- Home

- »

- Semiconductors

- »

-

Semiconductor Memory Market Size & Share Report, 2030GVR Report cover

![Semiconductor Memory Market Size, Share & Trends Report]()

Semiconductor Memory Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Consumer Electronics, IT & Telecommunication, Automotive; Industrial, Aerospace & Defense, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-651-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Memory Market Summary

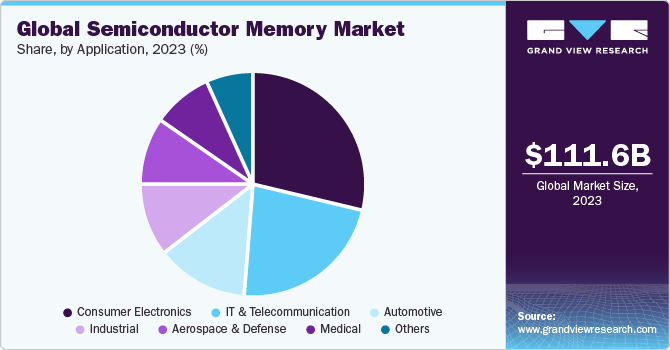

The global semiconductor memory market size was estimated at USD 111.62 billion in 2023 and is projected to reach USD 240.66 billion by 2030, growing at a CAGR of 11.6% from 2024 to 2030. The market is poised to experience significant growth on a global scale due to the increasing adoption of semiconductor components across various industries, including automotive, consumer electronics, and IT & telecom.

Key Market Trends & Insights

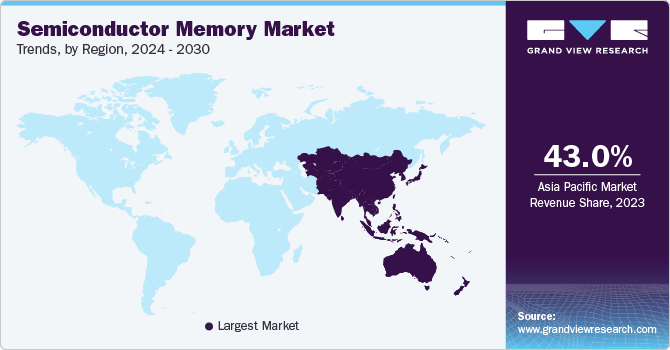

- Asia Pacific led the overall market in 2023, with a market share of more than 43.0%.

- North America is expected to grow notably with a CAGR of 13.7%.

- By type, the DRAM segment led the market and accounted for more than 49% share of the global revenue in 2023.

- By application, the consumer electronics segment led the market and accounted for more than 33% share of the global revenue in 2023

Market Size & Forecast

- 2023 Market Size: USD 111.62 Billion

- 2030 Projected Market Size: USD 240.66 Billion

- CAGR (2024-2030): 11.6%

- Asia Pacific: Largest market in 2023

It is an essential electronic device that serves as computer memory/chips by utilizing Integrated Circuit (IC) technology. These memories are categorized based on the types of data storage and access methods they offer, which include non-volatile ROM (Read Only Memory) and volatile RAM (Random Access Memory). As the demand for faster, more reliable, and power-efficient memory solutions rises, the market is expected to expand, opening new opportunities for businesses operating in this sector.

Advancing semiconductor technology, encompassing refining processes, enhancing energy efficiency, and maximizing chip capacity, has paved the way for cutting-edge memory solutions tailored to a wide range of industries. As fresh and upgraded semiconductor chip products emerge, companies are eager to embrace these breakthroughs to elevate the quality of their offerings and services. Additionally, the pervasive use of smartphones and other portable devices has sparked an unprecedented desire for high-performance chips that deliver seamless user experiences and swift app loading times and empower smooth multitasking capabilities, reflecting modern users' evolving demands and aspirations.

The dynamic adoption of memory-centric components in cutting-edge products such as smartphones, wearables, and electronic gadgets is the driving catalyst behind the market's expansion. Moreover, the escalating reliance of the automotive and electronics sectors on semiconductor devices, including Flash ROM and DRAM, is distinctly amplifying the demand for integrated chips and gadgets. The global hunger for smart devices, consumer electronics, smartphones, and workstations further accentuate the imperative for technologically sophisticated chips. Consequently, the market is undergoing a compelling growth phase, presenting many promising avenues for businesses operating in this industry.

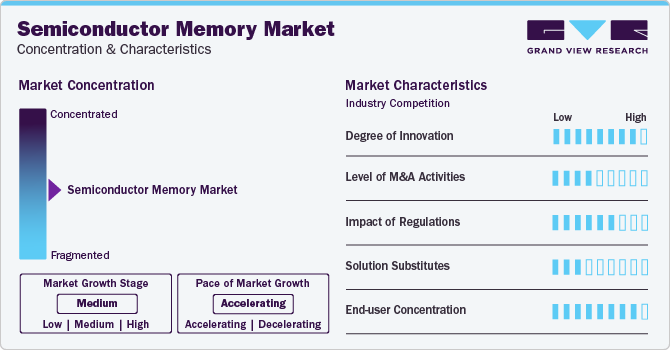

Market Concentration & Characteristics

The semiconductor memory market growth stage is medium. The semiconductor memory market exhibits a high degree of innovation. Continuous advancements in semiconductor technologies, including the development of new memory architectures, increased storage capacities, and enhanced performance, are prevalent. The industry is dynamic, with ongoing efforts to improve efficiency and introduce novel solutions.

Mergers and acquisitions activities in the semiconductor memory market are relatively low. While there may be collaborations and partnerships, major consolidation through mergers or acquisitions is less common. Companies often focus on internal R&D and strategic collaborations to drive innovation.

The semiconductor memory market faces a medium impact of regulations. Regulatory considerations relate to intellectual property, export controls, and environmental regulations in the manufacturing process. Compliance with these regulations is crucial for market players, but the overall impact is not as high as in some other industries.

The availability of direct substitutes for semiconductor memory products is low. These memory solutions are integral components in electronic devices, and alternative technologies that offer similar performance and scalability are limited. The specialized nature of semiconductor memory contributes to a low level of product substitution.

The end user concentration in the semiconductor memory market is high. The demand for semiconductor memory primarily comes from a concentrated group of industries, including consumer electronics, automotive, data centers, and telecommunications. The market's dependence on these sectors results in a high level of end user concentration.

Type Insights

The DRAM segment led the market and accounted for more than 49% share of the global revenue in 2023. By type segment, the market is bifurcated into SRAM, MRAM, DRAM, Flash ROM, and Others. Dynamic Random-Access Memory, commonly referred to as DRAM, holds a vital role in contemporary computer systems due to its remarkable data access speed and responsiveness. As a volatile semiconductor memory, DRAM relies on a constant power source to retain stored data. Its significance rests in its capability to execute rapid read and write operations, positioning it as the core memory component in computers, smartphones, servers, and various computing devices. The swift data retrieval provided by DRAM ensures the seamless and efficient operation of applications, offering users a smooth experience and enabling effective multitasking. This technology proves indispensable across a multitude of industries and applications, spanning high-performance computing, cloud services, gaming, artificial intelligence, and machine learning. As technology continues evolving, the DRAM market maintains its robustness, driven by the escalating demand for robust computing systems, data-centric applications, and the ever-expanding universe of mobile devices and cloud-driven services.

The Flash ROM segment is anticipated to witness the fastest growth, growing at a CAGR of 13.6% throughout the forecast period. Flash ROM, also known as Flash memory or NAND Flash, is a non-volatile semiconductor memory that possesses the ability to preserve data even when the power supply is disconnected. This characteristic has made it a fundamental component in a wide array of electronic devices, including smartphones, tablets, USB drives, digital cameras, and solid-state drives (SSDs). The significance of Flash ROM stems from its reliability and convenience in data storage. This aspect makes it exceptionally well-suited for applications requiring persistent information storage, such as saving system configurations, operating systems, and user data. The surge in cloud-based services and the growing prominence ofbig data applications have fueled a substantial demand for data centers and efficient storage solutions. Flash ROM's exceptional speed and reliability have positioned it as the preferred choice for data storage in these data centers, consequently boosting the performance of cloud services and expediting data processing.

Application Insights

The consumer electronics segment led the market and accounted for more than 33% share of the global revenue in 2023. By application segment, the market is bifurcated into consumer electronics, IT & telecommunication, automotive, industrial, aerospace & defense, medical, and others. In the rapidly evolving consumer electronics landscape, the demand for memory solutions that can keep up with the ever-increasing data requirements is paramount. The continuous advancement is characterized by introducing of higher-density chips and improved memory architectures, has played a focal role in meeting these escalating demands. This ongoing progress enables consumer electronics manufacturers to offer cutting-edge innovations and empowers them to maintain a competitive edge in a fast-paced and dynamic market. Moreover, the seamless integration of semiconductor chips with cloud-based services and data-driven applications has become a game-changer in the consumer electronics industry. By efficiently accessing and storing data on remote servers, consumer devices can tap into the vast capabilities of the cloud, enriching user experiences and expanding the ecosystem of interconnected devices and services. As consumer electronics continue to evolve, leveraging the full potential of semiconductor chips becomes essential for driving success in this dynamic and competitive market.

The IT & telecommunication segment is anticipated to grow at a considerable CAGR of 13.3% throughout the forecast period. The scalability of semiconductor memory is critical in addressing ever-increasing data demands. As the use of connected devices, IoT, and data-intensive applications continues to surge, expanding chips capacities flexibly becomes crucial to meet these growing requirements. Moreover, semiconductor chips are pivotal in driving innovation in the IT & telecommunication sector. By seamlessly integrating memory technologies with cloud computing and data analytics, businesses can unlock the full potential of their IT systems. This integration enhances the capabilities of IT infrastructure, enabling real-time data analysis, AI-driven decision-making, and personalized user experiences. The advanced features enabled by semiconductor memory open up new possibilities for businesses, allowing them to deliver cutting-edge services and applications to their customers and stay ahead in a competitive market.

Regional Insights

Asia Pacific led the overall market in 2023, with a market share of more than 43.0%. Several key factors are driving the market in Asia Pacific. The region is witnessing rapid economic growth coupled with increasing consumer spending on electronic devices. In 2023, the region witnessed surged sales of electronic devices, such as laptops and smartphones. As a result, there is a surge in demand for memory-intensive products such as smartphones, tablets, and smart home appliances, fueling the need for advanced semiconductor memory solutions. Additionally, the growing adoption of cloud computing and data-driven applications across various industries bolstered the demand for high-performance solutions to support the massive data processing requirements. Moreover, the rise of the Internet of Things (IoT) in the region is contributing to the growth of the market, as IoT devices rely heavily on memory for data storage and processing. Furthermore, governments in several Asia Pacific countries are investing in infrastructure development, including the establishment of data centers and 5G networks, further driving the demand for semiconductor memory solutions to support these initiatives.

North America is expected to grow notably with a CAGR of 13.7%. The North American market is witnessing strong expansion, owing to the region's forefront position in technological advancement. With a significant focus on research and development across various sectors, the demand for state-of-the-art semiconductor memory solutions is rising, especially to bolster cutting-edge applications in artificial intelligence, machine learning, and data analytics. Moreover, North America is a key hub for the gaming and entertainment industry, where high-performance memory is crucial for delivering captivating gaming experiences and seamless content streaming. The region's growth is further fueled by the widespread adoption of cloud-based services and the establishment of data centers, creating a need for advanced semiconductor chip solutions capable of handling the substantial volume of generated and processed data. The escalating embrace of autonomous vehicles and smart transportation systems in North America amplifies the requirement for robust memory solutions, ensuring real-time data processing and swift decision-making.

U.S. Semiconductor Memory Market Trends

The semiconductor memory market in U.S. is projected to grow at a CAGR of 12.2% from 2024 to 2030. The demand for semiconductor memory chips in the U.S. has been on the rise, driven by various factors such as increased adoption of advanced technologies, growth in data-centric applications, and the expansion of cloud computing. There is a notable shift towards advanced memory technologies, including DDR5 (Double Data Rate 5), LPDDR5 (Low Power Double Data Rate 5), and emerging non-volatile memory technologies. These advancements aim to meet the increasing performance and efficiency requirements of modern applications.

UK Semiconductor Memory Market Trends

The UK semiconductor memory market has seen growing demand for memory solutions, particularly in automotive and industrial applications. The expansion of IoT (Internet of Things) devices and the integration of advanced technologies in vehicles contribute to this trend. The growing demand for cloud services and data storage has influenced the need for advanced memory solutions in data centers. This includes both DRAM and NAND Flash memory to support the increasing data processing requirements.

India Semiconductor Memory Market Trends

The semiconductor memory market in India is projected to grow at a CAGR of 20.9% from 2024 to 2030. With increasing concerns about data security, there is an emphasis on developing memory solutions with enhanced security features. This is crucial in applications where data integrity and protection are paramount. The semiconductor ecosystem in India is evolving, with a focus on building a robust semiconductor industry. Initiatives are being taken to enhance the overall semiconductor infrastructure, including research and development capabilities.

Saudi Arabia Semiconductor Memory Market Trends

Saudi Arabia has been making strategic investments in technology infrastructure, including the semiconductor industry. These investments aim to promote technological advancement and reduce dependence on imported semiconductor components. Saudi Arabia's Vision 2030 initiative includes plans for economic diversification, with a focus on developing a knowledge-based economy. This initiative may contribute to the growth of the semiconductor industry, including memory solutions.

Key Semiconductor Memory Company Insights

Some of the key players operating in the market include Samsung; SK HYNIX INC.; Macronix International Co., Ltd.; Micron Technology, Inc.; and Infineon Technologies AG, among others.

-

Samsung is a global consumer electronics company that offers consumer electronics, such as mobile phones, tablets, and home appliances. The company also offers semiconductor memory solutions, such as Dynamic Random Access Memory (DRAM), and Double Data Rate (DDR) variants, including DDR3, DDR4, and DDR5. The company puts a strong emphasis on Research and Development (R&D) to launch new, innovative memory solutions.

-

SK HYNIX INC. offers various memory products, such as DRAM, including DDR and Low Power DDR (LPDDR); and NAND storage, among others. The company provides memory solutions for various applications, including consumer electronics and automotive. The company has a global presence, with four R&D subsidiaries in the U.S., Taiwan, Italy, and Belarus.

Everspin Technologies and Macronix International Co., Ltd. are some of the emerging companies in the global semiconductor memory market.

-

Macronix International Co., Ltd. provides non-volatile memory solutions, such as NAND Flash, NOR Flash, and Read-Only Memory (ROM). The company’s NOR Flash portfolio includes Serial NOR Flash and Parallel NOR Flash memories. The company’s memory solutions cater to a wide range of applications, including automotive, communications, and industrial.

-

Everspin Technologies is a leading player in the semiconductor memory market, specializing in the development and manufacturing of Magnetoresistive Random Access Memory (MRAM) solutions. MRAM is a type of non-volatile memory that combines the best features of both volatile and non-volatile memories, offering fast access times, high endurance, and data retention without the need for power.

Key Semiconductor Memory Companies:

The following are the leading companies in the semiconductor memory market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these semiconductor memory companies are analyzed to map the supply network.

- Integrated Silicon Solution Inc.

- Micron Technology, Inc*

- Macronix International Co., Ltd.

- Samsung

- SK HYNIX INC.

- Taiwan Semiconductor Manufacturing Company Limited

- Texas Instruments Incorporated

- Infineon Technologies AG*

- IBM Corporation

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

Recent Developments

-

In February 2023, Texas Instruments Incorporated announced that it would invest USD 11 billion into the construction of its next 300-mm semiconductor wafer fabrication plant in Utah, U.S. The company aimed to expand its manufacturing capacity to meet the growing demand for semiconductors in electronics.

-

In November 2022, Infineon Technologies AG and Taiwan Semiconductor Manufacturing Company Limited announced a partnership to introduce the latter’s Resistive RAM (RRAM) Non-Volatile Memory (NVM) technology to the former’s AURIX microcontrollers. The companies aimed to improve performance and reduce the power consumption of microcontrollers with the RRAM technology.

-

In August 2023, SK HYNIX INC. announced that it had started supplying a 24GB LPDDR5X DRAM mobile DRAM package, the industry’s first such solution with a 24 Gb capacity. The new product provides enhanced performance while consuming low power. The company aimed to meet its customers’ needs with this product.

-

In November 2022, Micron Technology, Inc. announced the launch of 1β (1-beta) DRAM technology and started shipping the qualification samples to select chipset partners and smartphone manufacturers. The DRAM supports highly responsive applications by delivering high performance and low power.

-

In June 2021, Texas Instruments Incorporated signed an agreement to acquire Micron Technology, Inc.’s 300-mm semiconductor facility in Lehi, Utah, for approximately USD 900 million. The acquisition is a part of Texas Instrument Incorporated’s long-term capacity planning and will help strengthen the company’s competitive advantage in technology and manufacturing.

Semiconductor Memory Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 124.76 billion

Revenue forecast in 2030

USD 240.66 billion

Growth Rate

CAGR of 11.6% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Market demand in 2023

USD 44.46 billion units

Volume forecast in 2030

USD 78.64 billion units

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; China; Japan; India; Taiwan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Integrated Silicon Solution Inc., Micron Technology, Inc, Macronix International Co., Ltd., Samsung, SK HYNIX INC., Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Infineon Technologies AG, IBM Corporation, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Memory Market Report Segmentation

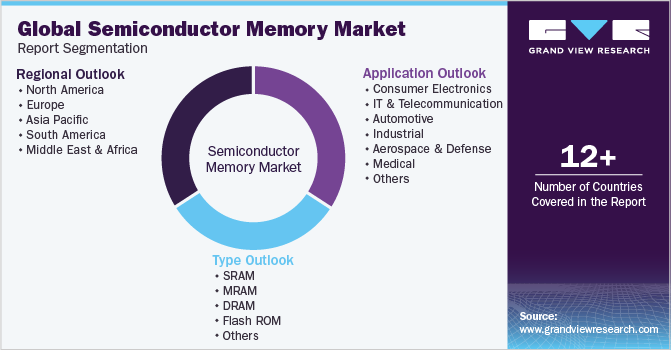

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global semiconductor memory market based on type, application, and region.

-

Type Outlook (Volume, Million Units; Revenue, USD Billion; 2017 - 2030)

-

SRAM

-

MRAM

-

DRAM

-

Flash ROM

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Billion; 2017 - 2030)

-

Consumer Electronics

-

IT & Telecommunication

-

Automotive

-

Industrial

-

Aerospace & Defense

-

Medical

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Billion; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global semiconductor memory market size was estimated at USD 134.41 billion in 2022 and is expected to reach USD 111.62 billion in 2023.

b. The global semiconductor memory market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 240.66 billion by 2030.

b. Asia Pacific is expected to dominate the market and grow at a CAGR of 6.9%. The region is witnessing rapid economic growth coupled with increasing consumer spending on electronic devices. In 2021, the region witnessed surged sales of electronic devices, such as laptops and smartphones.

b. Some key players operating in the semiconductor memory market include integrated Silicon Solution Inc.; Micron Technology; Macronix International Co., Ltd.; Samsung Electronics; SK Hynix; Taiwan Semiconductor; Texas Instruments; Toshiba; Cypress Semiconductor Corporation; and IBM.

b. Key factors driving the market growth include rapid development in the form of digitization and automation in the entire electronics industry, along with the use of memory-based elements in technologically advanced products such as smartphones, wearable devices, and electronic gadgets. Advancing semiconductor technology, encompassing refining processes, enhancing energy efficiency, and maximizing chip capacity, has paved the way for cutting-edge memory solutions tailored to a wide range of industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.