- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermochromic Polymer Films Market Size Report, 2033GVR Report cover

![Thermochromic Polymer Films Market Size, Share & Trends Report]()

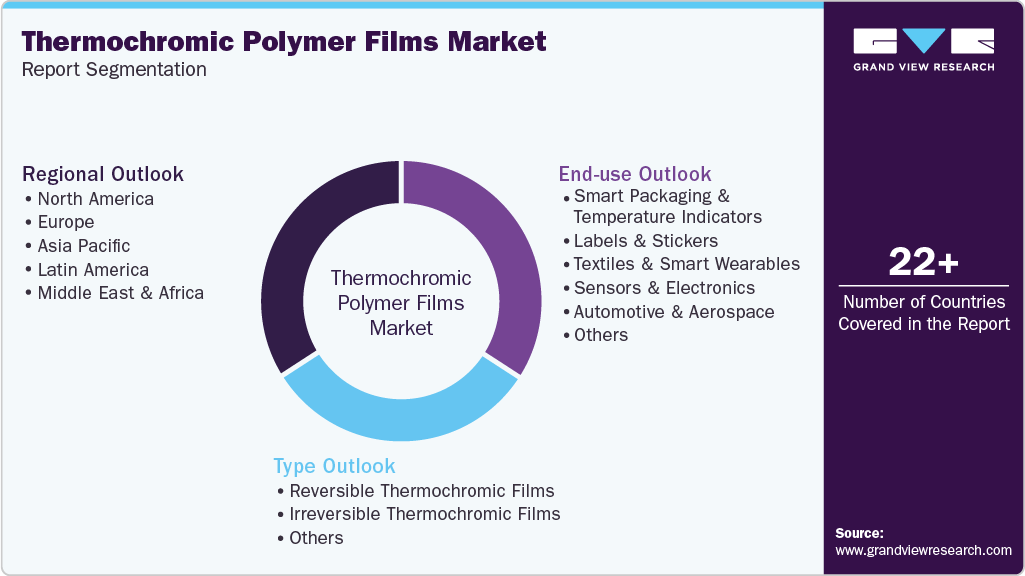

Thermochromic Polymer Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Reversible Thermochromic Films, Irreversible Thermochromic Films), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-795-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermochromic Polymer Films Market Summary

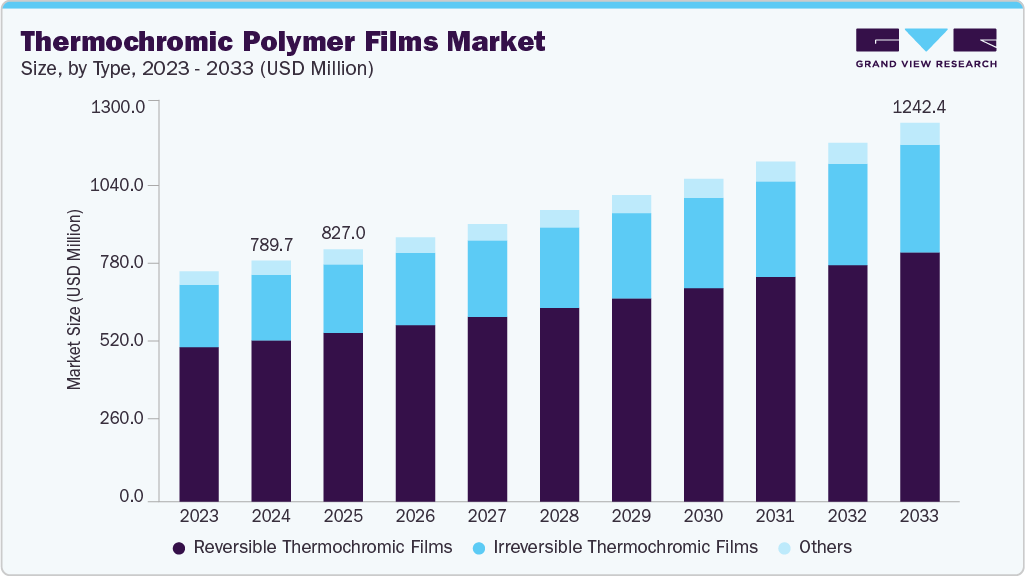

The global thermochromic polymer films market size was estimated at USD 789.7 million in 2024 and is projected to reach USD 1,242.4 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. Growing use of thermochromic polymer films in consumer goods packaging is driving market growth.

Key Market Trends & Insights

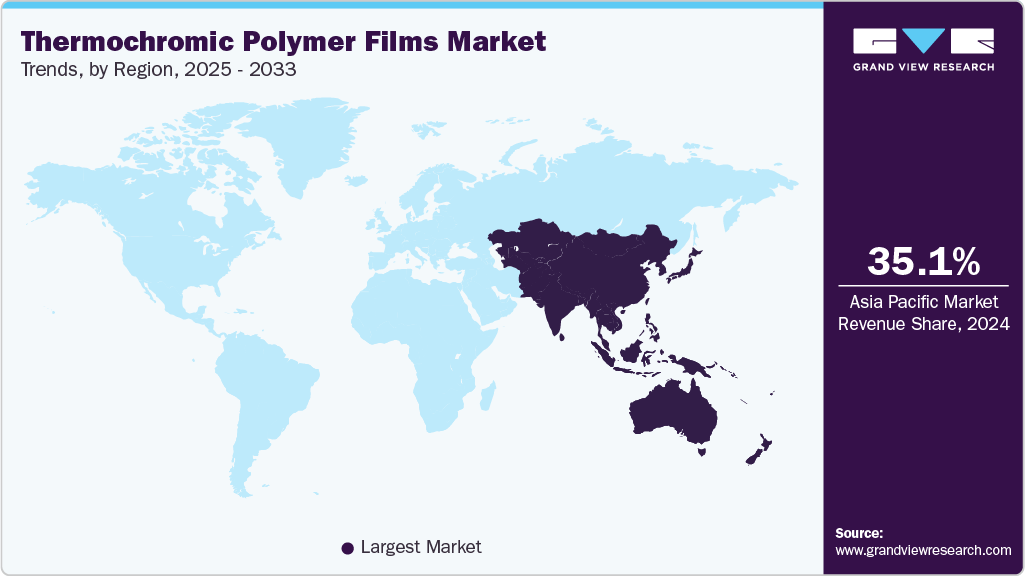

- Asia Pacific dominated the thermochromic polymer films market with the largest revenue share of 35.13% in 2024.

- The thermochromic polymer films market in China is expected to grow at a substantial CAGR of 5.9% from 2025 to 2033.

- By type, the irreversible thermochromic films segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By end use, the textiles & smart wearables segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 789.7 Million

- 2033 Projected Market Size: USD 1,242.4 Million

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

As brands use color-changing effects to enhance product appeal and communicate freshness or temperature status. This innovation improves customer engagement and supports premium product positioning in competitive retail markets.

Product and application convergence toward intelligent packaging and building envelopes. Manufacturers are shifting from simple pigment formulations to laminated polymer films that integrate microencapsulated thermochromic systems with barrier and adhesive layers. This convergence enables visible, passive temperature indication in consumer packaging and scalable retrofit films for glazing. The shift is supported by rising R&D activity in polymer formulations and scalable film-coating processes.

Drivers, Opportunities & Restraints

Rising demand for real-time, tamper-evident temperature monitoring across cold chains. Food, pharmaceutical, and biotech customers require simple visual indicators to assure product integrity without electronics. Thermochromic films offer low-cost, single-sheet integration into labels, seals, and inner packaging, reducing spoilage risk and logistics liability while meeting traceability mandates. This use-case is accelerating commercial adoption.

Energy and sustainability applications in smart glazing and adaptive facades present high-value growth avenues. Thermochromic polymer films can modulate solar transmission or act as low-power, passive indicators in window retrofit markets, creating demand from building owners seeking operational savings and simplified retrofit solutions. Partnerships between film producers and glass/architectural suppliers could unlock large-volume contracts and premium ASPs.

Material durability and regulatory compliance limit faster scale-up. Microencapsulated thermochromic systems can suffer color fatigue, migration, and reduced cycle life when exposed to UV, solvents or repeated thermal cycling. Meeting food-contact regulations and achieving consistent performance after lamination add formulation and validation cost. These technical and regulatory hurdles raise effective deployment costs and slow adoption in conservative end markets.

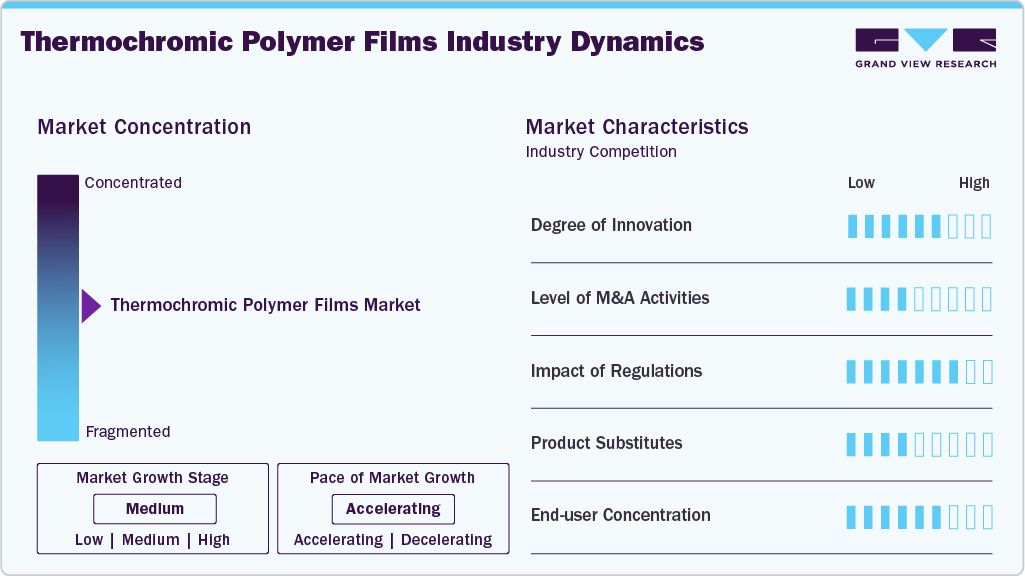

Market Concentration & Characteristics

The market growth stage of the thermochromic polymer films market is medium, and the pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies like Chromatic Technologies Inc., LCR Hallcrest Ltd., OliKrom SAS, Matsui International Company, Inc., Smarol Industry Co., Ltd., New Prismatic Enterprises Co., Ltd., TMC Hallcrest Asia Ltd., Kolorjet Chemicals Pvt. Ltd., DuPont de Nemours, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Thermochromic polymer films are moving beyond simple dye systems toward engineered multifunctional composites. Recent research emphasizes micro- and nano-encapsulation, polymer-nanocomposite matrices and printable thermochromic inks that improve switching precision and mechanical durability. These advances enable tailored transition temperatures, higher luminous transmittance for glazing, and integration with barrier or phase-change layers for thermal management. The result is a pipeline of products suited to building facades, reusable packaging and wearable sensing where performance and endurance are mandatory.

Buyers evaluate thermochromic films alongside electronic temperature sensors, RFID-enabled smart labels and alternative functional coatings. Electronic sensors deliver higher accuracy and data logging but add cost and complexity; RFID labels provide traceability at scale but require readers and power planning. Other material substitutes include photochromic inks, irreversible temperature indicators and phase-change coatings, which can match specific use cases such as security seals or thermal buffering but often trade off reusability and optical clarity. Choice of substitute now depends on required fidelity, lifecycle cost and regulatory constraints.

Type Insights

Reversible thermochromic films dominated the thermochromic polymer films market across the type segmentation in terms of revenue, accounting for a market share of 66.99% in 2024. Demand for dynamic energy management in buildings is driving adoption. Owners and architects seek retrofit solutions that passively modulate solar gain and reduce HVAC load without electrical control. Reversible films deliver repeatable optical shifts with predictable switching temperatures, making them attractive for adaptive glazing and façade overlays. Improved microencapsulation and scalable coating techniques are now lowering unit costs and easing integration with laminated glass systems.

The irreversible thermochromic films segment is anticipated to grow at the fastest CAGR of 5.7% through the forecast period. Single-use temperature validation is the primary commercial pull for irreversible films. Food and pharmaceutical supply chains prefer one-time visual alerts that permanently record threshold breaches for liability and recall management. These films are simple to apply, require no read-out devices and fit existing labeling workflows, which accelerates procurement by conservative quality teams. Market reports show the irreversible segment commanding a substantial revenue share in current thermochromic volumes.

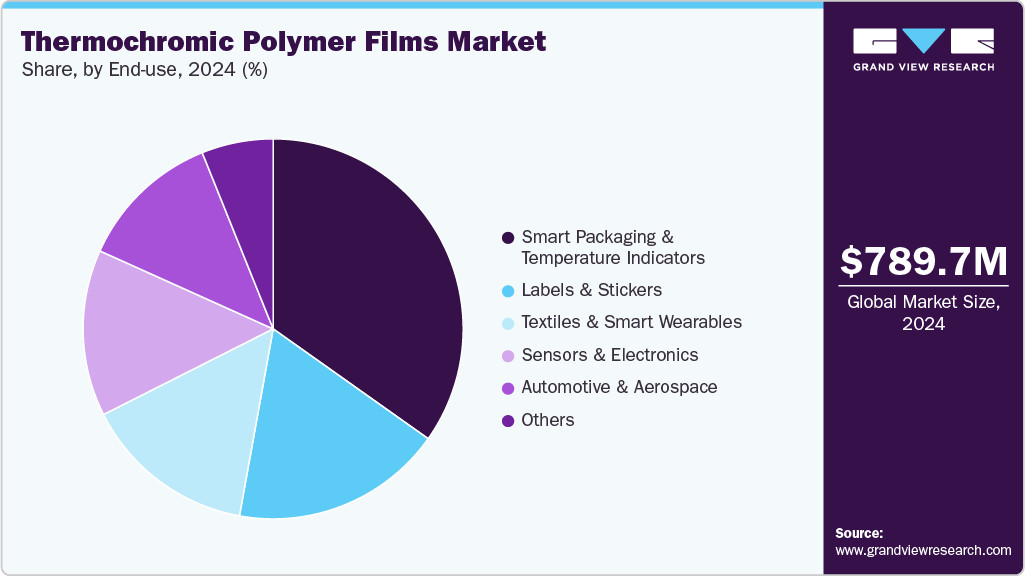

End-use Insights

Smart packaging and temperature indicators dominated the thermochromic polymer films market across the end use segmentation in terms of revenue, accounting for a market share of 34.81% in 2024. Regulatory tightening and e-commerce growth are expanding demand for visible, non-electronic temperature indicators in packaging. Brands and logistics providers need low-cost, tamper-resistant ways to demonstrate cold-chain integrity for temperature-sensitive goods. Thermochromic films integrated into labels and liners meet this need while simplifying quality audits and reducing returns. Forecasts for smart packaging reinforce strong near-term uptake of film-based visual indicators.

The textiles & smart wearables segment is expected to expand at the fastest CAGR of 5.8% through the forecast period. Consumer and healthcare use-cases are pushing thermochromic films into fabrics for real-time thermal feedback and experiential design. Sportswear and safety apparel incorporate color-change zones to signal overheating or to reveal functional patterns during activity. For medical and eldercare markets, visual thermal cues offer a low-complexity method to monitor localized temperature without electronics. Advances in printable thermochromic inks and durable encapsulation are improving wash-and-wear longevity, which is unlocking larger commercial pilots.

Regional Insights

North America thermochromic polymer films market is expected to grow at a significant CAGR over the forecast period. Strong regulatory pressure on cold-chain integrity and rapid adoption of smart packaging are driving demand for thermochromic polymer films. Food and pharma firms prefer low-cost visual indicators to complement electronic monitoring in logistics. Brand owners also use color-change films to enhance shelf impact and reduce returns in e-commerce. Combined market momentum in smart labels and reusable cold-chain solutions supports near-term commercial uptake.

U.S. Thermochromic Polymer Films Market Trends

In the U.S. thermochromic polymer films market, growth is anchored by the pharmaceutical and biotech sectors, where biologics shipments require verified temperature control. Thermochromic films provide an inexpensive, single-sheet method for frontline verification during distribution and last-mile delivery. Continued investment in advanced materials and local production capacity shortens qualification cycles for large buyers. Recent market estimates show the U.S. as a leading revenue contributor for thermochromic materials.

Asia Pacific Thermochromic Polymer Films Market Trends

Asia Pacific held the largest share of 35.13% in terms of revenue of the thermochromic polymer films market in 2024 and is expected to grow at the fastest CAGR of 5.5% over the forecast period. Rapid e-commerce expansion and rising consumer interest in experiential packaging are expanding applications for thermochromic films. Markets such as India and Southeast Asia favour low-cost, printable solutions that add brand differentiation and freshness cues without complex supply-chain changes. The region’s textile and wearable sectors also experiment with color-change functionalization for sports and safety apparel. Manufacturers are scaling regional production to meet heterogeneous demand.

Large-scale construction activity and strong domestic manufacturing capacity create an addressable market for thermochromic glazing films and industrial applications. Local producers can rapidly iterate formulations to meet performance and cost targets for building, packaging and textile customers. Government emphasis on energy performance in buildings and rapid adoption of smart consumer goods further accelerate commercial trials. China’s scale makes it a strategic production and demand hub for global suppliers.

Europe Thermochromic Polymer Films Market Trends

Energy efficiency mandates and large-scale retrofit programs are creating demand for adaptive facade and glazing solutions. Building owners seek passive technologies that lower HVAC loads and help meet near-term decarbonization targets. Thermochromic films offer a non-electrical option for reducing solar heat gain in retrofit scenarios. Policy-driven renovation funds and green building certifications are making pilots and rollouts commercially viable.

Key Thermochromic Polymer Films Company Insights

The thermochromic polymer films market is highly competitive, with several key players dominating the landscape. Major companies include Chromatic Technologies Inc., LCR Hallcrest Ltd., OliKrom SAS, Matsui International Company, Inc., Smarol Industry Co., Ltd., New Prismatic Enterprises Co., Ltd., TMC Hallcrest Asia Ltd., Kolorjet Chemicals Pvt. Ltd., and DuPont de Nemours, Inc. The thermochromic polymer films market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Thermochromic Polymer Films Companies:

The following are the leading companies in the thermochromic polymer films market. These companies collectively hold the largest market share and dictate industry trends.

- Chromatic Technologies Inc.

- LCR Hallcrest Ltd.

- OliKrom SAS

- Matsui International Company, Inc.

- Smarol Industry Co., Ltd.

- New Prismatic Enterprises Co., Ltd.

- TMC Hallcrest Asia Ltd.

- Kolorjet Chemicals Pvt. Ltd.

- DuPont de Nemours, Inc.

Recent Developments

-

In April 2025, OliKrom launched a dynamic roof coating that changes reflectivity with temperature to cut cooling loads. The product targets commercial buildings and claims up to 15% peak-season cooling savings, positioning thermochromic coatings as a retrofit energy-efficiency solution.

-

In 2024, Chromatic Technologies Inc. rolled out interactive thermochromic labels in a seasonal campaign with a global beverage brand. The collaboration delivered heightened shelf impact and reported double-digit uplifts in category engagement, demonstrating commercial viability for film-based temperature/marketing overlays.

Thermochromic Polymer Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 827.0 million

Revenue forecast in 2033

USD 1,242.4 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Chromatic Technologies Inc.; LCR Hallcrest Ltd.; OliKrom SAS; Matsui International Company, Inc.; Smarol Industry Co., Ltd.; New Prismatic Enterprises Co., Ltd.; TMC Hallcrest Asia Ltd.; Kolorjet Chemicals Pvt. Ltd.; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermochromic Polymer Films Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the thermochromic polymer films market report on the basis of type, end use, and region:

-

Type Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

Reversible thermochromic films

-

Irreversible thermochromic films

-

Others

-

-

End-use Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

Smart Packaging & Temperature Indicators

-

Labels & Stickers

-

Textiles & Smart Wearables

-

Sensors & Electronics

-

Automotive & Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global thermochromic polymer films market size was estimated at USD 789.7 million in 2024 and is expected to reach USD 827.0 million in 2025.

b. The global thermochromic polymer films market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 1,242.4 million by 2033.

b. Reversible thermochromic films dominated the thermochromic polymer films market across the type segmentation in terms of revenue, accounting for a market share of 66.99% in 2024 and is forecasted to grow at 5.0% CAGR from 2025 to 2033.

b. Some key players operating in the thermochromic polymer films market include Chromatic Technologies Inc., LCR Hallcrest Ltd., OliKrom SAS, Matsui International Company, Inc., Smarol Industry Co., Ltd., New Prismatic Enterprises Co., Ltd., TMC Hallcrest Asia Ltd., Kolorjet Chemicals Pvt. Ltd., and DuPont de Nemours, Inc.

b. Growing use of thermochromic polymer films in consumer goods packaging is driving market growth, as brands use color-changing effects to enhance product appeal and communicate freshness or temperature status. This innovation improves customer engagement and supports premium product positioning in competitive retail markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.