- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoplastic Polyimides Market Size, Industry Report, 2033GVR Report cover

![Thermoplastic Polyimides Market Size, Share & Trends Report]()

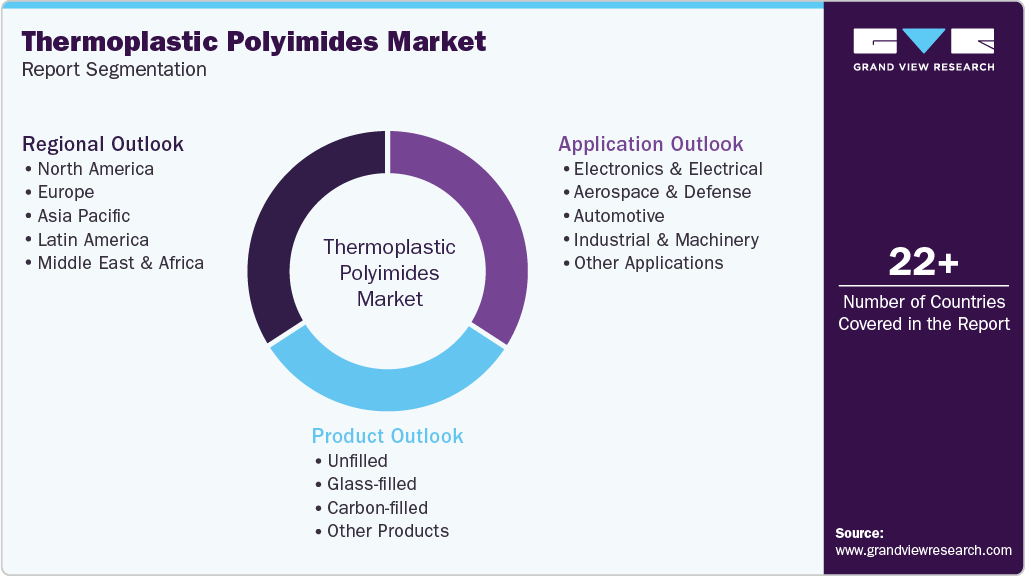

Thermoplastic Polyimides Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Unfilled, Glass-filled, Carbon-filled), By Application (Electronics & Electrical, Aerospace & Defense, Automotive, Industrial & Machinery), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-820-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermoplastic Polyimides Market Summary

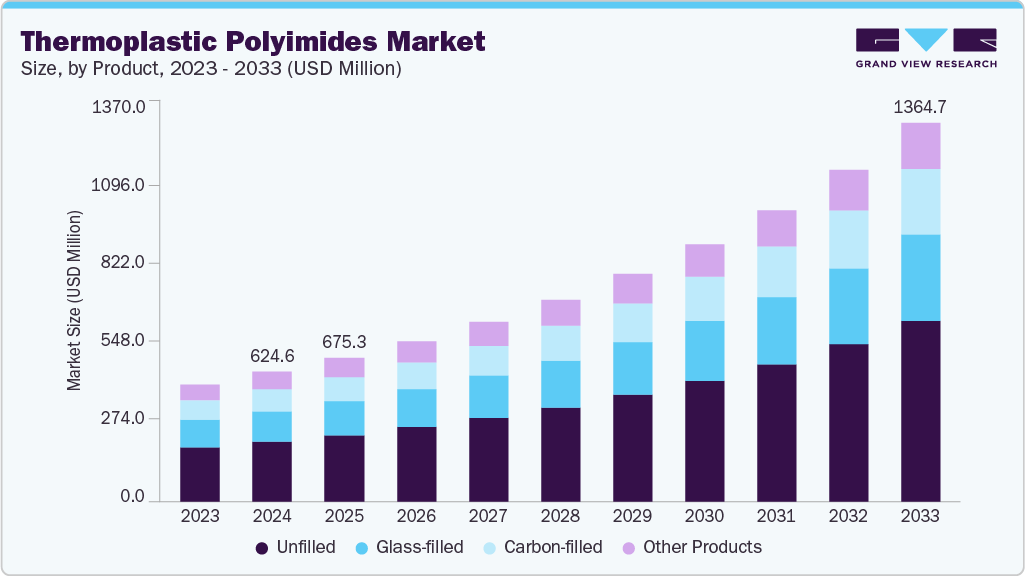

The global thermoplastic polyimides market size was estimated at USD 624.6 million in 2024 and is projected to reach USD 1,364.7 million by 2033, growing at a CAGR of 9.2% from 2025 to 2033. A growing driver is the rising use of thermoplastic polyimides in advanced manufacturing, where their dimensional stability supports tighter tolerances in high-precision components.

Key Market Trends & Insights

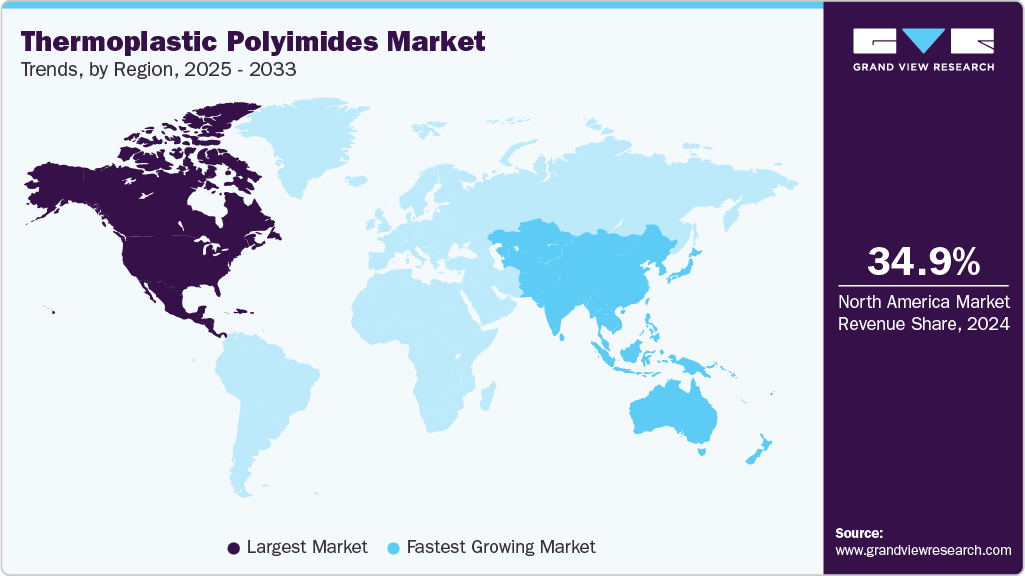

- North America dominated the thermoplastic polyimides market with the largest revenue share of 34.88% in 2024.

- The U.S. led the North America market and captured around 75% of the revenue market share in 2024.

- By product, the unfilled segment dominated the thermoplastic polyimides industry in terms of revenue, accounting for a market share of 38.23% in 2024.

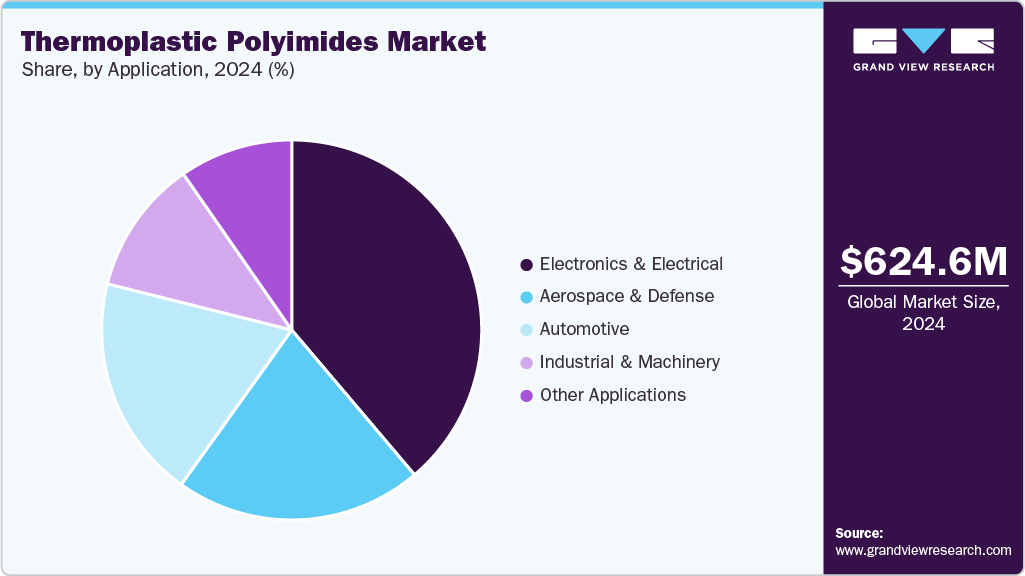

- By application, the electronics & electrical dominated the market for thermoplastic polyimides, accounting for a share of 38.80% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 624.6 Million

- 2033 Projected Market Size: USD 1,364.7 Million

- CAGR (2025-2033): 9.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This improves production efficiency and reduces defect rates, encouraging OEMs to specify TPIs in more mission-critical applications. Demand for thermoplastic polyimides is shifting from niche aerospace uses to broader adoption in electric vehicles and high-reliability electronics.

Manufacturers are increasingly specifying TPIs for electric powertrain insulation, connector housings, and compact thermal management components. This reorientation is lifting reported market forecasts and accelerating capacity investments across suppliers.

Drivers, Opportunities & Restraints

The primary market driver is the combination of high thermal stability, dielectric strength, and toughness that TPIs offer relative to conventional engineering plastics. OEMs targeting higher power density and longer service life choose TPIs to meet electrical insulation and continuous-use temperature requirements. This technical advantage is pushing end users to re-evaluate metal and lower-grade polymer specifications.

Shrinking electronics and the electrification of transportation create white space for component consolidation using TPIs. Designers can replace multi-material assemblies with fewer TPI parts, reducing weight and assembly cost while improving reliability. Suppliers that develop cost-competitive formulations and scalable melt-processing routes can capture premium margins by offering design-in support to OEMs.

Widespread adoption is constrained by the high cost of raw materials and demanding processing requirements. TPI resin synthesis and melt processing require specialized equipment and strict quality control, which increases entry and scale-up costs for producers. Regulatory pressure on polymer lifecycle and limited recycling pathways add further commercial friction in cost-sensitive segments.

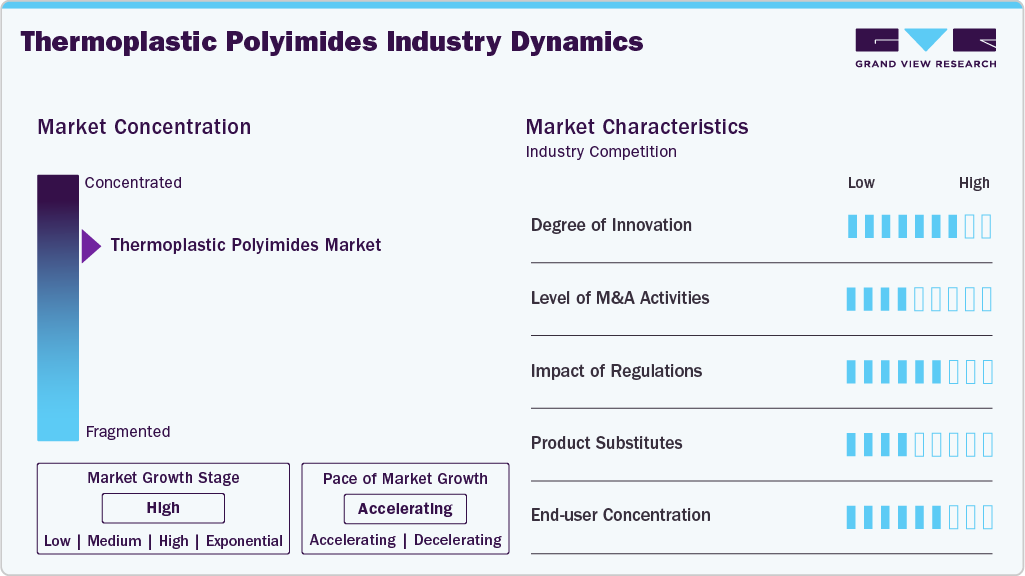

Market Concentration & Characteristics

The market growth stage of the thermoplastic polyimides industry is high, and the pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies such as Mitsui Chemicals, Inc., SABIC, Solvay S.A., and DuPont de Nemours, Inc., among others, play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Thermoplastic polyimides show incremental and application-driven innovation rather than disruptive breakthroughs. Recent development focuses on processable grades that retain high-temperature performance while improving melt flow for injection molding and powder bed fusion. Suppliers are investing in formulation science to balance thermal stability, toughness, and lower glass transition for easier processing. Innovations in carbon-filled and film formats are driving faster design cycles in electronics and mobility.

Competition comes from other high-performance thermoplastics, such as PEEK, PPS, and polyamideimide, each offering trade-offs in terms of cost, processability, and temperature resistance. PEEK competes where chemical resistance and mechanical strength are dominant, while PPS undercuts the price for moderately high-temperature uses. Polyamideimide is chosen when a balance of strength and melt processability is required. Buyers select substitutes based on part function, certification needs, and total cost of ownership.

Product Insights

The unfilled segment dominated the thermoplastic polyimides industry in terms of revenue, accounting for a market share of 38.23% in 2024. Unfilled thermoplastic polyimides attract OEMs where pure polymer properties matter. They deliver high thermal stability and superior ductility without the need for fillers, which simplifies qualification for tight-tolerance parts. Molders favor unfilled grades for predictable melt behavior and consistent surface finish in precision injection molding. This lowers scrap and shortens validation cycles for complex components.

The carbon-filled segment is anticipated to grow at a substantial CAGR of 10.1% through the forecast period. Carbon-filled TPIs drive demand where structural performance and functional integration are required. Carbon reinforcement improves stiffness, fatigue resistance, and through-thickness thermal conductivity, enabling load-bearing components that also manage heat. The combination supports lightweighting in chassis and powertrain modules and opens pathways to continuous-fiber 3D printing for complex geometries. Suppliers that optimize fiber-matrix adhesion win design wins in high-value segments.

Application Insights

Electronics & electrical dominated the market for thermoplastic polyimides, accounting for a share of 38.80% in 2024. In electronics, TPIs are specified for their dielectric strength and long-term thermal performance. The material supports higher power densities in EV electronics, telecom modules, and 5G base station hardware by resisting thermal aging and electrical breakdown. Film and molded TPI parts improve reliability in miniaturized assemblies and reduce the need for secondary cooling features. Emerging product grades that ease melt processing accelerate adoption across the value chain.

The aerospace & defense segment is expected to expand at a substantial CAGR of 10.1% over the forecast period. Aerospace demand is propelled by the need for polymers that can withstand sustained high temperatures while cutting weight. TPIs retain mechanical strength in engine surroundings and hot-structure applications where metals add cost and mass. Their resistance to chemicals, moisture, and radiation enhances part durability and reduces life-cycle maintenance costs. Manufacturers prefer TPI when certification programs prioritize performance with definable processing windows.

Regional Insights

The North America thermoplastic polyimides industry held the largest share of 34.88% in terms of revenue in 2024. Demand for high-temperature, high-reliability polymers from advanced electronics and EV supply chains is the primary growth lever. Designers are specifying TPIs for insulating compact power electronics and connectors where sustained thermal and dielectric performance reduces system cooling needs. Investment in domestic high-performance materials capacity is rising to shorten supply chains and secure qualified sources.

U.S. Thermoplastic Polyimides Market Trends

The U.S. thermoplastic polyimides industry has gained ground from federal defense and aerospace procurement, which has accelerated material qualification for advanced thermoplastics. U.S. programs favor polymers that cut weight while meeting long service intervals and tight certification windows. That preference translates into near-term specification wins for TPIs in engine surrounds, avionics housings, and mission-critical connectors.

Europe Thermoplastic Polyimides Market Trends

The thermoplastic polyimides industry in Europe has witnessed an uptick due to the roll-out of 5G infrastructure and industrial automation, thereby raising demand for polymers with superior dielectric and thermal stability. Telecom and power electronics suppliers choose TPIs to support higher-frequency operation and prolonged thermal stress. Regional regulatory focus on lifecycle performance also favors materials that extend system service life and reduce maintenance cycles.

Asia Pacific Thermoplastic Polyimides Market Trends

The thermoplastic polyimides industry in the Asia Pacific is expected to expand at a substantial CAGR of 9.8% over the forecast period. The rapid expansion of electronics manufacturing and electric vehicle production positions the Asia Pacific as the largest regional demand pool for TPIs. Local OEMs and tier suppliers seek high-performance resins to support miniaturized modules and high-power battery electronics. Policy pushes for domestic componentisation and supply-chain diversification accelerate qualification of TPI formulations across China, India, and Southeast Asia.

Key Thermoplastic Polyimides Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Mitsui Chemicals, Inc., SABIC, Solvay S.A., DuPont de Nemours, Inc., Evonik Industries AG, Saint-Gobain Performance Plastics Corporation, Ensinger GmbH, Victrex plc, and Toray Industries, Inc. The market for thermoplastic polyimides is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability.

Key Thermoplastic Polyimides Companies:

The following are the leading companies in the thermoplastic polyimides market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsui Chemicals, Inc.

- SABIC

- Solvay S.A.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Saint-Gobain Performance Plastics Corporation

- Ensinger GmbH

- Victrex plc

- Toray Industries, Inc.

Recent Developments

-

In July 2025, Arkema (via its affiliate PI Advanced Materials) launched Zenimid, a new ultra-high-performance thermoplastic polyimide brand, positioning it for demanding markets such as aerospace, EV battery systems, 5G infrastructure, and FPCBs.

-

In August 2025, Asahi Kasei announced plans to double production capacity of its PIMEL photosensitive polyimide (PSPI) by 2030, investing about USD 102 billion to strengthen its supply position for semiconductor interlayer insulation.

Thermoplastic Polyimides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 675.3 million

Revenue forecast in 2033

USD 1,364.7 million

Growth rate

CAGR of 9.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Mitsui Chemicals, Inc.; SABIC; Solvay S.A.; DuPont de Nemours, Inc.; Evonik Industries AG; Saint-Gobain Performance Plastics Corporation; Ensinger GmbH; Victrex plc; Toray Industries, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermoplastic Polyimides Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global thermoplastic polyimides market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Unfilled

-

Glass-filled

-

Carbon-filled

-

Other Products

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Electronics & Electrical

-

Aerospace & Defense

-

Automotive

-

Industrial & Machinery

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global thermoplastic polyimides market size was estimated at USD 624.6 million in 2024 and is expected to reach USD 675.3 million in 2025.

b. The global thermoplastic polyimides market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2033 to reach USD 1,364.7 million by 2033.

b. Electronics & electrical dominated the thermoplastic polyimides market across the application segmentation in terms of revenue, accounting for a market share of 38.80% in 2024 and is forecasted to grow at 8.9% CAGR from 2025 to 2033.

b. Some key players operating in the thermoplastic polyimides market include Mitsui Chemicals, Inc., SABIC, Solvay S.A., DuPont de Nemours, Inc., Evonik Industries AG, Saint-Gobain Performance Plastics Corporation, Ensinger GmbH, Victrex plc, and Toray Industries, Inc

b. Some key players operating in the thermoplastic polyimides market include Mitsui Chemicals, Inc., SABIC, Solvay S.A., DuPont de Nemours, Inc., Evonik Industries AG, Saint-Gobain Performance Plastics Corporation, Ensinger GmbH, Victrex plc, and Toray Industries, Inc

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.