- Home

- »

- Clinical Diagnostics

- »

-

Trypsin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Trypsin Market Size, Share & Trends Report]()

Trypsin Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Bovine, Porcine), By Application (Biotechnology & Pharmaceutical Industry, Food Industry), By End-use (Research, Diagnostic, Industrial Use), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-273-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Trypsin Market Size & Trends

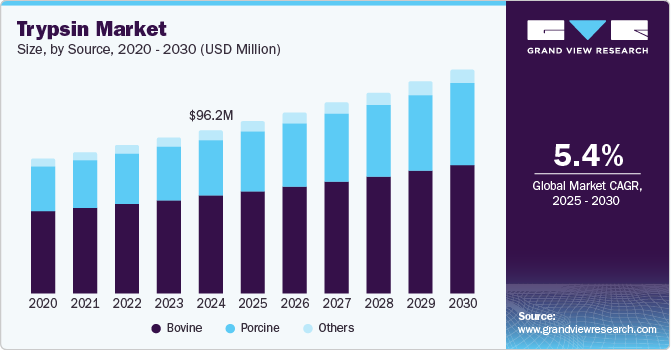

The global trypsin market size was estimated at USD 96.2 million in 2024 and is anticipated to grow at a CAGR of 5.4% from 2025 to 2030. Trypsin is an enzyme essential for protein digestion, with its growing use across various industries-including pharmaceuticals, food science research, detergents, and leather-bating-expected to boost market expansion. Additionally, the rising emphasis on drug discovery and development is further accelerating market growth.

In February 2022, the International Agency for Research on Cancer (IARC) reported that during the pandemic, new cases of colon cancer reached approximately 1.15 million. This number is projected to rise to 1.82 million by 2040, reflecting an increase of 56% between 2020 and 2040, with over 3 million new cases per year anticipated in the coming years. Alongside this, trypsin has garnered attention for its potential tumor-suppressive properties, suggesting its possible use in cancer treatments. This is expected to contribute to the growing demand for trypsin-related studies and therapeutics, further driving market growth during the forecast period.

Trypsin’s use in food and pharmaceutical manufacturing is being shaped by innovative techniques and ongoing research. For instance, in April 2020, a study published by Microbial Cell Factories explored the high hydrolysis efficacy of microbial Streptomyces griseus trypsin (SGT), indicating its potential as a trypsin source for insulin production. The study’s findings, particularly concerning the adaptive mutant trypsin (K101A), highlighted a significant increase in trypsin production. Such research and developments are poised to propel market expansion.

Widely used in pharmaceutical, food, and environmental research and development, the enzyme is valued for its unique ability to hydrolyze proteins. It also serves as a raw material for internal medicine, especially in treatments for endocrine diseases and clinical surgery. The use of enzyme catalysts has been scaled up for commercial applications in the pharmaceutical, food, and beverage industries, helping reduce waste and increasing efficiency in these sectors. Additionally, TRYPSIN VI, considered one of the best sources of trypsin, has found applications in nutraceuticals, particularly as an anti-inflammatory agent and a digestive supplement for both veterinary and human use.

Numerous studies are also investigating diagnostic potential for a range of disorders, including cancer, acute pancreatitis, malabsorption, and cystic fibrosis. Rising R&D investments, increased drug launches, and regulatory approvals are further driving the market. For instance, in October 2022, Phathom Pharmaceuticals partnered with Evonik to manufacture vonoprazan, a gastrointestinal drug recently approved by the FDA for treating gastric acid-related diseases. Such developments are expected to create ample opportunities in the global trypsin market during the forecast period.

Source Insights

The bovine segment dominated the market with the largest share of 59.71% in 2024. Due to its specific cleavage activity, bovine trypsin has gained widespread use across various fields. It is not only readily available but also relatively affordable compared to other proteases. Animal-derived bovine trypsin is commonly utilized in vaccine production, and research laboratories, such as Sisco Research Laboratories, rely on it for cell culture applications. Leading companies like Merck Millipore and Thermo Fisher Scientific also offer bovine trypsin products suitable for cell culture, supporting a wide range of applications. Additionally, the growing adoption in research and development within academic and pharmaceutical industries is expected to further drive market growth.

The porcine segment is expected to grow at a significant CAGR over the forecast period. Porcine trypsin is used in the production of vaccines, including those for influenza, chickenpox, polio, and rotavirus. Although animal-derived sources were historically used in vaccine development and production, their current usage is now minimized. Animal-based trypsin is only utilized when it guarantees the effectiveness and safety of vaccines, and its use is strictly regulated.

Application Insights

Biotechnology and pharmaceutical dominated the market with the largest share of 56.40% in 2024 and is the fastest-growing segment and is expected to grow at a CAGR of 5.8% over the forecast period. Trypsin is widely used in high-throughput screening methods to study protein interactions with potential drug candidates, facilitating the understanding of structure-function relationships in target proteins, which supports the development of novel therapeutics. For instance, Thermo Scientific's Pierce Trypsin Protease, MS Grade, is a highly purified enzyme chemically modified to enhance its activity and stability in proteomic applications. It is treated with Tosyl phenylalanyl chloromethyl ketone (TPCK) and methylated to improve digestive stability by eliminating chymotrypsin activity. The pharmaceutical sector is one of the most innovative industries globally, with companies investing in the development of high-quality natural enzymes and proteins. For example, Novea Technologies, Inc. produces active pharmaceutical ingredients (APIs) using pancreatic enzymes for compliant food solutions. These enzymes are used in diagnostic media and functional food ingredients, which contribute to the development of infant formulas and nutraceutical products. The company also manufactures Trypsin 1:250, derived from porcine pancreas, for cell culture applications. The wide-ranging applications, combined with its lack of adverse effects, are expected to increase its adoption by pharmaceutical companies, thereby driving market growth.

The cosmetics and personal care segment is contributing to the growth of the trypsin market, as the enzyme is increasingly used in skincare products for its exfoliating and skin-rejuvenating properties. Trypsin aids in removing dead skin cells, promoting cell turnover, and improving skin texture. Its mild nature and effectiveness in enhancing product formulations are driving its adoption, boosting segment growth.

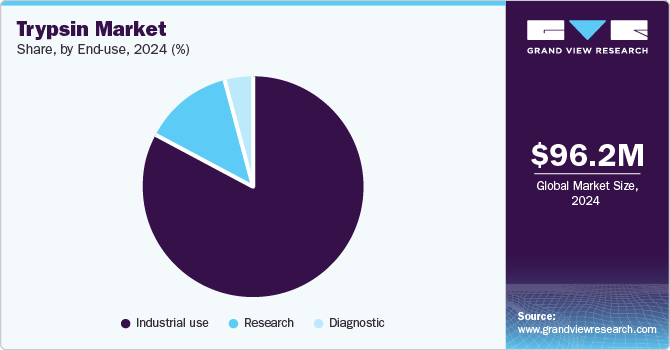

End-use Insights

The industrial use segment dominated the market in 2024 with a share of 83.02%. This growth is driven by the increasing application of trypsin industries such as detergents, leather bating, and food and pharmaceuticals. In detergents, trypsin is employed to break down protein-based stains like blood and egg. However, its use in this sector is somewhat limited due to concerns about safety and environmental impact. In the food and pharmaceutical industries, trypsin is utilized to enhance the functional properties of food proteins, including emulsification, foaming, solubility, and gelling.

The research segment is expected to grow at a rapid CAGR over the forecast period, driven by trypsin’s role in cell harvesting for cell culture preparation, particularly for detaching adherent cells from culture flasks. While trypsin has various pharmaceutical and nutritional applications, natural sources of enzyme are primarily used in molecular biology. The demand has surged due to advancements in proteomics research and innovations in R&D by companies and research institutes. For example, in January 2024, Ensysce Biosciences announced receiving FDA breakthrough status for developing tamper-proof opioids using trypsin-activated abuse protection and multi-pill abuse resistance, offering safer prescription options for pain management and helping to prevent opioid-related deaths.

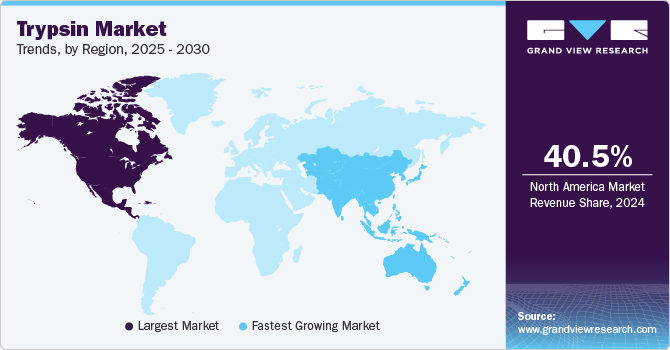

Regional Insights

The North America trypsin market dominated the global market and accounted for 40.49% of revenue share in 2024. This significant share can be attributed to the presence of major market players, including Bio-Rad Laboratories, Creative Enzymes, Hawkins, Agilent Technologies, Promega Corporation, and Thermo Fisher Scientific. Additionally, various collaborations and partnerships among these companies have fostered regional market growth. The rising incidence of pancreatitis, cystic fibrosis, and cancer in the region is also expected to drive demand in diagnostics. For example, a report from the American Lung Association in November 2022 noted approximately 30,000 cases of cystic fibrosis in the U.S., with an estimated 1 in 30 Americans being carriers. Furthermore, enzyme therapy shows potential for inhibiting the growth of metastatic tumor cells, as trypsin demonstrates tumor-suppressive properties in cancer progression. These factors are likely to further propel the growth of the trypsin market.

U.S. Trypsin Market Trends

The U.S.trypsin market held a significant share of North America market in 2024, driven by advancements in therapeutics. For instance, Merck Millipore, a key player in the U.S. market, provides various sources of Tumor-Associated Trypsin Inhibitor (TATI), which serves as a prognostic marker for colorectal cancer treatment. When combined with trypsin in certain cancer types, TATI can help minimize tissue damage by inhibiting trypsin and other proteases, leading to more favorable diagnostic outcomes. These developments in the field are expected to further increase the demand in the coming years.

Europe Trypsin Market Trends

The Europe trypsin market is experiencing significant growth driven by several factors. This growth can be attributed to the presence of key local players. In June 2021, a safety analysis published by the European Food Safety Authority (EFSA) indicated that the food enzyme trypsin derived from porcine pancreas, used for hydrolyzing whey protein and infant formula, posed a low risk of allergic sensitization following consumption. This finding is a significant factor contributing to the region's growth.

The UK trypsin market is expected to show significant growth driven by several factors, driven by a significant number of research studies published by various institutes on the use of exogenous trypsin enzymes for R&D. A study by Public Health England indicates that porcine trypsin is widely utilized by key players in vaccine manufacturing.

The Germany trypsin market is experiencing significant growth. Ongoing developments in the region, such as those at the German Cancer Research Center (DKFZ), are focused on creating new diagnostic methods. Additionally, several leading suppliers manufacture enzymes for wholesale and foreign trade, particularly for active pharmaceutical ingredients (APIs). For example, BIOZYM Gesellschaft supplies pancreatin trypsin derived from porcine pancreas to markets in the UAE, EU countries, and Asia Pacific. This increase in enzyme exports is expected to boost country’s growth in the region.

Asia Pacific Trypsin Market Trends

The Asia Pacific trypsin market is expected to grow at the fastest CAGR over the forecast period, driven by industrial growth that contributes to the economic development of various countries. Additionally, a significant portion of the population in this region suffers from wounds and injuries. According to a WHO report from October 2023, more than 1 billion people in India experience moderate to high level of burns each year. In Bangladesh, approximately 173,000 children suffer from moderate to severe burns annually. Furthermore, in Bangladesh, and Pakistan, 17% of children with burns face temporary disabilities, while 18% experience permanent disabilities. In rural Nepal, burns rank as the second most common type of injury, contributing to 5% of disabilities. The highest prevalence of burn cases is found in Southeast Asia and the Western Pacific region, where low- and middle-income countries account for over 90% of burn-related fatalities due to poverty and inadequate infrastructure. The lack of advancements in burn treatment and increasing bacterial resistance complicates management. As a result, therapies focused on controlling inflammation with oral hydrolytic enzymes, particularly trypsin, are becoming more important. These factors are expected to drive the demand in the region.

The China trypsin market is growing at a lucrative rate, fueled by rising per capita income, which leads to greater adoption of diagnostic and therapeutic solutions. Additionally, technological breakthroughs, standardized management practices, increasing acceptance of green sourcing, heightened R&D investment, and enhanced collaboration between industry and academia are all contributing to the region's growth.

Latin America Trypsin Market Trends

The Latin America trypsin market exhibits high growth potential for the trypsin market, driven by various factors. Increasing investments in the healthcare sector, growing awareness of enzyme-based therapies, and a burgeoning pharmaceutical industry are expected to propel this growth. Additionally, the region's expanding population and rising prevalence of chronic diseases are contributing to the demand for these products.

Middle East and Africa Trypsin Market Trends

The MEA trypsin market growth driven by several factors. Increasing investments in R&D and the development of healthcare infrastructure are boosting the demand for trypsin in this region. The rising need for trypsin-based treatments is a key driver. Advances in enzyme engineering are improving efficacy, expanding its applications beyond healthcare to sectors like food processing and research. Government initiatives supporting biotech research and development are also fueling market growth, creating promising opportunities for companies involved in the production and distribution of trypsin.

The Saudi Arabia trypsin market growth driven by growing awareness of trypsin's role in accelerating chemical reactions and its wide range of applications across various industries. The demand for environmentally sustainable solutions is also contributing to market growth. Several Saudi companies are collaborating with international partners, gaining access to advanced technology, distribution channels, and expertise.

Key Trypsin Company Insights

The market is highly competitive due to several strategic initiatives such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Trypsin Companies:

The following are the leading companies in the trypsin market. These companies collectively hold the largest market share and dictate industry trends.

- Merck Millipore

- Novozymes

- Agilent Technologies

- Thermo Fisher Scientific

- Sartorius AG

- Neova Technologies

- BIOZYM

- PromoCell GmbH

- Promega Corporation

- Bovogen Biologicals

- Zymetech

- BBI Solutions

- Linzyme Biosciences

Recent Developments

-

In January 2024, Creative Enzymes, a global leader in enzyme-related products and services, introduced its latest innovation: Trypsin-Chymotrypsin, a powerful combination of proteolytic enzymes poised to drive significant advancements across various industries. This launch represents a notable milestone in the scientific field, aimed at enhancing operational efficiencies.

-

In January 2023, Sun Pharma India finalized the acquisition of the Disperzyme and Phlogam brands from Aksigen. These products are the first enzyme-bioflavonoid combinations to complete scientific studies and receive DCGI approval in India, specifically designed for patients undergoing minor surgery to help manage the inflammatory response.

-

In February 2023, Water Corp launched its RapiZyme Trypsin. This chemically enhanced recombinant trypsin has demonstrated superior reliability while significantly reducing digestion time from over three hours to just 30 minutes.

Trypsin Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 101.2 million

The revenue forecast in 2030

USD 131.5 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Merck Millipore; Novozymes; Agilent Technologies; Thermo Fisher Scientific, Inc.; Sartorius AG; Promega Corporation; Bovogen; Biologicals; Zymetech; BBI Solutions; Neova Technologies; BIOZYM; PromoCell GmbH; Linzyme Biosciences.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trypsin Market Report Segmentation

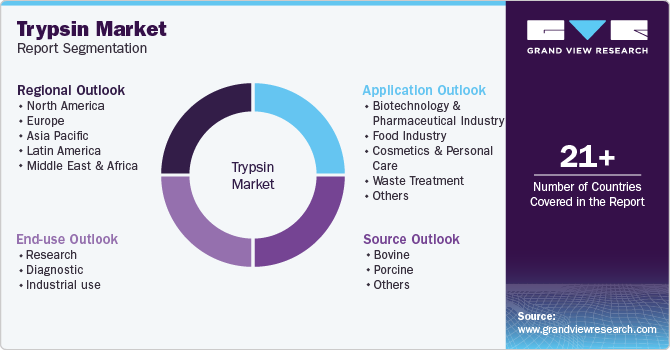

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global trypsin market report on the basis of source, application, end-use, and regions.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Porcine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Industry

-

Food Industry

-

Cosmetics and Personal Care

-

Waste Treatment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Diagnostic

-

Industrial use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global trypsin market size was estimated at USD 96.2 million in 2024 and is expected to reach USD 101.2 million in 2025.

b. The global trypsin market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 131.5 million by 2030.

b. North America dominated the trypsin market with a share of 40.49% in 2024. This is owing to increasing biotechnology and pharmaceuticals-related research and development within the region

b. Some key players operating in the trypsin market include Merck Millipore, Novozymes, Agilent Technologies, Thermo Fisher Scientific, Sartorius AG, Neova Technologies, BIOZYM, PromoCell GmbH, Promega Corporation, Bovogen Biologicals, Zymetech, BBI Solutions, and Linzyme Biosciences

b. Key factors that are driving the market growth include the increasing prevalence of gastrointestinal disorders along with increasing research applications of trypsin across industries

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.