- Home

- »

- Power Generation & Storage

- »

-

Steam Turbine Market Size, Share & Trends Report, 2030GVR Report cover

![Steam Turbine Market Size, Share & Trends Report]()

Steam Turbine Market (2023 - 2030) Size, Share & Trends Analysis Report By Capacity (<150 MW, 151-300 MW, >300 MW), By End-use (Power & Utility, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-207-5

- Number of Report Pages: 73

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steam Turbine Market Market Summary

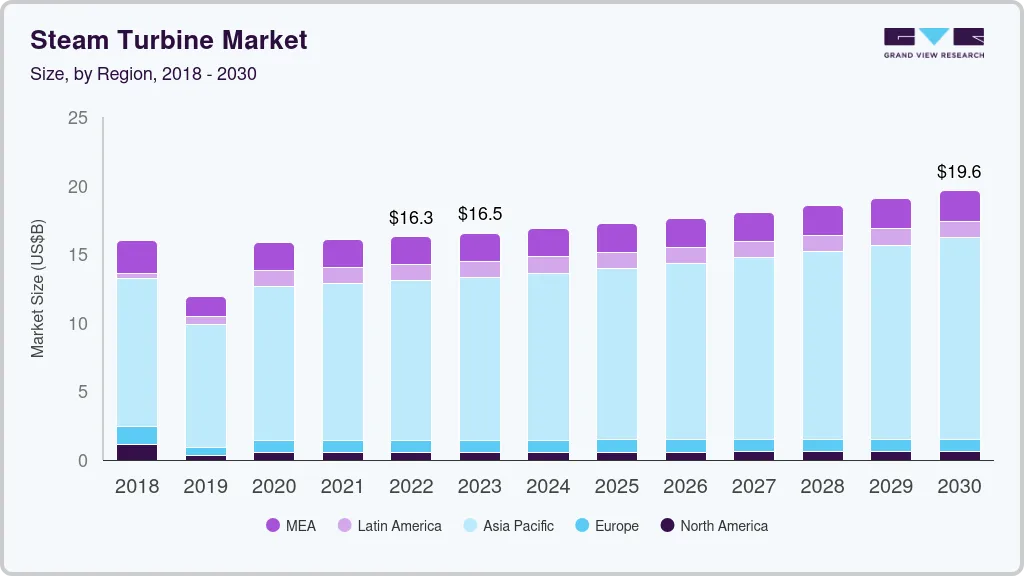

The global steam turbine market size was estimated at USD 16,269.7 million in 2022 and is projected to reach USD 19,641.3 million by 2030, growing at a CAGR of 2.5% from 2023 to 2030. An increase in the number of power plants is likely to be commissioned to compensate for the energy deficit and this is expected to propel the demand for steam turbines in the coming years.

Key Market Trends & Insights

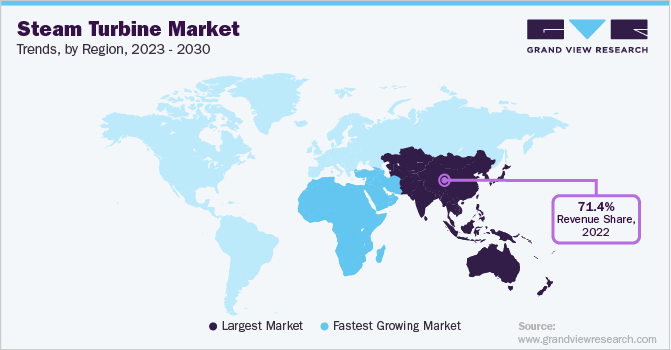

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- Country-wise, Russia is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, more than 300 mw accounted for a revenue of USD 9,860.4 million in 2022.

- 151 to 300 MW is the most lucrative capacity segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 16,269.7 Million

- 2030 Projected Market Size: USD 19,641.3 Million

- CAGR (2023-2030): 2.5%

- Asia Pacific: Largest market in 2022

The U.S. emerged as the largest market in North America in 2022. An increase in the number of combined-cycle natural gas plants in the country as they are reliable sources of energy is one of the prominent reasons for the rising demand for steam turbines in the U.S. Policymakers in the country are focusing on developing sustainable energy generation plants. This is anticipated to surge the number of steam turbine installations in the U.S. in the coming years.

The increasing focus of the Government in the U.S. on establishing energy-efficient and clean power generation plants is also contributing to the surge in the number of CHP installations in the country. Rising demand for combined heat and power across North America is expected to drive the growth for the market in the region over the forecast period.

Policymakers in the U.K. are focusing on reducing carbon emissions and carrying out energy-efficient power generation. This has resulted in the formulation and stringent implementation of various environmental and emission norms in the country. Steam turbines are employed in industrial applications for use in CHP units.

The COVID-19 pandemic has hindered the growth of the market for steam turbines globally owing to the unavailability of steam turbine parts that delay their production and cause logistic issues. This further results in delays in ongoing steam turbine installation projects. A reduction in new orders for turbine installations is being witnessed owing to the diversion of funds by steam turbine buyers to sustain the COVID-19 crisis.

Steam turbine manufacturers have taken subsequent steps to provide turbines to end users with ongoing projects. Vendors are opting for digital tools and are following social distancing norms and using PPE to carry out new power plant installations.

Capacity Insights

Based on capacity, the market for steam turbines has been segmented into up to 150 MW, 151 to 300 MW, and more than 300 MW. In terms of revenue, more than 300 MW accounted for the largest share of 61.61% in the global market in 2022. Up to 150 MW capacity steam turbines are expected to witness significant growth on account of increasing demand for industrial CHP units. CHP units are getting popular across various process industries on account of their superior efficiencies than single units. CHP also serves as a source of direct power, electricity, and heat, and it has observed a surge in demand in the recent past.

Due to high demand of small steam turbines in small- and mid-sized combined cycle power plants (CCPP), combined heat and power (CHP), petrochemicals, biomass, and concentrated solar power (CSP) solutions, the segment is expected to have the highest growth over the forecast period. In addition, vendors manufacturing steam turbines are more focused on the small steam turbines category due to high demand from steel, cement, chemical, and other industries.

The demand of large capacity steam turbine is expected to see a decline due to the transition to renewable and clean energy technologies from coal-based power technologies in countries across the globe. However, increasing demand for uninterrupted power supply from developing countries such as China and India is expected to add to the market value of large capacity steam turbines over the forecast period.

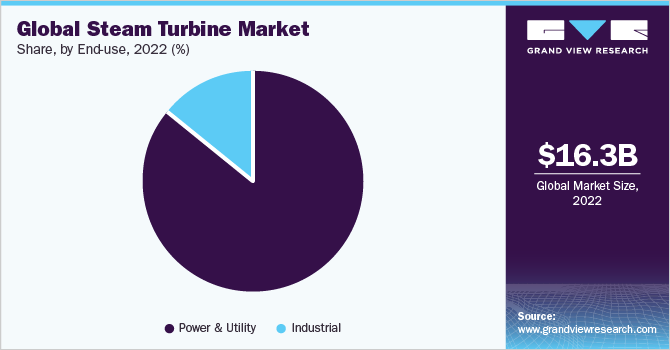

End-use Insights

Based on end-use, the market has been segmented into power & utility and industrial. In terms of revenue, power & utility segment led the market in 2022 by accounting for a share of 85.55% of the market this year. This segment is expected to maintain its dominance in the market over the forecast period as well. Steam turbines have been traditionally employed in electrical power generation applications.

Steam turbine units can be paired with any combustion fuel, however; coal has been the preferred fuel in the past. Increasing environmental concerns have restricted the usage of coal-fired power plants and clean energy sources such as natural gas. Moreover, the usage of renewable energy resources has become the need of the hour.

The growth of industrial segment of the market can be attributed to the increased industrial activities across the world. Steam turbines are employed in industrial applications in the form of CHP units. These units offer better efficiency than single units and produce outputs in multiple ways. In addition, frequent load limits and power outages have contributed to the increasing demand for steam turbines in in-house power plants in the industrial sector.

Regional Insights

Steam turbines are widely used for CHP applications in the U.S. Unlike gas turbines and reciprocating engine CHP systems wherein heat is a byproduct of the power generation process, steam turbine-based generators normally generate electricity as a byproduct of heat (steam) generation. Steam turbines use separate heat sources and as such, fuel is not converted to electric energy by them. The energy is transferred from boilers to turbines through high-pressure steam that powers turbines and generators.

Steam turbines are widely used for CHP applications in Europe. Extraction-condensing type steam turbines are used in large industrial CHP applications. These turbines are deployed in combined-cycle plants wherein they extract a portion of the steam for the process. There are a large number of independent power producers (IPP) in Europe using combined-cycle power plants, which operate on natural gas to provide power to electric grids and steam to one or more industrial customers.

In Russia, the demand for power and heat is rapidly increasing in the country, thereby pushing the limits of current production throughout the country. Moreover, high-energy industrial users in the country take into account the value of onsite power generation and self-generation in wake of rising electricity prices and concerns related to the uninterrupted and secure power supply.

Key Companies & Market Share Insights

Ongoing globalization is the key to market competition with international trade forming an important aspect of sustainable growth. Most of the players have established joint ventures with several customers and suppliers in various countries globally that help increase their market shares, decrease their costs, and enable them to gain access to new markets.

Well-known industry players across the steam turbine market are mainly focusing on various key premeditated assets that include product customization, development of innovative product range, and inorganic growth ventures as part of their plan. Additionally, for upgradation, and maintenance, market players are also providing services to gain competitive benefits over other market players. Some prominent players in the global steam turbine market include:

-

Ansaldo Energia S.p.A

-

Bharat Heavy Electricals Limited,

-

Doosan Škoda Power

-

Elliot Group

-

Fuji Electric Co., Ltd.

-

General Electric

-

Kawasaki Heavy Industries, Ltd.

-

MAN Energy Solutions

-

Mitsubishi Power Ltd.

-

Siemens Energy

-

Toshiba Corporation

-

Trillium Flow Technologies

Steam Turbine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.54 billion

Revenue forecast in 2030

USD 19.64 billion

Growth rate

CAGR of 2.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in MW, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

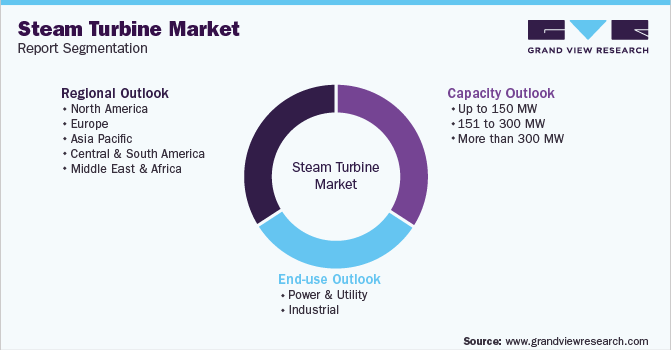

Segments covered

Capacity, end-use

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Russia; China; India

Key companies profiled

General Electric; Mitsubishi Power Ltd.; Siemens Energy; Toshiba Corporation; Ansaldo Energia S.p.A; Doosan Škoda Power; Bharat Heavy Electricals Limited; MAN Energy Solutions; Fuji Electric Co., Ltd.; Elliot Group; Kawasaki Heavy Industries, Ltd.; Trillium Flow Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steam Turbine Market Report Segmentation

This report forecasts revenue and volume growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steam turbine market report based on capacity, end-use, and region:

-

Capacity Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Up to 150 MW

-

151 to 300 MW

-

More than 300 MW

-

-

End-use Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power & Utility

-

Industrial

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Russia

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the steam turbine market include General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Ltd., and Ansaldo Energia.

b. The global steam turbine market size was estimated at USD 16.27 billion in 2022 and is expected to reach USD 16.54 billion in 2023.

b. The global steam turbine market is expected to witness a compound annual growth rate of 2.5% from 2023 to 2030 to reach USD 19.64 billion by 2030.

b. Key factors driving the growth of the steam turbine market include the development of large-scale fossil-fuel-based power plants to fulfill growing power demand in various countries.

b. Power & Utility was the largest end-use segment accounting for 85.55% of the total revenue in 2022 owing to the deployment of a number of large-scale power projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.