- Home

- »

- Medical Devices

- »

-

Thailand Aesthetic Medicine Market Size, Share Report, 2030GVR Report cover

![Thailand Aesthetic Medicine Market Size, Share & Trends Report]()

Thailand Aesthetic Medicine Market Size, Share & Trends Analysis Report By Procedure Type (Invasive, Non-invasive), By End-use (Hospitals, Clinics & Aesthetic Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-616-6

- Number of Report Pages: 72

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

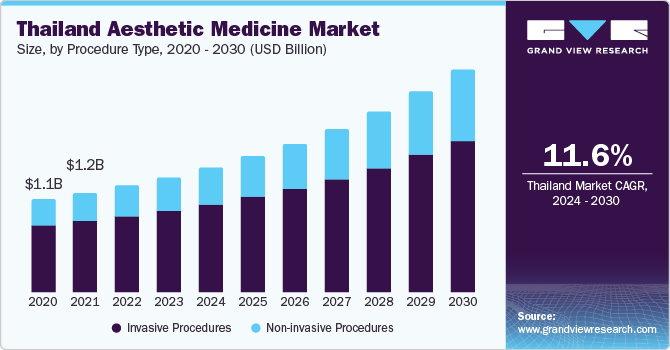

The Thailand aesthetic medicine market size was valued at USD 1.46 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.6% from 2024 to 2030. The shifting trend towards maintaining optimal aesthetic beauty is one of the major drivers for the adoption of aesthetic procedures. Moreover, the rise in medical tourism and the growing geriatric population are expected to boost the market growth. However, the onset of COVID-19 in 2020 impacted the overall aesthetic market in the country. Cities like Bangkok, which are major cosmetic hubs in the country, witnessed week-long lockdowns. Medical tourism in the country faced setbacks due to travel restrictions.

However, the country has eased mobility restrictions and the aesthetic market recovered significantly by 2021 due to the high procedural demand. The demand for aesthetic procedures is increasing and reimbursements for traditional insurance‐based medicine are declining. An increasing number of medical practitioners, regardless of their specialties, are engaged in medical aesthetic practices, such as performing aesthetic procedures in their offices or practicing in medical spas. Minimally invasive procedures like injectables, laser hair removal, chemical peels, laser skin resurfacing, and non-invasive fat reduction have gained popularity in the country.

For instance, botulinum toxin filler procedures witnessed an increase of 13% in 2019 from 2018. This indicates that the demand for non-invasive procedures is growing in the country. The non-invasive procedure segment is expected to grow at a steady CAGR from 2024 to 2030. Tourism is a major economic factor in Thailand. According to the World Travel & Tourism Council (WTTC), Thailand ranked among the top five destinations globally with regard to high inbound medical tourism spending. In 2019, tourism contributed to about 20% of the country’s GDP and 60% of the medical tourists visit the country for cosmetic procedures. The Thai government allocates around 13.3% of its total healthcare budget to medical healthcare services.

The country is also recognized as the most competitive destination globally in terms of high-quality treatments and affordable healthcare. Thus, the majority of the patients from the U.S., Australia, and Europe seeking aesthetic treatment visit Thailand. Medical treatments in other Asian countries, such as Singapore and Malaysia, cost three times and two times more, respectively than those in Thailand. The country is becoming a hub for affordable and high-quality aesthetic treatments. The cost of rhinoplasty and other invasive procedures is three to four times less in Thailand as compared to other western countries. According to the International Society of Aesthetic Plastic Surgery (ISAPS), around 102,407 invasive and 52,140 noninvasive aesthetic procedures were performed in Thailand in 2020.

Moreover, ISAPS also reported that Thailand witnessed the highest (33.2%) proportion of foreign patients seeking aesthetic treatment, followed by Mexico (22.5%) and Turkey (19.2%). Rising government initiatives and the establishment of state-of-the-art medical facilities to perform aesthetic procedures have led to increased awareness and adoption of cosmetic procedures in the country. The onset of COVID-19 impacted the country’s aesthetic treatment as well as the medical tourism sector in the first and second half of 2020. Bangkok and Phuket, which are major cities in the country, are highly dependent on tourism and consist of the majority of the healthcare facilities for aesthetic treatments.

According to the Asia Foundation, more than 62% of the businesses in these regions were completely closed during strict periods of lockdown in 2020. This also implies that elective cosmetic procedures in hospitals, as well as clinics, were postponed, affecting the aesthetic medicine market in the country. However, as the country has eased mobility restrictions, its economy is expected to grow gradually by the second half of 2021. According to the International Society of Aesthetic Plastic Surgery, the volume of aesthetic treatments in the country rose higher than the pre-pandemic levels the country, for instance in 2020 invasive treatments grew by 10% and non-invasive treatments grew by 70% as compared to 2019.

Procedure Type Insights

The invasive procedure segment held a maximum share of around 71.98% of the overall market revenue in 2023. According to a survey by the International Society of Aesthetic Plastic Surgery (ISAPS) in 2021, around 102,407 invasive aesthetic procedures were performed in the country, with eyelid surgery, rhinoplasty, and breast augmentation being the most frequently performed procedures. This is because invasive procedures are cheaper in the country as compared to other Western countries, as its currency is weaker than that of European and North American countries, and patients can save around 20-65% of their cost.

The Invasive procedure segment is further segmented into Breast augmentation, liposuction, nose reshaping, eyelid surgery, tummy tuck, and others. The eyelid surgery segment held a significant market share in 2021. Since a majority of the Thai population does not have creased eyelids, they opt for eyelid surgeries to gain a defined eye shape and remove sagging. Non-invasive procedures are expected to witness the highest growth during the forecast period owing to the fact that they offer pain-free cosmetic treatments with zero downtime and a reduced recovery period. This is anticipated to fuel the demand for these treatments. The most popular treatments were skin tightening, Botox injections, and non-invasive fat reduction.

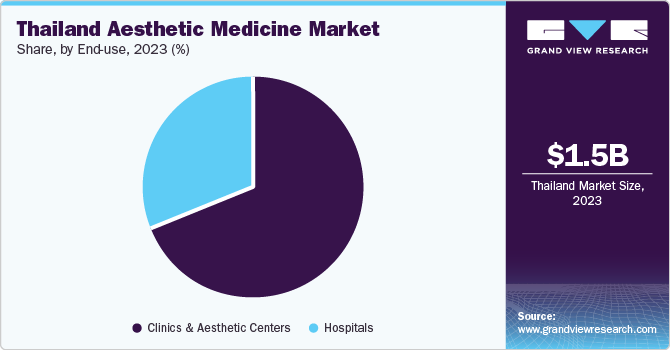

End-use Insights

The hospitals segment held the highest market share of more than 44.8% in 2023 and is also anticipated to grow lucratively during the forecast period. Clinics are frequently visited by patients for aesthetic procedures, such as skin rejuvenation, body contouring & reshaping, wrinkle reduction, and scar treatment. Dermatology and beauty clinics are increasingly adopting technologically advanced aesthetic systems that can cater to a wide range of skin conditions and this has resulted in high patient footfall. The Health Service Support Department’s Sanatorium and Art of Healing Bureau is the regulatory body that oversees private clinics and private hospitals in the country.

The country has 1,458 clinics that provide aesthetic services and represent 13% of all medical clinics in Thailand. However, the clinic segment is not efficiently regulated, and many complaints have been filed to the Office of the Consumer Protection Board related to aesthetic surgery over the years. This might hamper the market growth. Thailand is becoming a major tourist destination and 60% of all the foreigners visiting the country are there for cosmetic surgery procedures. The majority of the hospitals in the country are certified and accredited by Joint Commission International (JCI). This international organization promotes strict adherence to quality care in 90 countries globally. Such accreditations boost reliability and trust among patients seeking treatment in the country.

Key Companies & Market Share Insights

Expansion of product portfolio & service offerings through procurement of advanced technology is a key strategy adopted by market players. In February 2021, Dr. Orawan Holistic Dermatology & Anti-Aging Institute received GHA’s COVID-19 Certification of Conformance for Medical Travel. This certification will imply to the patients that the company’s medical travel program’s operational protocols, practices, and procedures have undergone an external review and reflect international best practices. Some of the prominent players in the Thailand aesthetic medicine market are:

-

Dermaster Co., Ltd.

-

BSL Clinic

-

Thai Medical Vacation

-

Bumrungrad International Hospital

-

Dr. Orawan Holistic Dermatology & Anti-Aging Institute

-

Nirunda International Aesthetic Clinic

Thailand Aesthetic Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.61 billion

Revenue forecast in 2030

USD 3.12 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, end-use

Country scope

Thailand

Key companies profiled

Dermaster Co., Ltd.; BSL Clinic; Thai Medical Vacation; Bumrungrad International Hospital; Dr. Orawan Holistic Dermatology & Anti-Aging Institute; Nirunda International Aesthetic Clinic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Thailand aesthetic medicine market report based on procedure type and end-use:

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Invasive Procedures

-

Breast Augmentation

-

Liposuction

-

Nose Reshaping

-

Eyelid Surgery

-

Tummy Tuck

-

Others

-

-

Non-invasive procedures

-

Botox Injections

-

Soft Tissue Fillers

-

Chemical Peel

-

Laser Hair Removal

-

Microdermabrasion

-

Others

-

Skin tightening (Thermage/Ulthera)

-

Non-invasive Fat Reduction/Body Contouring

-

Others

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics & Aesthetic centers

-

Frequently Asked Questions About This Report

b. The Thailand aesthetic medicine market size was estimated at USD 1.46 billion in 2023 and is expected to reach USD 1.61 billion in 2024.

b. The Thailand aesthetic medicine market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 3.12 billion by 2030.

b. The invasive procedure segment dominated the Thailand aesthetic medicine market with a share of 71.98% o in 2023. This is because invasive procedures are cheaper in the country as compared to other Western countries, thus promoting tourism to avail the services.

b. Some key players operating in the Thailand aesthetic medicine market include Dermaster Co, Ltd, BSL Clinic, Thai Medical Vacation, Bumrungrad International Hospital, Dr. Orawan Holistic Dermatology & Anti-Aging Institute, and Nirunda International Aesthetic Clinic

b. Key factors that are driving the Thailand aesthetic medicine market growth include shifting trend towards maintaining optimal aesthetic beauty, the rise in medical tourism, high popularity of minimally invasive procedures, and the growing geriatric population prone to different skin conditions

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."