- Home

- »

- Plastics, Polymers & Resins

- »

-

Synthetic Paper Market Size & Share, Industry Report, 2033GVR Report cover

![Synthetic Paper Market Size, Share & Trends Report]()

Synthetic Paper Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (BOPP, HDPE, PET), By Application (Label, Non-label), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: 978-1-68038-258-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Paper Market Summary

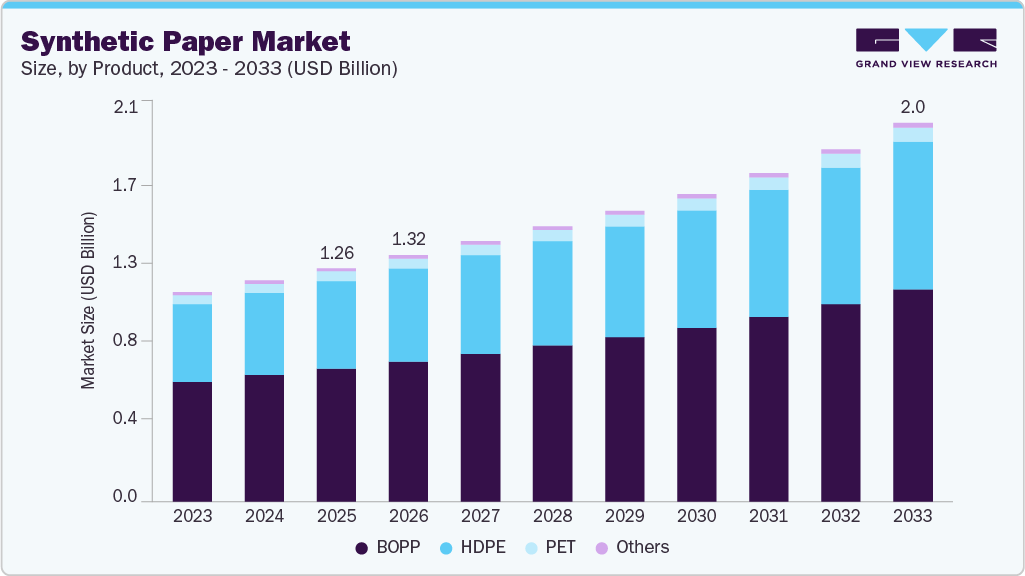

The global synthetic paper market size was estimated at USD 1.20 billion in 2024 and is projected to reach USD 2.05 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The industry is expected to grow significantly due to the inclination of consumers toward eco-friendly and recycled packaging.

Key Market Trends & Insights

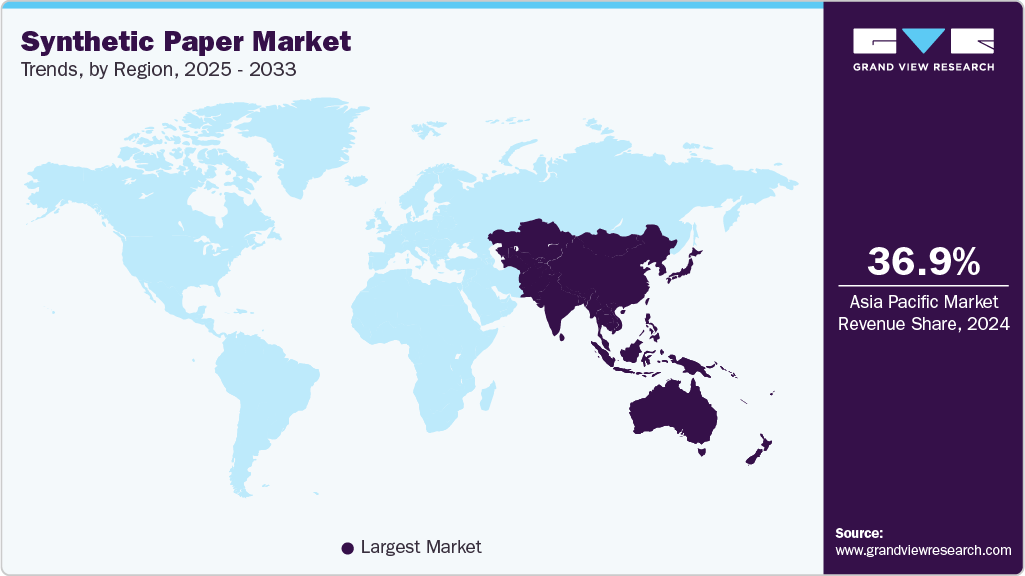

- Asia Pacific dominated the synthetic paper market with the largest revenue share of 36.87% in 2024.

- The synthetic paper market in China is projected to grow significantly, fueled by strong demand in packaging, retail, and industrial sectors.

- By product, the BOPP products dominated the industry, accounting for a revenue share of 57.14% in 2024.

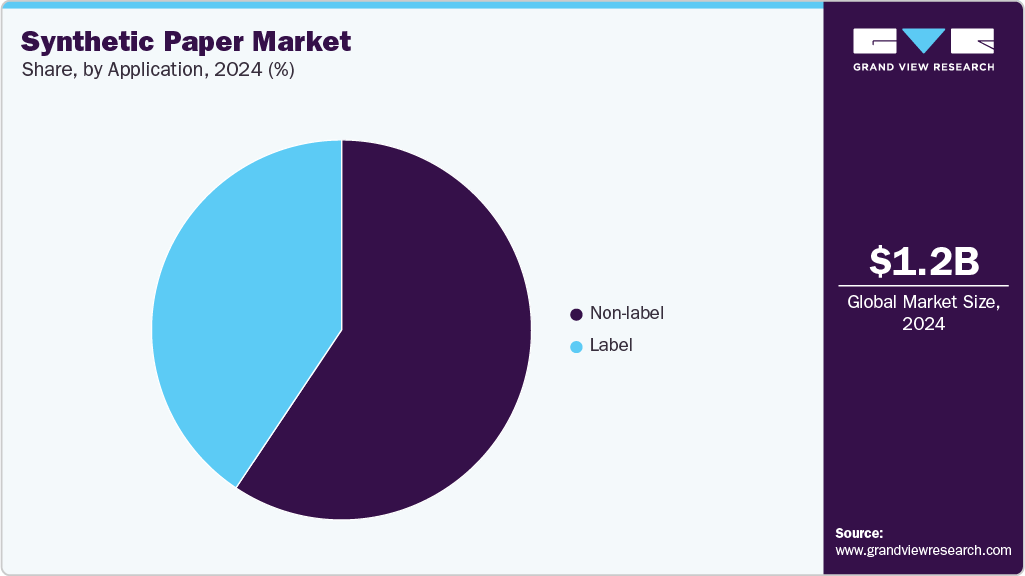

- By application, the non-labelling application segment led the market, accounting for around 60% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.20 Billion

- 2033 Projected Market Size: USD 2.05 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

Synthetic paper is produced from synthetic resins that are extracted from petroleum. Exceptional properties offered by the material, such as resistance against tear, chemicals, moisture, and oil, along with better heat seal ability, printability, and high strength, are providing it an edge over conventional paper. It is extensively used in industries such as packaging, food & beverages, consumer goods, transportation, and pharma goods. The U.S. is one of the key markets for synthetic as the increasing awareness regarding the use of environmentally friendly products is expected to propel the use of synthetic paper over vinyl in the coming years. Digital printing is expected to pave the way for new opportunities for the product over the forecast period.

The industry is witnessing consistent growth, propelled by the increasing need for durable, water- and tear-resistant options to replace traditional paper in packaging, labeling, and specialty printing uses. Major factors driving this trend include heightened adoption within the food and beverage, healthcare, and industrial sectors, where attributes like moisture resistance, chemical stability, and extended shelf-life are essential. Additionally, the push toward sustainability is boosting growth, as manufacturers transition to recyclable and eco-friendly polymer materials to align with regulatory demands and consumer preferences. Furthermore, technological advancements in printing compatibility and surface finish are broadening application opportunities, facilitating greater use in premium labels, outdoor signage, tags, and promotional items.

Drivers, Opportunities & Restraints

The demand for synthetic paper is anticipated to rise due to the growing need for durable, water-, and tear-resistant options compared to traditional paper, especially in areas like packaging, labeling, and specialty printing. Industries such as food and beverage, healthcare, and manufacturing are likely to favor synthetic paper for its chemical stability, resistance to moisture, and extended shelf-life. Increased awareness regarding product durability and the necessity for high-quality printing is expected to further enhance its adoption, alongside advancements that improve its compatibility with inkjet, flexography, and offset printing methods.

The growth of the industry is likely to be hindered by high production costs and a lack of awareness in certain areas. When compared to traditional paper, synthetic paper is anticipated to require specialized polymers and processing methods, which could raise material and manufacturing costs. Furthermore, the recycling infrastructure for synthetic paper is expected to be limited, which may lead to difficulties in disposing of it at the end of its life and could impede its acceptance by environmentally conscious consumers and businesses.

The market is anticipated to present considerable opportunities in sustainable and niche applications. The rising focus on environmentally friendly alternatives is likely to propel the creation of recyclable and biodegradable synthetic paper. Fast-growing sectors such as high-end labels, outdoor displays, industrial tags, and promotional items are expected to increasingly embrace synthetic paper due to its strength, resistance to weather, and print quality. Innovations in surface finish and compatibility with printing technologies are projected to broaden the potential uses of synthetic paper.

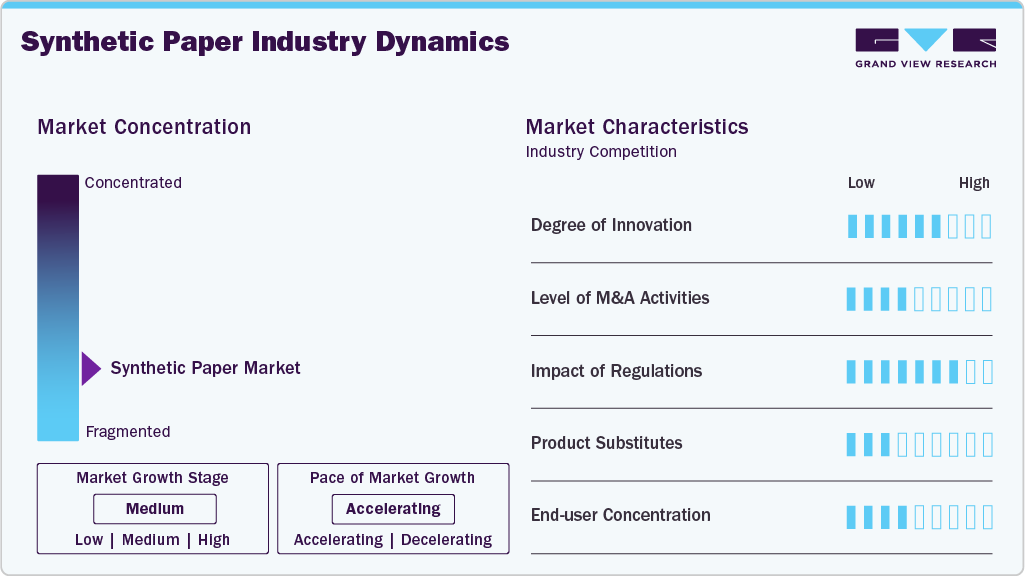

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like Formosa Plastics Group, SIHL Group, B & F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Films, Toyobo Co., Ltd., TechNova, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The industry is projected to showcase a moderate to significant level of innovation, fueled by advancements in materials that provide enhanced durability, print quality, and environmental compliance. Businesses are likely to concentrate on improving recyclability, resistance to water and tearing, and compatibility with diverse printing technologies. Breakthroughs in surface treatments and polymer formulations are anticipated to open up new possibilities in high-end labels, industrial tags, and specialty packaging, thereby reinforcing the market’s value proposition.

Mergers and acquisitions within the synthetic paper sector are anticipated to be discerning, as firms aim for strategic buys to enhance their product ranges, expand their geographical reach, and improve their technological prowess. Regulations concerning environmental sustainability, recycling, and chemical safety are projected to have a considerable impact on market trends, compelling manufacturers to utilize eco-friendly polymers and adopt low-emission production methods. Adhering to these regulations is likely to influence competitive tactics and guide investment choices throughout the entire supply chain.

The market is anticipated to experience moderate competition from traditional paper and specialty films in applications where cost is a key factor. Nonetheless, synthetic paper is predicted to maintain its edge in areas that demand durability, resistance to moisture, and extended shelf life. A greater concentration of end-users is expected in industries such as food and beverage packaging, healthcare, and industrial labeling, where the performance requirements favor synthetic paper over conventional options, enabling major manufacturers to capitalize on their established relationships and expertise in applications.

Product Insights

BOPP products dominated the industry, accounting for a revenue share of 57.14% in 2024, owing to the better strength offered by the material, which makes them suitable for packaging perishable items such as snacks, fast food, vegetables, fruits, and confectionery. The superior properties exhibited by BOPP have resulted in its extensive use in the packaging of chemicals, textiles, cosmetics, and food & beverages. The growth of the above-mentioned application industries in emerging economies such as India and China is expected to result in high demand for BOPP film in the Asia Pacific over the forecast period.

HDPE-based synthetic papers, majorly used in the packaging of powder, cheese, frozen food, and electronic parts, are expected to be the fastest-growing product segment over the forecast period, growing at over 6.8% from 2025 to 2033. The papers exhibit high moisture barrier and temperature resistance properties, and are non-abrasive, non-scratch, and acid-resistant. HDPE is expected to gain popularity over the forecast period in emerging economies such as Brazil, China, India, and Russia, mainly due to its low cost and extensive application scope. HDPE films are also used as release liners and interleaving sheeting, foam-in-place, and box liners owing to their better release property without silicone coating.

Application Insights

The non-labelling application segment led the market, accounting for around 60% of the global revenue in 2024. Synthetic paper's exceptional durability and tensile strength to hold heavy items make it suitable for non-labeling applications such as packaging. Moreover, the material's superior resistance to moisture and extreme heat is expected to drive its growth in the packaging application segment.

The convenience of fine printing over synthetic paper using ink and adhesives contributes to its higher demand in various industries. The ease of printability on the surface of synthetic papers contributes to its application in printing on packaged items. Moreover, they are scratch-and stain-resistant and thus facilitate the usage in the packaging of delicate materials.

The label application segment is expected to witness the fastest growth over the forecast period, at a CAGR of 6.6%. Medical tags are also expected to be the fastest-growing application segment over the forecast period, growing at a CAGR of over 8.0% from 2023 to 2033. Medical tags are used in applications such as blood bags, test samples in pathological labs, test tubes, pharmaceuticals, medical devices, medical machinery, bottles, and first aid.

The healthcare sector is one of the fastest-growing industries globally, and its expansion is expected to surge the demand for medical tags. Synthetic papers are used for medical tags because they are reliable in conditions such as tampering and extreme cryogenic temperatures.

Regional Insights

Asia Pacific synthetic paper market held the largest share of 36.87% in terms of revenue in 2024 and is expected to grow at the fastest CAGR of 7.1% over the forecast period, on account of the growing demand in the pharmaceutical, printing & packaging industry. In addition, the exponential growth witnessed by e-commerce retail in the region is expected to be a major growth factor for synthetic paper over the forecast period.

The growth in the Asia Pacific can be attributed to the growing end-user industries like pharmaceuticals, cosmetics, consumer goods, and food & beverages due to the increasing disposable income and improved standard of living of the working-class population in developing countries such as India and China.

The synthetic paper market in China is projected to grow significantly, fueled by strong demand in packaging, retail, and industrial sectors. Increased e-commerce activities and the need for durable, high-quality labels and tags are anticipated to boost consumption, while government initiatives focused on environmental protection are expected to encourage manufacturers to adopt recyclable and eco-friendly polymer solutions. The rapid pace of industrialization and the transition towards premium, high-performance printing materials are likely to present opportunities for both local and global companies, with competitive pricing and large-scale production improving market accessibility.

North America Synthetic Paper Market Trends

The synthetic paper market in North America accounted for a notable revenue share of the market in 2024. Wrap-around labels are increasingly used in beverage packaging, including fruit juices and functional drinks, diversifying from bottled water. This is expected to drive the growth of the label industry in North America, thus positively affecting the growth of the synthetic paper market.

U.S. Synthetic Paper Market Trends

The synthetic paper market in the U.S. is projected to experience steady growth as demand increases in packaging, labeling, and durable printing sectors. The rising use of food and beverage packaging, retail labels, and outdoor signs is anticipated to boost consumption, backed by the need for moisture resistance and enduring print quality. Regulations promoting sustainability and consumer preference for recyclable and eco-friendly materials are likely to drive manufacturers to create low-VOC, recyclable grades of synthetic paper, while improvements in compatibility with digital and flexographic printing are expected to broaden its application in short-run and customized projects.

Europe Synthetic Paper Market Trends

The synthetic paper market in Europe is anticipated to thrive due to strict environmental regulations and a rising demand for eco-friendly packaging and labeling options. This growth is likely to be driven by the widespread use of synthetic paper in premium labels, industrial tags, and security printing, where aspects like durability and chemical resistance are essential. The region's commitment to circular economy initiatives is predicted to fast-track the creation of recyclable and low-carbon-footprint synthetic paper alternatives, while ongoing advancements in printing technologies are expected to facilitate deeper integration across a variety of end-use industries.

Key Synthetic Paper Company Insights

Key players operating in the synthetic paper market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Synthetic Paper Companies:

The following are the leading companies in the synthetic paper market. These companies collectively hold the largest market share and dictate industry trends.

- Formosa Plastics Group

- SIHL Group

- B&F Plastics, Inc.

- Jindal Poly Films Ltd.

- Cosmo Films Ltd.

- Granwell Products, Inc.

- Transcendia, Inc.

- Valéron Strength Films

- Toyobo Co., Ltd.

- TechNova

Recent Developments

-

In September 2025, Cosmo Films introduced CSP Dualcoat as part of its Cosmo Synthetic Paper range. This dual-coated product is aimed at providing outstanding print quality and longevity, while being suitable for various printing methods, including offset, flexographic, thermal transfer, HP Indigo, and screen printing. It addresses high-performance needs for applications such as commercial displays, tags, labels, retail packaging, and outdoor signage, and contributes to sustainability efforts by not using wood pulp.

-

In November 2024, Huge Paper, in partnership with Yupo, launched SuperYupo synthetic paper in Canada. This new product line enables double-sided printing with standard paper inks while preserving the durability, water resistance, and UV stability found in traditional synthetic paper. This innovation streamlines printing processes and broadens the applications of synthetic paper for high-quality printing and labeling.

Synthetic Paper Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2033

USD 2.05 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million square meters; revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; China; Japan; India; Thailand; Australia; Singapore; Brazil; Argentina; Saudi Arabia

Key companies profiled

Formosa Plastics Group; SIHL Group; B & F Plastics; Inc.; Jindal Poly Films Ltd.; Cosmo Films Ltd.; Granwell Products, Inc.; Transcendia, Inc.; Valéron Strength Films; Toyobo Co., Ltd.; TechNova

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Paper Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global synthetic paper market report on the basis of product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

BOPP

-

HDPE

-

PET

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Label

-

Hand tags

-

Medical tags

-

Others

-

-

Non-label

-

Packaging

-

Documents

-

Others

-

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.