- Home

- »

- Advanced Interior Materials

- »

-

Thermal Management Materials Market Size Report, 2033GVR Report cover

![Thermal Management Materials Market Size, Share & Trends Report]()

Thermal Management Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Phase Change Materials (PCMs), Thermal Interface Materials (TIMs), Gap Fillers, Pads, Greases, Adhesives), By End Use (Consumer Electronics, Automotive & Transportation, Industrial & Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-767-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Management Materials Market Summary

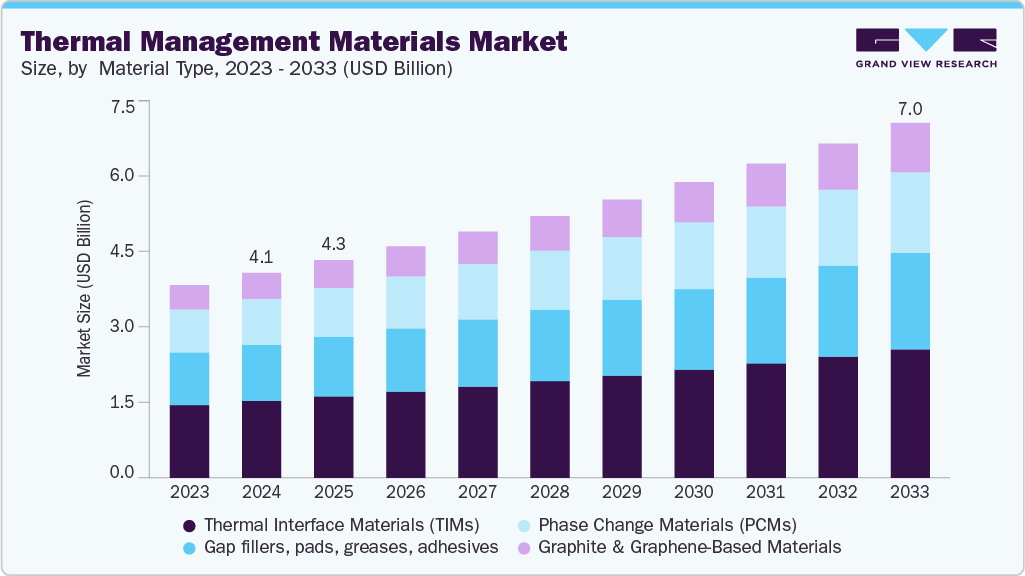

The global thermal management materials market size was estimated at USD 4.06 billion in 2024 and is projected to reach is anticipated to reach USD 7.04 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The market is witnessing rapid growth due to the exponential rise in electronics usage and the miniaturization of devices, which generates higher heat densities.

Key Market Trends & Insights

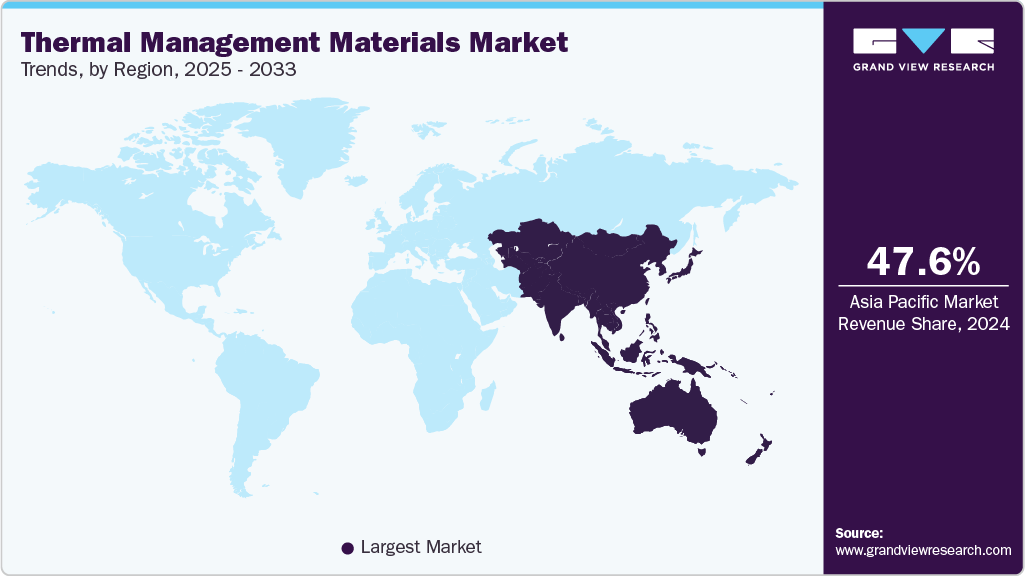

- Asia Pacific dominated the thermal management materials market with the largest revenue share of 47.6% in 2024.

- By material type, the graphite & graphene-based materials segment is expected to grow at the fastest CAGR of 7.3% over the forecast period.

- By end use, the automotive & transportation segment is expected to grow at the fastest CAGR of 6.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.06 Billion

- 2033 Projected Market Size: USD 7.04 Billion

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2024

Increasing adoption of electric vehicles (EVs) has intensified the need for efficient battery cooling and thermal regulation systems. The proliferation of high-performance computing, AI-driven applications, and data centers has increased the heat management requirements across various sectors. Moreover, consumer demand for energy-efficient and long-lasting electronic devices is pushing manufacturers to integrate advanced thermal solutions. Rapid urbanization and industrial automation also contribute to heightened demand.

Key drivers include technological advancements in thermal interface materials (TIMs), heat sinks, and phase change materials that provide high thermal conductivity and reliability. Increasing EV production globally, particularly in China, Europe, and the U.S., drives demand for materials capable of efficiently managing battery and powertrain heat. The semiconductor industry’s push for smaller, faster, and more powerful chips has led to the development of materials that prevent overheating. Growth in renewable energy, particularly solar inverters and wind turbine electronics, also supports the market. The need for lightweight, high-performance, and eco-friendly materials to enhance energy efficiency is another significant driver.

Recent innovations include the development of graphene-enhanced thermal interface materials, carbon nanotube composites, and lightweight polymer-based heat spreaders. Companies are focusing on multifunctional materials that combine thermal conductivity with electrical insulation or structural strength. Additive manufacturing (3D printing) for customized heat sinks and cooling components is emerging as a key trend. Phase change materials and liquid cooling solutions for EVs and high-performance computing are gaining traction. Integration of AI-driven thermal management systems in data centers and EVs optimizes performance and reduces energy consumption.

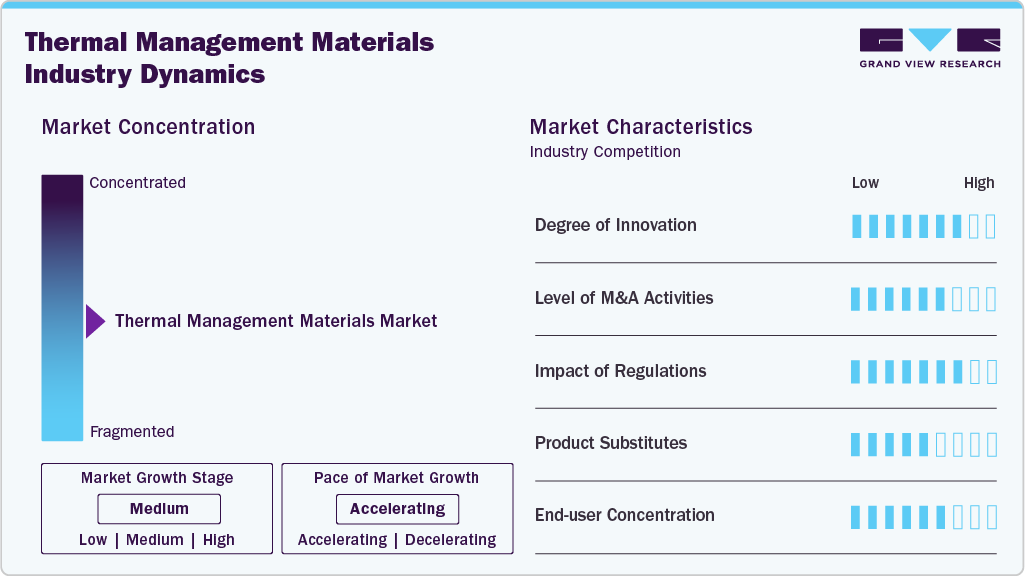

Market Concentration & Characteristics

The thermal management materials market is moderately consolidated, with a few global leaders dominating the high-performance segment while numerous regional suppliers cater to local demand. Major players such as Honeywell, 3M, Laird, Dow, and Henkel hold significant market share, primarily due to advanced R&D capabilities and established customer relationships. However, the entry of innovative start-ups and specialized regional manufacturers increases competitive pressure, particularly in niche applications such as EVs and high-performance computing.

Substitutes for thermal management materials include conventional passive cooling solutions, metal-based heat sinks, and natural convection techniques in low-power devices. However, these substitutes often lack the efficiency required for high-density electronics or EV batteries. Emerging trends in liquid cooling and immersion cooling technologies present partial substitution threats in data centers. Material innovations such as phase change composites and graphene-enhanced solutions reduce the effectiveness of traditional substitutes. While substitutes exist, the demand for high-performance, compact, and eco-friendly solutions limits their market penetration.

Material Type Insights

The thermal interface materials (TIMs) segment held the largest revenue market share of 37.5% in 2024, due to their critical role in enhancing heat transfer between surfaces in electronic devices and high-power components. They are widely used in semiconductors, LEDs, data centers, and EV batteries where efficient heat dissipation is vital for performance and reliability. Their dominance is also supported by continuous innovations in gap fillers, thermal greases, pads, and adhesives that provide superior conductivity and easy application. With the surge in consumer electronics and compact devices, TIMs remain the backbone of the industry.

The graphite & graphene-based materials segment is expected to grow at the fastest CAGR of 7.3% over the forecast period, owing to their superior thermal conductivity, lightweight nature, and flexibility compared to traditional metals. Their adoption is expanding in next-generation electronics, flexible devices, and EV batteries where efficiency and miniaturization are key. Graphene’s potential in creating ultra-thin heat spreaders and coatings makes it attractive for smartphones, wearables, and high-performance computing systems. As R&D investments increase, graphene-enhanced TIMs and composites are expected to disrupt traditional solutions and accelerate growth in this segment.

End Use Insights

The consumer electronics segment held the largest revenue market share of 48.0% in 2024, driven by rising demand for smartphones, laptops, tablets, and smart devices. With miniaturization and higher processing power, effective thermal solutions have become critical to ensure device safety, performance, and longevity. The boom in 5G-enabled devices, gaming consoles, and wearables further amplifies this demand. Leading manufacturers integrate advanced TIMs, heat spreaders, and graphite sheets to address overheating issues. The sheer scale of global consumer electronics production cements this segment as the dominant force in the market.

The automotive & transportation segment is expected to grow at the fastest CAGR of 6.9% over the forecast period, largely fueled by the accelerating adoption of electric and hybrid vehicles. EV batteries, power electronics, and charging infrastructure require efficient heat dissipation solutions to maintain performance, safety, and lifespan. Advanced TIMs, phase change materials, and graphite composites are increasingly being integrated into battery packs and electronic control systems. Government incentives for EV adoption and the global shift toward sustainable mobility are further driving this trend, positioning automotive applications as one of the fastest-growing end-use sectors.

Regional Insights

Asia Pacific thermal management materials market dominated the global market and accounted for the largest revenue share of 47.6% in 2024, driven by the presence of major electronics and EV manufacturing hubs in China, Japan, South Korea, and India. The region benefits from high consumer electronics adoption, rapid industrialization, and significant investments in semiconductor fabrication facilities. Government initiatives supporting EV adoption, renewable energy infrastructure, and smart city projects further drive demand. Companies in the region are actively innovating with graphene-based and polymer composite thermal solutions. The presence of both established multinationals and local start-ups strengthens competitive dynamics. Expansion of data centers to support cloud computing and AI applications adds another layer of demand.

Thermal management materials market in China is the largest single-country market, fueled by its robust EV and electronics sectors. Local governments offer subsidies and incentives for EV manufacturers, battery producers, and semiconductor fabs, boosting thermal management material consumption. Rapid R&D in advanced materials, including high-performance TIMs, phase change composites, and graphene solutions, enhances domestic capabilities. The increasing export of electronics and EVs also stimulates demand for reliable thermal solutions. Investments in 5G infrastructure and AI-driven computing centers are creating new growth avenues. Collaborative ventures between domestic and international material suppliers accelerate technology transfer and commercialization.

North America Thermal Management Materials Market Trends

North America shows strong demand across automotive, aerospace, semiconductor, and data center sectors. High EV penetration in the U.S. and Canada drives thermal material adoption, particularly for battery and powertrain cooling. Expansion of cloud computing, AI, and high-performance computing infrastructure requires efficient heat management solutions. Domestic players and multinationals collaborate to introduce high-performance and eco-friendly materials. Government incentives for clean energy and energy efficiency standards further support market growth. R&D investments in advanced polymers, composites, and phase change materials are key to staying competitive.

U.S. Thermal Management Materials Market Trends

In the U.S., thermal management materials demand is primarily driven by the automotive and electronics industries. Rapid EV adoption, smart grid projects, and expansion of high-density data centers create strong requirements for high-efficiency thermal solutions. Companies focus on advanced TIMs, polymer-based heat spreaders, and liquid cooling systems. Federal and state-level incentives for EVs and energy-efficient infrastructure support market growth. Strategic partnerships between OEMs and material innovators accelerate product deployment. The focus on energy conservation and sustainability drives the adoption of recyclable and eco-friendly materials. The U.S. market is highly competitive but offers substantial opportunities for innovation-driven companies.

Europe Thermal Management Materials Market Trends

Europe’s thermal management materials market benefits from strong EV adoption, industrial automation, and strict energy efficiency regulations. Germany, France, and the U.K. are the largest contributors, with Germany leading due to its automotive and electronics industries. The European Green Deal and related policies encourage sustainable, high-performance thermal solutions. Expansion of data centers and semiconductor fabrication facilities further stimulates demand. Companies are innovating with graphene-based composites and eco-friendly polymers to meet regulatory standards. Collaborative R&D initiatives between universities and industry players accelerate product development.

Thermal management materials market in Germany stands out as a key regional market due to its strong automotive, electronics, and industrial machinery sectors. EV production, energy-efficient electronics, and precision manufacturing demand advanced thermal management solutions. Government incentives, regulatory frameworks, and a strong focus on sustainability accelerate the adoption of high-performance materials. R&D in polymer composites, phase change materials, and graphene-enhanced TIMs is robust. German companies actively export thermal solutions globally, strengthening their market position. The market is highly competitive, with both local innovators and international suppliers vying for a share.

Central & South America Thermal Management Materials Market Trends

Central & South America is an emerging market for thermal management materials, with growth primarily driven by automotive and industrial electronics sectors. Brazil and Mexico lead the region due to expanding manufacturing and industrial infrastructure. Increasing demand for energy-efficient electronics and industrial automation solutions contributes to adoption. Government initiatives for clean energy and smart infrastructure projects provide indirect support. Local suppliers cater to standard thermal solutions, while multinational players introduce advanced materials. Growth is moderate but steady, supported by urbanization and rising electronics consumption.

Middle East & Africa Thermal Management Materials Market Trends

The Middle East and Africa region is witnessing gradual adoption of thermal management materials, driven by industrial automation, renewable energy projects, and expanding data center infrastructure. UAE and Saudi Arabia are the leading markets, focusing on energy-efficient cooling solutions for electronics and EVs. Government-backed smart city and clean energy initiatives support market expansion. High demand exists in telecommunications, aerospace, and defense sectors for advanced thermal materials. Regional companies are increasingly partnering with global suppliers to access high-performance products. The market remains nascent but is expected to grow with infrastructure development and increasing technology adoption.

Key Thermal Management Materials Company Insights

Some of the key players operating in the market include Union Tenda Technology Co., Ltd, Dycotec Materials Ltd.

-

Union Tenda Technology Co., Ltd. is a high-tech enterprise specializing in the research, development, and production of electronic thermal insulation materials. With over 14 years of experience, the company offers a comprehensive range of products including thermal pads, gels, greases, potting compounds, and conductive ceramics. Their solutions cater to various applications such as new energy vehicles, wireless charging systems, and consumer electronics, aiming to enhance thermal performance and reliability.

-

Dycotec Materials Ltd. is a UK-based advanced materials company that develops and manufactures high-performance conductive, insulative, dielectric, and overcoat inks and films. Their expertise lies in formulating materials for printed electronics, thick film pastes, and thermal interface materials. Serving industries such as automotive, aerospace, semiconductor, medical, and clean energy, Dycotec provides innovative solutions to meet the evolving needs of modern electronics.

Master Bond and E-SONG EMC are some of the emerging market participants in the thermal management materials market.

-

Master Bond Inc. is a U.S.-based manufacturer specializing in the development of high-performance adhesives, sealants, and coatings. Their product line includes thermally conductive and electrically insulative adhesive films and preforms, designed to meet stringent thermal management specifications. These materials are widely employed in various industries to ensure efficient heat dissipation and enhance the reliability of electronic components.

-

Established in 1991, E-SONG EMC Co., Ltd. is a specialist in electromagnetic interference (EMI) shielding, absorbing, and thermal interface materials. The company develops, designs, and manufactures high-quality products aimed at addressing the challenges of miniaturized electronics and high-frequency bandwidths. Their solutions are integral to ensuring the performance and longevity of electronic devices in various applications.

Key Thermal Management Materials Companies:

The following are the leading companies in the thermal management materials market. These companies collectively hold the largest market share and dictate industry trends.

- Union Tenda Technology Co., Ltd

- Pcmwala

- Master Bond

- Dycotec Materials Ltd

- Boyd

- Boyd

- E-SONG EMC

- Compelma

- Indium Corporation

- Fujipoly

Recent Developments

-

In August 2025, PCMwala launched IP05, India's first inorganic Phase Change Material (PCM) formulated for +5°C. This innovation caters to the pharmaceutical sector, offering reliable temperature control for sensitive products during transit.

-

In January 2025, Master Bond developed EP53TC, a two-component epoxy designed for bonding, sealing, coating, and small potting applications where efficient heat dissipation is crucial. The epoxy is formulated with a specialty filler with a particle size ranging from 5 to 30 microns, offering a flowable system with a mixed viscosity of 45,000-65,000 cps at room temperature.

Thermal Management Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.32 billion

Revenue forecast in 2033

USD 7.04 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Union Tenda Technology Co., Ltd; Pcmwala; Master Bond; Dycotec Materials Ltd; Boyd; PCM Energy P. Ltd; E-SONG EMC; Compelma; Indium Corporation; Fujipoly

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Management Materials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the thermal management materials market based on material type, end use, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase Change Materials (PCMs)

-

Thermal Interface Materials (TIMs)

-

Gap fillers, pads, greases, adhesives

-

Graphite & Graphene-Based Materials

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Automotive & Transportation

-

Industrial & Manufacturing

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global thermal management materials market size was estimated at USD 4.06 billion in 2024 and is expected to reach USD 7.04 billion in 2025.

b. The global thermal management materials market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 7.04 billion by 2033.

b. The thermal interface materials (TIMs) segment held the highest revenue market share of 37.5% in 2024, due to their critical role in enhancing heat transfer between surfaces in electronic devices and high-power components.

b. Some of the key players operating in the thermal management materials market include Union Tenda Technology Co., Ltd, Pcmwala, Master Bond, Dycotec Materials Ltd, Boyd, PCM Energy P. Ltd, E-SONG EMC, Compelma, Indium Corporation, and Fujipoly

b. Growing demand for high-performance electronics, rising adoption of electric vehicles, advancements in 5G and AI technologies, and increasing need for energy-efficient cooling solutions are key factors driving the thermal management materials market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.