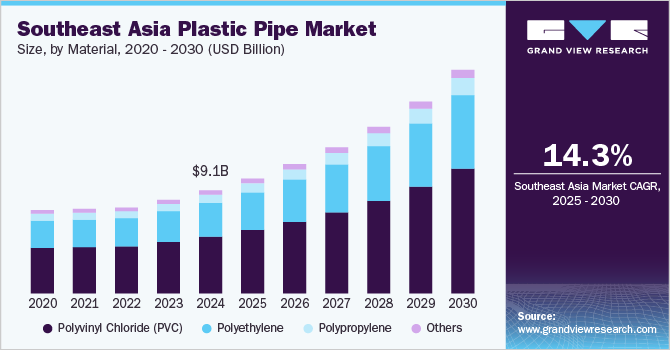

The Southeast Asia plastic pipe market size was estimated at USD 9.09 billion in 2024 and is expected to grow at a CAGR of 14.3% from 2025 to 2030. This market is driven by rapid urbanization and infrastructure development, increasing demand for durable and cost-effective piping solutions in water supply and sewage systems. Additionally, government initiatives promoting sustainable and eco-friendly materials further boost market growth.

The Southeast Asia region is undergoing significant transformation due to rapid industrialization and urbanization, fueled by a growing population and advancing technologies. As cities expand and rural areas transition into urban hubs, there is a rising need for robust infrastructure to support the increasing demands of these populations. Among the critical areas of focus are efficient water supply systems and reliable sewage networks, which are essential for both public health and the region’s economic growth. Plastic pipes, known for their durability, cost-effectiveness, and ease of installation, play a pivotal role in meeting these infrastructure requirements.

In the residential sector, the surge in housing developments is driving the demand for high-quality piping solutions for clean water distribution and wastewater management. As urban areas become more densely populated, the need for efficient plumbing systems to cater to multi-story buildings and gated communities is growing. Plastic pipes, particularly those made from PVC and HDPE, are becoming the preferred choice due to their ability to withstand high pressure and resist corrosion, ensuring long-term reliability.

The industrial sector is also witnessing a surge in demand for advanced piping systems. Industries, including manufacturing, chemical processing, and electronics, require robust solutions for transporting water, chemicals, and other liquids essential for their operations. Plastic pipes offer a cost-effective alternative to traditional materials like metal, providing resistance to chemical reactions and leaks, which are crucial in industrial applications. The growing focus on sustainability and environmental compliance in industries further supports the shift toward lightweight, recyclable plastic piping solutions.

Another factor contributing to the rise in demand for plastic pipes in agriculture is the shift from state-led farming initiatives to a more market-oriented approach. This shift has encouraged private sector involvement and foreign direct investment (FDI) in agriculture. For instance, Malaysia and Thailand have seen a surge in private investments in large-scale agricultural projects, particularly for cash crops such as rubber, palm oil, and tropical fruits, which are primarily grown for export markets. These large-scale operations require modern, reliable irrigation systems to optimize production, making plastic pipes a preferred solution due to their adaptability to large-scale farming needs.

Material Insights

The polyvinyl chloride (PVC) segment recorded the largest revenue share of over 55.0% in 2024 and is expected to grow at the fastest CAGR of 14.5% over the forecast period. PVC is one of the most used materials in the market due to its durability, cost-effectiveness, and resistance to corrosion. PVC pipes are extensively used for water distribution, sewage systems, and irrigation due to their lightweight and easy installation. They are also preferred for underground applications because of their chemical and environmental resistance.

Polypropylene (PP) pipes are known for their high-temperature resistance and mechanical strength, making them ideal for hot and cold water supply systems. They are also widely used in plumbing, HVAC (heating, ventilation, and air conditioning) systems, and industrial applications where thermal stability is required. These pipes are also recyclable, adding to their appeal in regions emphasizing sustainability.

Polyethylene (PE) pipes, available in various types such as high-density polyethylene (HDPE) and polyethylene 100 (PE100), are widely used in water distribution, gas pipelines, and agricultural applications. These pipes are known for their flexibility, lightweight, and high-impact resistance, making them suitable for diverse applications, including trenchless installations.

Application Insights

The irrigation segment accounted for the largest revenue share of over 42.0% in 2024. The growing need to enhance agricultural productivity to meet rising food demand is driving the demand for plastic pipes in irrigation. Government initiatives promoting efficient irrigation systems, especially in countries such as Indonesia, Thailand, and Vietnam, further boost this segment. Additionally, the increasing adoption of micro-irrigation systems to conserve water is contributing to the growth of plastic pipes in the irrigation sector.

The water supply segment is anticipated to grow at the fastest CAGR of 15.6% over the forecast period. Plastic pipes are extensively used in urban and rural water supply systems due to their durability, ease of installation, and resistance to chemical corrosion. They are commonly used for transporting potable water from treatment plants to households and industrial facilities. Rapid urbanization and population growth in Southeast Asia are driving the demand for reliable water supply infrastructure, thus triggering segment growth.

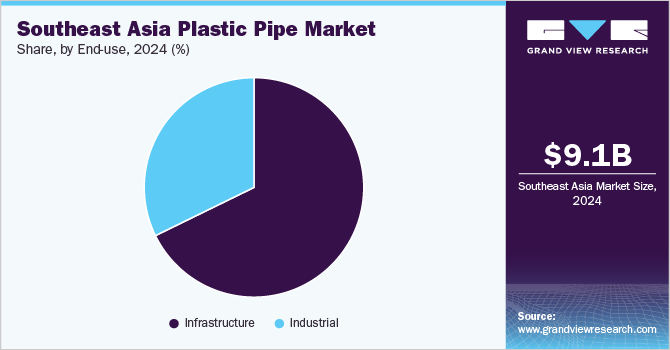

End-use Insights

The infrastructure segment recorded the largest revenue share of over 67.0% in 2024. This dominance is due to its extensive use in water supply, sewage management, and drainage systems. Plastic pipes, particularly PVC and HDPE, are widely preferred for their durability, corrosion resistance, and cost-effectiveness in large-scale infrastructure projects. Rapid urbanization and government-backed smart city initiatives in countries such as Indonesia, Vietnam, and Thailand have significantly increased the demand for plastic pipes in urban infrastructure development.

The industrial segment is projected to grow at the fastest CAGR of 14.4% during the forecast period. Due to their resistance to corrosion and chemicals, this segment uses plastic pipes extensively in chemical processing, power generation, and manufacturing industries. Increasing industrialization across Southeast Asia, especially in Malaysia, the Philippines, and Vietnam, is fueling the demand for plastic pipes. The expansion of manufacturing industries, including electronics, automotive, and textiles, is driving demand for plastic pipes in process water and chemical handling applications.

Country Insights

Indonesia Plastic Pipe Market Trends

Indonesia plastic pipe market dominated the Southeast Asia market and accounted for the largest revenue share of more than 42.0% in 2024. This dominance is due to its robust infrastructure development, rapidly growing construction sector, and strategic economic policies. The country's massive population of over 270 million, combined with significant urban expansion and government investments in water, sewerage, and irrigation systems, has created an unprecedented demand for plastic piping solutions. Government infrastructure initiatives have further accelerated Indonesia's plastic pipe market expansion. The country's ambitious national infrastructure program, particularly projects like the "Making Indonesia 4.0" strategy, has prioritized infrastructure development across water management, sanitation, and urban development sectors.

Vietnam Plastic Pipe Market Trends

The plastic pipe market in Vietnam is projected to grow at the fastest CAGR of 15.8% during the forecast period. Vietnam is experiencing rapid urbanization and infrastructure growth, which is a key driver for the plastic pipe market. Government-backed initiatives such as the Socio-Economic Development Plan (SEDP) 2021 - 2025 and Vietnam Vision 2030 emphasize the development of modern infrastructure, including water supply, drainage systems, and sanitation. As cities expand and rural areas become more urbanized, there is a rising demand for plastic pipes due to their durability, corrosion resistance, and cost-effectiveness. Projects such as the Hanoi Metro and the expansion of Ho Chi Minh City's water supply systems rely heavily on plastic pipes, contributing significantly to market growth.

Thailand Plastic Pipe Market Trends

Thailand plastic pipe market growth in the Southeast Asia market is due to its rapidly expanding construction and infrastructure sector. The Thai government has prioritized major infrastructure projects, including the Eastern Economic Corridor (EEC), which aims to modernize infrastructure across industrial zones, creating a high demand for plastic pipes in water distribution, drainage, and sewage systems. Thailand's Eastern Economic Corridor (EEC) is indeed preparing for a significant influx of foreign direct investment (FDI) by introducing a comprehensive incentive package. This initiative aims to attract investors seeking a strategic location in Southeast Asia, leveraging the EEC's exceptional infrastructure and commitment to innovation. This outlook is expected to drive the need for durable, lightweight, and cost-effective plastic piping systems.

Key Southeast Asia Plastic Pipe Company Insights

The Southeast Asia plastic pipe industry is highly competitive, driven by increasing demand from the construction, water management, and agricultural sectors. Major players dominate the market, leveraging their extensive distribution networks and strong brand presence. The market is characterized by a mix of local and international manufacturers offering a wide range of PVC, HDPE, and PPR pipes. Local players often compete on price and regional presence, while international players focus on product innovation and quality standards. Market share is fragmented, with top companies capturing a significant portion due to their ability to meet growing infrastructure demands and adhere to regulatory standards. The growing adoption of sustainable and durable piping solutions is also intensifying competition, prompting manufacturers to invest in R&D and technological advancements.

Key Southeast Asia Plastic Pipe Companies:

- Spirolite (m) Sdn Bhd

- Bina Plastic Industries Sdn Bhd

- Borouge Pte Ltd

- Cew Sin Plastic Pipe Sdn Bhd

- Cipli Industries Sdn Bhd

- Chin Lean Plastic Factory Sdn Bhd

- Dura-Mine Sdn Bhd

- Euratech Industries Sdn Bhd

- Binh Minh Plastics Joint Stock Company

- GF Piping Systems Ltd.

- PT.BIS MPOIN

- Vinilon Group

Recent Developments

-

In May 2024, Sunningdale Tech Ltd., a company based in Singapore, acquired Proactive Plastics, a U.S. manufacturer. This purchase is part of Sunningdale's strategy to expand its operations in the U.S. and enhance its capabilities in producing high-quality plastic components. The deal aims to strengthen Sunningdale's market presence and support its growth objectives in the North American region.

-

In October 2024, Wavin, a global supplier of plastic pipe systems, announced a significant investment of USD 52.6 million to establish Southeast Asia's first plastic pipe manufacturing facility in Indonesia. This new facility aims to enhance local production capabilities and meet the growing demand for sustainable building materials in the region.

Southeast Asia Plastic Pipe Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.13 billion

Revenue forecast in 2030

USD 19.72 billion

Growth rate

CAGR of 14.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, country

Country scope

Singapore; Indonesia; Vietnam; Thailand; Malaysia; Philippines

Key companies profiled

Spirolite (M) Sdn Bhd; Bina Plastic Industries Sdn Bhd; Borouge Pte Ltd; Cew Sin Plastic Pipe Sdn Bhd; Cipli Industries Sdn Bhd; Chin Lean Plastic Factory Sdn Bhd; Dura-Mine Sdn Bhd; Euratech Industries Sdn Bhd; Binh Minh Plastics Joint Stock Company; GF Piping Systems Ltd.; PT. BIS MPOIN; Vinilon Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Plastic Pipe Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia plastic pipe market report based on material, application, end-use, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

High-density Polyethylene (HDPE)

-

Polyethylene 100 (PE100)

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Irrigation

-

Water Supply

-

Sewerage

-

Plumbing

-

HVAC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure

-

Industrial

-

Water & Wastewater

-

Semiconductor

-

Chemical

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Singapore

-

Indonesia

-

Vietnam

-

Thailand

-

Malaysia

-

Philippines

-

Frequently Asked Questions About This Report

b. The Southeast Asia Plastic pipe market was estimated at around USD 9.09 billion in the year 2024 and is expected to reach around USD 10.13 billion in 2025.

b. The Southeast Asia Plastic pipe market is expected to grow at a compound annual growth rate of 14.3% from 2025 to 2030 to reach around USD 19.72 billion by 2030.

b. The irrigation segment accounted for the largest market share of over 42.0% in 2024. The growing need to enhance agricultural productivity to meet rising food demand is driving the demand for plastic pipes in irrigation

b. The key players in the Southeast Asia Plastic pipe market include Spirolite (M) Sdn Bhd; Bina Plastic Industries Sdn Bhd; Borouge Pte Ltd; Cew Sin Plastic Pipe Sdn Bhd; Cipli Industries Sdn Bhd; Chin Lean Plastic Factory Sdn Bhd; Dura-Mine Sdn Bhd; and Euratech Industries Sdn Bhd, among others

b. The Southeast Asia plastic pipe market is driven by rapid urbanization and infrastructure development, increasing demand for durable and cost-effective piping solutions in water supply and sewage systems. Additionally, government initiatives promoting sustainable and eco-friendly materials further boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.