- Home

- »

- Electronic Devices

- »

-

Surface Vision And Inspection Market Size, Share Report 2030GVR Report cover

![Surface Vision And Inspection Market Size, Share & Trends Report]()

Surface Vision And Inspection Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Surface Type, By System, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-773-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surface Vision And Inspection Market Trends

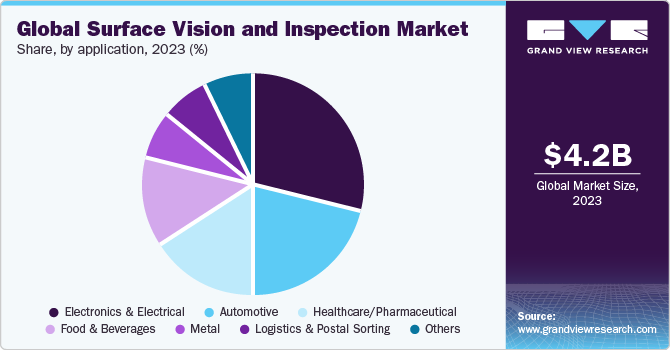

The global surface vision and inspection market size was estimated at USD 4.22 billion in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2030. The increasing demand for 3D vision systems using laser triangulation across the healthcare sector and the automotive industry is expected to drive the market growth over the forecast period. Pharmaceutical companies require speedy and accurate inspection systems to detect and separate foreign materials from raw material components required to manufacture the final product.

Laser technology is used in multiple ways for pharmaceuticals, mostly where traceability and security are vital considerations, such as the inspection of seal and blister in an insoluble product from the package.The growing preference for 3D technologies involving the use of a laser in the production line and complex applications such as paint and surface inspection of vehicles is anticipated to boost the surface vision and inspection market growth over the forecast period.

The machine learning approach to surface vision has helped in automating the design process of surface vision systems. This approach includes image acquisition, preprocessing, feature extraction, and classification. Furthermore, in-line image processing technology classifies, detects, filters, and maps specific defects accurately over the entire area of the surface. Improvements in these areas are anticipated to influence the growth of surface vision and inspection.

With the advancement of image processing technology, surface vision with charged coupled device cameras has enabled fast image acquisition and reduced false inspection rates. This has become widely used in industrial visual inspection, greatly improving production efficiency, and lowering the labor intensity of the workers. The focus on developing algorithms for machine learning integrated into vision systems with Convolution Neural Networks (CNN), Artificial Neural Networks (ANN), Support Vector Machine (SVM), and Extreme Learning Machine (ELM) is expected to drive the demand for vision systems on manufacturing floors over the forecast period.

Furthermore, the adoption of surface vision systems across different industries and sectors, such as electronics & semiconductors, food & beverage, and aerospace & defense, is anticipated to increase owing to the use of automation to lower operational costs, including the cost of labor. The implementation of surface vision systems in various production stages allows optimization of manufacturing expenditures, considerably benefiting in terms of overall operational spending. Thus, the advantages associated with vision systems and various technologies, such as machine learning and deep learning, are attracting manufacturers to adopt surface vision and inspection systems at a faster pace.

3D imaging technologies such as laser scanners can capture the depth and geometry of a surface, providing a more comprehensive picture of defects such as cracks, dents, and unevenness. Moreover, machine learning algorithms can be trained on vast datasets of images containing different components of defects. This allows them to automatically identify anomalies in real time, surpassing the limitations of human inspectors. In January 2024, Doss Visual Solution s.r.l., a machinery equipment provider, partnered with Pan Stone Europe Limited, a sales agency in Europe, to provide visual inspection systems to customers across Europe. Doss Visual Solution s.r.l. provides DOSS 3D Inspection System, which utilizes advanced technology to update 3D images of objects and evaluates them for any irregularities or defects. It is an optimal choice for industries that require accurate measurements and inspections, such as precision engineering and aerospace.

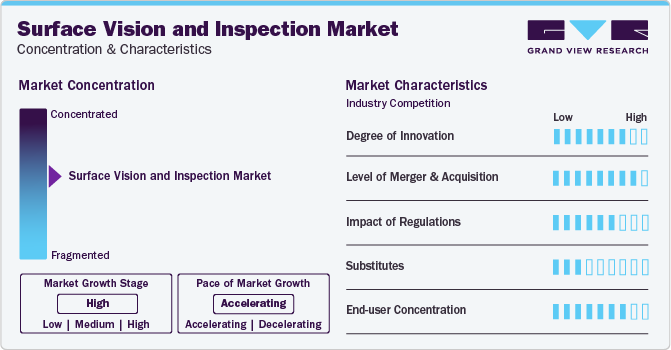

Market Concentration & Characteristics

Technological advancements are leading to the development of highly automated surface vision systems through the use of machine learning, such as extreme learning machines and artificial neural networks. Further, the increasing use of big data and internet of things is emerging as a key trend for implementing Industry 4.0 aimed at interconnecting people, machines, production resources, and products online.

The global cyber security market is also witnessing a high level of merger and acquisition initiatives by various leading and emerging players. For instance, in November 2023, Industrial Vision Systems Ltd. was acquired by Oxford Metrics, a UK-based smart sensing software company. The company was acquired at an amount of EUR 8.10 million (USD 8.83 million). The acquisition helped Oxford Metrics expand its footprints in the surface vision and inspection market.

Specific sectors are regulated by industry licensing authorities that are meant to certify a minimum level of competence and adherence to standards in maintaining the quality of products. Globally, pharmaceutical firms must comply with the federal laws of the Food and Drug Administration (FDA) to resolve the issues and erratic problems associated with manufacturing activities such as quality and defect-less production.

Due to the absence or negligible presence of direct substitutes to the technology, the threat of substitutes is very low in the market. However, there may be internal substitutes in the market. For instance, a small-scale company may use the manual inspection process of its products, which may act as a substitute in the surface vision and inspection market.

There is increasing demand across of surface vision and inspection solutions and services among end-use industries to ensure compliance with a high standard of quality for products and implement automation in the manufacturing industry to reduce human inspection and lower the rate of false inspection. There is also increased end-user preference for software systems that provide accurate images for traceability of defects.

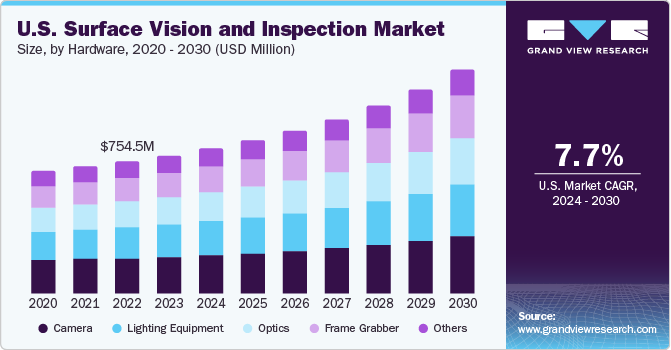

Component Insights

The hardware segment accounted for the largest market share accounting for more than 70% of the surface vision and inspection market in 2023. The demand for enhanced quality products is increasing among end-use industries and sectors such as manufacturing, logistics, and healthcare, which is leading to the adoption of automated inspection systems. Hardware components such as high-resolution cameras, 3D imaging sensors, and powerful processors are essential for the effective functioning of these systems. Further, the camera segment is expected to contribute significantly to the market growth, surface vision & inspection systems equipped with high-resolution cameras can execute real-time and high-precision inspection, reducing defects and improving consistency. Continuous advancements in camera technology, including higher resolutions, faster frame rates, and improved sensitivity, enhance the capabilities of surface vision & inspection systems. These advancements allow systems to handle complex inspection tasks with improved accuracy.

The software segment is expected to register the fastest CAGR at 9.7% during the forecast period from 2024-2030. Surface vision & inspection software helps achieve quality control in a reliable and automated way by providing real-time defect detection and analysis capabilities. As there is a continuous evolution in manufacturing processes and product types, surface vision & inspection software should be updated and able to address these changes. Modern surface vision & inspection software offers features such as user-friendly interfaces for creating custom inspection routines and the ability to integrate with different hardware components.

Surface Type Insights

The 2D segment accounted for the largest market share in the surface vision and inspection market in 2023. 2D surface vision and inspection play pivotal roles across various industries, from manufacturing to healthcare. Quality control is among the significant factor driving the demand for 2D surface vision and inspection segment in manufacturing, as precise inspection of surfaces ensures product integrity, identifying defects, and detects imperfections early in the production process, thereby reducing waste and improving overall quality. Further, automated 2D surface vision systems can rapidly scan and analyze surfaces, streamlining inspection processes and increasing productivity.

The 3D technology segment is expected to record the highest CAGR during the forecast period from 2024 to 2030. Industries strive to minimize human error and optimize throughput, automated inspection systems equipped with 3D vision capabilities offer a compelling solution. These systems can swiftly identify defects, measure dimensions, and perform intricate surface analyses with minimal human intervention, thereby enhancing productivity and reducing costs.

System Insights

The computer-based systems segment accounted for a significant market share in the surface vision and inspection market in 2023. Computer-based surface vision and inspection systems are gaining significant relevance among various industries, it is revolutionizing quality control and enhancing efficiency among industries. These systems utilize advanced algorithms and high-resolution cameras to analyze surface characteristics with remarkable precision. The widespread adoption of these systems is due to its ability to detect imperfections and anomalies that might escape human observation, ensuring products meet stringent quality standards. Thus, these factors are expected to drive the demand for computer-based systems in the surface vision and inspection market.

The camera-based systems segment is expected to record the fastest CAGR during 2024 to 2030. The rising application of advanced technologies including AI and ML enables real-time analysis of captured images, enabling swift identification, and classification of defects. Moreover, their ability to operate in diverse environments, including harsh lighting conditions and varying surface textures, underscores greater importance among industries. Additionally, integration with machine learning algorithms empowers these systems to continuously learn and improve, refining their inspection capabilities over time. As a result, industries can achieve unparalleled levels of quality assurance and productivity, driving innovation and competitiveness in the global market.

Application Insights

By application, the electronics & electrical industry segment of the surface vision and inspection market is expected to have the largest market share of around 28% in 2023. Manufacturers in the electronics & electrical industry are emphasizing the production of compact electronic devices, with the incorporation of densely packed circuit boards with intricate components. Surface vision & inspection systems with high-resolution cameras and precise lighting are essential for inspecting these tiny components and identifying defects such as solder faults, misaligned components, and missing parts. Thus, these are the key factors driving the demand for surface vision and inspection in the electronics & electrical industry.

The metal segment is expected to expand with the highest CAGR from 2024-2030. Surface vision & inspection systems ensure product quality, optimize production processes, and contribute to the safety and efficiency of metal manufacturing operations. Various companies in the market are focusing on developing surface vision & inspection systems designed for the metal industry. For instance, in June 2023, IMS Messsysteme GmbH, a surface vision & inspection systems provider, introduced an optimized version of its Inclusion Detection System (IDS) for cold-rolled strip steels. IDS is especially helpful for tin plate and thin sheet makers who need to ensure an enhanced level of quality.

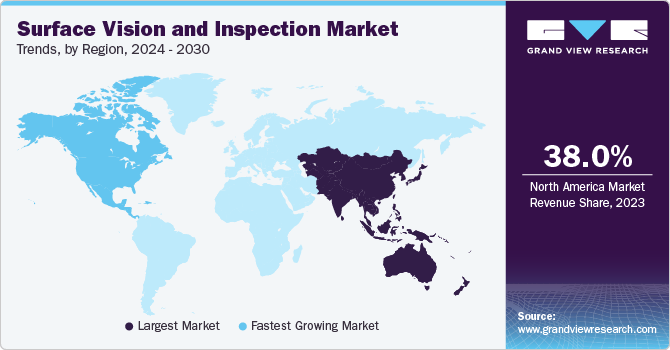

Regional Insights

North America held the second major share of over 24% of the surface vision and inspection market in 2023. The growth of the North America market can be attributed to the increasing demand for surface vision and inspection from cosmetic, drug, and food and beverage manufacturers. The North American government has implemented strict laws and regulations to oversee the quality of products across various sectors.

U.S. Surface Vision And Inspection Market Trends

The surface vision and inspection market in U.S. is growing significantly at a CAGR of around 7.7% from 2024 to 2030. The growth of the U.S. surface vision and inspection market can be attributed to the increasing focus of end users on automation and the implementation of advanced technologies such as artificial intelligence and machine learning across several industries. Moreover, stringent regulations overseeing product safety and quality in the country are propelling manufacturers to adopt surface vision and inspection systems.

Asia Pacific Surface Vision And Inspection Market Trends

The surface vision and inspection market in Asia Pacific is growing significantly at a CAGR of 10.0% from 2024 to 2030. Rapid industrialization in developing countries; the presence of major semiconductor, electronics, and automotive manufacturers; and the establishment of stringent quality standards are some factors driving the demand for surface vision & inspection systems in Asia Pacific.

The surface vision and inspection market in China is growing significantly at a CAGR of 10.6% from 2024 to 2030. China's manufacturing sector is massive and constantly evolving. Stricter quality control measures are crucial for maintaining competitiveness in the global market. Surface vision systems offer a reliable and efficient solution for ensuring product quality.

The India surface vision and inspection market is growing significantly at a CAGR of 11.2% from 2024 to 2030. Manufacturers across the country are particularly sensitive to upfront costs. The market favors surface vision systems that offer a high Return on Investment (ROI) with lower initial investments and easier maintenance requirements.

The surface vision and inspection market in Japan is growing significantly at a CAGR of around 9.2% from 2024 to 2030. Japan is at the forefront of robotics technology. The seamless integration of surface vision systems with robots enables highly automated and efficient inspection solutions across various industries. The country excels in miniaturization technologies.

Europe Surface Vision And Inspection Market Trends

The surface vision and inspection market in Europe is growing significantly at a CAGR of around 9.1% from 2024 to 2030. European regulatory bodies have established stringent regulations to oversee product safety and quality. Surface vision systems play a crucial role in supporting manufacturers in seamless compliance with these regulations.

The surface vision and inspection market in the UK is growing significantly at a CAGR of around 9.8% from 2024 to 2030. The UK is witnessing a rise in industrial automation efforts, and surface vision plays a key role in automating inspection processes, leading to greater efficiency and lower human error. Smart sensing technology providers operating in the country are undertaking strategic initiatives such as partnerships, collaborations, and mergers & acquisitions to enhance their presence in the surface vision and inspection market.

The Germany surface vision and inspection market is growing significantly at a CAGR of 8.8% from 2024 to 2030. Germany has a well-developed automotive industry with a strong focus on quality and innovation. This translates to a high demand for advanced surface vision systems for inspecting car parts and ensuring their flawless finish and functionality.

The surface vision and inspection market in France is growing significantly at a CAGR of 10.3% from 2024 to 2030. France boasts a prominent aerospace industry with rigorous quality standards. Surface vision systems are essential for ensuring accurate aircraft parts, contributing to market growth. In addition, there is a high demand for quality inspection in various end-use industries, such as automobiles, cosmetics, and fashion apparel.

Middle East & Africa Surface Vision And Inspection Market Trends

The surface vision and inspection market in the Middle East & Africa region is growing significantly at a CAGR of 8.6% from 2024 to 2030. Several MEA countries are expanding their exports in different sectors, such as oil & gas, automotive, and pharmaceuticals. Stringent quality control measures are crucial for meeting international standards. Surface vision systems offer an efficient and reliable solution for ensuring product quality and export competitiveness.

Key Surface Vision And Inspection Company Insights

Some of the key players operating in the surface vision and inspection market include Cognex Corporation, Omron Corporation, and Keyence Corporation among others.

-

Cognex Corporation has strategically expanded its market reach by forging partnerships with key players in various industries, enabling them to offer tailored solutions to address specific customer needs effectively. By combining technological excellence with strategic partnerships, Cognex has established itself as a go-to provider for surface vision and inspection solutions, driving growth and market leadership in the ever-evolving landscape of industrial automation.

-

Keyence Corporation has established itself as a market leader in surface vision and inspection through a series of strategic initiatives tailored to meet the evolving demands of various industries. One key initiative is their relentless focus on research and development (R&D), which enables the company to continuously innovate and introduce cutting-edge solutions. By investing heavily in R&D, Keyence stays at the forefront of technological advancements, developing highly accurate and efficient vision systems capable of detecting even the most subtle surface defects.

IMS Messsysteme GmbH and Vitronic GmbH are some of the emerging market participants in the surface vision and inspection market.

-

IMS Messsysteme GmbH is emerging as a significant player in the surface vision and inspection sector through key strategic initiatives. Leveraging its expertise in measurement technology, IMS has diversified into surface inspection systems, offering innovative solutions for quality control in manufacturing processes. One of the company's core strategies involves investing in research and development to enhance its product portfolio and stay abreast of technological advancements.

-

Vitronic GmbH is emerging as a significant player in the surface vision and inspection industry, leveraging key strategic initiatives to solidify its position in the market. The company distinguishes itself through its innovative approach to developing advanced imaging solutions for quality control and automation across diverse sectors. One of Vitronic's primary strategic initiatives is its relentless focus on research and development, investing in cutting-edge technologies to enhance the accuracy, speed, and reliability of its inspection systems.

Key Surface Vision And Inspection Companies:

The following are the leading companies in the Surface Vision And Inspection market. These companies collectively hold the largest market share and dictate industry trends.

- AMETEK, Inc.

- Baumer Inspection GmbH

- Cognex Corporation

- Edmund Optics

- OMRON Corporation

- Industrial Vision Systems Ltd.

- ISRA VISION GmbH

- IMS Messsysteme GmbH

- KEYENCE CORPORATION

- KITOV Systems Ltd.

- Zebra Technologies Corporation

- NATIONAL INSTRUMENTS CORPORATIONS

- Panasonic Corporation

- Teledyne Technologies Incorporated

- Vitronic GmbH

Recent Developments

-

In March 2024, Baumer Inspection GmbH company announced a new compact multiturn encoder (EB360R) for mobile machines. The new EB360R contactless sensor is specially designed for mobile machines and is maintenance-free even in harsh conditions.

-

In March 2024, KEYENCE CORPORATION company introduced Rugged Industrial Handheld Code Reader; AI enabled decoder. It provides more reliable and faster reading. Moreover, the reader’s wireless charging facilitates longer service life with better safety.

-

In October 2023, OMRON Corporation partnered with Boldyn Networks, a private networks provider, to enhance automation and connectivity through private 5G networks. Data connectivity challenges prevalent in AMR and real-time process control environments can be addressed by integrating 5G private networks.

Surface Vision And Inspection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.50 billion

Revenue forecast in 2030

USD 7.66 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, surface type, system, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

AMETEK, Inc.; Baumer Inspection GmbH; Cognex Corporation; Edmund Optics; OMRON Corporation; Industrial Vision Systems Ltd.; ISRA VISION GmbH; IMS Messsysteme GmbH; KEYENCE CORPORATION; KITOV Systems Ltd.; Zebra Technologies Corporation; NATIONAL INSTRUMENTS CORPORATIONS; Panasonic Corporation; Teledyne Technologies Incorporated; Vitronic GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Surface Vision And Inspection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surface vision and inspection market report based on component, surface type, system, application, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Camera

-

Optics

-

Lighting Equipment

-

Frame Grabber

-

Other

-

-

Software

-

-

Surface Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

2D

-

3D

-

-

System Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computer-based Systems

-

Camera-based Systems

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Electronics & Electrical

-

Smart Phones and Tablets

-

Smart Devices with Glass Displays

-

Others

-

-

Healthcare/Pharmaceutical

-

Food & Beverages

-

Logistics & Postal Sorting

-

Metal

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface vision and inspection market size was estimated at USD 4.22 billion in 2023 and is expected to reach USD 4.50 billion in 2024.

b. The global surface vision and inspection market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 7.66 billion by 2030.

b. The hardware segment accounted for the largest market share, accounting for more than 71% of the surface vision and inspection market in 2023. The demand for enhanced quality products is increasing among end-use industries and sectors such as manufacturing, logistics, and healthcare, which is leading to the adoption of automated inspection systems.

b. Some key players operating in the surface vision and inspection market include AMETEK, Inc., Baumer Inspection GmbH, Cognex Corporation, Edmund Optics, OMRON Corporation, Industrial Vision Systems Ltd., ISRA VISION GmbH, IMS Messsysteme GmbH, KEYENCE CORPORATION, KITOV Systems Ltd., Zebra Technologies Corporation, NATIONAL INSTRUMENTS CORPORATIONS, Panasonic Corporation, Teledyne Technologies Incorporated, and Vitronic GmbH.

b. The implementation of surface vision systems in various production stages allows optimization of manufacturing expenditures, considerably benefiting in terms of overall operational spending. Thus, the advantages associated with vision systems and various technologies, such as machine learning and deep learning, are attracting manufacturers to adopt surface vision and inspection systems at a faster pace.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.