- Home

- »

- Clothing, Footwear & Accessories

- »

-

Swiss Watch Market Size & Share, Industry Report, 2033GVR Report cover

![Swiss Watch Market Size, Share & Trends Report]()

Swiss Watch Market (2025 - 2033) Size, Share & Trends Analysis Report By Price (Entry-Level Swiss, Luxury Swiss), By Type (Mechanical, Quartz), By End-User (Men, Women), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-725-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Swiss Watch Market Summary

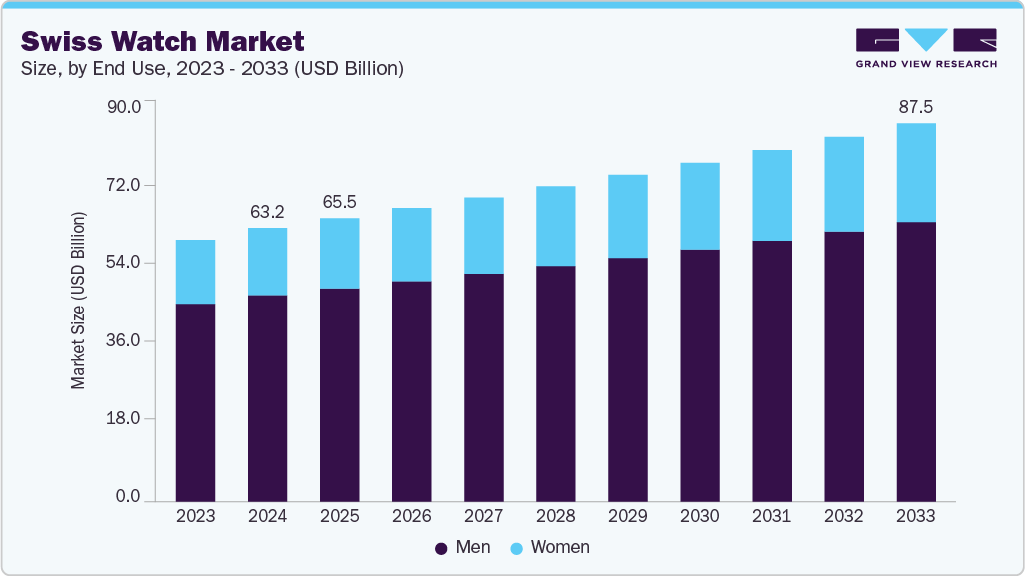

The global swiss watch market size was estimated at USD 63.21 billion in 2024 and is projected to reach USD 87.48 billion by 2033, growing at a CAGR of 3.7% from 2025 to 2033. This growth is supported by the industry’s strong heritage, precision engineering, and brand equity.

Key Market Trends & Insights

- By region, North America accounted for the largest market revenue share in 33.79% in 2024.

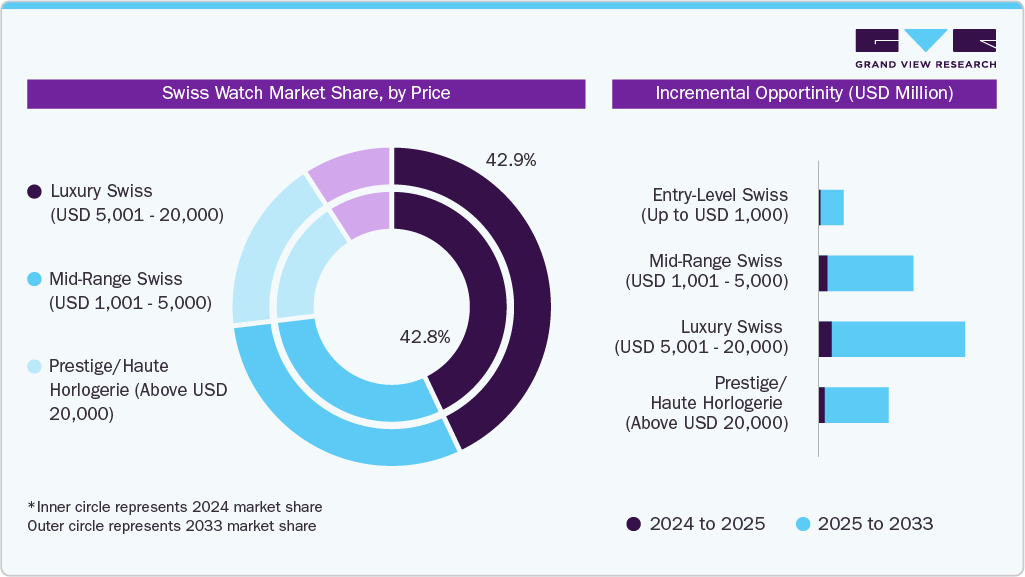

- By price, the luxury swiss (USD 5,001 - 20,000) segment led the market with the largest revenue share of 42.75% in 2024.

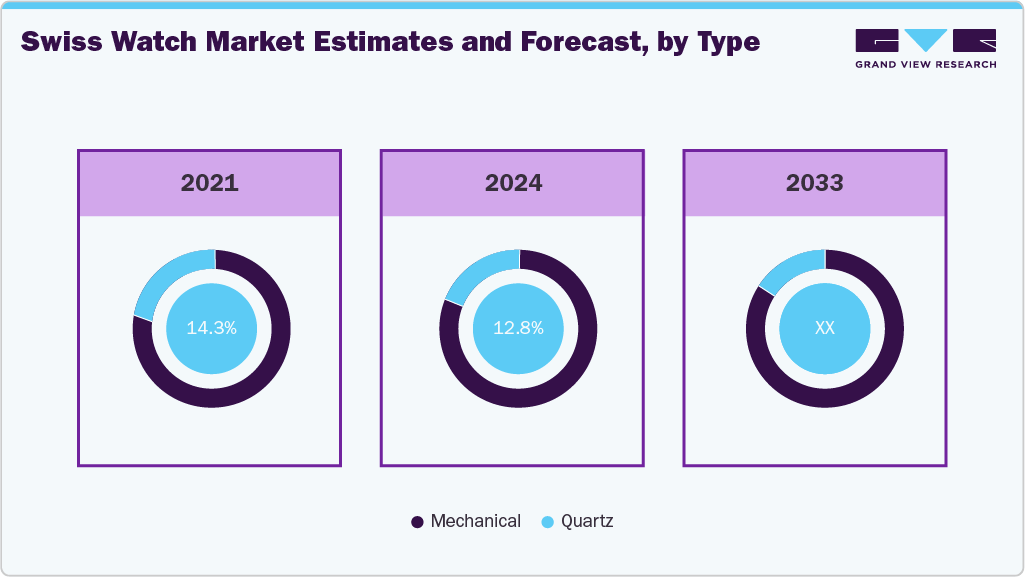

- By type, the mechanical swiss watch segment led the market with the largest revenue share of 80.82% in 2024.

- By end use, the men segment led the market with the largest revenue share of 75.42% in 2024.

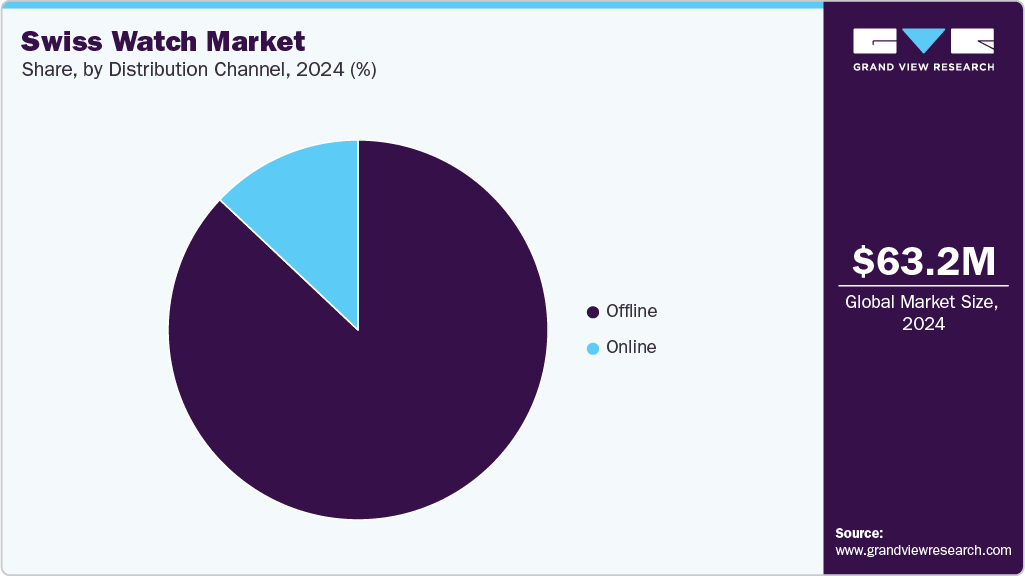

- By distribution channel, the offline sales segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 63.21 Billion

- 2033 Projected Market Size: USD 87.48 Billion

- CAGR (2025-2033): 3.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing affluence in emerging markets continues to drive demand for premium timepieces. The swiss watch industry’s sustained growth is anchored in its global reputation for precision engineering, artisanal craftsmanship, and heritage-driven brand value. Swiss manufacturers have successfully maintained a perception of exclusivity and quality, allowing them to command premium prices even in a competitive global luxury landscape. This enduring appeal ensures a loyal customer base in mature markets while attracting new buyers who aspire to own a Swiss timepiece.

Another key driver is the rising affluence in emerging economies, particularly in Asia-Pacific and the Middle East. These regions are witnessing an expanding class of consumers with high disposable incomes and a growing interest in luxury goods as symbols of status and lifestyle. Strategic marketing, localized retail expansion, and a strong presence in global luxury hubs further enhance Swiss watchmakers’ ability to capture this demand.

The forecasted CAGR of 3.7% between 2025 and 2033 also reflects the industry’s adaptability to evolving consumer preferences. While traditional mechanical watches remain the cornerstone, brands are embracing design innovation, limited editions, and digital engagement to appeal to younger demographics. Coupled with stable sales in established markets, these factors position the industry for measured yet consistent growth over the coming decade.

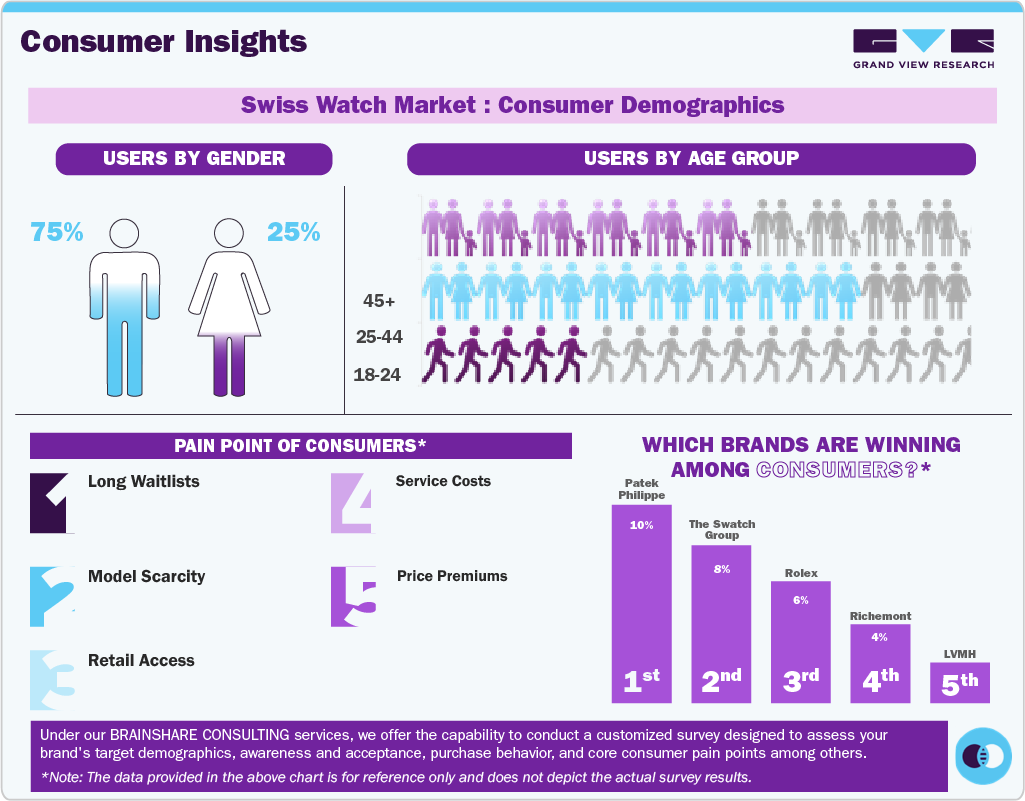

The demographic data shows that Swiss watch consumers are predominantly male, accounting for 75% of the user base, while women represent 25%. This reflects the traditional dominance of men’s collections in the luxury watch market, where a wider range of mechanical models, higher price points, and strong collector culture drive male-oriented sales. Women’s participation, while smaller, is gradually growing as brands expand their offerings for female buyers.

By age group, the largest share of Swiss watch users falls within the 25-44 age range, representing the prime earning years and a demographic with both purchasing power and a strong interest in luxury goods. The 45+ segment also forms a significant portion, reflecting long-term brand loyalty and the preference for investment-grade timepieces among established consumers. Younger buyers aged 18-24 make up the smallest segment, but their growing interest in entry-level luxury watches and brand storytelling suggests future potential.

Key consumer pain points include long waitlists for popular models, model scarcity due to limited production, and restricted retail access in certain geographies. Price premiums in the secondary market and high service costs also influence purchase decisions. In terms of brand preference, Patek Philippe leads, followed by The Swatch Group, Rolex, Richemont, and LVMH, highlighting a mix of heritage-driven high-end players and diversified luxury groups competing for market share.

Price Insights

The luxury swiss (USD 5,001 - 20,000) segment led the market with the largest revenue share of 42.75% in 2024, due to its strong positioning between accessible luxury and ultra-high-end exclusivity. It benefits from a wide consumer base that values heritage, mechanical excellence, and brand prestige while remaining within a reachable price band for affluent professionals and collectors. Consistent demand is further supported by global brand recognition, diversified retail presence, and the appeal of timeless designs that hold long-term value.

The prestige/haute horlogerie (Above USD 20,000) is anticipated to grow at the fastest CAGR of 4.4% from 2025 to 2033. It is growing faster as it caters to a niche of high-net-worth individuals seeking rarity, personalization, and investment-grade craftsmanship. Limited production runs, intricate complications, and bespoke services enhance exclusivity, while rising wealth concentration in Asia, the Middle East, and North America fuels demand. The segment also benefits from the perception of these watches as collectible assets, driving sustained interest and premium pricing power.

Type Insights

The mechanical swiss watches segment led the market with the largest revenue share of 80.82% in 2024, due to their strong association with heritage, craftsmanship, and prestige. They are viewed as luxury investments, often featuring intricate complications and artisanal finishing that appeal to collectors and enthusiasts worldwide. Limited production, brand legacy, and the perception of mechanical timepieces as symbols of status reinforce their dominant market position.

The Quartz swiss watches segment is expected to grow at the fastest CAGR of 2.9% from 2025 to 2033, driven by their affordability, precision, and lower maintenance requirements. They attract a broader audience, including younger buyers and those seeking entry-level Swiss watches. Increasing adoption in fashion-forward designs, women’s segments, and casual luxury lines further supports steady growth in this category.

End Use Insights

The men segment led the market with the largest revenue share of 75.42% in 2024, due to the category’s historical dominance, broader product variety, and higher representation in mechanical and high-complication models. Men’s watches often command higher average selling prices, with strong demand driven by collector culture, professional status symbolism, and established brand marketing strategies focused on male clientele.

The women segment is anticipated to witness at the fastest CAGR of 4.4% from 2025 to 2033, fueled by rising disposable incomes, increasing self-purchasing behavior, and greater representation of women in the luxury consumer base. Brands are expanding offerings with technically sophisticated, jeweled, and fashion-forward designs, tapping into a segment that is underpenetrated compared to men’s, creating significant growth potential.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 87.03% in 2024, due to the luxury sector’s reliance on in-person retail experiences, where customers can physically inspect craftsmanship, receive personalized service, and build trust with authorized dealers. Flagship boutiques, high-end department stores, and exclusive events also reinforce brand image and exclusivity, driving strong preference for offline purchases.

The online segment is expected to grow at the fastest CAGR of 4.7% from 2025 to 2033, driven by the expansion of brand-owned e-commerce platforms, improved digital authentication, and growing consumer comfort with purchasing high-value items online. Virtual consultations, immersive product visuals, and global reach enable brands to tap into younger, tech-savvy luxury buyers and capture cross-border demand.

Regional Insights

North America dominated the swiss watch market with the largest revenue share of 33.79% in 2024. North America benefits from a mature but resilient luxury market with strong consumer loyalty to heritage brands. The region’s large collector base, preference for mechanical timepieces, and established retail infrastructure support consistent demand. High visibility through flagship stores, authorized retailers, and luxury department chains reinforces brand image and accessibility for affluent buyers.

U.S. Swiss Watch Market Trends

The swiss watch market in the U.S. accounted for the largest market revenue share in North America in 2024, showing robust growth supported by high per-capita luxury spending, economic stability, and a strong gifting culture for premium watches. Consumer interest is driven by both functional and investment value, with mechanical, limited-edition, and bespoke models performing particularly well. Aggressive marketing campaigns, celebrity endorsements, and exclusive retail experiences further strengthen the country’s position as a key growth driver for Swiss watch sales.

Asia Pacific Swiss Watch Market Trends

The swiss watch market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by the rapid expansion of luxury consumption, particularly in China, Hong Kong, and Japan, which serve as both retail and re-export hubs for Swiss watches. Rising disposable incomes, an expanding affluent class, and the cultural association of Swiss watches with prestige and professional success fuel demand. In addition, emerging markets such as India and Southeast Asia are experiencing increased brand penetration through flagship boutiques and premium retail partnerships.

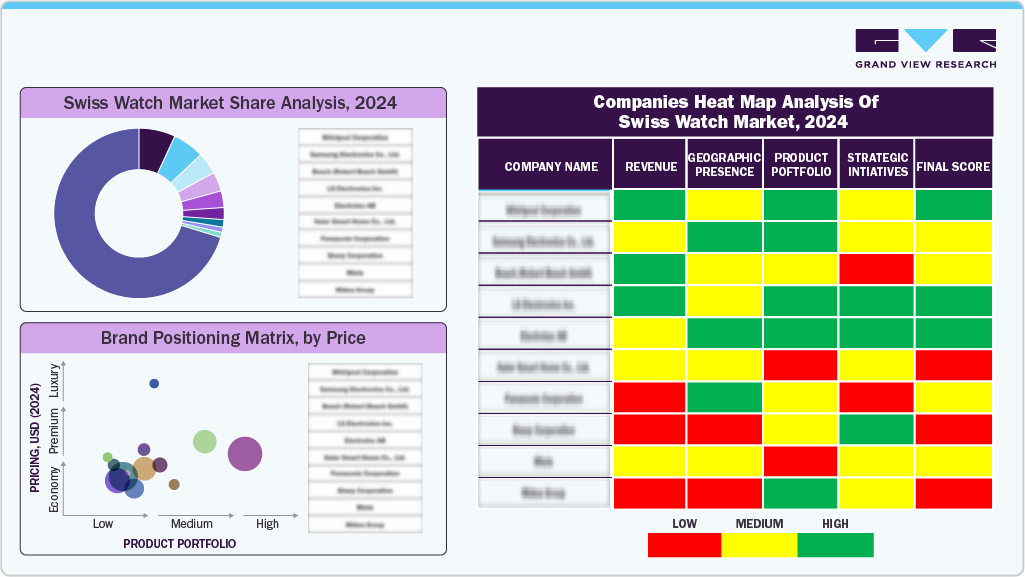

Key Swiss Watch Company Insights

The Swiss watch industry is highly competitive, shaped by distinct regional and cultural preferences that influence design, pricing, and product positioning. Leading brands such as Rolex, Patek Philippe, Audemars Piguet, Omega, and TAG Heuer tailor their offerings to suit diverse consumer segments, from entry-level luxury to ultra-high-end Haute Horlogerie. Innovation is central to the industry, with frequent launches of new models, complications, and limited editions aimed at sustaining consumer interest and reinforcing exclusivity.

The market also sees growing fragmentation, as independent watchmakers and niche brands gain traction through unique craftsmanship, heritage storytelling, and specialized designs. Established players are expanding their global retail presence, strengthening e-commerce channels, and leveraging targeted marketing campaigns to enhance brand visibility. Collaborations with celebrities, sports events, and cultural icons further amplify consumer engagement and brand desirability.

In addition, efficiency in production and supply chain optimization helps maintain competitive pricing while preserving quality standards. Sustainability has emerged as a key differentiator, with many Swiss watchmakers adopting ethical sourcing, recycling initiatives, and environmental certifications to appeal to eco-conscious luxury buyers. Brand share analysis remains critical for evaluating competitive positioning, identifying high-growth segments, and informing strategic investments in this prestige-driven market.

Key Swiss Watch Companies:

The following are the leading companies in the swiss watch market. These companies collectively hold the largest market share and dictate industry trends.

- Rolex

- Patek Philippe

- Audemars Piguet

- The Swatch Group

- Richemont

- LVMH Moët Hennessy Louis Vuitton

- Breitling

- Chopard

- Hublot

- Zenith

Recent Developments

-

In May 2025, Swiss luxury watch brand Franck Muller has unveiled a new limited-edition collection in partnership with the Solana blockchain. The series is highly exclusive, comprising just 1,111 pieces. Combining traditional Swiss craftsmanship with modern digital innovation, the watches offer both style and contemporary appeal. Each timepiece is priced at 20,000 Swiss francs, approximately 24,356 US dollars.

Swiss Watch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 65.48 billion

Revenue forecast in 2033

USD 87.48 billion

Growth rate

CAGR of 3.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price, type, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Switzerland, Hong Kong; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia

Key companies profiled

Rolex; Patek Philippe; Audemars Piguet; The Swatch Group; Richemont; LVMH Moët Hennessy Louis Vuitton; Breitling; Chopard; Hublot; Zenith

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Swiss Watch Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global swiss watch market report based on price, type, end use, distribution channel, and region.

-

Price Outlook (Revenue, USD Million, 2021 - 2033)

-

Entry-Level Swiss (Up to USD 1,000)

-

Mid-Range Swiss (USD 1,001 - 5,000)

-

Luxury Swiss (USD 5,001 - 20,000)

-

Prestige / Haute Horlogerie (Above USD 20,000)

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanical

-

Quartz

-

-

End Use Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Hong Kong

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global swiss watch market size was valued at USD 63.21 billion in 2024

b. The global swiss watch market is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2025 to 2033.

b. Mechanical swiss watches accounted for 80.82% of the market in 2024 due to their strong association with heritage, craftsmanship, and prestige.

b. The key players in the market include Rolex; Patek Philippe; Audemars Piguet; The Swatch Group; Richemont; LVMH Moët Hennessy Louis Vuitton; Breitling; Chopard; Hublot; Zenith

b. The growth is supported by the industry’s strong heritage, precision engineering, and brand equity. Increasing affluence in emerging markets continues to drive demand for premium timepieces

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.