- Home

- »

- Smart Textiles

- »

-

Tire Cord Fabrics Market Size & Share, Industry Report 2030GVR Report cover

![Tire Cord Fabrics Market Size & Trend Report]()

Tire Cord Fabrics Market Size & Trend Analysis Report By Material (Nylon, Polyester), By Tire Type (Radial, Bias), By Application (OEM, Replacement), By Vehicle Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-596-0

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Tire Cord Fabrics Market Size & Trends

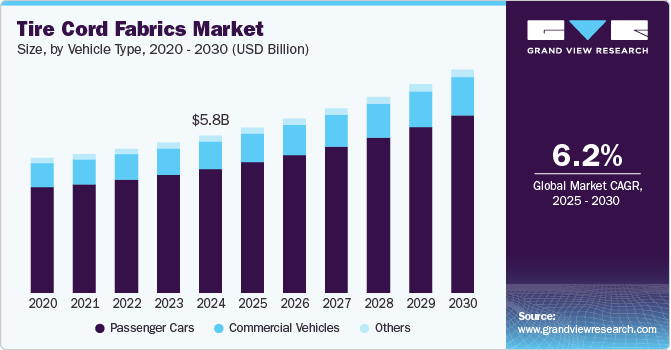

The global tire cord fabrics market size was estimated at USD 5.79 billion in 2024 and is expected to register a CAGR of 6.2% over the forecast period. Tire cord fabrics are a crucial component in the production of tires, providing the necessary strength and durability to withstand high-pressure conditions, heavy loads, and extensive wear and tear. As global vehicle production continues to rise, driven by growing populations, urbanization, and higher disposable incomes, the demand for tires and tire cord fabrics also increases. Moreover, consumer preference is shifting toward higher-performance tires, such as radial tires, which require specialized cord fabrics and play a significant role in market expansion.

Developing more efficient and sustainable vehicles has prompted tire manufacturers to invest in higher-quality materials, including cord fabrics. With automakers focusing on improving fuel efficiency and reducing carbon footprints, lightweight and stronger materials are in high demand. Tire cord fabrics made from synthetic materials, such as polyester, nylon, and steel, offer superior performance and contribute to these goals, driving their adoption in modern tire manufacturing.

In addition, the increase in demand for commercial and heavy-duty vehicles is another crucial factor boosting the TCF market. Trucks, buses, and off-road vehicles, which require high-strength tires for their demanding operations, are significant consumers of tire cord fabrics. The growing logistics and transportation sectors, particularly in developing regions such as Asia Pacific, are pushing for a higher tire production volume. This, in turn, drives the demand for TCF as it is essential to meet the durability and load-bearing requirements of tires used in heavy-duty vehicles.

Vehicle Type Insights

The passenger cars segment accounted for the largest revenue share of 78.8% in 2024 and is further expected to expand at the fastest CAGR of 6.3% through 2030. Factors such as the growing demand for passenger cars in developing economies and the rising demand for durable, fuel-efficient tires are primarily responsible for segment growth. Growing regulatory support for the adoption of EVs is anticipated to positively impact demand for tire cord fabrics over the forecast period. For instance, under the Incentives for Zero-Emission Vehicles (iZEV) Program, the Government of Canada offers rebates of up to USD 5,000 on purchasing designated EV models.

The commercial vehicle segment is projected to expand at a notable CAGR over the projected period. Commercial vehicles such as buses, trucks, and trailers carry heavy loads and exhibit higher tire replacement rates. Thus, the longer lifecycle and durability associated with using tire cord fabrics are anticipated to drive product penetration in this segment. Tire replacement costs account for a major portion of the overall operating costs of major transport organizations and fleet operators. Thus, even a small improvement in the tire lifecycle has the potential to generate significant cost savings. Therefore, growing commercial vehicle tire production product utilization is projected to positively impact the overall market growth.

Material Insights

The polyester segment accounted for the largest revenue share of 60.2% in 2024. Polyester tire cords find wide-ranging applications in producing passenger car tires due to their low shrinkage, strength, and low-cost properties. The material is also witnessing growing adoption as a constituent for manufacturing hybrid tire cord fabrics.

The rayon segment is expected to expand at a CAGR of 6.3% during the forecast period. The main factor contributing to the popularity of rayon tire cords is their cost-effectiveness. Compared to alternative materials like nylon or polyester, rayon is relatively inexpensive to produce. The process involves converting cellulose from wood pulp into fibers through chemical treatment. This process is less complex and costly than the production of synthetic fibers like nylon or polyester. As a result, rayon tire cord offers a cost-effective solution for tire manufacturers without compromising performance.

The nylon segment held a significant revenue share in 2024. Factors such as superior fatigue resistance, high tenacity, and improved adhesion to rubber attributes offered by the product are primary factors fuelling the segment’s share. Nylon tire cord fabrics are widely used to produce high-wear-resistant tires for commercial applications. Aircraft, agricultural, and truck tires are some types made using nylon. Furthermore, it is preferred for producing wet-condition tires owing to its lower moisture-retaining properties.

The other materials segment consists of steel-and aramid-based tire cord fabrics. It is projected to expand at a lucrative CAGR over the projected period. The growing use of aramid fibre-based fabrics for manufacturing high-performance racing tires and aircraft tires is projected to boost the segment’s global tire cord fabrics growth.

Application Insights

The replacement segment accounted for the largest revenue share of 67.1% in 2024. Increased consumer awareness about the rolling resistance and growing demand for radial tires drive segment growth. Commercial vehicles are a major factor driving the growth of this segment. Vehicles such as trucks, container carriers, and buses carry heavy loads over a longer distance, with the tires thus exhibiting more wear than passenger cars. Commercial replacement tires are generally made of nylon fabrics owing to wear resistance.

The OEM segment is anticipated to register the fastest CAGR of 7.4% over the forecast period. Growing emphasis on reducing vehicular emissions and adopting stringent emission norms drive the demand for fuel-efficient tires with lower rolling resistance. Furthermore, demand for motorcycles in Asia and Africa is further expected to boost market growth. The rising popularity of SUVs also has a positive impact on segment growth. Major SUV manufacturers include high-performance sports tires as part of the standard original equipment. They are manufactured using aramid tire cord fabric, owing to its superior strength-to-weight ratio.

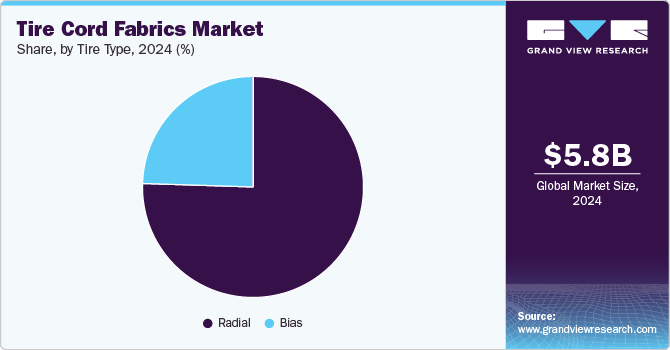

Tire Type Insights

The radial segment accounted for the largest revenue share of 75.5% in 2024 and is expected to expand at the fastest CAGR of 6.3% during the forecast period. Radial tires are being adopted more due to their durability, stability, temperature performance, wear resistance, and superior fuel efficiency. In radial tires, the steel belts are aligned at a 90-degree angle with the tread line, allowing the sidewall and tire tread to function independently. Thus, radial tires exhibit low sidewall flex and more ground contact. Radial tires are widely used in passenger cars and light commercial vehicles.

The bias tire segment is projected to expand at a steady CAGR over the forecast period, owing to its low-cost property, suitability for rough terrain, and ability to carry heavy loads. However, properties such as high rolling resistance value, reduced wear resistance, and susceptibility to overheating are expected to restrain segment growth. Bias tires consist of nylon belts that run at a 30 to 45-degree angle with the tread line. These tires' multiple overlapping rubber plies give them a tough, rugged build and improved sidewall puncture protection. Bias tires are widely used in construction, agriculture, and marine settings.

Regional Insights

North America tire cord fabrics held a substantial market revenue share in 2024. As the region's automotive industry expands, the need for durable, high-performance tires is rising. Tire cord fabrics are essential for tires, providing strength and structural integrity. The growth of the automotive industry, driven by rising disposable incomes and urbanization, leads to an increased need for tire cord fabrics for manufacturing various types of tires, including those for commercial vehicles, passenger cars, and heavy-duty trucks. The need for durable, high-performance tires rises as the automotive industry expands. Tire cord fabrics are essential components in tires, providing strength and structural integrity. The growth of the automotive industry, driven by rising disposable incomes and urbanization, leads to an increased need for tire cord fabrics for manufacturing various types of tires, including those for commercial vehicles, passenger cars, and heavy-duty trucks.

U.S. Tire Cord Fabrics Market Trends

The tire cord fabrics market in the U.S. is experiencing significant growth. The shift towards electric vehicles (EVs) is another significant factor influencing the market. EVs require specialized tires designed to handle their unique weight distribution and torque characteristics. This transition necessitates innovative tire design and manufacturing approaches, leading to increased demand for advanced tire cord fabrics that can support these new requirements. As EV adoption continues to grow due to environmental concerns and government incentives, so will the need for tailored solutions within the tire industry.

Asia Pacific Tire Cord Fabrics Market Trends

The tire cord fabrics market in Asia Pacific accounted for the largest revenue share of 51.6% in 2024. Countries like China, India, and Japan are at the forefront of this growth, contributing to a substantial increase in vehicle manufacturing. As tire manufacturers seek to meet the growing demand for vehicles, the need for high-quality tire cord fabrics, essential components that provide strength and durability to tires, has escalated.

China tire cord fabrics market is experiencing substantial growth. As one of the largest global automotive markets, China has consistently increased vehicle manufacturing, driven by domestic demand and export opportunities. The growing middle class and urbanization have increased disposable incomes and vehicle ownership. Consequently, this surge in automotive production directly boosts the demand for tire cord fabrics, essential components in tire manufacturing.

Middle East & Africa Tire Cord Fabrics Market Trends

The tire cord fabrics market in the Middle East & Africa is anticipated to register the fastest CAGR of 8.4% over the forecast period. The automotive industry in this region has been experiencing significant expansion due to increasing consumer demand, urbanization, and economic development. Countries like South Africa, Egypt, and the United Arab Emirates are witnessing a surge in vehicle manufacturing, directly correlating with an increased need for tire cord fabrics. As more vehicles are produced, the demand for high-quality tires rises, boosting the requirement for durable tire cord fabrics used in tire reinforcement.

Key Tire Cord Fabrics Company Insights

Some of the key players operating in the market include Indorama Ventures Public Company Limited, Kolon Industries Inc., and others:

-

Indorama Ventures Public Company Limited is a global producer of petrochemicals and synthetic fibers with a significant presence in the tire cord fabrics market. The company specializes in manufacturing high-performance tire cord fabrics that are essential for producing tires for various vehicles, including passenger cars, trucks, and specialty vehicles.

-

Kolon Industries Inc., a South Korean company, specializes in producing high-performance materials, including tire cord fabrics. Within the tire industry, Kolon focuses on developing innovative solutions that enhance tire durability and performance. Their tire cord fabrics are engineered to provide superior strength and flexibility, critical for ensuring safety and longevity in tire applications.

Key Tire Cord Fabrics Companies:

The following are the leading companies in the tire cord fabrics market. These companies collectively hold the largest market share and dictate industry trends.

- Indorama Ventures Public Company Limited

- Kolon Industries Inc.

- SRF Ltd.

- TEIJIN LIMITED

- Century Enka Limited

Recent Developments

-

In January 2023, Century Enka Limited commenced commercializing a nylon tire cord fabric crafted entirely from fully recycled nylon waste. Apollo Tyres Ltd. will utilize this new environment-friendly material for specific product lines across various market sectors.

-

In April 2023, Kordsa Teknik Tekstil A.Ş. revealed its plans to expand its production facility in Tennessee, U.S. The organization invests USD 50 million to enhance and expand the factory's manufacturing capacity. The Chattanooga-based factory currently produces Nylon 66 yarn, which is then shipped to North Carolina to produce tire cord fabric. With this expansion, Kordsa will have the capability to manufacture tire cord fabric locally, which can then be sold to tire makers in the U.S.

-

In September 2022, TEIJIN LIMITED announced that Teijin Frontier Co., Ltd., its business unit, had developed an environment-friendly tire cord by utilizing a low-impact, chemically recycled polyester fiber and an adhesive-free from resorcinol formaldehyde (RF), which is a carcinogen harmful to both humans and the environment.

-

In September 2022, Kolon Industries Inc. announced the successful expansion of its tire cord manufacturing facility in Vietnam's Binh Duong province. The company is making rapid progress in enhancing its global competitiveness. This expansion has enabled the company to bring its annual manufacturing capacity for PET (polyester) tire cords at the facility to 19,200 tons, bringing its global capacity to 103,200 tons.

Tire Cord Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.09 billion

Revenue forecast in 2030

USD 8.22 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actual estimates/Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; South Korea; Thailand; Australia; Brazil; UAE; Saudi Arabia

Segments covered

Material, tire type, vehicle type, application, region

Key companies profiled

Indorama Ventures Public Company Limited; Kolon Industries Inc.; SRF Ltd.; TEIJIN LIMITED; Century Enka Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tire Cord Fabrics Market Report Segmentation

This report forecasts volume & revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tire cord fabrics market based on material, tire type, vehicle type, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nylon

-

Polyester

-

Rayon

-

Others

-

-

Tire Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Radial

-

Bias

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

OEM

-

Replacement

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Frequently Asked Questions About This Report

b. The global tire cord fabrics market size was estimated at USD 5.79 billion in 2024 and is expected to reach USD 6.09 billion in 2025.

b. The global tire cord fabrics market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 8.22 billion by 2030.

b. Polyester material accounted for the largest revenue share of 54.4% in 2024 of the tire cord fabrics market, owing to its growing application in manufacturing of passenger car tires on account of its low cost and high strength.

b. Some of the key players operating in the tire cord fabrics market include Toray Industries Inc., Kolon Industries Inc., Teijin Ltd., Milliken & Company, and Century Enka Limited.

b. The key factors that are driving the tire cord fabrics market include the rising demand for automobiles coupled with rising adoption of fuel efficient and durable tires across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."