- Home

- »

- Network Security

- »

-

Spear Phishing Market Size & Share, Industry Report, 2033GVR Report cover

![Spear Phishing Market Size, Share & Trends Report]()

Spear Phishing Market (2025 - 2033) Size, Share & Trends Analysis By Component (Solutions, Services), By Deployment (On-Premises, Cloud-based, Hybrid), By Organization Size, By End User (IT and Telecommunication, BFSI, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-682-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spear Phishing Market Summary

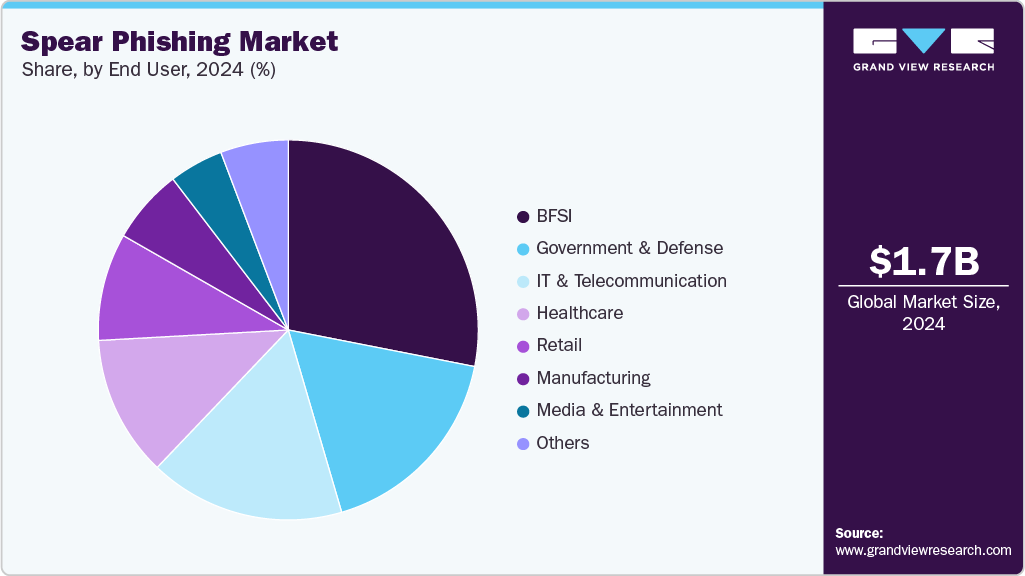

The global spear phishing market size was estimated at USD 1.75 billion in 2024 and is projected to reach USD 4.84 billion by 2033, growing at a CAGR of 12.1% from 2025 to 2033. The market is rapidly evolving to address the growing complexity of targeted phishing attacks aimed at high-value individuals, critical enterprise systems, and sensitive organizational data.

Key Market Trends & Insights

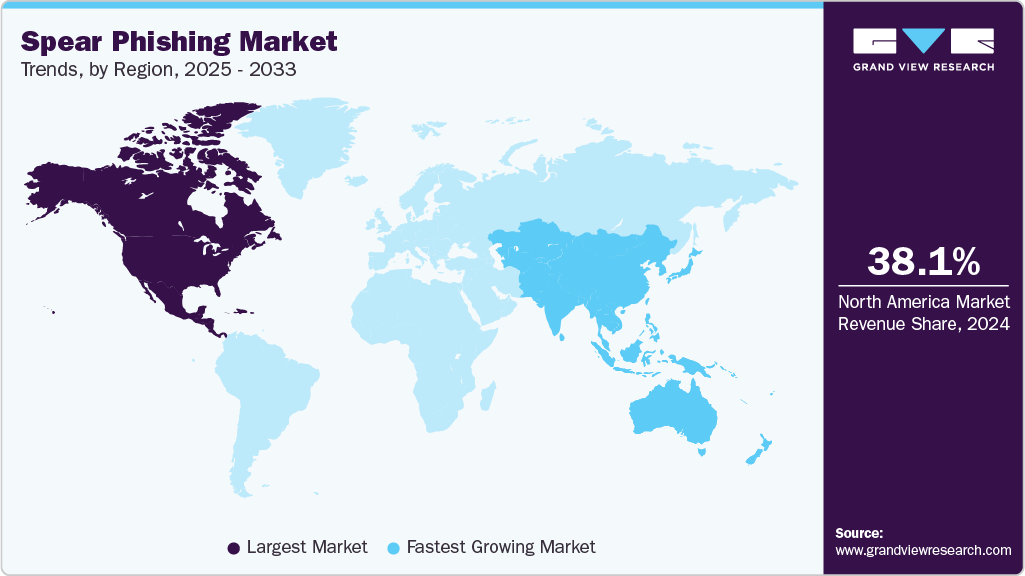

- North America held a 38.11% revenue share of the global spear phishing market in 2024.

- In the U.S., the market is driven by the country’s status as the primary target for high-profile spear phishing campaigns across critical sectors such as financial services, healthcare, defense, and technology.

- By component, the solutions segment held the largest revenue share of 72.93% in 2024.

- By organization size, the large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Billion

- 2033 Projected Market Size: USD 4.84 Billion

- CAGR (2025-2033): 12.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises are increasingly adopting multi-layered cybersecurity frameworks that incorporate advanced phishing detection tools, AI-enabled email security, and behavioral threat analytics designed specifically to identify and neutralize targeted social engineering threats. Large enterprises, especially in BFSI, government, and healthcare sectors, are expanding their cybersecurity tools to include email security gateways, advanced threat protection (ATP), and identity and access management (IAM) solutions to fight spear phishing. Organizations are also strengthening their human firewall with phishing simulation platforms, security awareness training, and managed detection and response (MDR) services. Small and medium-sized enterprises (SMEs) are adopting cloud-based spear phishing protection solutions to secure remote workforces without high capital costs. Additionally, the market is quickly seeing the rise of AI and machine learning-based detection models that analyze communication patterns and detect unusual sender behavior.

Additionally, the global spear phishing market is bolstered by expanding public-private partnerships focused on threat intelligence sharing and real-time response coordination. For example, the UK’s National Cyber Security Centre (NCSC) launched the Suspicious Email Reporting Service (SERS), allowing organizations and individuals to report suspected spear phishing emails directly, aiding in the development of national threat intelligence databases. This collaborative effort is fueling the market’s transition from scattered phishing controls to proactive, adaptable cybersecurity systems centered on continuous monitoring, threat prediction, and cross-sector information exchange to enhance cyber resilience across industries.

Component Insights

The solutions segment held the largest revenue share of 72.93% in 2024 within the spear phishing market, driven by the increasing adoption of AI-powered, automated security platforms designed to address the rising sophistication of targeted phishing attacks. As businesses expand their digital infrastructure through cloud services and hybrid workplace models, demand for advanced solutions that provide real-time detection, contextual analysis, and proactive defense mechanisms against spear phishing threats continues to grow. This trend is fueling rapid adoption of integrated email security, advanced threat protection (ATP), and behavioral analytics solutions that block malicious content and bolster employee resilience against social engineering. For example, in June 2024, IRONSCALES introduced GPT-powered spear phishing simulations, combining AI-driven threat detection with personalized employee training to strengthen email security and response readiness. This development underscores the market’s shift toward intelligent, adaptable solutions that combine security automation with user awareness, allowing organizations to address both technical vulnerabilities and human factors. As a result, the rising demand for scalable, AI-enabled, and behaviorally informed security solutions is expected to propel the growth of the solutions segment in the global spear phishing market.

The services segment is projected to grow at the fastest CAGR of 13.1% during the forecast period in the spear phishing market, driven by the rising demand for outsourced cybersecurity expertise and continuous threat monitoring to counter evolving phishing tactics. As organizations face increasing resource constraints, there is a growing preference for managed security services, incident response support, and professional consulting to proactively address targeted phishing risks. Additionally, services such as phishing simulation training, security awareness programs, and fully managed detection and response (MDR) offerings are gaining popularity, especially among small and medium-sized enterprises (SMEs) and industries with limited in-house security capabilities. Moreover, increasing regulatory requirements for cyber hygiene, like GDPR and NIS2, are motivating enterprises to invest in professional services for compliance and risk assessments. In summary, the growing complexity of spear phishing attacks, combined with the need for quick incident response and human-centered defense strategies, is driving the services segment to become the fastest-growing part of the spear phishing market.

Deployment Insights

The cloud-based segment accounted for the largest revenue share of 55.5% in 2024 in the spear phishing market, driven by the adoption of cloud-native cybersecurity platforms that provide flexible, real-time protection against sophisticated phishing threats. As enterprises adopt digital transformation, SaaS applications, hybrid work environments, and multi-cloud infrastructures, the demand for easily deployable spear phishing solutions is increasing. Cloud-based platforms offer key advantages such as centralized threat detection, AI-powered phishing prevention, and automated response capabilities that can be rapidly scaled across geographically dispersed teams without the need for complex on-premises infrastructure. For instance, in May 2025, Obsidian Security introduced a cloud-based browser extension designed to autonomously detect shadow SaaS usage, manage AI app risks, and proactively block spear phishing attacks targeting OAuth access tokens, enabling mid-sized enterprises to gain real-time visibility and protection within modern cloud environments. The solution highlights the market’s shift towards lightweight, scalable, and behavior-aware security architectures that align with evolving enterprise needs. Consequently, the increasing emphasis on seamless cloud integration, real-time adaptive defense mechanisms, and reduced operational overhead are expected to drive the growth of the cloud-based segment in the global spear phishing market.

The hybrid segment is projected to have the fastest CAGR of 11.7% in the coming years within the spear phishing market, driven by the increasing demand for flexible cybersecurity architecture that effectively secures both on-premises and cloud-based infrastructures. As enterprises operate within hybrid IT environments, the need for unified spear phishing protection across various communication channels and access points has grown. This trend is especially notable in highly regulated sectors such as banking, healthcare, and government, where organizations must comply with strict data residency and privacy regulations while modernizing their security operations. Hybrid deployment models allow businesses to maintain strong on-premises security controls alongside scalable cloud-based threat detection and response capabilities. Additionally, the rise in targeted phishing campaigns that exploit both internal and cloud-hosted communication systems is prompting enterprises to adopt hybrid solutions that provide comprehensive, real-time threat visibility and coordinated incident response across their entire IT ecosystem. This operational flexibility and improved protection coverage are likely to drive faster adoption of hybrid deployments in the global spear phishing market.

Organization Size Insights

The large enterprises segment held the largest revenue share of 68.98% in 2024 in the spear phishing market, driven by the increased exposure of large organizations to targeted phishing campaigns aimed at exploiting critical business operations. As large enterprises continue to expand their digital footprints across cloud platforms, SaaS applications, and hybrid communication systems, they encounter risks from evolving attack methods that target both corporate and personal communication channels. This has prompted significant investments in advanced spear phishing protection strategies, including AI-powered threat detection, incident response services, and executive-focused cybersecurity training. For example, in January 2025, Microsoft reported a spear phishing campaign by the Star Blizzard group, which targeted high-ranking officials by sending malicious QR codes via email to compromise WhatsApp accounts, highlighting the growing trend of multi-vector phishing attacks against key enterprise personnel. These developments underscore the need for comprehensive, layered security approaches within large organizations, reinforcing their dominant share in the global spear phishing market due to their greater resource allocation toward proactive threat mitigation, regulatory compliance, and enterprise-wide cyber resilience.

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at the highest CAGR of 12.7% during the forecast period in the spear phishing market, mainly because of the increasing number of targeted phishing attacks against smaller businesses that lack advanced cybersecurity systems. As cybercriminals more frequently exploit weaknesses in less protected organizations through personalized spear phishing campaigns, SMEs are realizing the importance of investing in sophisticated phishing defenses to protect sensitive data and prevent operational disruptions. This rising awareness, along with the availability of affordable, cloud-based spear phishing solutions that require little in-house expertise, is speeding up adoption among SMEs. Additionally, regulatory pressures and customer expectations for better data security are encouraging SMEs to adopt cost-effective managed security services and AI-powered email protection tools, fueling their rapid market growth.

End User Insights

The BFSI segment held the largest revenue share of 28.09% in 2024 in the spear phishing market, driven by the increasing exposure of financial institutions to highly targeted and sophisticated phishing attacks. As the sector increasingly adopts cloud-based banking services, digital payment ecosystems, and hybrid workplace models, the demand for advanced security solutions that offer real-time detection, adaptive threat analysis, and proactive account protection has grown significantly. This has resulted in the rapid deployment of AI-powered email security, adversary-in-the-middle (AiTM) attack prevention, and identity verification solutions within BFSI environments to counter evolving phishing techniques. For example, in August 2022, Zscaler ThreatLabz revealed a large-scale AiTM phishing campaign targeting enterprise users of Microsoft email services, utilizing sophisticated proxy-based phishing kits, smart cloaking techniques, and MFA bypass mechanisms to compromise corporate accounts. This highlights the increasing complexity of phishing attacks within financial ecosystems. This incident underscores the sector’s growing focus on intelligent, multi-layered spear phishing defense strategies to protect financial operations and ensure regulatory compliance. As a result, the urgent need for high-assurance, AI-driven security solutions is likely to keep the BFSI segment dominant in the global spear phishing market.

The healthcare segment is expected to grow at the highest CAGR of 13.9% during the forecast period in the spear phishing market, driven by the increasing exposure of healthcare organizations to targeted phishing campaigns aimed at compromising sensitive patient data, financial information, and critical healthcare infrastructure. As the sector accelerates the adoption of electronic health records, telemedicine platforms, and cloud-based patient management systems, cybercriminals are exploiting these digital touchpoints with advanced spear phishing techniques to initiate data breaches and ransomware attacks. This growing threat landscape has prompted significant investment in AI-powered email security, behavioral threat detection, and phishing awareness training across healthcare institutions. For instance, in May 2025, according to a report by the American Hospital Association, the healthcare sector reported the highest number of cyberthreat incidents in 2024, including frequent spear phishing attacks that served as the primary entry point for broader cyber intrusions, highlighting the increasing urgency for advanced security measures in healthcare environments. This trend, combined with regulatory pressures like HIPAA and expanding telehealth services, is expected to drive the rapid adoption of intelligent phishing protection solutions within the healthcare sector.

Regional Insights

North America held the largest share of 38.11% in the spear phishing market in 2024, driven by the region’s increased exposure to sophisticated phishing campaigns targeting high-value industries such as banking, healthcare, and government sectors. The rapid growth of hybrid work models and widespread reliance on cloud-based email platforms among North American companies has boosted demand for advanced spear phishing defense solutions, especially those incorporating AI-driven detection and user behavior analytics.

Additionally, rising regulatory pressure through frameworks like the SEC’s cybersecurity disclosure requirements and HIPAA in healthcare is encouraging organizations to invest in proactive phishing mitigation tools. The region has also seen a surge in AI-powered phishing attacks, with the FBI’s 2024 IC3 report showing a significant rise in business email compromise (BEC) cases, prompting firms to adopt multi-layered email security and managed phishing defense services. Moreover, increased public-private collaborations, such as CISA’s phishing awareness campaigns and joint cybersecurity task forces, are strengthening regional defenses against spear phishing, making North America a leading contributor to market growth.

U.S. Spear Phishing Market Trends

The U.S. spear phishing market is driven by the country’s status as the primary target for high-profile spear phishing campaigns across critical sectors such as financial services, healthcare, defense, and technology. The rapid shift towards cloud-based communication platforms and hybrid work models in U.S. enterprises has heightened the demand for AI-driven phishing detection tools, advanced email security gateways, and adaptive incident response systems.

Additionally, the introduction of stringent cybersecurity regulations, including updates to SEC disclosure rules mandating timely reporting of cyber incidents, is compelling organizations to strengthen spear phishing defenses. The FBI’s 2024 IC3 report revealed a significant surge in business email compromise (BEC) attacks in the U.S., accounting for the highest financial losses among cybercrimes, further accelerating enterprise investments in advanced phishing protection. Moreover, government-led initiatives such as the Cybersecurity and Infrastructure Security Agency’s (CISA) anti-phishing programs and sector-specific cybersecurity directives are fostering widespread adoption of proactive spear phishing prevention solutions, reinforcing the U.S.’s leading position in the global spear phishing market.

Europe Spear Phishing Market Trends

The spear phishing market in Europe is anticipated to register considerable growth from 2025 to 2033. The growth is driven by stringent regulatory frameworks such as the GDPR and NIS2 directive that compel enterprises and governments to invest heavily in cybersecurity. The region has experienced several high-impact spear phishing incidents, including a recent €5 million fraudulent transaction within Ireland’s National Treasury Management Agency, which was executed through a sophisticated email spoofing attack and has prompted a full-scale review of financial security protocols by the Irish Debt Office. This incident illustrates the growing sophistication and financial stakes of spear phishing in Europe, leading organizations to accelerate adoption of advanced email authentication, AI-driven threat intelligence, and real-time fraud detection solutions. Additionally, European governments and regulatory bodies are increasingly fostering collaboration between public sector entities and private cybersecurity vendors to share threat intelligence, coordinate phishing response mechanisms, and elevate sector-wide resilience-driving robust, targeted security investments in the region.

The UK spear phishing market is experiencing robust growth, driven by escalating cyberattacks targeting critical government and financial sectors. For instance, in June 2025 HM Revenue & Customs (HMRC), a major phishing campaign compromised around 100,000 taxpayer accounts and resulted in £47 million in fraudulent refund claims, prompting nationwide security upgrades and stricter email authentication protocols; this surge in high-profile attacks, including recent state-sponsored spear phishing campaigns identified by the National Cyber Security Centre (NCSC) involving Russian and Iranian threat actors targeting UK officials and think tanks, is accelerating the adoption of AI-powered email security solutions, anomaly detection tools, and advanced user awareness programs, positioning the UK as one of Europe’s most rapidly evolving spear phishing markets.

The Germany spear phishing market accounted for a growing share in the spear phishing market in 2024, driven by a sharp increase in targeted phishing campaigns against critical industries such as manufacturing, automotive, and financial services. Additionally, the January 2025 discovery by Cisco Talos of a spear phishing campaign distributing TorNet backdoor malware via fake financial documents specifically targeting German enterprises reflects the growing sophistication of attack vectors within the country. These developments are accelerating the adoption of AI-driven spear phishing solutions, advanced attachment sandboxing, and adaptive behavioral analytics, while government-backed initiatives such as the BSI’s cybersecurity awareness programs are reinforcing phishing resilience across corporate and public sector entities, making Germany a key growth contributor in the European spear phishing market.

Asia Pacific Spear Phishing Market Trends

The Asia Pacific is expected to experience the fastest CAGR of 13.2% from 2025 to 2033 in the spear phishing market. This growth is driven by a rapid rise in cyberattacks targeting emerging digital economies such as India, China, and Southeast Asian nations, amid increased cloud adoption and growth in digital banking. The region is anticipated to see a sharp increase in advanced spear phishing attacks, with Indian government agencies reporting frequent assaults on defense and critical infrastructure through AI-generated impersonation emails. Meanwhile, financial regulators in Singapore have raised concerns about growing business email compromise (BEC) scams that exploit deepfake voice cloning techniques. Additionally, rising geopolitical tensions have intensified state-sponsored spear phishing campaigns, such as recent Chinese-linked attacks targeting policymakers in Taiwan and the Philippines. This expanding threat environment is prompting organizations across the region to implement AI-powered threat detection, phishing-resistant email authentication protocols, and large-scale employee awareness programs. These efforts are further supported by regulatory measures, like India’s CERT-In phishing reporting mandate and Australia’s updated cybersecurity strategy focused on phishing mitigation.

The Japan spear phishing market is experiencing steady growth, driven by the increasing digitalization of financial services, e-government platforms, and corporate operations, making organizations highly vulnerable to targeted phishing campaigns. The country’s large base of credit card users and rapid expansion of cashless payment systems have contributed to a rising volume of credential harvesting and impersonation attacks. Additionally, Japan’s manufacturing and technology sectors, including critical supply chain ecosystems, are being increasingly targeted through business email compromise (BEC) and vendor impersonation phishing schemes. The adoption of AI-powered email security, anomaly-based phishing detection, and phishing simulation training is accelerating, supported by growing public-private cybersecurity collaborations and government initiatives under Japan’s Cybersecurity Strategy, which emphasize phishing resilience and advanced threat response capabilities across both public and private sectors.

The China spear phishing market is undergoing rapid expansion, propelled by digital transformation across state-owned enterprises, fintech platforms, and the public sector. As organizations shift to cloud infrastructures and embrace ubiquitous mobile payment systems including WeChat Pay and Alipay, attackers are leveraging context-aware spear phishing aimed at mobile and social payment channels. Concurrently, heightened geopolitical tensions have spurred advanced persistent threat (APT) groups to exploit spear phishing as a vector for corporate and governmental espionage. In response, Chinese organizations are stepping up investments in AI-enhanced email security, mobile-optimized phishing prevention, and zero-trust access frameworks. Government-backed cybersecurity policies, such as the Cyberspace Administration’s Enhanced Email Security Guidelines, are further catalyzing adoption of centralized threat intelligence sharing, employee resilience initiatives, and multi-factor authentication enhancements to counter the evolving spear phishing landscape.

The India spear phishing market is expanding rapidly, fueled by the country’s accelerated digital payments adoption, widespread mobile-first internet engagement, and increasing integration of cloud services within businesses and government platforms. Spear phishing actors are increasingly targeting financial inclusion schemes, digital wallet ecosystems, and telecom subscribers, exploiting trust in SMS-based and app-based notifications used by brands like UPI and mobile banks. Additionally, the rise of remote work and SaaS usage in Indian enterprises has widened the attack surface, compelling organizations to deploy AI-enhanced email security, SMS/WhatsApp phishing detection, and behavior-based anomaly analysis. Public sector cybersecurity initiatives such as CERT-In’s phishing reporting framework and the MeitY-guided PSIRT program are spurring both awareness and investment in integrated phishing protection solutions, with many companies adopting phishing simulation training and mobile-integrated threat monitoring to strengthen resilience in the local ecosystem.

Key Spear Phishing Company Insights

Key players operating in the spear phishing industry are BAE Systems, Microsoft Corporation, FireEye Inc., and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Cofense recorded a new AI-powered phishing email every 42 seconds, with many parts of polymorphic campaigns that dynamically change their content to evade conventional filters. AI enables attackers to automate malware creation, scale attacks across industries, and craft highly personalized spear phishing emails that mimic trusted internal communications and executive style, making them harder to detect. These AI-driven tactics have significantly increased business email compromise (BEC) by 70% year-over-year, emphasizing the failure of perimeter-only email defenses and highlighting the urgent need for post-delivery detection and rapid, expert-guided response in spear phishing defense strategies.

-

In March 2025, Proofpoint announced a global strategic alliance with Microsoft, choosing Microsoft Azure as the platform for its security innovations. This partnership will enhance spear phishing protection by enabling Proofpoint to deliver advanced, AI-driven email security and seamless integration with Microsoft 365. The collaboration aims to provide faster threat detection and more effective risk mitigation against targeted spear phishing attacks, leveraging real-time intelligence and automated workflows for mutual customers.

-

In September 2024, Aviation Industry Corporation of China (AVIC), has been indicted by the U.S. Department of Justice for conducting a multi-year spear phishing campaign targeting NASA, U.S. military branches (Army, Air Force, Navy), the Federal Aviation Administration, research universities, and aerospace firms. Using fake email accounts impersonating U.S.-based researchers and colleagues, he fraudulently obtained specialized aerospace engineering and computational fluid dynamics software and source code, which could be utilized for military and industrial applications.

Key Spear Phishing Companies:

The following are the leading companies in the spear phishing market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Microsoft Corporation

- FireEye Inc.

- Symantec Corporation (Broadcom)

- Proofpoint, Inc.

- GreatHorn, Inc.

- Cisco Systems, Inc.

- Phishlabs

- Intel Corporation

- Mimecast Ltd.

- Trend Micro Incorporated

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Cofense Inc.

- Area1 Security

Spear Phishing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.94 billion

Revenue forecast in 2033

USD 4.84 billion

Growth rate

CAGR of 12.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report scope

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

BAE Systems; Microsoft Corporation; FireEye Inc.; Symantec Corporation (Broadcom); Proofpoint, Inc.; GreatHorn, Inc.; Cisco Systems, Inc.; Phishlabs; Intel Corporation; Mimecast Ltd.; Trend Micro Incorporated; Check Point Software Technologies Ltd.; Fortinet, Inc.; Cofense Inc.; Area1 Security

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spear Phishing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the spear phishing market report based on component, deployment, organization size, end user, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Email Security Solutions

-

Advanced Threat Protection (ATP)

-

Data Loss Prevention (DLP)

-

Endpoint Detection & Response (EDR)

-

Identity & Access Management (IAM)

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-based

-

Hybrid

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT and Telecommunication

-

BFSI

-

Government & Defense

-

Healthcare

-

Retail

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global spear phishing market size was estimated at USD 1.75 billion in 2024 and is expected to reach USD 1.94 billion in 2025.

b. The global spear phishing market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2033 to reach USD 4.84 billion by 2033.

b. The BFSI segment accounted for the largest revenue share of 28.09% in 2024 in the spear phishing market, driven by the rising exposure of financial institutions to highly targeted and sophisticated phishing attacks.

b. Some key players operating in the market include BAE Systems, Microsoft Corporation, FireEye Inc., Symantec Corporation (Broadcom), Proofpoint, Inc., GreatHorn, Inc., Cisco Systems, Inc., Phishlabs, Intel Corporation, Mimecast Ltd., Trend Micro Incorporated, Check Point Software Technologies Ltd., Fortinet, Inc., Cofense Inc., Area1 Security, and Others.

b. Factors such as the growing complexity of targeted phishing attacks aimed at high-value individuals, critical enterprise systems, and sensitive organizational data plays a key role in accelerating the spear phishing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.