- Home

- »

- Clothing, Footwear & Accessories

- »

-

Sustainable Footwear Market Size And Share Report, 2030GVR Report cover

![Sustainable Footwear Market Size, Share & Trends Report]()

Sustainable Footwear Market Size, Share & Trends Analysis Report By Type (Athletic, Non-athletic), By End-user (Men, Women, Children), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-462-8

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Sustainable Footwear Market Size & Trends

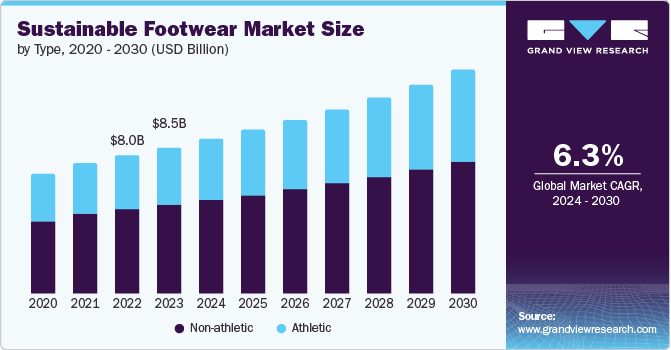

The global sustainable footwear market size was estimated at USD 8.46 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. Growing consumer awareness and concern for environmental sustainability have increased the demand for eco-friendly footwear options. In addition, advancements in sustainable materials and production methods have enabled manufacturers to offer stylish and functional footwear that meets the preferences of eco-conscious consumers. Government regulations and incentives promoting sustainable practices in the fashion industry have further accelerated market growth. Moreover, the rise of ethical and socially responsible consumer behavior has boosted the adoption of sustainable footwear brands.

Sustainability has been observed to be a key trend over the years. Many experts believe that innovations in production will continue to gather momentum. Many prominent market participants, including Nike and Adidas, contributed to sustainable production methods, such as reduced labor costs and wastage. Digitization also allows the creation of sample footwear with better materials and enables the use of a 3-D printer for predicting a single shoe in multiple forms, patterns, and colors.

Many footwear companies have begun to make substantial changes in their production methods. They are increasingly incorporating recycled and sustainable materials into their product lines, such as recycled PET plastics, organic cotton, and sustainable alternatives to leather. This shift reduces the consumption of virgin resources and helps divert waste from landfills. In September 2023, Nike launched its innovative recyclable shoe, the ISPA Link Axis. This groundbreaking shoe, accessible through Nike's SNKRS app, is engineered for complete disassembly, allowing each component to undergo full recycling. Nike's design approach for this shoe incorporates interlocking parts, eliminating the need for adhesive materials and minimizing the overall use of resources.

Moreover, companies are implementing measures to reduce water and energy consumption and minimize carbon emissions. Sustainable footwear brands invest in cleaner, more efficient production technologies and sustainable packaging practices. This holistic approach to sustainability resonates with consumers concerned about the materials used in their footwear and its entire lifecycle, from production to disposal. In August 2023, the global initiative Fashion for Good, in collaboration with its brand partners Adidas, Target, Inditex, and Zalando, initiated a pilot program with FastFeetGrinded, an innovator in footwear recycling. The pilot aims to test and validate a process that promotes the integration of recycled materials into footwear, further propelling the shift toward a circular and sustainable footwear industry. Technological advancements are among the most promising opportunities for the market's future. These innovations are set to transform the industry, offering both environmental benefits and consumer appeal. Advanced sustainable materials and manufacturing technologies on the horizon present exciting possibilities for brands and consumers alike.

These innovations are poised to unlock new horizons in sustainable footwear production. For instance, developments in lab-grown leather and bio-fabricated materials pave the way for cruelty-free, eco-friendly alternatives to traditional leather. These materials reduce the environmental impact of animal agriculture and offer unique textures and properties that can be harnessed for innovative footwear designs.

3D printing is another game-changing technology that holds tremendous potential. It enables the customization of sustainable footwear, allowing consumers to have shoes precisely tailored to their feet. This enhances comfort and reduces waste by eliminating the need for excess inventory and manufacturing.

Market Dynamics

One of the most fundamental factors driving market growth is increasing consumer awareness and concern regarding environmental issues. In recent years, there has been a notable shift in consumer consciousness, with more people recognizing the detrimental ecological consequences associated with traditional footwear production. Traditional footwear manufacturing often involves the heavy consumption of natural resources, contributing to resource depletion. The extraction of materials like leather and rubber and energy-intensive manufacturing, dyeing, and transportation processes have historically placed a significant burden on ecosystems. Consumers are increasingly becoming aware of these issues, prompting them to seek alternatives.

The role of celebrities and influencers is undeniably pivotal in propelling the sustainable footwear market forward. High-profile endorsements and collaborations with sustainability-conscious influencers have become a powerful catalyst in raising awareness about eco-friendly footwear options. In today's digitally connected world, the influence wielded by these prominent figures cannot be underestimated, as they play a vital role in shaping consumer choices and preferences.

Market Concentration & Characteristics

The sustainable footwear industry is experiencing a high degree of innovation, driven by increasing consumer demand for environmentally responsible products and advances in material science. Companies are pioneering the use of eco-friendly materials, such as recycled plastics, organic cotton, and plant-based leathers made from sources like pineapple leaves, mushrooms, and cactus. Innovations extend to manufacturing processes, with brands employing techniques that reduce waste and carbon emissions, such as 3D printing and waterless dyeing.

The sustainable footwear industry has seen a moderate but growing level of merger and acquisition (M&A) activities, driven by the increasing consumer demand for eco-friendly products and the need for established companies to enhance their sustainability credentials. Larger, traditional footwear brands are actively acquiring smaller, innovative companies specializing in sustainable materials and manufacturing practices to diversify their portfolios and meet regulatory and market demands.

Regulatory activities significantly impact the sustainable footwear industry, driving innovation and accountability among manufacturers. Increasingly stringent environmental regulations and sustainability standards compel companies to adopt greener practices and materials, such as using renewable resources, reducing carbon emissions, and ensuring ethical labor practices. Compliance with these regulations often requires substantial investment in research and development, leading to the creation of more eco-friendly products and processes.

In the sustainable footwear industry, product substitutes primarily include traditional footwear made from synthetic and non-eco-friendly materials such as conventional leather, PVC, and other petroleum-based products. These alternatives often rely on less sustainable manufacturing processes, which can be more cost-effective and widely available. Other types of eco-conscious footwear alternatives, like those made from natural materials but not necessarily focusing on sustainability practices (e.g., untreated leather or natural rubber), can also serve as substitutes.

End user concentration in the sustainable footwear industry is primarily driven by a growing segment of environmentally conscious consumers who prioritize sustainability in their purchasing decisions. This demographic includes eco-minded millennials and Gen Z consumers, who are highly aware of the environmental impact of their choices and prefer brands that align with their values. In addition, there is a rising demand from athletes and outdoor enthusiasts seeking performance footwear made from sustainable materials that do not compromise quality or functionality.

Type Insights

The non-athletic segment accounted for a share of over 60% of the global revenue in 2023. Consumers are increasingly making socially responsible fashion choices, which drives the demand for non-athletic sustainable footwear. The growing availability of various sustainable casual shoes for women and men further contributes to the market growth. Innovations in sustainable materials, such as recycled and vegan materials, have allowed fashion brands to create stylish and environmentally responsible footwear choices. Furthermore, luxury brands are recognizing the importance of using sustainable materials in their footwear production. For instance, in August 2022, Louis Vuitton announced the launch of sustainable unisex sneakers. The sneaker is made of recycled and organic materials, such as recycled polyurethane, recycled cotton, corn-based plastic, and recycled polyester.

The athletic segment is projected to grow at a CAGR of 6.8% from 2024 to 2030, owing to the significant product launches by major companies, such as Nike Inc. and Puma SE. Athletic sustainable footwear consists of shoes created from recycled and eco-friendly materials, manufactured by companies adhering to sustainable business practices throughout their manufacturing and supply chain processes. As sustainability gains prominence among consumers, the demand for eco-friendly products, such as sustainable athletic footwear, grows. In September 2021, Nike announced the launch of Air Zoom Alphafly Next Nature sneakers. The sneakers are an upgrade to the Air Zoom Alphafly NEXT%. The Air Zoom Alphafly Next Nature includes 20% recycled TPU, 45% recycled polyester, 100 % recycled PEBA, 100% recycled polyester, and 50% recycled TPU throughout the shoe. These sustainable materials are used in various parts of the shoe, emphasizing its eco-friendly design.

End-user Insights

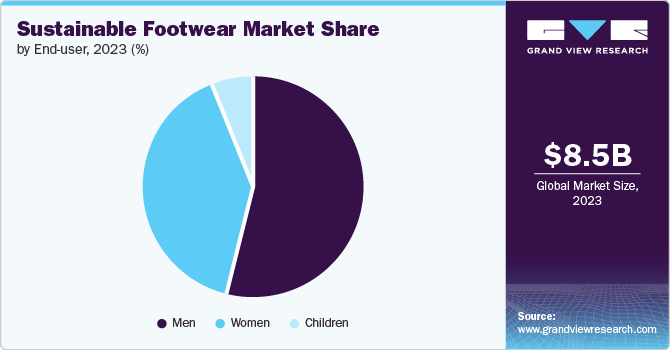

The men’s sustainable footwear segment accounted for a share of over 54% in 2023. The growing popularity of sustainable athletic footwear and associated technologies drives product demand among men. The increasing number of men participating in sports and fitness drives the demand for sustainable athletic footwear. Athletic footwear manufacturers are increasingly developing innovative and sustainable choices to meet the preferences of active men. Athletic footwear manufacturers offer innovative and sustainable options tailored to the needs and values of active men. In August 2023, U.S.-based sneaker brand Psudo announced the launch of PSUDO blue, a collection of shoe styles for men and women, in partnership with Blumaka, a manufacturer of shoe insoles and outsoles. PSUDO blu sneakers are manufactured near-shore at the Blumaka factory in El Salvador, which operates on solar power. The launch of the new PSUDO blu line brought PSUDO closer to achieving its objective of actively participating in and promoting a circular economy.

The women’s sustainable footwear segment is projected to grow at a CAGR of 6.9% from 2024 to 2030, driven by the increasing awareness of sustainable fashion among women. Several brands are launching campaigns or exchange programs to drive product demand among this demographic. In March 2021, a UK-based provider of eco-friendly footwear, VIVAIA, announced the launch of its Spring Summer collection of sustainable footwear. The collection offers various styles inspired by different professions and lifestyles. The brand utilizes 3D knit technology to create its shoes from recycled plastic bottles. The company also invited customers to participate in a Free Trial campaign, where 500 testers globally could provide feedback and suggestions. Through the campaign, the company aims to positively impact both the environment and consumers.

Regional Insights

The North America sustainable footwear market is projected to grow at a CAGR of 6.1% from 2024 to 2030. To address this rising demand, several U.S. organizations are dedicated to educating consumers about sustainable fashion and raising awareness of the fashion industry's impact on the environment and society. For instance, the Sustainable Apparel Coalition is a global alliance of apparel, footwear, and textile companies that is working to reduce the environmental and social impacts of the fashion industry.

U.S. Sustainable Footwear Market Trends

The sustainable footwear market in the U.S. is projected to grow at a CAGR of 6.0% from 2024 to 2030. The demand for sustainable footwear in the U.S. is mainly driven by rising environmental consciousness and changing consumer preferences. Consumers in the country are increasingly making purchasing decisions based on their values and principles. In January 2022, according to a survey conducted by First Insight and the Wharton School of the University of Pennsylvania's Baker Retailing Center, in partnership with the World Economic Forum, 68% of consumers were willing to pay more for sustainable products.

Asia Pacific Sustainable Footwear Market Trends

The Asia Pacific sustainable footwear market accounted for a share of over 36% of the global revenue in 2023. Advancements in sustainable material sourcing and manufacturing processes in the region make it easier for footwear companies to produce eco-friendly products while maintaining affordability. Governments in the region are also taking steps to address environmental concerns. This includes setting regulations and incentives to encourage sustainability in manufacturing processes and products, including footwear. Across the Asia Pacific, rising disposable incomes have enabled consumers to make more conscious purchasing decisions. The willingness to pay more for eco-friendly products, especially among sustainable shoppers, is creating a growing market for sustainable footwear in the region. A study conducted by YouGov in May 2022 found that in Singapore, 46% of people are willing to pay extra for eco-friendly products. This percentage increases to 60% among those who prefer sustainable brands. However, 63% of sustainable shoppers aged 55 and older are unconcerned about paying extra for environmentally friendly products.

The sustainable footwear market in China is projected to grow at a CAGR of 7.5% from 2024 to 2030. Consumer attitudes toward sustainability are transforming China. The increasing prominence of sustainability on social media and other online platforms is reshaping how consumers in the country perceive this concept. Many consumers are more inclined to select footwear that aligns with their values and the sustainability trends they come across on the internet.

The India sustainable footwear market is projected to grow at a CAGR of 7.1% from 2024 to 2030. The emergence of startups offering a wide variety of casual sneakers and non-athletic shoes in the country is driving the segment. For instance, in August 2022, India-based Solecraft Footwear announced the launch of sweat-resistant charcoal shoes. The shoes are made from Japanese bamboo charcoal, Australian Merino wool, and recycled coffee grounds oil derived from plants.

Europe Sustainable Footwear Market Trends

The sustainable footwear market in Europe is estimated to grow at a CAGR of 6.4% from 2024 to 2030, fueled by stringent regulations and environmental standards regarding footwear manufacturing. Growing consumer preference for more sustainable products is also boosting the demand for sustainable footwear. Eco-shoes, sustainable fashion, and ethical fashion are popular concepts, especially in North and West Europe. Over the past few years, brands and consumers have become more environmentally conscious. Therefore, several sustainability initiatives have been taken up by footwear brands to prevent plastic pollution. For instance, in May 2021, U.S.-based footwear and sportswear retailer Foot Locker opened a sustainability-driven store in Barcelona, Spain that uses recycled materials, including mannequins made from reused sneakers and recycled materials. The initiative indicates that sustainability is increasingly becoming a prominent focus in the footwear industry in the region.

The UK sustainable footwear market is projected to grow at a CAGR of 6.6% from 2024 to 2030. The high concentration of manufacturers of sustainable footwear in the country is likely to drive regional growth. Players such as VEJA, Elvis & Kresse, Po-Zu, and Ecoalf are sustainable footwear manufacturers who have been innovating production methods and materials and collaborating with organizations to launch new products for different end-user segments.

The sustainable footwear market in Germany is projected to grow at a CAGR of 6.0% from 2024 to 2030. The increasing number of German fair-fashion labels and their commitment to sustainability is driving the demand for sustainable footwear in the country. An increasing number of German fashion labels are achieving certifications, such as the Global Organic Textile Standard (GOTS), creating awareness regarding sustainable and ethical fashion practices among consumers in the country. For instance, according to deutschland.de, in 2019, 332 German brands were certified with the Global Organic Textile Standard (GOTS) label.

Central & South America Sustainable Footwear Market Trends

The Central & South America sustainable footwear market is estimated to grow at a CAGR of 5.3% from 2024 to 2030. The sustainable footwear market in Central and South America is growing due to increased environmental awareness, supportive government policies, favorable economic conditions, cultural influences, and technological advancements. Manufacturers like Veja, Cariuma, Insecta Shoes, Havaianas, and Alpargatas are leading the way with innovative strategies that emphasize sustainable materials, ethical practices, and community engagement.

Middle East & Africa Sustainable Footwear Market Trends

The sustainable footwear market in Middle East & Africa is estimated to grow at a CAGR of 4.8% from 2024 to 2030. There is a growing awareness of environmental issues across the region, leading consumers to seek sustainable alternatives in their purchasing decisions. This shift in consumer behavior is driving the demand for eco-friendly products, including footwear. Tamashee, a UAE-based footwear brand, focuses on sustainability and ethical production practices. It offers handmade shoes crafted from eco-friendly materials such as vegetable-tanned leather and recycled rubber, catering to environmentally conscious consumers in the region.

Key Sustainable Footwear Company Insights

The global market is characterized by growing competition, with a large number of startup formations and internationally renowned players venturing into sustainable footwear production. Companies focus on strategic expansions to reinforce their position in the market. Many prominent market participants, including Nike and Adidas, have been investing in sustainable methods of production through reduced production waste. Newer brands such as Rothy’s, Inc. and VEJA capture a moderate market share and benefit from a growing distribution network. Key players operating in the market adopt various steps to strengthen their industry presence.

Key Sustainable Footwear Companies:

The following are the leading companies in the sustainable footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Adidas AG

- VEJA

- Rothy’s, Inc.

- Amour Vert, Inc

- LYMI, Inc., dba Reformation

- Native Canada Footwear Ltd

- MATISSE FOOTWEAR

- NISOLO

- Threads 4 Thought

- THE TROPIC FEEL, S.L.

Recent Developments

-

In June 2024, THE TROPIC FEEL, S.L. launched All-Terrain Sneakers with a 5.5 mm thick rubber. These all-vegan sneakers have 18% recycled content and are also GRS-certified

-

In May 2024, the company launched its collection on Amazon to broaden its reach. The brand’s bestselling shoes, including The Point, The Flat, and The Driving Loafer, are now available on Rothy’s Amazon storefront.

-

In April 2024, Veja opened the American Sneaker Cobbler Space in Williamsburg, Brooklyn to make sneaker repairs and cleanings easy for its customers.

Sustainable Footwear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.96 billion

Revenue forecast in 2030

USD 12.96 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; France; Italy; Spain; China; South Korea; Japan; India; Australia; Brazil; South Africa

Key companies profiled

THE TROPIC FEEL, S.L.; Adidas AG; Rothy’s, Inc.; VEJA; NISOLO; MATISSE FOOTWEAR; Native Canada Footwear Ltd.; Amour Vert, Inc.; Threads 4 Thought; LYMI, Inc.; dba Reformation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Footwear Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable footwear market report on the basis of type, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Athletic

-

Non-athletic

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Scandinavia

-

-

Asia Pacific

-

China

-

South Korea

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sustainable footwear market size was estimated at USD 8.46 billion in 2023 and is expected to reach USD 8.96 billion in 2024.

b. The global sustainable footwear market is expected to grow at a compounded growth rate of 6.3% from 2024 to 2030 to reach USD 12.96 billion by 2030.

b. The non-athletic segment dominated the global sustainable footwear market with a share of 60.8% in 2022. The growing availability of various sustainable casual shoes for women and men further contributes to the market growth.

b. Some key players operating in the sustainable footwear market include the TROPIC FEEL, S.L.; Adidas AG; Rothy’s, Inc.; VEJA; NISOLO; MATISSE FOOTWEAR; Native Canada Footwear Ltd;

b. Key factors that are driving the sustainable footwear market growth include growing consumer awareness and concern for environmental sustainability, which have increased the demand for eco-friendly footwear options. Also, the rise of ethical and socially responsible consumer behavior has boosted the adoption of sustainable footwear brands.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."