- Home

- »

- Plastics, Polymers & Resins

- »

-

Styrenic Block Copolymer Market Size & Share Report, 2045GVR Report cover

![Styrenic Block Copolymer Market Size, Share & Trends Report]()

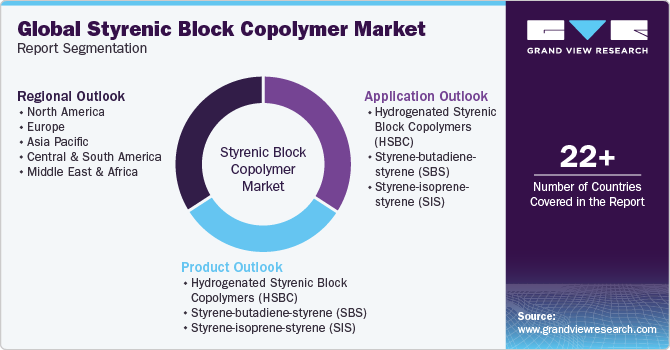

Styrenic Block Copolymer Market (2024 - 2045) Size, Share & Trends Analysis Report By Product (Hydrogenated Styrenic Block Copolymers, Styrene-butadiene-styrene, Styrene-isoprene-styrene), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-052-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2013 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Styrenic Block Copolymer Market Trends

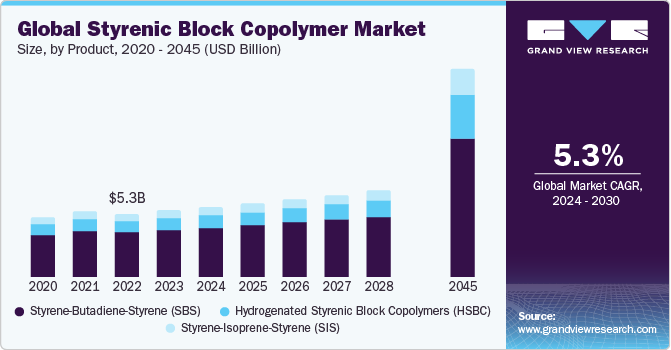

The global styrenic block copolymer market size was estimated at USD 5.58 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2045. The styrenic block copolymers (SBC) are produced by ionic copolymerization of styrene, isoprene, and butadiene and are considered one of the largest volume commercial thermoplastic elastomers. The market is expected to be driven by the rising demand from various applications such as footwear, adhesives & sealants, paints & coatings, polymer modification, paving and roofing, toys, and medical devices.

Rising positive coronavirus cases again in China and across the globe have up surged the demand for medical components such as IV drip chambers, bags, and tubing, further projecting to propel market growth. Rising positive coronavirus cases again in China and across the globe have up surged the demand for medical components such as IV drip chambers, bags, and tubing, further projecting to propel market growth.

On account of their molecular structure, styrenic block copolymers possess processing characteristics of thermoplastics and mechanical properties of rubbers. SBC’s consist of one soft elastomeric midblock and two hard polystyrene end blocks. The styrenic block copolymers display good elastomeric properties once they have solidified and exhibited higher tensile strength, compared to unreinforced vulcanized rubbers.

The raw materials of styrenic block copolymers such as styrene, isoprene, and butadiene are derived from derivatives of crude oil. External factors that could affect the price of raw materials include the unpredictability of changes in laws or regulations, war, pandemics, political instability, production disruption, natural disasters, civil unrest, terrorist attacks, and degradation of transportation infrastructure used to deliver raw materials in any of the countries. Future supply-demand changes is likely to lead to volatility in the prices of styrenic block copolymers. The cost of these raw materials is also significantly influenced by the changes in energy prices. For instance, the on-going eastern European geopolitical conflict between Russia and Ukraine has spiked energy prices thus significantly imprinting its marks on the styrenic block copolymers’ raw material prices.

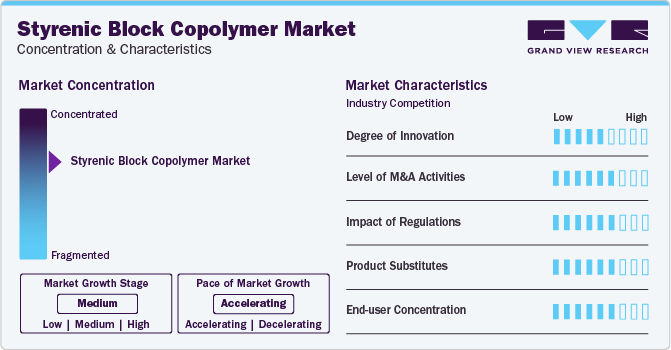

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include LCY Group, KRATON CORPORATION, ZEON CORPORATION, Asahi Kasei Corporation, China Petroleum & Chemical Corporation (Sinopec), INEOS, and Styrolution Group GmbH, among others. Several players are engaged in framework development to improve their market share.

Regulatory measures and policies aimed at the production of styrenic block copolymer are likely to impact the market growth. The production of HSBCs must be listed on relevant chemical inventories like the US Toxic Substances Control Act (TSCA), EU Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), and Japanese Existing and New Chemical Substances (ENCS). Restrictions on volatile organic compounds (VOCs) or persistent organic pollutants (POPs) can impact the use of certain SBCs.

Competition from substitute materials poses a significant restraint to the SBC market, challenging its market share and growth prospects. Various alternative materials, such as thermoplastic polyurethanes (TPUs), engineering plastics, and natural rubber, offer comparable or even improved properties at lower costs, thus enticing manufacturers to explore alternatives to traditional SBCs.

Companies are pursuing global expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for Styrenic Block Copolymer (SBC) materials in several applications including footwear, adhesives, and asphalt modifier.

Product Insights

The styrene-butadiene-styrene segment led the market with the largest revenue share of over 70.58% in 2023. SBS falls under the category of unsaturated styrenic block copolymers along with styrene isoprene styrene (SIS). The polystyrene composition of the SBS provides durability while the polybutadiene chain of the composition allows the material to be able to return to its original state upon stretching. SBS is most widely utilized in demanding, high-performance applications such as adhesives & sealants, asphalt/bitumen modification, polymer modification, and vulcanized compounding. These copolymers display significant advantages for adhesives formulation since they work efficiently at processing temperatures & act like reinforced elastic rubbers under standard application conditions.

In addition, the SBS is used in the modification of various polymers that include high impact polystyrene (HIPS), general purpose polystyrene (GPP), acrylonitrile butadiene styrene (ABS), and bulk molding compounds. The outlook for SBS in polymer modification is expected to be positive due to the stable growth of automotive production in developed regions such as North America and Europe coupled with the increasing requirements of home appliances in developing regions such as Southeast Asia and the Middle East.

The styrene ethylene butadiene styrene (SEBS), styrene-ethylene propylene styrene (SEPS), and styrene isoprene butadiene styrene (SIBS) fall under the hydrogenated styrenic block copolymer category. The presence of double bonds in the midblock structure of SIS and SBS makes them vulnerable to oxidative and thermal degradation. The hydrogenated styrenic block copolymers such as SEPS, SEBS, and SIBS have more stability compared to unsaturated SBC, thereby exhibiting an improved weathering resistance, thermal resistance, and ability to withstand exposure to harsh outdoor environments.

SEPS has excellent UV and heat resistance, is flexible, and is simple to process. By partially and selectively hydrogenating styrene-isoprene-styrene copolymers (SIS), SEPS can be produced. The hydrogenation process also increases thermal stability, weathering, and oil resistance along with the ability to withstand steam sterilization. The above-mentioned properties makes SEPS useful in applications such as hot melt adhesives, impact modification for engineering thermoplastics, and paving & roofing.

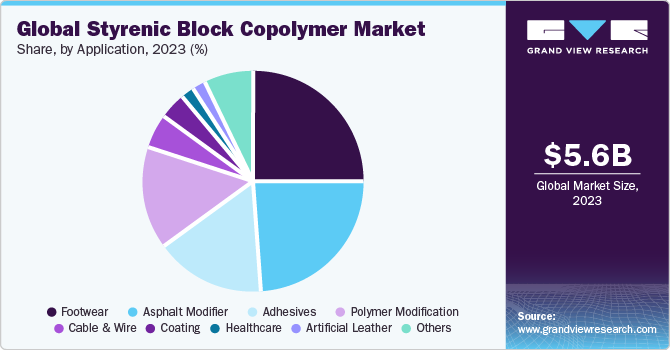

Application Insights

Based on application, the footwear segment led the market in 2023 with the largest revenue share of over 20.93%. In the SBC market, the manufacturing of footwear is one prominent and widespread application. It is known for its excellent elasticity, durability, and adhesive properties. As such, SBS is extensively used in the production of shoe soles. The unique ability of this copolymer to combine flexibility with toughness makes it an ideal material for creating comfortable and resilient footwear that can withstand the rigors of daily use.

The asphalt modifier segment is expected to grow at a significant CAGR during the forecast period. One of the significant applications of SBC is in asphalt modification wherein it plays an essential role in enhancing the properties of asphalt used in road construction. This copolymer is commonly used as a polymer modifier to improve the performance of asphalt by imparting increased elasticity and durability to it.

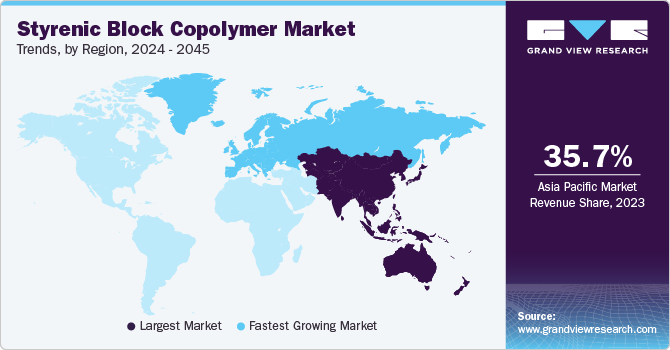

Regional Insights

The styrenic block copolymer (SBC) market in North America is expected to grow at a significant CAGR over the forecast period, and is also accounted with the revenue share of 26.69% in 2023. An increase in the adoption of SBC in food packaging as stretch wrapping films, along with regulatory approval in the U.S. for the use of SBC in medical applications such as medical tubing, is going to drive market growth in North America. Strong demand from the footwear industry, coupled with an increase in the number of road development projects, is anticipated to further boost the market growth.

U.S. Styrenic Block Copolymer (SBC) Market Trends

The styrenic block copolymer (SBC) market in U.S. is expected to grow at the fastest CAGR over the forecast period. The growing number of automobiles running on the road has driven the government of the U.S. to fund new road and highway infrastructure projects to tackle the congestion issues. Moreover, the U.S. government has also announced funding to modernize and repair the existing roads, bridges, ports, rails, and intermodal transportation system which can drive the demand for asphalt modification, thereby fueling the demand for styrenic block copolymers in the U.S.

Asia Pacific Styrenic Block Copolymer (SBC) Market Trends

Asia Pacific dominated the styrenic block copolymer (SBC) market with a revenue share of over 35.65% in 2023. This is attributed to the strong demand from end-use industries such as paving & roofing, footwear, adhesives & sealants, and medical devices. Rapid expansion in the construction sector influenced by the growing desire for affordable housing and government schemes promoting basic amenities is driving the market growth in emerging economies such as India, China and Indonesia.

The styrenic block copolymer (SBC) market in China is anticipated to register at the fastest CAGR of 4.9% over the forecast period. China dominates the market in Asia Pacific region, owing to the growing demand for prefabricated buildings in the country. The flourishing automotive, construction, footwear, and medical device industries in China surge the demand for styrenic block copolymers (SBCs) in the country as they provide flexibility, durability, and impact resistance to the products being developed by these industries.

The Japan styrenic block copolymer (SBC) market is expected to grow at a significant CAGR in the forecast period, owing to the increasing footwear manufacturing in the country, coupled with the strong demand for this copolymer for use in paving & roofing applications.

Europe Styrenic Block Copolymer (SBC) Market Trends

The styrenic block copolymer (SBC) market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The growth of various end-use industries in Europe, including footwear, automotive, etc., as well as the rise in infrastructure developments, is anticipated to drive demand for SBCs in the region over the forecast period. Countries such as France, Germany, Italy, Russia, and the UK are the major producers and consumers of these copolymers in Europe.

The Germany styrenic block copolymer (SBC) market held a significant share in Europe. The market is anticipated to register at the fastest CAGR of 5.3% over the forecast period. Germany has a well-established automotive industry. SBCs are increasingly being used for developing automotive components owing to their lightweight, superior impact resistance, and high design flexibility. Moreover, the surging use of SBCs in paving & roofing applications, as well as in polymer modifiers, footwear, and adhesives & sealants is also contributing to the market growth.

The styrenic block copolymer (SBC) market in UK is expected to grow at a significant CAGR during the forecast period. The rising cases of chronic diseases among the elderly population in the country drive the demand for advanced medical devices in the UK. This, in turn, surges the production of medical devices in the country. Thus, increasing production of medical devices in the UK is expected to fuel the consumption of SBCs in the country.

Central & South America Styrenic Block Copolymer (SBC) Market Trends

The styrenic block copolymer (SBC) market in Central & South America is expected to witness at a significant CAGR over the forecast period. The rise in disposable incomes and expansion in end-use manufacturing industries are expected to boost the demand for SBCs in the region.

The Brazil styrenic block copolymer (SBC) market held a significant share in Central & South America. The market is anticipated to register at the fastest CAGR of 6.1% over the forecast period. The increasing urbanization of Brazil's population is driving demand for footwear, owing to the rise in urbanization, and creating market growth opportunities.

Middle East & Africa Styrenic Block Copolymer (SBC) Market Trends

The styrenic block copolymer (SBC) market in the Middle East & Africa is expected to witness at the significant CAGR over the forecast period. The market in the Middle East & Africa is characterized by high consumption rates of these copolymers in Saudi Arabia and the UAE. These two countries accounted for a share of over 56% of the market in the Middle East & Africa in terms of volume in 2023.

Key Styrenic Block Copolymer Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Styrenic Block Copolymer Companies:

The following are the leading companies in the styrenic block copolymer (SBC) market. These companies collectively hold the largest market share and dictate industry trends.

- LCY Group

- KRATON CORPORATION

- ZEON CORPORATION

- Asahi Kasei Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- INEOS Styrolution Group GmbH

- JSR Corporation

- Korea Kumho Petrochemical Co., Ltd.

- TSRC

- En Chuan Chemical Industries Co., Ltd.

- Denka Company Limited

- Kuraray Co., Ltd.

- Dynasol Group

- LG Chem

- CHIMEI

- Versalis S.p.A.

- SIBUR

- Zhejiang Zhongli Synthetic Material Technology Co., Ltd.

- Fujian Gulei Petrochemical Co., Ltd.

Recent Developments

-

In February 2024, Kraton Corporation, a manufacturer of high-value biobased products and specialty polymers, announced an investment worth USD 35 million to upgrade its existing crude tall oil biorefinery towers in its production facility in Panama City, Florida, U.S.

-

In July 2023, KKR & CO. INC. announced the expansion of its chemicals portfolio by acquiring Chase Corporation at an investment valued at USD 1.3 billion. This acquisition is expected to help KKR & CO. INC. expand its exposure in the specialty chemicals space

-

In June 2023, Kraton Corporation, one of the leading manufacturers of high-value biobased products and specialty polymers, announced the expansion of its existing manufacturing facility in Berre, France. The company stated that it will produce up to 100% ISCC PLUS certified renewable SBC through a mass balance approach under the brand name, CirKular+ ReNew Series. This initiative emphasizes Kraton's commitment to sustainability, offering products with up to 85% cradle-to-gate carbon footprint reduction (including biogenic carbon) when compared to fossil-based alternatives manufactured at the Berre facility

Styrenic Block Copolymer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.87 billion

Revenue forecast in 2045

USD 17.37 billion

Growth rate

CAGR of 5.3% from 2024 to 2045

Base year for estimation

2023

Historical data

2013 - 2022

Forecast period

2024 - 2045

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2045

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America: Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Norway; China; India; Japan; Australia; Thailand; South Korea; Malaysia; Indonesia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

LCY Group; KRATON CORPORATION; ZEON CORPORATION; Asahi Kasei Corporation; China Petroleum & Chemical Corporation (Sinopec); INEOS; Styrolution Group GmbH; JSR Corporation; Korea Kumho Petrochemical Co., Ltd.; TSRC, En Chuan Chemical Industries Co., Ltd.; Denka Company Limited, Kuraray Co., Ltd.; Dynasol Group; LG Chem; CHIMEI; Versalis S.p.A.; SIBUR; Zhejiang Zhongli Synthetic Material Technology Co., Ltd.; Fujian Gulei Petrochemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Styrenic Block Copolymer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2013 to 2045. For this study, Grand View Research has segmented the global styrenic block copolymer market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2045)

-

Hydrogenated Styrenic Block Copolymers (HSBC)

-

Styrene-butadiene-styrene (SBS)

-

Styrene-isoprene-styrene (SIS)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2045)

-

Hydrogenated Styrenic Block Copolymers (HSBC)

-

Cable & Wire

-

Footwear

-

Asphalt Modifier

-

Adhesives

-

Artificial Leather

-

-

Styrene-butadiene-styrene (SBS)

-

Footwear

-

Asphalt Modification

-

Polymer Modification

-

Adhesives

-

Others

-

-

Styrene-isoprene-styrene (SIS)

-

Coating

-

Pressure Sensitive Adhesives

-

Healthcare

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2013 - 2045)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Malaysia

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global styrenic block copolymer market size was estimated at USD 5.58 billion in 2023 and is expected to reach USD 5.87 billion in 2024.

b. The global styrenic block copolymer market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2045 to reach USD 17.37 billion by 2045.

b. The Asia Pacific dominated the styrenic block copolymer market with a share of over 35.50% in 2023. This is attributable to strong demand from the construction, footwear, adhesives & sealants industry.

b. Some of the key players operating in the global styrenic block copolymer market include KRATON CORPORATION, Versalis S.p.A., INEOS Styrolution Group GmbH, JSR Corporation, Korea Kumho Petrochemical Co., Ltd., China Petrochemical Corporation, LYC Group, LG Chem, Zeon Europe GmbH, Asahi Kasei Corporation, TSRC, KURARAY CO., LTD, and Grupo Dynasol.

b. Key factors driving the styrenic block copolymer market growth include increasing demand in medical applications and growing demand from the footwear industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.