- Home

- »

- Next Generation Technologies

- »

-

Sovereign Cloud Market Size, Share, Industry Report, 2033GVR Report cover

![Sovereign Cloud Market Size, Share & Trends Report]()

Sovereign Cloud Market (2026 - 2033) Size, Share & Trends Analysis Report By Deployment, By Functionality (Data Sovereignty, Technical Sovereignty, Operational Sovereignty), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-635-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sovereign Cloud Market Summary

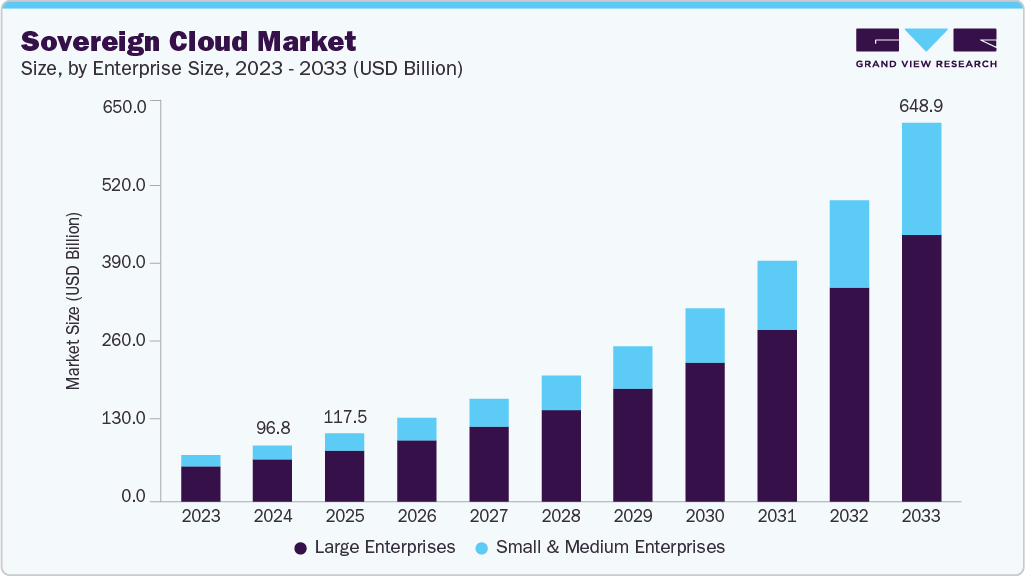

The global sovereign cloud market size was estimated at USD 117.53 billion in 2025 and is projected to reach USD 648.87 billion by 2033, growing at a CAGR of 24.1% from 2026 to 2033. The market is rapidly expanding as organizations and governments increasingly prioritize data sovereignty, security, and compliance with local regulations.

Key Market Trends & Insights

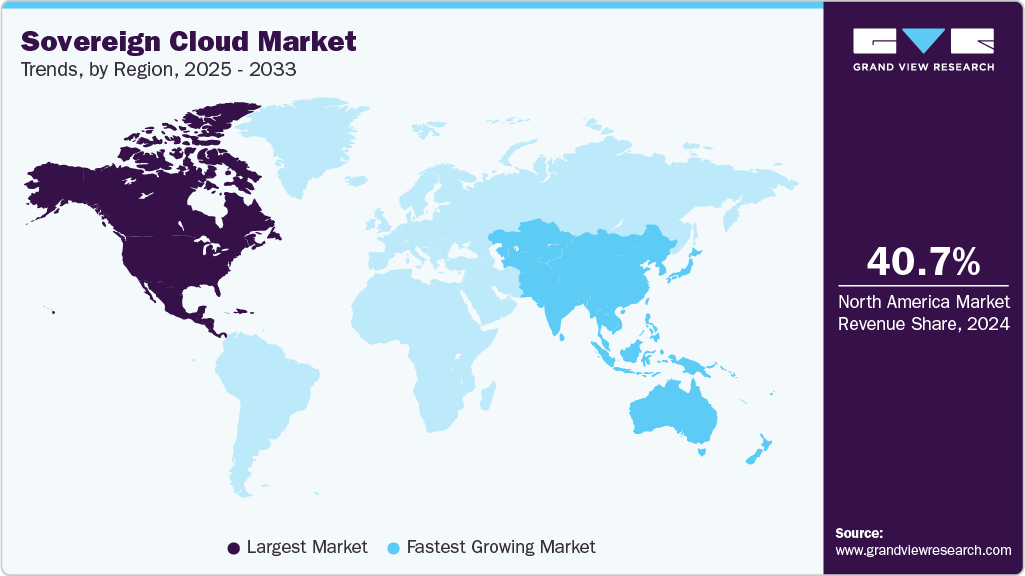

- North America held a 40.4% revenue share of the global sovereign cloud market in 2025.

- In the U.S., the market is driven by federal mandates emphasizing data localization, national security, and operational independence from foreign jurisdictions.

- By deployment, the cloud segment held the largest revenue share in 2025.

- By functionality, the data sovereignty segment held the largest revenue share in 2025.

- By enterprise size, the large enterprises segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 117.53 Billion

- 2033 Projected Market Size: USD 648.87 Billion

- CAGR (2026-2033): 24.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Governments and enterprises are emphasizing data sovereignty, the principle that data must reside within specific national or regional borders and comply with local laws. This trend is accelerating investments in sovereign cloud infrastructure that offer enhanced data privacy, security, and legal compliance, especially in regions such as Europe, with GDPR, and Asia-Pacific, with emerging data localization laws.

Cloud deployments are becoming the preferred model, as they offer a strategic balance between flexibility, scalability, and regulatory compliance. Organizations are leveraging cloud solutions to keep data on private clouds while using public cloud resources for less-sensitive workloads. This trend reflects a shift towards cloud adoption strategies that address both operational efficiency and sovereignty concerns simultaneously.

Moreover, the growing demand for functionalities centered around data sovereignty, technical sovereignty, and operational sovereignty. Among these, data sovereignty growth is propelled by data residency regulations and an increasing need to protect sensitive information from foreign access or breaches. Technical sovereignty, focusing on control over infrastructure and technology stacks, and operational sovereignty, emphasizing transparency and control over cloud operations, are also gaining traction as organizations seek end-to-end control of their cloud environments.

Furthermore, the rise of digital nationalism and concerns about technological dependence on foreign cloud providers are fueling the adoption of AI in the sovereign cloud market. As geopolitical tensions intensify and nations seek greater autonomy over their digital economies, there is an increasing emphasis on reducing reliance on global hyperscale cloud providers headquartered outside the country. This has led to strategic initiatives to build or partner with regional cloud providers capable of delivering sovereign cloud services with embedded AI tooling. These initiatives are not merely about economics; they reflect a broader agenda to cultivate local AI ecosystems that can compete globally while retaining control over technological infrastructure. Sovereign cloud platforms equipped with robust AI frameworks, model governance, and scalable computing resources serve as catalysts for local innovation, empowering domestic startups, research institutions, and enterprises in digital transformation without exposing core intellectual property to external jurisdictions.

Deployment Insights

Cloud segment dominated the market and accounted for the revenue share of 83.4% in 2025 as sovereign cloud provides better control and transparency, such as customer-managed encryption keys, geo-fencing, and isolated data centers. These features reassure organizations that they retain operational, technical, and legal sovereignty over their data, thus driving the adoption of clouds. Additionally, cloud-native solutions continuously ensure the integrity of hardware, firmware, operating systems, platforms, and workloads. For instance, in April 2025, Hewlett Packard Enterprise (HPE) introduced HPE GreenLake, a cloud-based security platform, which integrates a cloud-native, zero-trust security architecture that continuously verifies the integrity of hardware, firmware, operating systems, platforms, and workloads. This enables rapid detection of advanced threats from silicon to cloud, reducing response times from an average of 28 days to mere seconds. Additionally, HPE has unveiled "Silicon on Demand," a consumption-based model allowing customers to instantly activate and pay for additional processor core capacity, enhancing flexibility and scalability in cloud deployments.

On-premise segment is anticipated to grow at a significant CAGR during the forecast period due to increasing demand for complete data control, national compliance, and operational independence. Governments and regulated industries such as defense, finance, and critical infrastructure are prioritizing self-managed environments to meet stringent data residency. On-premise sovereign cloud solutions allow organizations to keep data physically within national borders, without relying on foreign hyperscalers or third-party infrastructure, reducing the risk of extraterritorial access. Additionally, the rise of geopolitical tensions and digital sovereignty initiatives is compelling countries to invest in national cloud infrastructure, often deployed on-premise within government data centers. These deployments also address concerns over vendor lock-in and offer organizations greater customization, isolation, and control over their IT environments, thus contributing significantly in driving the growth of on-premises segment.

Functionality Insights

Data sovereignty segment dominated the market in 2025, due to the increasing demand for stronger data governance and the protection of sensitive information. Governments are adopting sovereign cloud solutions that guarantee compliance with local laws, ensure legal jurisdiction over data, and reduce the risk of foreign surveillance. This shift is evident in regulated sectors such as finance, healthcare, and public administration, where the consequences of data breaches or legal non-compliance are severe. For instance, the Reserve Bank of India (RBI) announced to launch the Indian Financial Services (IFS) Cloud in the fiscal year 2025-26. This initiative aims to provide a sovereign, secure, and scalable cloud platform for Indian financial institutions while ensuring compliance with India’s data localization regulations. Additionally, it is designed to support not only large banks but also smaller banks and non-banking financial companies (NBFCs), offering them affordable access to modern cloud technologies.

Technical sovereignty segment is expected to grow at the CAGR of 24.6% over the forecast period as rising geopolitical uncertainties have heightened concerns over data security and the potential for foreign surveillance. Additionally, organizations are increasingly prioritizing operational independence by seeking greater control over their infrastructure, software, and hardware, which allows them to develop tailored solutions that address their unique needs while minimizing reliance on external vendors. For instance, in May 2025, Google expanded its sovereign cloud offerings in the European Union to directly address concerns about data security and compliance with the EU’s stringent data privacy laws. The company introduced a new “data shield” feature to enhance cybersecurity and formed partnerships with local firms, such as Thales, to ensure compliance with tougher data protection standards, especially in sensitive industries.

Enterprise Size Insights

Large enterprises segment dominated the market in 2025 as large organizations are subject to stringent data sovereignty laws that require localized data storage, processing, and control. These organizations need to ensure that their data and infrastructure remain under local control to comply with national and international laws, avoid foreign surveillance, and mitigate risks related to cross-border data flows. Their scale and complexity also demand advanced solutions that provide full operational, technical, and data sovereignty capabilities, as found in sovereign cloud platforms. For instance, in March 2025, SAP Canada launched the sovereign cloud capabilities, developed to meet the growing demand among Canadian organizations for operational, technical, legal, and data sovereignty, along with robust security and regulatory compliance. This solution is designed to help businesses fully capitalize on the benefits of cloud computing while ensuring they retain complete control and autonomy over their data and digital infrastructure.

The small and medium enterprises segment is expected to grow at the highest CAGR during the forecast period, driven by increasing digital transformation and the need for secure cloud infrastructure. Also, sovereign cloud solutions allow SMEs to achieve regulatory compliance without building expensive in-house infrastructure. Additionally, sovereign cloud offerings are becoming cost-effective and scalable and are available through consumption-based or pay-as-you-go models, which align with the budget and flexibility needs of SMEs. These solutions include security, compliance controls, and local data residency features, making them accessible to smaller organizations, hence contributing significantly to driving the growth of the small and medium enterprises segment during the forecast period.

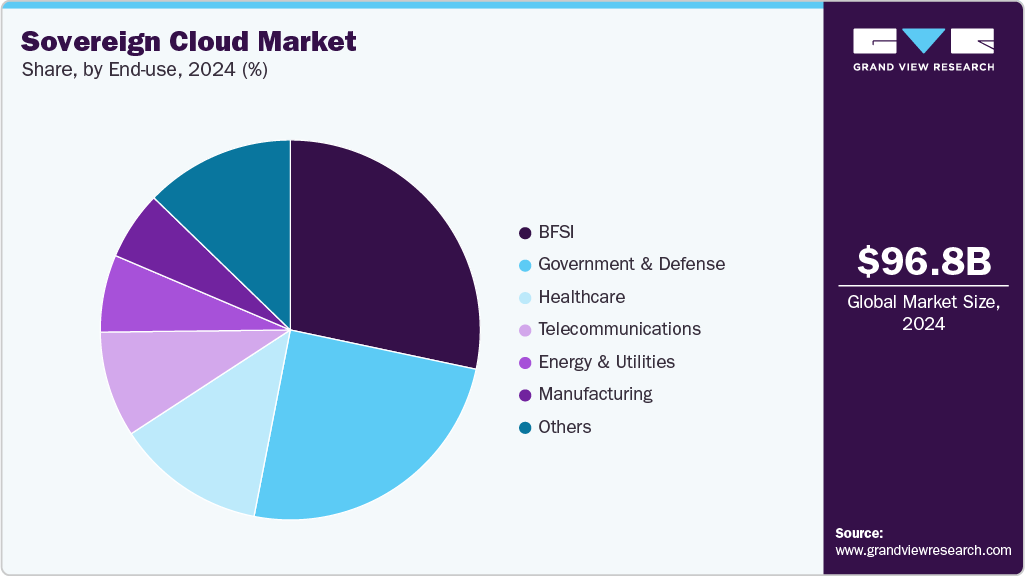

End-use Insights

BFSI segment dominated the market and accounted for the revenue share of over 28.0% in 2025 as BFSI institutions operate under national and international regulations regarding data storage, access, and processing. Laws like GDPR (Europe), RBI Guidelines (India), BaFin (Germany), and others mandate that financial data must often be stored within the country’s borders. Sovereign cloud solutions are specifically designed to comply with such rules, giving BFSI institutions assurance of full legal control over data. Additionally, banks and financial institutions deal with transactional and credit data, which are the prime targets for cyber threats.

Sovereign cloud providers offer enhanced data protection by hosting data in local data centers operated under national laws, reducing the risk of foreign surveillance or third-party access. For instance, in June 2025, the Indian government announced to launch a cybersecurity enhancement initiative which involves upgrading the Uttar Pradesh Cooperative Bank Limited and 50 district cooperative banks by integrating them into a core banking system (CBS)-based cloud platform. The National Bank for Agriculture and Rural Development (NABARD) will assist with technical expertise, training, and partial funding. A ₹10 crore budget for 2025-26 has been allocated to support infrastructure upgrades, staff training, and cyber awareness. This initiative aims to fortify cybersecurity and build public trust in district cooperative banks, hence contributing significantly to driving the adoption of sovereign cloud in the BFSI sector.

The healthcare segment is expected to grow at the highest CAGR during the forecast period as healthcare organizations handle vast amounts of personal health information (PHI), making data privacy paramount. Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., the General Data Protection Regulation (GDPR) in the EU, and India's Digital Personal Data Protection Act mandate strict data protection measures. Sovereign cloud solutions ensure that data resides within national borders and is subject to local laws, facilitating compliance with these stringent regulations. Also, the adoption of digital health technologies such as electronic health records (EHRs) and telemedicine has surged, especially during the COVID-19 and these technologies require scalable and secure IT infrastructure. Sovereign clouds provide the necessary scalability and security while ensuring data sovereignty, ideal for supporting healthcare's digital evolution, thus contributing significantly to boosting the growth of the healthcare segment.

Regional Insights

In 2024, North America emerged as the largest regional market in the global sovereign cloud landscape, accounting for 40.7% of the market, driven by growing concerns over data sovereignty, rising cybersecurity threats, and intensified regulatory scrutiny to safeguard sensitive data. Organizations are prioritizing cloud infrastructure that ensures compliance with domestic data laws and restricts foreign access, especially among geopolitical tensions and high-profile data breaches. The shift towards digital transformation, especially in sectors handling sensitive citizen and consumer information, has further accelerated the demand for sovereign cloud solutions that offer both technological flexibility and localized governance.

U.S. Sovereign Cloud Market Trends

The sovereign cloud industry in the U.S. is expected to grow significantly, driven by federal mandates emphasizing data localization, national security, and operational independence from foreign jurisdictions. Agencies across the defense, intelligence, and civilian sectors are prioritizing sovereign cloud infrastructure that complies with frameworks such as FedRAMP High and ITAR. Additionally, the Department of Defense’s JWCC initiative is further accelerating demand by requiring multi-vendor, secure cloud capabilities for mission-critical workloads. Consequently, these factors are contributing notably in driving the growth of the sovereign cloud in U.S. market.

Europe Sovereign Cloud Market Trends

Sovereign cloud industry in Europe is anticipated to register considerable growth from 2026 to 2033, as the European Union is actively working to establish a robust regulatory environment to ensure data sovereignty. Additionally, major cloud service providers are responding to Europe's emphasis on digital sovereignty by investing in localized infrastructure. For instance, in May 2024, Amazon Web Services (AWS) announced plans to invest EUR 7.8 billion in establishing a sovereign cloud region in Germany, designed to operate independently from other AWS regions and tailored to meet Europe's data protection requirements.

The UK sovereign cloud market is experiencing significant growth, driven by increasing regulatory requirements, national security concerns, and the need for data sovereignty. In response, major cloud providers are establishing localized infrastructure to meet these demands. For instance, in November 2024, SAP launched a dedicated sovereign cloud service in the UK, aiming to support government and business sectors that require stringent data residency and compliance standards. Similarly, in September 2024, Amazon Web Services (AWS) announced plans to invest EUR 8 billion in UK data centers over the next five years, reflecting the growing demand for secure and locally governed cloud services. These developments underscore the UK's commitment to enhancing its digital infrastructure while ensuring data remains under national control.

Germany sovereign cloud market is characterized by strong government support and digitalization initiatives aimed at enhancing data sovereignty and compliance with stringent data protection regulations like GDPR. Projects such as the Gaia-X initiative and the German government's Cloud Computing Strategy are pivotal in promoting a secure, federated cloud infrastructure that prioritizes local data control.

Asia Pacific Sovereign Cloud Market Trends

Asia Pacific is expected to be the fastest-growing region, representing a CAGR of 24.7% from 2026 to 2033, as governments across the APAC region are implementing stringent data sovereignty laws, compelling organizations to store and process data within national borders. Countries like Australia, Singapore, Japan, and South Korea are implementing the process of enforcing regulations that prioritize local data residency and control. This regulatory environment is reshaping cloud adoption strategies, with enterprises increasingly seeking solutions that ensure compliance with local laws. Also, due to the growing demand for sovereign cloud solutions, major cloud service providers are making substantial investments in the Asia Pacific region. For instance, in June 2025, Amazon Web Services (AWS) announced a USD 5 billion investment to establish a new AWS Asia Pacific (Taipei) Region in Taiwan, aiming to enhance local business innovation and digital transformation. This strategic move is driving market growth by expanding localized infrastructure that complies with national data sovereignty regulations, enabling enterprises to securely store and process data within the region.

Japan sovereign cloud market is rapidly evolving, driven by strong government initiatives and increasing demand for data sovereignty and security. Additionally, Japan’s expanding data center ecosystem supports this growth, fueled by advancements in AI, IoT, and 5G technologies that demand high-performance, secure cloud environments. Moreover, substantial investments from global tech giants and a national emphasis on data sovereignty is also boosting market growth. For instance, in April 2024, Oracle announced it to invest over USD 8 billion in Japan to expand its cloud computing and AI infrastructure, aiming to meet the growing demand for cloud services and address digital sovereignty requirements. This investment is fueling the growth of Japan’s sovereign cloud market by enhancing compliant infrastructure that supports government and enterprise needs for secure data processing.

The China sovereign cloud market held a substantial market share in 2025, as China's regulatory framework mandates strict data localization and sovereignty requirements. Key legislations such as the Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL) require that personal and critical data collected within China be stored and processed domestically. These laws aim to protect national security and personal privacy, compelling businesses to adopt cloud solutions that ensure data remains within Chinese borders.

Key Sovereign Cloud Company Insights

Key players operating in the sovereign cloud market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Microsoft partnered with Yotta Data Services to integrate Azure AI services into Yotta’s Shakti Cloud, a sovereign AI cloud platform, aiming to boost AI innovation in India.

-

In March 2025, AWS signed an agreement with the German Federal Office for Information Security (BSI) to advance cybersecurity and digital sovereignty in Germany and the EU.

Key Sovereign Cloud Companies:

The following key companies have been profiled for this study on the sovereign cloud market

- Alibaba Cloud

- Amazon Web Services (AWS)

- Clever Cloud

- Cloudian

- Google Cloud Platform (GCP)

- IBM Corporation

- Microsoft Azure

- Oracle Cloud Infrastructure (OCI)

- OVHcloud

- SAP SE

- Tencent Cloud

- T-Systems

Sovereign Cloud Market Report Scope

Report Attribute

Details

Market size in 2026

USD 143.26 billion

Revenue forecast in 2033

USD 648.87 billion

Growth rate

CAGR of 24.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, Functionality, Enterprise Size, End-use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services (AWS); Microsoft Azure; Google Cloud Platform (GCP); Oracle Cloud Infrastructure (OCI); IBM Cloud; Alibaba Cloud; Tencent Cloud; OVHcloud; SAP SE; T-Systems; Clever Cloud; Cloudian

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sovereign Cloud Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sovereign cloud market report based on deployment, functionality, enterprise size, end use, and region.

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-Premise

-

-

Functionality Outlook (Revenue, USD Billion, 2021 - 2033)

-

Data Sovereignty

-

Technical Sovereignty

-

Operational Sovereignty

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Government & Defense

-

Healthcare

-

BFSI

-

Telecommunications

-

Energy & Utilities

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key companies operating in the sovereign cloud industry market include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Oracle Cloud Infrastructure (OCI), IBM Cloud, Alibaba Cloud, Tencent Cloud, OVHcloud, SAP, T-Systems, Clever Cloud, Cloudian

b. Cloud deployments are becoming the preferred model, as they offer a strategic balance between flexibility, scalability, and regulatory compliance. Organizations are leveraging cloud solutions to keep data on private clouds while utilizing public cloud resources for less sensitive workloads. This trend reflects a shift towards cloud adoption strategies that address both operational efficiency and sovereignty concerns simultaneously.

b. The global sovereign cloud market size was estimated at USD 117.53 billion in 2025 and is expected to reach USD 143.26 billion in 2026.

b. The global sovereign cloud market is expected to grow at a compound annual growth rate of 24.1% from 2026 to 2033 to reach USD 648.87 billion by 2033.

b. Cloud segment dominated the market and accounted for the revenue share of 83.4% in 2025 as sovereign cloud provides better control and transparency, such as customer-managed encryption keys, geo-fencing, and isolated data centers. These features reassure organizations that they retain operational, technical, and legal sovereignty over their data, thus driving the adoption of clouds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.