- Home

- »

- Medical Devices

- »

-

Stethoscope Market Size, Share, Trends And Report, 2030GVR Report cover

![Stethoscope Market Size, Share & Trends Report]()

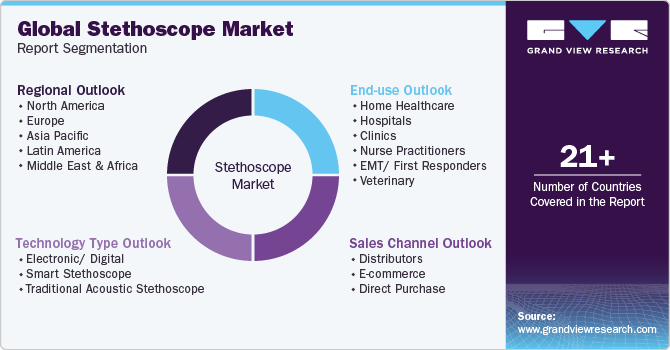

Stethoscope Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology Type (Electronic/Digital Stethoscope, Smart Stethoscope), By Sales Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-050-7

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Stethoscope Market Summary

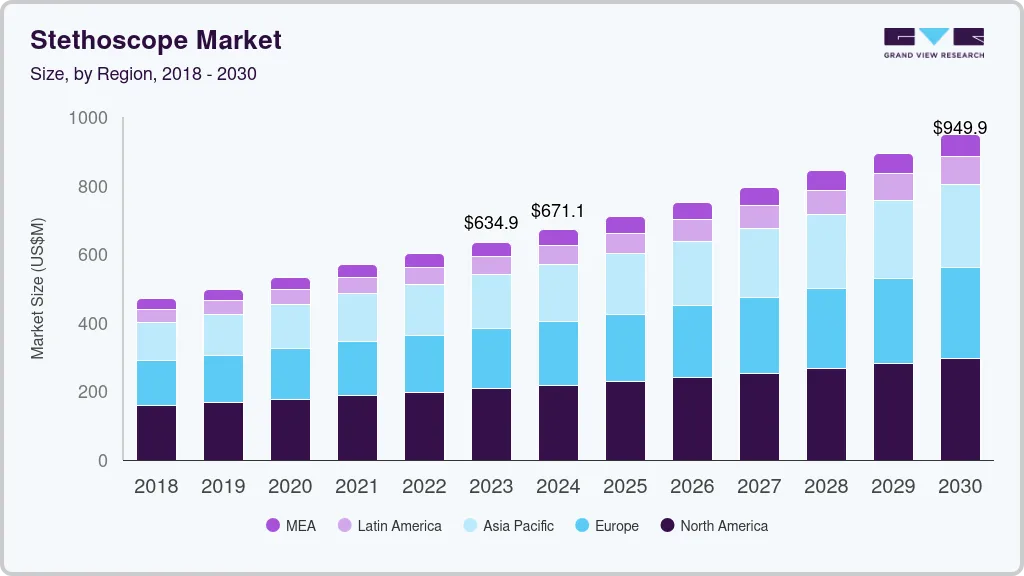

The global stethoscope market size was estimated at USD 634.9 million in 2023 and is projected to reach USD 949.9 million by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The market is driven by numerous factors such as the increasing adoption of digital stethoscopes in diagnosis of chronic conditions, partnerships, and collaboration among the industry key players for novel product launches coupled with rising prevalence of cardiovascular and respiratory diseases.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, traditional acoustic stethoscope accounted for a revenue of USD 471.1 million in 2023.

- Smart Stethoscope is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 634.9 million

- 2030 Projected Market Size: USD 949.9 million

- CAGR (2024-2030): 5.9%

- North America: Largest market in 2023

For instance, as per the data findings from a study revealed by American College of Cardiology Foundation in 2023, ischemic heart disease remains the predominant contributor to global cardiovascular disease (CVD) mortality, with an age-standardized rate of 108.8 deaths per 100,000. Increase in worldwide CVD-related fatalities, raised from 12.4 million in 1990 to 19.8 million in 2022.

Stethoscopes assume a pivotal role in preventive healthcare, facilitating healthcare professionals in discerning early indicators of cardiovascular and respiratory issues before they escalate into more critical stages thus propelling industry growth.

Industry key players are involved in strategic partnerships and collaborations for novel product launches, thus driving the market growth in near future. For instance, in September 2023, FIGS, Inc. and Eko Health, Inc. joined forces to introduce FIGS | Eko CORE 500 Digital Stethoscope. This strategic collaboration brought together two entities that innovatively transformed fundamental tools for healthcare professionals, namely scrubs and stethoscopes, leveraging advanced technology, contemporary design, and establishing genuine connections within the healthcare community. Key players collaborating can collectively address global healthcare challenges, such as improving access to healthcare in underserved regions. Joint initiatives contribute to the development of stethoscopes tailored to specific healthcare needs and demographics. Such initiatives boost the market growth.

Moreover, increasing adoption of digital stethoscope in diagnosis of chronic conditions propels the market growth. For instance, the article published by Contemporary PEDS Journal in September 2023, stated that a hybrid AI stethoscope demonstrated efficacy in the identification of cardiac and respiratory ailments. Researchers developed a digital stethoscope interface tailored for integration with a cost-effective Raspberry Pi Zero 2w single-board computer. The suggested configuration exhibited seamless performance on computing platform and was found affordable with the price at approximately $25, rendering it suitable for deployment in economically constrained regions. In addition, increasing demand for digital stethoscopes for chronic disease management is expected to stimulate extensive exploration and progress in this field. Advancements in sensor technology, artificial intelligence, and connectivity are likely to result in the creation of more advanced and effective diagnostic instruments which has a positive impact on the market expansion.

Market Concentration & Characteristics

The market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a rising geriatric population, increasing prevalence of chronic diseases, and growing demand for advanced diagnostic tools.

Key strategies implemented by players in global market are FDA approval for new product launches, expansion, acquisitions, partnerships, and other strategies. In June 2023, Sparrow BioAcoustics officially obtained approval from U.S. FDA for commercialization of its software, facilitating transformation of smartphones into medical stethoscopes. This groundbreaking Software as a Medical Device (SaaMD) empowered smartphones to function as top-tier stethoscope devices, capable of capturing, analyzing, and sharing data about cardiovascular and pulmonary sounds.

The market features a wide range of stethoscope products with varying designs, materials, and functionalities. Manufacturers offer products catering to different preferences and needs of healthcare professionals.

Stethoscopes, serving as vital medical instruments, are subject to rigorous evaluation within specific national regulatory frameworks. Regulatory bodies, such as the U.S. FDA in U.S. or European Medicines Agency (EMA) in Europe, systematically assess and approve these devices based on well-defined safety and efficacy standards. The validation processes mandated by regulatory authorities typically require manufacturers to strictly adhere to stringent quality and safety criteria. It is the responsibility of manufacturers to substantiate that their stethoscope products comply with these established standards, thereby confirming the safety of these devices for use in healthcare settings by both healthcare professionals and patients.

The market is intricately influenced by collaborative worldwide efforts aimed at standardizing regulations for medical devices. The primary goal of this harmonization initiative is to create consistency in regulatory requirements across various geographical regions, facilitating smoother international trade and ensuring high standards of product quality and safety. Regulatory authorities regularly implement post-market surveillance measures to methodically evaluate operational effectiveness and safety of medical devices, including stethoscopes, after their deployment.

Manufacturers are expanding their product lines to include smart stethoscopes with advanced features. These devices have built-in sensors, recording capabilities, and software applications that assist in analyzing and interpreting heart and lung sounds. Moreover, product expansion includes development of specialized stethoscopes tailored for specific medical applications.

Market is characterized by dominance of well-established players possessing strong brand equity and a proven history of manufacturing high-quality stethoscopes. These industry leaders consistently exert considerable influence, playing a pivotal role in shaping and setting standards within the sector. Manufacturers demonstrate proficiency in catering to varied preferences and requirements of healthcare professionals, leading to a wide-ranging assortment of products accessible in the market.

Emerging markets in Asia, Latin America, and Africa present opportunities for stethoscope manufacturers. Growing healthcare awareness, increasing investments in healthcare infrastructure, and rising disposable incomes contribute to market expansion in these regions. Establishing effective distribution networks is crucial for regional expansion. Collaborating with local distributors or forming partnerships with healthcare institutions facilitates better market reach and penetration.

Technology Type Insights

Based on technology type, the traditional acoustic stethoscope segment led the market with the largest revenue share of 74.19% in 2023. In comparison to advanced stethoscopes, traditional acoustic stethoscope demonstrates notable cost-effectiveness, user-friendly features, and extensive accessibility. This makes it particularly well-suited for use by paramedics and nurses. In regions with limited access to advanced medical imaging technologies, especially prevalent in rural areas of developing countries, traditional stethoscopes play a crucial role in diagnosing cardiac and pulmonary disorders. Unlike electronic stethoscopes, acoustic stethoscopes do not require batteries or power sources. This eliminates the need for ongoing battery replacements and ensures that the instrument is always ready for use. In addition, maintenance of acoustic stethoscopes is relatively simple. Cleaning and sanitizing the chest piece and earpieces are the primary maintenance tasks, and replacement parts are readily available. These factors are expected to contribute to an increased demand for traditional acoustic stethoscopes in the foreseeable future.

The smart stethoscope segment is expected to register the fastest CAGR of 7.02% during the forecast period. AI-powered smart stethoscope is transforming remote medicine. Smart stethoscopes are emerging as advanced homecare medical devices and cutting-edge tools for medical practitioners. Leveraging advanced technology, these stethoscopes play a pivotal role in diagnosing respiratory illnesses and disorders by closely monitoring heart rhythms. Notably, in the WHO European region, an alarming 80% of cases involving heart and lung sounds are inaccurately diagnosed and inadequately treated. The integration of artificial intelligence (AI) in these stethoscopes contributes to enhancing diagnostic accuracy and consistency. By facilitating more precise interpretations of physiological data, these AI-enabled devices address the prevalent issue of misdiagnosis in the realm of cardiovascular and respiratory health. Furthermore, integration of this technology presents the potential to markedly decrease superfluous clinical appointments, consequently streamlining healthcare resource utilization and enhancing overall patient outcomes.

Moreover, industry key players are involved in strategic agreement driving the industry growth in near future. For instance, in August 2022, Caregility, and Eko Health, Inc. recently established a collaborative integration partnership. This strategic alliance facilitated seamless incorporation of Eko's smart stethoscopes and software into Caregility's cloud platform. Consequently, users utilizing Caregility's iConsult application can conduct precise auscultation, encompassing the examination of heart, lung, and other bodily sounds, during virtual physical examinations with enhanced quality. Such initiatives boost industry growth.

Sales Channel Insights

Based on sales channel, the distributors segment led the market with the largest revenue share of 54.09% in 2023. Healthcare institutions, particularly hospitals and clinics, frequently establish enduring contractual agreements and affiliations with distributors and manufacturers. Key industry players are strategically opting for extended contracts with end users to broaden their market reach and strengthen their market position. Distinguished entities such as 3M, Cardionics, American Diagnostic Company, Eko Health, Inc., Thinklabs, and Welch Allyn have officially appointed dealers and distributors in each geographical region, offering a comprehensive range of stethoscopes and associated components.

Moreover, authorized dealers in this sector gain access to localized warranty services, encompassing repair and replacement provisions for addressing potential product defects. Engaging in partnerships with distributors affords healthcare facilities the strategic advantages of rapid product availability, ability to fulfill minimum order requisites, and potential for cost savings related to consignment and delivery. This strategic framework is positioned to exert a substantial impact on the expansion of this market segment over the anticipated timeframe.

The e-commerce segment is expected to register the fastest CAGR of 7.01% during the forecast period. Increasing usage of stethoscopes within the online and e-commerce sales channel is anticipated to drive market expansion. eHealth, as a rapidly growing sector within the e-commerce landscape, contributes significantly to this trend. The surging popularity of online transactions for medical products can be attributed to the enhanced capability of end users to compare and select products based on diverse criteria, including type, brand, price, and point of sale. Prominent entities in the online market, such as Amazon, Walmart, Walgreens, CVS, and Stethoscope.com, are leading the way by offering a comprehensive array of stethoscopes from various suppliers to end users, institutions, and healthcare facilities. This shift in distribution channels underscores the industry's adaptability to evolving consumer preferences and emphasizes the crucial role played by online platforms in addressing the demands of the market within the healthcare industry.

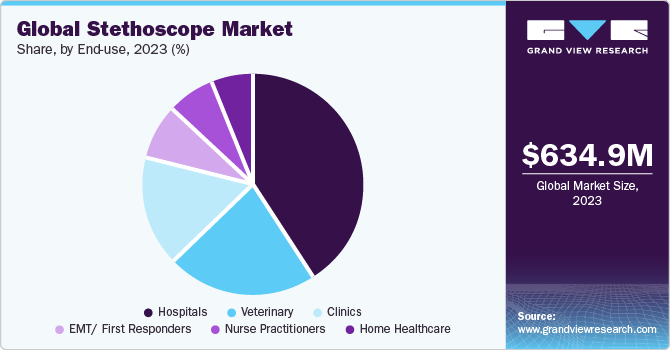

End-use Insights

Based on end-use, the hospitals segment led the market with the largest revenue share of 40.92% in 2023 and expected to register the fastest CAGR of 6.40% during the forecast period. Increasing number of patients seeking medical care across diverse illnesses and treatments has led to a substantial surge in hospital admissions. Notably, hospitals emerge as the predominant consumer within the market for stethoscopes, both in terms of product acquisition and associated services. Stethoscopes play a crucial role in optimizing therapeutic protocols, leading to increased efficiency, and delivering accurate outcomes promptly. As a result, extensive integration of stethoscopes in hospital environments is expected to grow at a significant CAGR over the forecasted period.

During patient assessments, stethoscopes are employed to gather vital information about patient's health. This includes assessing heart rate, rhythm, and identifying abnormal sounds that may indicate underlying medical issues. Stethoscopes are indispensable in emergency departments and critical care units within hospitals. They are used to quickly assess patient’s conditions and make informed decisions in emergency situations. Hospitals prioritize procurement of high-quality and reliable stethoscopes to ensure accurate diagnoses and patient care. Brands with a strong reputation for quality are often preferred. Furthermore, the advent of COVID-19 pandemic is projected to escalate the dependence on stethoscopes within hospitals, leading to a surge in demand. Consequently, these factors are considered to be pivotal drivers fueling the expansion of the hospital end use segment.

Regional Insights

North America dominated the market with the revenue share of 32.64% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Surge in chronic diseases such as cardiovascular and respiratory disorders, due to unhealthy lifestyle coupled with the presence of well-developed healthcare infrastructure are the key factors intensifying the stethoscope’s market growth. For instance, as per the article published by American Medical Association from a study finding in December 2023, global prevalence of Chronic Obstructive Pulmonary Disease (COPD) was anticipated to approximate 600 million cases by year 2050, signifying a 23% relative increase in the COPD-afflicted population compared to the baseline in 2020. Projections indicated that most substantial rise would manifest among females and within the socioeconomically categorized low- and middle-income countries and regions.

The prevailing influence of prominent manufacturers and ascendancy of governmental initiatives are pivotal factors fueling market expansion. Consequently, North America is poised to assert its dominance in the overarching regional market throughout the forecast period. Noteworthy participants in the North American stethoscope market include 3M, Medline Industries, Welch Allyn, and American Diagnostic Corporation.

U.S. Stethoscope Market Trends

The stethoscope market in U.S. is expected to grow at the fastest CAGR over the forecast period. U.S. market has experienced notable technological advancements, marked by a transition to digital stethoscopes. These instruments frequently incorporate functionalities such as electronic amplification, noise mitigation, and integration with electronic health records, reflecting a discernible trend toward enhanced and interconnected diagnostic tools.

Europe Stethoscope Market Trends

Europe is one of the most advanced regions globally with novel technologies and developed infrastructure, resulting in significant healthcare facilities and patient care. Increasing prevalence of chronic disorders, rising adoption of sedentary lifestyle, and introduction of technologically advanced products in the European market have contributed to the market growth. In addition, increase in investments by government private institutions is expected to drive the market. However, lack of supportive reimbursement policies in developing countries of Europe is likely to hinder the market growth over the forecast period.

The stethoscope market in the UK is expected to grow at the fastest CAGR over the forecast period, due to driven by increasing geriatric population coupled with increasing prevalence of chronic diseases.

The France stethoscope market is expected to grow at the fastest CAGR over the forecast period, owing to an increased focus on stethoscopes designed with materials that are easy to clean, aligning with stringent infection control protocols in healthcare settings in this region propelling market growth.

The stethoscope market in Germany is expected to grow at the fastest CAGR over the forecast period, owing increasing demand for high-quality and precise stethoscopes, with healthcare professionals emphasizing diagnostic accuracy.

Asia Pacific Stethoscope Market Trends

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. The substantial patient pool in the region is anticipated to yield noteworthy market growth. Furthermore, the heightened inclination towards clinical trials and substantial research and development investments by prominent market entities, driven by their cost-efficient structures, serve as influential factors propelling market growth in the Asia Pacific region. Increasing awareness regarding the treatment of chronic diseases and enhancements in the clinical development framework within developing economies are poised to fuel the market's expansion in this geographical area.

The stethoscope market in India is expected to grow at the fastest CAGR over the forecast period.Several companies and start-ups in India are trying to leverage the opportunity by launching new & affordable products in the market. Moreover, in this region penetration of advanced medical imaging is limited to rural areas, stethoscope plays an important role in the diagnosis of cardiac and pulmonary disorders. Smart or digital stethoscopes have a modern viewpoint on traditional stethoscopes and hence are considered as a valuable tool for healthcare professionals thus, driving the industry growth in near future.

The China stethoscope market is expected to grow at the fastest CAGR over the forecast period.With the expansion of healthcare infrastructure and increasing awareness of preventive healthcare, China's market might experience growth, driven by rising demand in hospitals and clinics.

The stethoscope market in Japan is expected to grow at the fastest CAGR over the forecast period. The Japanese market may witness a trend toward stethoscopes that incorporate innovative healthcare technologies, aligning with Japan's focus on technological advancements in healthcare.

Middle East & Africa Stethoscope Market Trends

Saudi Arabia is the most populous country in the region with the fastest growth rate. Increasing healthcare expenditure and gradual adoption of technologically advanced products in these countries are among factors expected to promote the market growth. In addition, increasing incidence of heart diseases in South Africa, Saudi Arabia, and the UAE is expected to propel the market growth. Thus, government’s efforts coupled with developing healthcare infrastructure in the region are further fueling growth of the market in the region. However, lack of skilled professionals and advanced healthcare settings in few Middle Eastern countries may hinder the market growth over the forecast period.

The stethoscope market in Saudi Arabia is expected to grow at the fastest CAGR over the forecast period, owing to country's investments in modernizing healthcare infrastructure, leading to increased adoption of advanced medical devices. In addition, in 2022 SFDA issued new Guidance on Medical Devices Classification (MDS-G008) for stethoscope as follows:

Class

Category

Rule

Class A

Stethoscope for diagnosis

Rule 1-Devices that either do not come in direct contact with the patient or contact intact skin

Class B

Electronic Stethoscope

Rule 10- Active devices for diagnosis and monitoring or intended for diagnostic or therapeutic radiology

The Kuwait stethoscope market is expected to grow at the fastest CAGR over the forecast period. Increasing healthcare expenditure and rising adoption of advanced healthcare facilities are among major factors driving the market. In Kuwait, Ministry of Health (MOH) is responsible for the oversight and regulatory framework governing medical devices, encompassing instruments such as stethoscopes.

Key Stethoscope Company Insights

HD Medical, Zahra Innovation, are some of the emerging players in the global market. The market is undergoing notable trends that are influencing the activities of emerging players in the industry. One key trend is the integration of advanced technologies into stethoscope design, such as digital features and connectivity options. Emerging players are actively leveraging these technological advancements to introduce innovative stethoscope models that offer enhanced diagnostic capabilities. Incorporation of electronic components, AI-driven analysis, and wireless connectivity aligns with the growing demand for smart healthcare solutions. This trend not only caters to the preferences of healthcare professionals seeking more efficient diagnostic tools but also aligns with the broader digital transformation in the healthcare sector.

Furthermore, rise of telemedicine and remote patient monitoring has prompted emerging players to explore stethoscope technologies that support telehealth initiatives. This includes stethoscopes with remote monitoring capabilities, allowing healthcare professionals to conduct auscultation remotely and contribute to the expansion of virtual healthcare services. Overall, trends in market reflect a shift towards technologically advanced, user-friendly, and infection-resistant devices, with emerging players at the forefront of driving innovation and reshaping the landscape of traditional diagnostic tools in the healthcare industry.

Key Stethoscope Companies:

The following are the leading companies in the stethoscope market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Medline Industries, LP.

- Welch Allyn (Hill-Rom Holdings, Inc.)

- Eko Health, Inc.

- GF Health Products, Inc.

- Rudolf Riester GmbH (Halma plc)

- American Diagnostic Corporation

- Cardionics Inc.

- PAUL HARTMANN AG

- HEINE Optotechnik GmbH & Co. KG

- StethoMe sp. z o.o.

Recent Developments

-

In November 2023, TRICORDER program, spearheaded by researchers from Imperial College London and supported by a USD 1.3 million grant from National Institute for Health and Care Research (NIHR), successfully implemented AI-equipped smart stethoscopes in 100 General Practitioner (GP) clinics. This initiative aimed to enhance diagnostic capabilities for heart failure within primary care settings by providing clinicians with advanced tools to aid in their assessments

-

In June 2023, Eko Health, Inc. officially received FDA clearance and introduced its advanced digital stethoscope, the Core 500, leveraging artificial intelligence (AI) technology for the identification of abnormal heart rhythms. This cutting-edge device seamlessly integrates AI software, high-fidelity audio capabilities, a full-color display, and a 3-lead electrocardiogram (ECG), marking a significant advancement in cardiac monitoring technology

-

In March 2023, Aevice Health officially disclosed regulatory approval from Singapore's Health Sciences Authority for its primary medical apparatus. The endorsed device, recognized as a wearable stethoscope designed for respiratory health surveillance, was considered as a significant milestone for company. Operating under nomenclature AeviceMD, AI-infused wearable stethoscope, positioned on chest, was demonstrated as an ongoing capacity to identify and document atypical respiratory sounds, including wheezing. Furthermore, it facilitates the continuous monitoring of key vital signs such as heart rate and respiratory rate. This regulatory clearance enhances Aevice Health's position in the medical device landscape and underscores the efficacy of its innovative health monitoring technology

-

In May 2022, 3M Littmann disclosed that its 3M Littmann CORE Digital Stethoscope secured an honorable mention within the health category of the 2022 Fast Company World Changing Ideas global awards program. This recognition underscored product's significant role in fostering innovation for greater public welfare, particularly in context of tackling pressing issues such as social inequality, climate change, and public health crises. The acknowledgment by this esteemed awards program highlights the product's noteworthy impact on addressing crucial societal challenges

Stethoscope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 671.08 million

Revenue forecast in 2030

USD 949.88 million

Growth rate

CAGR of 5.96% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Technology type,sales channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Medline Industries; LP.; Welch Allyn (Hill-Rom Holdings, Inc.); Eko Health, Inc.; GF Health Products, Inc.; Rudolf Riester GmbH (Halma plc); American Diagnostic Corporation; Cardionics Inc.; PAUL HARTMANN AG; HEINE Optotechnik GmbH & Co. KG;StethoMe sp. z o.o

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stethoscope Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stethoscope market report based on technology type, sales channel, end-use, and region.

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic/ Digital

-

Smart Stethoscope

-

Traditional Acoustic Stethoscope

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Distributors

-

E-commerce

-

Direct Purchase

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Healthcare

-

Hospitals

-

Clinics

-

Nurse Practitioners

-

EMT/ First Responders

-

Veterinary

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global stethoscope market size was estimated at USD 634.93 million in 2023 and is expected to reach USD 671.08 million in 2024.

b. The global stethoscope market is expected to grow at a compound annual growth rate of 5.96% from 2024 to 2030 to reach USD 949.88 million by 2030.

b. North America dominated the stethoscope market with a share of 32.64% in 2023. This is attributable to the rise in chronic diseases such as cardiovascular and respiratory disorders, owing to the unhealthy lifestyle coupled with the presence of the sophisticated healthcare infrastructure.

b. Some of the key players operating in the stethoscope market include 3M, Medline Industries Inc, Welch Allyn (Hill-rom Holdings, Inc.), Eko Devices Inc, GF Health Products, Inc, Rudolf Riester GmbH, (Halma Plc), American Diagnostics Corporation, Cardionics, Heine Optotechnik GmbH & Co. KG.

b. Key factors that are driving the stethoscope market growth include the increasing prevalence of cardiovascular and respiratory diseases, the increasing application of digital stethoscopes in the diagnosis of chronic conditions, and rapid technological advancements in the stethoscope.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.