- Home

- »

- Distribution & Utilities

- »

-

Timing Relay Market Size & Share, Industry Report, 2030GVR Report cover

![Timing Relay Market Size, Share & Trends Report]()

Timing Relay Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Delay-on Relay, Delay-off Relay), By End-user (Utility, Industrial), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-420-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Timing Relay Market Summary

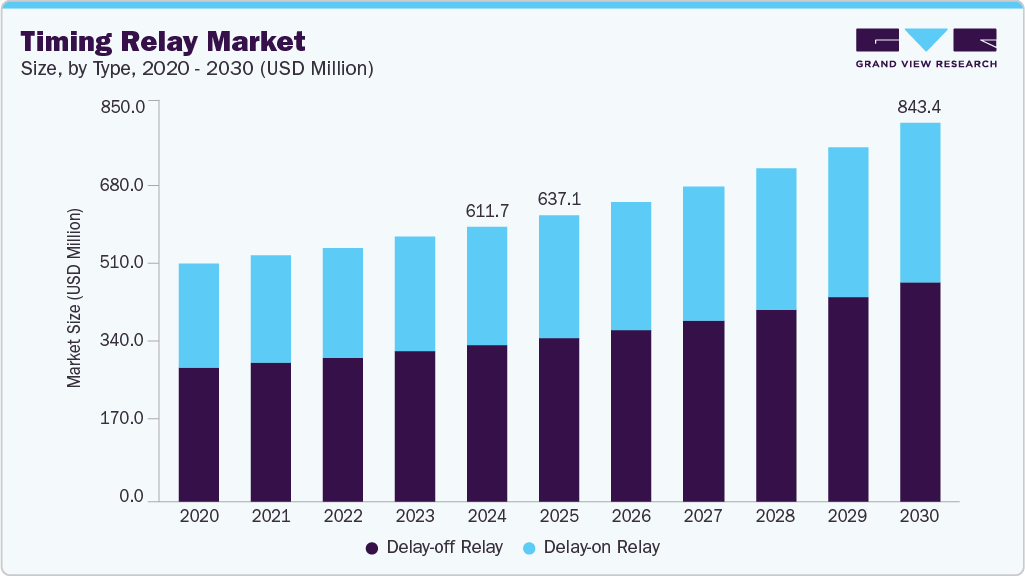

The global timing relay market size was estimated at USD 611.70 million in 2024 and is projected to reach USD 843.4 million by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The rise of automation in numerous sectors, such as manufacturing, automotive, and process industries, propels the expansion of the timing relay industry.

Key Market Trends & Insights

- North America timing relay market dominated the global market and accounted for the largest revenue share of over 32.6% in 2024.

- The U.S. timing relay market held a significant share of the regional timing relay industry due to the focus of the U.S. government on infrastructure enhancement and smart city projects.

- By type, the delay-off relay segment registered the largest revenue share of 57.0% in 2024.

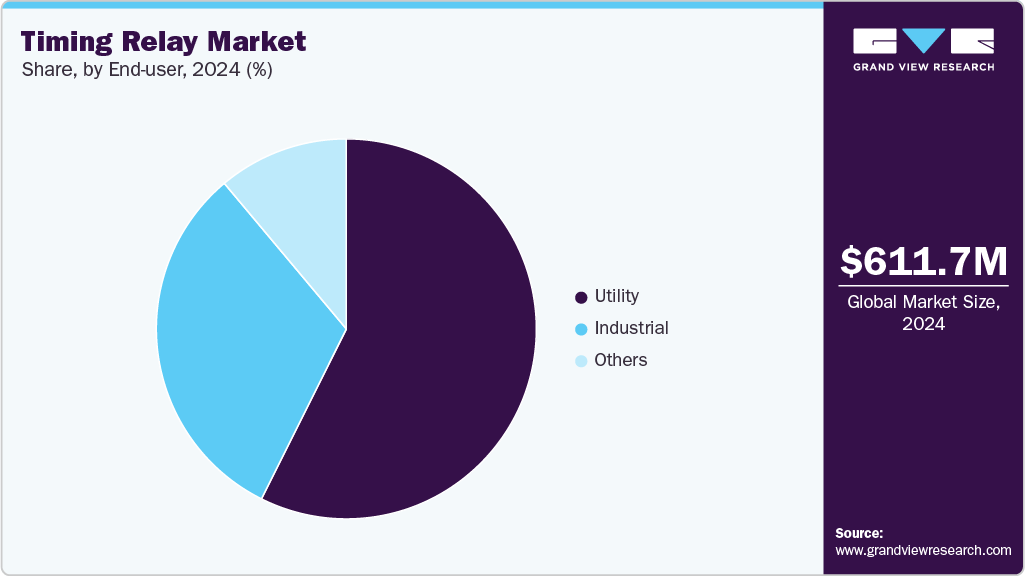

- By end-user, the utility segment accounted for the highest revenue share of the timing relay industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 611.7 Million

- 2030 Projected Market Size: USD 843.4 Million

- CAGR (2025-2030): 5.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As businesses aim to enhance efficiency and minimize human errors, timing relays become essential for regulating the sequence of operations, overseeing start and shutdown processes, and maintaining accurate timing within automated systems. For instance, in production lines, timing relays are utilized to synchronize the operation of conveyor belts, robotic arms, and other machinery to streamline production flow.In addition, the increasing focus on energy efficiency and power management favorably impacts the timing relay market. This equipment is crucial for regulating industrial machinery, motor control systems, and energy management systems, as it helps manage lighting, HVAC systems, and other electrical equipment in commercial and residential settings. It facilitates the timed operation of devices, ensuring they operate only when necessary, decreasing energy usage and expenses. For example, in smart buildings, timing relays can be set up to switch off nonessential devices during peak energy demand times or to oversee the functioning of renewable energy systems.

Moreover, the growth of smart grid technologies and the rising use of renewable energy sources fuel the demand for timing relays. These devices play a vital role in overseeing power distribution, balancing loads, and providing fault protection within electrical grids. With the growing sophistication of power systems due to the incorporation of different energy sources, the need for timing relays to facilitate seamless transitions and safeguard equipment from potential damage caused by power variations also increases. In solar and wind energy installations, for instance, timing relays are utilized to align power output with grid requirements and manage battery storage systems.

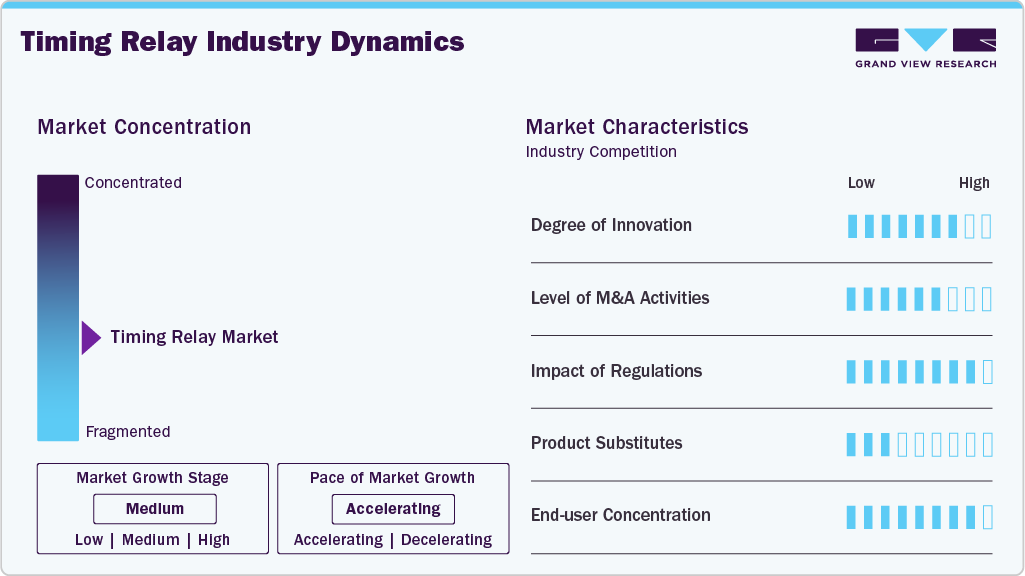

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of industry growth is accelerating. The market operates with low to moderate regulatory oversight, as these products are not subjected to extensive direct regulation. Compliance requirements are typically limited to standard certifications concerning electrical safety, Electromagnetic Compatibility (EMC), and environmental regulations, such as Restriction of Hazardous Substances (RoHS). Nevertheless, broader regulatory movement toward energy efficiency and smart building standards may indirectly affect demand and product design, encouraging their integration into more sustainable and automated systems. Compared to other electronic control devices, timing relays encounter fewer legal and compliance obstacles, facilitating operations of established companies and new entrants in the global market with minimal adjustments.

The market shows a high concentration of end users, with a large portion of demand arising from several key industries: industrial automation, building automation, energy systems, and transportation infrastructure. These sectors rely significantly on timing relays for managing processes, sequencing equipment, and handling energy management. In smart infrastructure, timing relays are vital for optimizing power consumption and automating essential functions. As a result, the growth potential of the timing relay industry is closely tied to investment cycles, automation trends, and modernization efforts within these sectors, making end-user dynamics a key factor influencing market performance.

Type Insights

The delay-off relay segment registered the largest revenue share of 57.0% in 2024. Safety requirements and the need for process optimization in multiple sectors primarily influence the segment demand. These relays play a vital role in situations where a gradual shutdown or cooling phase is essential to avoid equipment damage or to ensure the safety of personnel. For example, in HVAC systems, chemical processing facilities, and data centers, delay-off relays assist in controlling residual heat or sustaining important processes for a specified time after the main power is turned off. In addition to industrial applications, delay-off relays are increasingly utilized in building automation, particularly in lighting control and ventilation systems, where timed shutdowns contribute to energy efficiency and operational convenience. Their ability to prevent power surges and minimize mechanical stress on equipment extends the life of systems and reduces maintenance costs. With the growing integration of automation and smart technologies, delay-off relays are being adapted for use in programmable systems, allowing for more precise control and customization. This makes them a valuable component in legacy systems as well as in modern digital infrastructure, reinforcing their relevance in evolving electrical and electronic control environments.

The delay-on relay segment is expected to grow rapidly at a CAGR of 5.4% over the forecast period, driven by the need for controlled and sequenced start-up processes in various industrial and commercial applications. They are essential in scenarios where sudden power surges, such as large motor start-ups or complex machinery initialization, need to be avoided. The growing automation in manufacturing and process industries has increased the demand for these relays, as they allow for precise timing control and smooth operation of interconnected systems.

End-user Insights

The utility segment accounted for the highest revenue share of the timing relay industry in 2024. In the utility sector, timing relays are utilized within power generation, transmission, and distribution systems. The increasing need for a dependable power supply, rising investments in smart grid technology, and the growing demand for effective energy management are significant factors driving the adoption of timing relays in the sector.

The industrial segment is expected to grow at the fastest rate over the forecast years. Timing relays are commonly employed in manufacturing processes, automation systems, and machinery control. They assist in sequenced operations, managing motor start and stop functions, and overseeing production cycles. Sectors such as automotive, food processing, pharmaceuticals, and chemicals depend heavily on timing relays for accurate control and safety protocols. The demand for enhanced precision, minimized downtime, and improved safety standards also fuels the growth of timing relay applications in industrial applications. Furthermore, the incorporation of timing relays into smart grid systems enhances the coordination of power networks, leading to greater reliability and efficiency in electricity delivery. In industrial environments, innovations in timing relay technology, including programmable and multifunctional relays, facilitate more advanced control over complex processes, increasing their utilization across different manufacturing industries, for example, the Siemens LOGO! 8 Logic Module.

Regional Insights

North America timing relay market dominated the global market and accounted for the largest revenue share of over 32.6% in 2024. The advanced manufacturing sector in the region, especially within the automotive and aerospace industries, is progressively implementing automation and smart factory technologies. In addition, the area's emphasis on energy efficiency and smart grid technologies significantly contributes to market growth. The growth of smart grid technologies in North America serves as a major factor driving the timing relay market. Timing relays play a vital role in these systems, offering precise control and coordination needed for effective power distribution and management. These advancements highlight the essential function of timing relays in bolstering the changing energy infrastructure in North America.

U.S. Timing Relay Market Trends

The U.S. timing relay market held a significant share of the regional timing relay industry due to the focus of the U.S. government on infrastructure enhancement and smart city projects. Timing relays play a vital role in smart grid networks, traffic management, and building automation, where accurate timing control is essential. For example, cities such as New York and Los Angeles are adopting advanced traffic light systems that use timing relays to improve traffic flow and alleviate congestion. New York City has rolled out its “Midtown in Motion” initiative, which incorporates real-time sensors, wireless technology, and adaptive signal controllers to optimize traffic signals dynamically. This system relies on accurate timing to adjust signals in response to existing conditions. These adaptive signal systems are highly reliant on timing relays to execute switching commands and delays with millisecond precision, ensuring safe and efficient traffic management. As smart cities advance their intelligent transportation systems, the need for dependable timing components is growing.

Europe Timing Relay Market Trends

Europe timing relay market is expected to grow significantly, driven by initiatives for smart cities, which create new prospects for timing relay manufacturers. From traffic control systems in Amsterdam to energy-efficient building management in Stockholm, timing relays are being incorporated into various urban development projects. These devices facilitate accurate scheduling of lighting, heating, and ventilation systems, aiding in energy conservation and enhancing urban living conditions. As an increasing number of European cities implement smart technologies, the need for advanced timing relays is anticipated to increase significantly during the forecast period. In February 2024, Siemens unveiled new products and collaborations at the Light + Building 2024 event, emphasizing sustainable infrastructure. The company showcased innovations in electronic switching and building operation management to improve energy efficiency and reduce carbon emissions in urban settings. Such advancements are projected to boost the demand for sophisticated timing relays, as they are essential for accurate scheduling and control within smart buildings and energy systems. The adoption of these technologies supports energy savings and enhances the quality of urban life across the region.

Asia Pacific Timing Relay Market Trends

Asia Pacific timing relay market is expected to grow at the fastest CAGR of 6.5% over the forecast years. Both major users of timing relays, the automotive and electronics sectors, are expanding rapidly in the region. Countries like Japan, South Korea, and Taiwan are at the forefront of electronics production, while China and India are emerging as significant centers for automotive manufacturing. The rising popularity of electric vehicles and Advanced Driver-assistance Systems (ADAS) in the regions fuels the demand for advanced timing relays used in battery management, motor control, and safety systems. In December 2023, OMRON Corporation launched the G3VM-63BR and G3VM-63ER solid-state relays, which are engineered for high-precision control in compact electronic devices. These relays are specifically designed for applications that require dependable and accurate timing control, such as automotive electronics and industrial automation. The release of these advanced relays has allowed manufacturers in the Asia Pacific to improve the performance and dependability of Electronic Control Units (ECUs) in vehicles. By incorporating OMRON's G3VM series relays, automotive and electronics manufacturers can attain finer timing functionalities, enhancing product safety features and energy efficiency.

The timing relay market in China led the Asia Pacific region and held a substantial market share in 2024. Driven by rapid industrial automation and infrastructure growth. Expanding automation in sectors such as electronics, textiles, and manufacturing has increased the demand for precise control systems like timing relays. The country’s cost-effective labor and strong infrastructure continue to attract global manufacturers, further boosting market growth. Additionally, China's focus on smart grids and renewable energy has expanded the use of timing relays in energy management and industrial applications.

Key Timing Relay Company Insights

The global timing relay industry is very competitive, with numerous large companies vying for higher market share. Some key players in this market are Schneider Electric, Eaton, Siemens, OMRON Corporation, and ABB Group. The market is projected to experience steady growth, fueled by increased investments in electrical networks, the expansion of renewable energy, and advances in industrial automation. However, it remains quite fragmented due to the presence of various regional and local competitors. The market is also experiencing mergers and acquisitions as larger firms buy regional companies to enhance their geographic reach and product offerings, thereby influencing the competitive landscape of the industry.

Key Timing Relay Companies:

The following are the leading companies in the timing relay market. These companies collectively hold the largest market share and dictate industry trends.

- OMRON Corporation

- Schneider Electric

- Eaton

- ABB Group

- Siemens

- TE Connectivity

- IDEC Corporation

- PHOENIX CONTACT India Pvt. Ltd.

- Crouzet

- Finder S.p.A.

- ComatReleco AG

- GEYA Electrical Equipment Supply

- Audiotronics

- Paragon Auto Control

- JVS Electronics

Recent Developments

-

In October 2024, Schneider Electric expanded its presence in cooling and data infrastructure solutions by acquiring Motivair for USD 870 million. Recognized for its precision cooling systems, Motivair enhanced Schneider’s commitment to sustainability and efficiency, which is essential in a time of increasing energy expenses and the need for environmentally friendly options. This acquisition enabled Schneider to provide cohesive, energy-efficient solutions for data centers, which are rapidly growing due to the ongoing digital transformation across various industries.

-

In January 2024, Teledyne Relays, a manufacturer of high-performance relays and switches, announced the launch of its innovative Multi-Function Timer Series. This new product line offers advanced timing capabilities for a wide range of applications, including industrial automation, building automation, and transportation systems. The Multi-Function Timer Series features programmable timing functions, multiple output options, and a compact design, making it a versatile solution for various timing control requirements.

Timing Relay Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 637.1 million

Revenue forecast in 2030

USD 843.4 million

Growth Rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-user, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Saudi Arabia

Key companies profiled

OMRON Corporation, Schneider Electric, Eaton., ABB, Siemens, TE Connectivity, IDEC Corporation, Phoenix Contact, Crouzet, FINDER S.p.A., ComatReleco AG, GEYA Electrical Equipment Supply, Audiotronics, Paragon Auto Control., JVS Electronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Timing Relay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global timing relay market report based on type, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Delay-on Relay

-

Delay-off Relay

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.