- Home

- »

- Plastics, Polymers & Resins

- »

-

TPE Films And Sheets Market Size, Industry Report, 2033GVR Report cover

![TPE Films And Sheets Market Size, Share & Trends Report]()

TPE Films And Sheets Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (SBC, TPU, TPO, TPV), By Form (Films, Sheets), By Application (Medical & Healthcare, Automotive, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-677-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

TPE Films And Sheets Market Summary

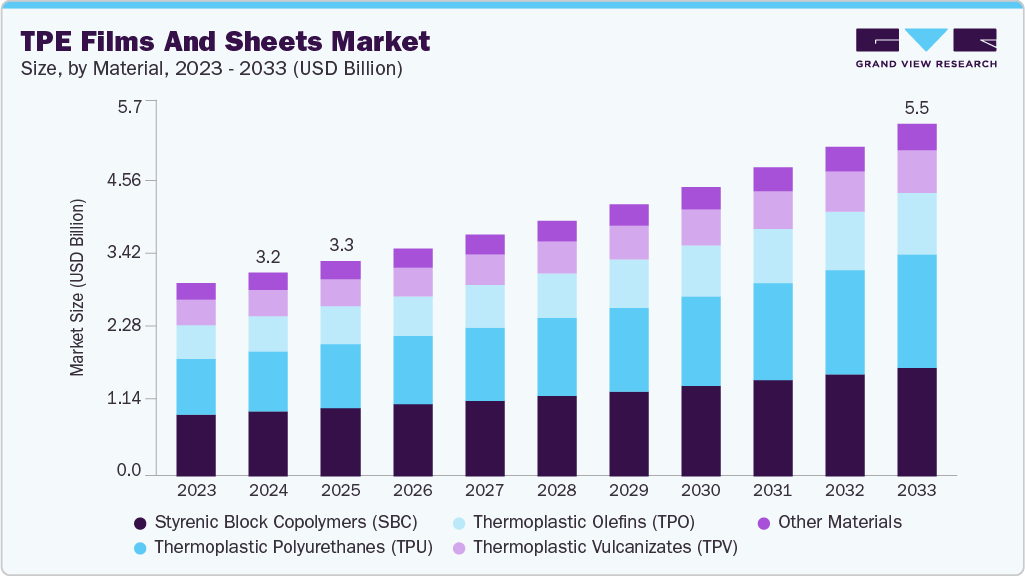

The global TPE films and sheets market size was estimated at USD 3.18 billion in 2024 and is projected to reach USD 5.49 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The market is driven by the demand for flexible, durable, and recyclable materials in the medical, automotive, packaging, and consumer goods sectors.

Key Market Trends & Insights

- Asia Pacific dominated the TPE films and sheets market with the largest revenue share of 43.02% in 2024.

- The TPE films and sheets market in India is expected to grow at the fastest CAGR of 7.6% from 2025 to 2033.

- By material, thermoplastic polyurethanes are expected to grow at the fastest revenue CAGR of 7.4% from 2025 to 2033.

- By form, films are expected to grow at the fastest CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By application, the medical & healthcare industry is expected to grow in revenue at the fastest CAGR of 7.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3.18 Billion

- 2033 Projected Market Size: USD 5.49 Billion

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2024

TPEs combine the elasticity of rubber with the processability of plastics, offering flexibility, resistance, and lightweight properties. Films and sheets made from TPEs are increasingly favored in applications that require comfort, chemical resistance, biocompatibility, and aesthetic versatility. The expanding focus on sustainability, safety, and performance also supports the market, as industries move toward reducing VOC emissions and adopting recyclable or bio-based alternatives. Technological advancements in processing, such as multi-layer extrusion, solvent-free coatings, and thermoforming, are expanding the material's usability in demanding end use sectors such as wound care, automotive interiors, wearable electronics, and smart packaging.

Drivers, Opportunities & Restraints

A primary driver for the TPE films and sheets industry is the growing demand in the medical and healthcare industry, where these materials are used in surgical drapes, wound dressings, tubing sheets, and flexible medical devices. TPE films offer excellent biocompatibility, softness, and sterilizability, making them ideal for sensitive clinical environments. Moreover, the aging population and expanding access to healthcare in developing countries are driving higher consumption of disposable and reusable medical products, many of which incorporate TPE materials.

One of the most significant opportunities in the market lies in the development of bio-based and recyclable TPE solutions. With increasing global pressure to reduce plastic waste and improve environmental footprints, manufacturers are investing in greener alternatives. Innovations in bio-based TPU and recyclable SBC blends are creating new avenues in medical, consumer goods, and sustainable packaging.

The market has a high production cost compared to conventional plastics like polyethylene or PVC. Advanced TPEs such as TPU or TPV require specialized compounding, additives, and manufacturing setups, which can increase overall production costs. This can limit adoption in highly price-sensitive sectors or in developing economies where cheaper alternatives dominate. Small- to mid-sized manufacturers often struggle with the capital investment required to scale up high-performance TPE film production.

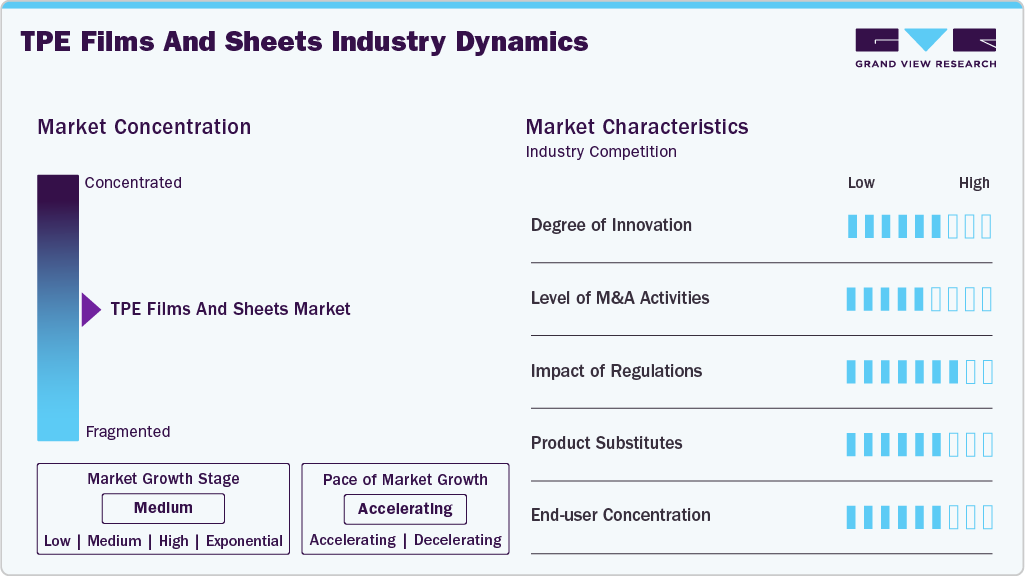

Market Concentration & Characteristics

The TPE films and sheets industry is in a medium growth stage and accelerating. It also exhibits a moderate to high degree of innovation. Innovations in solvent-free and recyclable TPU films, multilayer extrusion techniques, and nano-reinforced TPEs have allowed manufacturers to cater to the rising demand for safer, lighter, and more functional materials.

Mergers and acquisitions in the market are moderate but strategically significant, as companies aim to strengthen their technology portfolios and regional footprints. Leading chemical and materials firms have acquired specialty TPE producers or niche film converters to integrate vertically and access high-margin segments like healthcare and electronics.

Regulations play an increasingly important role in shaping the TPE films and sheets industry. Strict norms around plastic waste, VOC emissions, medical material compliance, and food-contact safety are pushing manufacturers to develop cleaner, safer, and recyclable TPE formulations. In Europe and North America, producers are offering sustainable alternatives to traditional flexible plastics, which is accelerating the transition to recyclable and bio-based TPE solutions.

The market faces competition from substitutes such as flexible PVC, silicone rubber films, EVA, and polyethylene-based sheets. While TPE films offer advantages in elasticity, safety, and sustainability, their higher cost can deter substitution in commoditized applications.

End user concentration in the market is moderate, with significant demand coming from a few dominant sectors, namely, medical & healthcare, automotive, and consumer goods. Large medical device manufacturers and automotive OEMs wield considerable influence over product specifications and purchasing terms.

Material Insights

Styrenic Block Copolymers (SBC) dominated the market across the material in terms of revenue, accounting for a market share of 31.94% in 2024. SBC-based TPE films and sheets are widely used due to their high elasticity, softness, and ease of processing. These materials are particularly popular in hygiene, packaging, and medical applications where comfort, transparency, and skin contact safety are critical. SBCs also offer cost advantages compared to other high-performance TPEs, making them a preferred choice for high-volume disposable products.

Thermoplastic Polyurethanes (TPU) are anticipated to grow at a significant CAGR of 7.4% through the forecast period. TPU is known for its exceptional abrasion resistance, elasticity, and transparency, making it ideal for high-performance uses in healthcare, automotive interiors, and consumer electronics. TPU also offers superior durability and biocompatibility, which makes it a go-to material for medical films, wearable sensors, and flexible protective gear.

TPO-based films and sheets are widely used in automotive and construction applications due to their ruggedness, UV resistance, and relatively low cost. These materials are favored for producing lightweight, weather-resistant components like roofing membranes, door panels, and protective covers.

TPV films and sheets combine the flexibility of elastomers with the durability of thermoplastics, making them suitable for automotive seals, soft-touch surfaces, and weatherproof applications. With higher heat resistance and better long-term aging properties than other TPEs, TPVs are increasingly used in under-the-hood and interior automotive parts.

Form Insights

Films led the market across the form segmentation in terms of revenue, accounting for a market share of 62.02% in 2024. TPE films are extensively used in flexible and thin-gauge applications where lightweight, conformability, and barrier properties are essential. These films are found in medical drapes, flexible packaging, electronic wearables, and hygiene products.

The demand for solvent-free, breathable, and skin-contact-safe films is particularly high in medical and personal care segments, with TPU and SBC dominating this space. TPE films also allow for high-quality printing, adding value in branded consumer packaging.

The sheets segment is expected to expand at a substantial CAGR of 5.6% through the forecast period. TPE sheets are thicker and more rigid than films, suitable for thermoforming, die-cutting, or structural applications. They are often used in automotive interiors, flooring, gaskets, and protective panels.

Sheets provide greater mechanical strength and are preferred where load-bearing or dimensional stability is critical. TPV and TPO are commonly used in sheet form, as they offer resistance to UV, heat, and impact, making them ideal for long-term or outdoor use.

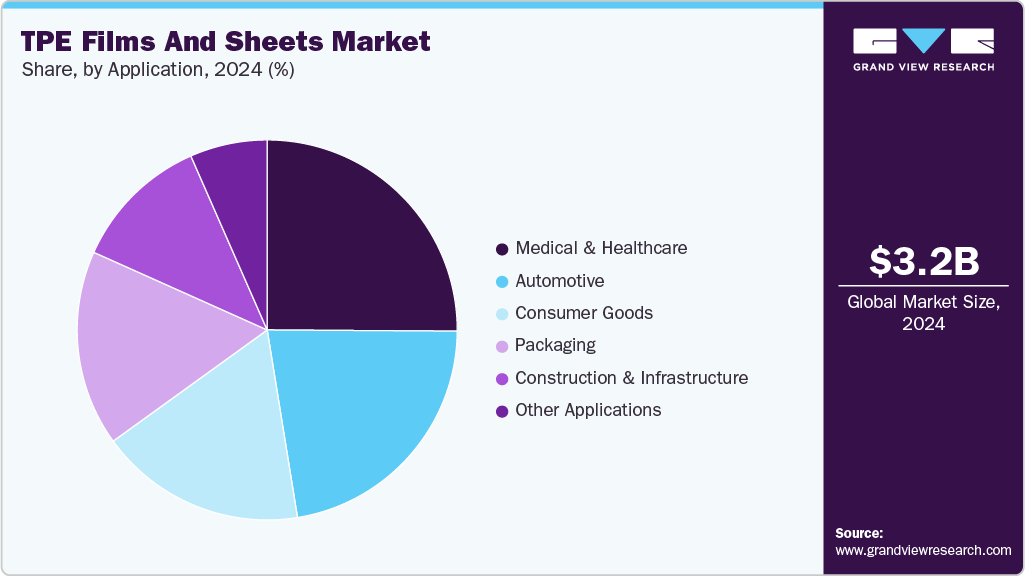

Application Insights

Medical & healthcare dominated the market in terms of revenue across applications, accounting for a market share of 25.10% in 2024. In the medical sector, TPE films and sheets are utilized owing to their biocompatibility, softness, and resistance to sterilization processes. These materials are used in wound care, surgical barriers, medical tubing covers, and wearable health devices.

The packaging segment is projected to witness a substantial CAGR of 7.3% over the forecast period. TPE films are increasingly replacing traditional plastics in flexible packaging due to their recyclability, transparency, and sealing performance. The shift toward mono-material, recyclable, and bio-based packaging is further propelling TPE film demand, especially in regions with stringent plastic regulations.

TPE films and sheets are increasingly used in the automotive industry for both functional and aesthetic components. They are applied in dashboard skins, door trims, under-the-hood insulation, and noise reduction layers. Lightweight and recyclable TPEs like TPO and TPV align well with the automotive sector’s goals of emissions reduction and cost-efficiency. As electric vehicles (EVs) rise, demand is expected to grow for soft-touch, noise-dampening, and thermally stable elastomeric materials.

In consumer goods, TPE films and sheets provide comfort, aesthetics, and durability across applications such as sports equipment, electronic accessories, and personal care items. TPU and SBC are particularly favored in this segment for their ability to deliver high performance in both functional and fashion-forward designs.

Regional Insights

North America TPE films and sheets industryis a mature yet innovation-driven market for TPE films and sheets, supported by strong regulatory frameworks, advanced healthcare systems, and demand for high-performance materials in automotive and electronics. There is a rising emphasis on sustainable and recyclable materials, particularly in the medical and packaging sectors, prompting higher use of solvent-free TPU films and multi-layer SBC composites.

U.S. TPE Films And Sheets Market Trends

The TPE films and sheets industryinthe U.S. leads the North American market, characterized by its demand for high-quality, biocompatible, and performance-oriented TPE products. Applications in medical device manufacturing, premium automotive interiors, and consumer electronics are key industry drivers.

Asia Pacific TPE Films And Sheets Market Trends

Asia Pacific TPE films and sheets industry accounted for the fastest and largest region with a revenue share of 43.02% in 2024, due to its expansive manufacturing base, rising healthcare infrastructure, and booming automotive industry. Countries such as China, Japan, South Korea, and India are at the forefront of TPE adoption, leveraging the material’s versatility for applications in medical products, packaging, and interiors.

China TPE films and sheets industry is the largest contributor within the Asia Pacific region, driven by its massive production and export-oriented industries. The country’s dominance in automotive, electronics, and low-cost medical devices creates strong demand for TPE films and sheets. With domestic companies rapidly modernizing to comply with environmental standards, there’s a notable shift toward recyclable and bio-based TPE materials, especially TPU films used in medical packaging and smart wearable devices.

The India TPE films and sheets industryis growing steadily, fueled by expanding sectors such as healthcare, e-commerce, packaging, and affordable automotive manufacturing. Increasing foreign investments in healthcare infrastructure and consumer goods production, along with supportive government initiatives like Make in India, are creating new opportunities for TPE suppliers.

Europe TPE Films And Sheets Market Trends

The TPE films and sheets industryin Europe is driven by thestrongdemand for TPE films and sheets in automotive interiors, medical packaging, and green construction materials. EU regulations on plastic waste and safety standards are pushing manufacturers to transition toward recyclable and non-toxic alternatives, such as TPU and TPV. Germany, France, and Italy are leading adopters, supported by sophisticated supply chains and environmental innovation.

Germany TPE films and sheets industry exhibits high demand from its automotive and medical technology industries. Known for precision engineering and strict regulatory compliance, the country favors high-quality, thermally stable, and recyclable materials. German OEMs are integrating advanced TPE films in interiors and consumer health devices, driving innovation in multi-functional, durable, and eco-friendly sheet and film formats.

Latin America TPE Films And Sheets Market Trends

The TPE films and sheets industry in Latin America is emerging, with demand driven by the growing automotive sector, medical imports, and packaging requirements. While economic challenges and price sensitivity restrict high-end material use, countries like Brazil and Argentina are seeing increasing adoption of SBC and TPO-based films due to their cost-efficiency and flexibility.

Middle East & Africa TPE Films And Sheets Market Trends

The Middle East & Africa TPE films and sheets industryis still in a nascent phase but holds promise due to rising urbanization, growing medical imports, and increasing investment in industrial manufacturing. GCC countries are gradually adopting advanced materials for healthcare and infrastructure development, while African nations focus on cost-effective SBC and TPO films.

Saudi Arabia TPE films and sheets industryis driven by Vision 2030’s push to diversify the economy and grow non-oil industries such as healthcare, automotive, and packaging. The government’s emphasis on sustainable materials and domestic manufacturing is fostering interest in TPE-based solutions.

Key TPE Films And Sheets Company Insights

The global TPE films and sheets industry is moderately consolidated, with a mix of large multinational chemical companies and specialized film converters competing across diverse end-use industries. Leading players differentiate themselves through product innovation, material customization, and strong application-specific expertise, especially in medical, automotive, and electronics sectors.

Key TPE Films And Sheets Companies:

The following are the leading companies in the TPE films and sheets market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Covestro AG

- Lubrizol Corporation

- Kraton Corporation

- Teknor Apex Company

- American Polyfilm Inc.

- 3M

- Huntsman Corporation

- RTP Company

- Permali

Recent Developments

-

In September 2024, Teknor Apex launched its new Monprene R6 CP‑10100 line of thermoplastic elastomers (TPEs), which incorporates 60% post‑consumer recycled (PCR) content while maintaining the performance, translucency, and vibrant colorability of virgin TPEs. Designed for injection molding and overmolding onto polypropylene, Monprene R6 CP‑10100 TPEs are fully recyclable and ideal for applications such as sporting goods, lawn & garden products, consumer electronics, appliances, and personal care items

TPE Films And Sheets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.36 billion

Revenue forecast in 2033

USD 5.49 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, form, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

BASF SE; Covestro AG; Lubrizol Corporation; Kraton Corporation; Teknor Apex Company; American Polyfilm Inc.; 3M; Huntsman Corporation; RTP Company; Permali

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

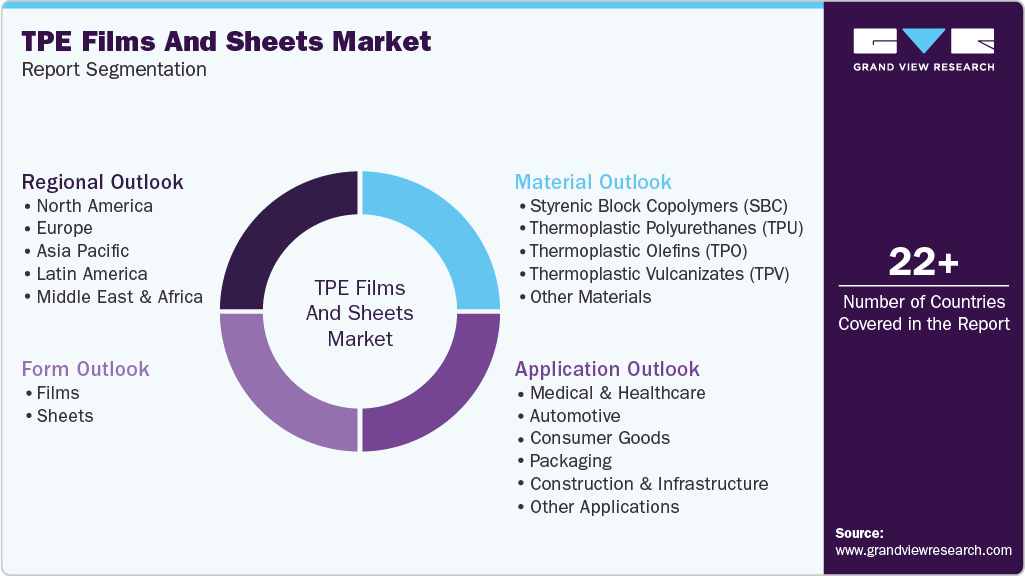

Global TPE Films And Sheets Market Report Segmentation

This report forecasts revenue & volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the TPE films and sheets market report based on material, form, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Styrenic Block Copolymers (SBC)

-

Thermoplastic Polyurethanes (TPU)

-

Thermoplastic Olefins (TPO)

-

Thermoplastic Vulcanizates (TPV)

-

Other Materials

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Films

-

Sheets

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical & Healthcare

-

Automotive

-

Consumer Goods

-

Packaging

-

Construction & Infrastructure

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global TPE films and sheets market size was estimated at USD 3.18 billion in 2024 and is expected to reach USD 3.36 billion in 2025.

b. The global TPE films and sheets market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2033, reaching USD 5.49 billion in 2033.

b. Asia Pacific dominated the global TPE films and sheets market with a revenue share of 43.02% in 2024, due to its expansive manufacturing base, rising healthcare infrastructure, and booming automotive industry.

b. Some of the key players in the global TPE films and sheets market include BASF SE, Covestro AG, Lubrizol Corporation, Kraton Corporation, Teknor Apex Company, American Polyfilm Inc., 3M, Huntsman Corporation, RTP Company, and Permali.

b. Key factors driving the global TPE films and sheets market are high demand for flexible, durable, and recyclable materials in the medical, automotive, packaging, and consumer goods sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.