Spray Adhesives Market Size & Trends

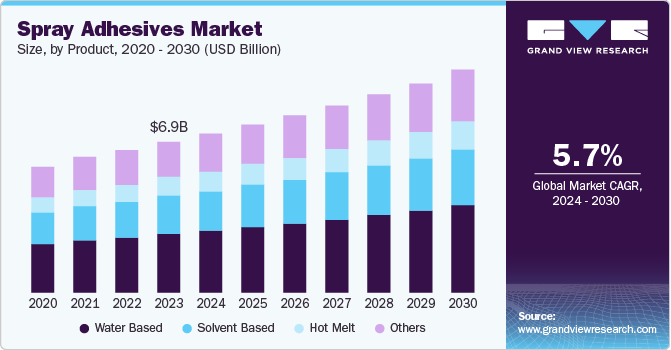

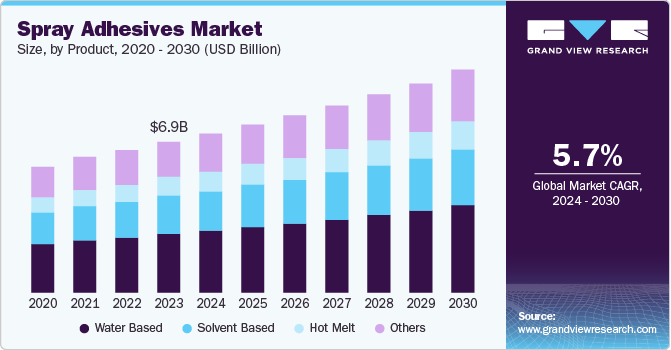

The global spray adhesives market size was valued at USD 6.88 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The factors driving spray adhesives market growth are increasing demand of spray adhesive in various industries, the increased construction activities due to the high rate of urbanization, new technologies resulting in new products, increased do-it-yourself trend spearheaded by e-commerce platforms, expansion in the furniture production and aerospace industries, contemporary legislation’s adherence to the security of spray adhesives.

The current spray adhesive market is expanding tremendously due to the rising preferences of different business fields such as the automotive industry, construction, packaging, and others. The flexibility of spray adhesives makes them ideal for use in several applications including laminating, sealing, and insulation. For instance, spray adhesives find application in assembling of automobile parts and car interior trims, which contributes to the market growth.

The construction industries across the world have been experiencing significant growth due to increase in urbanization and infrastructure development initiatives. Construction applications of spray adhesives include flooring and floor coverings, wall coverings and insulating materials. This trend is more noticeable in the emerging markets where there is a fast growth in the level of urbanization.

The advancement in technology has witnessed consumers gain easy access to several spray adhesive products from e-commerce platforms. Moreover, people are more inclined to renovate their houses, which involves utilization of adhesives. With more people participating in DIY projects, the need for easy-to-use spray adhesive also increases.

Product Insights

Water based dominated the spray adhesives market with a market share of 38.9% in 2023. These products are formulated using both natural and synthetic polymers.

These products are formulated with water as a key diluent. They do not contain VOC emitting solvents, owing to which they can be utilized as low VOC adhesives for various industrial applications. Styrene-butadiene, polyvinyl acetate (PVAC), acrylics, and vinyl acetate-ethylene (VAE) are a couple of synthetic polymers used for manufacturing these products. The water-based emulsion systems are suitable for high-speed general product assembly applications. Owing to the wet bonding characteristics of these adhesives, they are widely used on wood, leather paper, textiles, and other permeable substrates.

The hot melt product segment is expected to grow at a CAGR of 5.8% in the forecast period. Hot melt adhesives are formed by heating and bonding occur as the molten adhesive cools and solidifies within a short span of time. This feature is particularly useful especially in high production line where time is of essence. These adhesives can work with several forms of substrates such as wooden material, plastic, metal and fabrics. Moreover, some hot melt adhesives contain no hazardous solvents or any other chemicals, which makes them safe for people using it and for the environment.

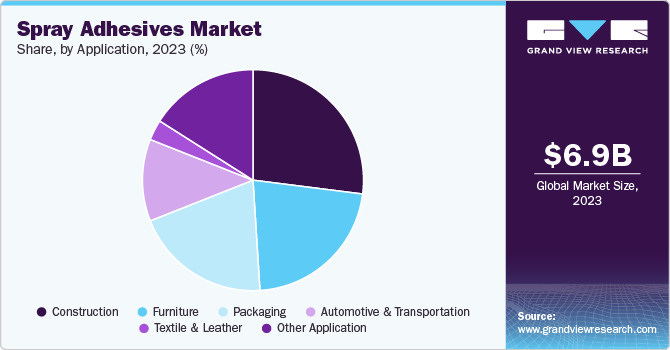

Application Insights

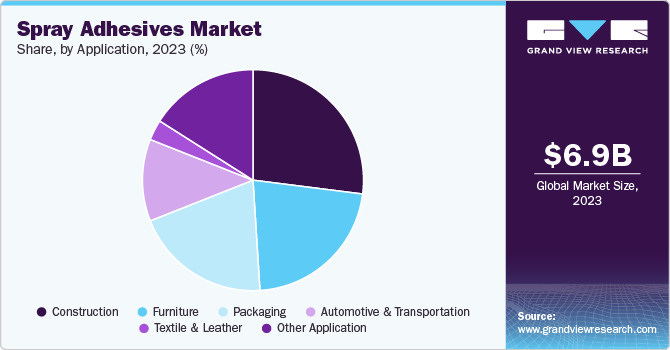

The construction segment dominated the market with a share of 28.1% in 2023. Spray adhesives are used due to their ability to stick almost any surface like wood, metal, plastic, fabric and many others. In construction, flexibility is paramount as most projects present different materials that need to be connected seamlessly. Spray adhesives normally provide an opportunity for quick assembly and installation as the bonding process occurs rapidly. It is especially useful in large projects since delays can often result in extra costs.

The furniture application segment is expected to register the fastest CAGR of 6.0% during the forecast period. A major factor that makes spray adhesives extensively used in furniture is the ease of application they offer. Generally, polyurethane is the most highly preferred material for glues used in furniture applications. Upholstery, cabinets, and other woodworking products extensively utilize aerosol glues. Polyurethane products provide improved adhesion for a wide number of substrates, such as wood, plastic, and glass owing to their elasticity and other structural properties. These attributes coupled with continued technological advancement have broadened the use of polyurethane adhesives in furniture & upholstery projects.

Flexible foams, padding, office panel coverings, decorative veneers and cabinets, mattress assembly, high-pressure lamination to plywood, and particle board are the key sub-uses of spray adhesives. The polyurethane-based glues prevent widening or separation of cracks caused in wooden cabinets due to climate changes.

Regional Insights

Asia Pacific spray adhesives dominated the global spray adhesives market with a share of 42.3% in 2023. Construction is one of the biggest applications of spray adhesive due to the growing demand of infrastructure and residential buildings in Asia Pacific. Several governments in emerging market countries including the India and China are putting a lot of emphasis on infrastructure development as they undertake various economic reforms.

North America Spray Adhesives Market Trends

North America spray adhesives market held substantial share in 2023. The development of different sectors including automotive, construction, and furniture in North America has raised the usage of spray adhesives. The spray adhesives market in the U.S. is expected to grow during the forecast period.

Key Spray Adhesives Company Insights

Some key companies in the spray adhesives market include Henkel Corporation., 3M, H.B. Fuller Company., Avery Dennison Corporation, BASF, Bostik. Market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more owing to increasing competition.

Key Spray Adhesives Companies:

The following are the leading companies in the spray adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel Corporation.

- 3M

- H.B. Fuller Company.

- Avery Dennison Corporation

- BASF

- Bostik

- ND Industries

- Uniseal, Inc.

- Beardow Adams

- Eastman Chemical Company

- Sika AG

Recent Developments

-

In February 2024, Henkel corporation announced the construction of Inspiration Center for Adhesive Technologies in Latin America. The new center is anticipated to create an ecosystem to develop solutions and innovations for the Adhesive Technologies business unit. It will also be a hub for capacity building, training and interaction with partners & customers in the region.

Spray Adhesives Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 7.25 billion

|

|

Revenue forecast in 2030

|

USD 10.14 billion

|

|

Growth rate

|

CAGR of 5.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

|

|

Key companies profiled

|

Henkel Corporation.; 3M; H.B. Fuller Company.; Avery Dennison Corporation; BASF; Bostik; ND Industries ; Uniseal, Inc. ; Beardow Adams; Eastman Chemical Company; Sika AG

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

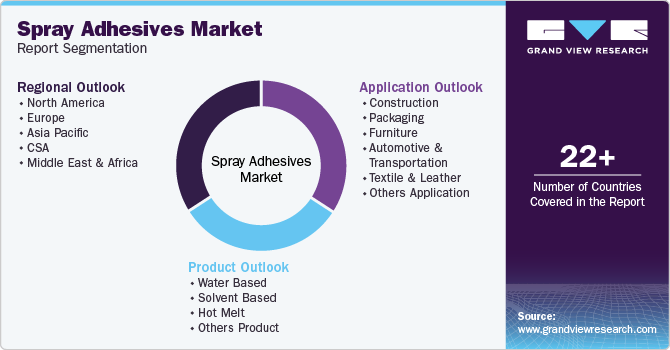

Global Spray Adhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spray adhesives market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Based

-

Solvent Based

-

Hot Melt

-

Others Product

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

CSA

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE