- Home

- »

- Homecare & Decor

- »

-

UK Glamping Market Size, Share And Growth Report, 2030GVR Report cover

![UK Glamping Market Size, Share & Trends Report]()

UK Glamping Market (2024 - 2030) Size, Share & Trends Analysis Report By Accommodation Type (Cabins & Pods, Tents, Yurts, Treehouses), By Age Group (18-32 Years, 33-50 Years, 51-65 Years), And Segment Forecasts

- Report ID: GVR-4-68040-202-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

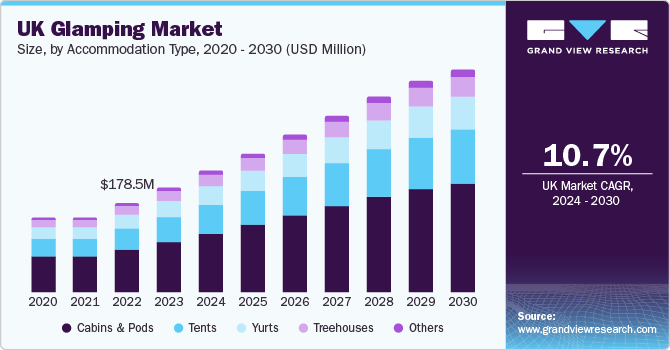

The UK glamping market size was estimated at USD 209.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030. Rising number of concerts and music festivalsevery other week across the globe is one of the primary key factors to drive market growth. Glamping or glamourous camping is considered contemporary camping in the present world and has become a trend for numerous music festivals. Growing awareness about the benefits of glamping such as significant discounts, appealing vacation packages, and upgrade options at a reasonable price is expected to boost market growth over the forecast period.

Music festival offers a wide range of glamping experiences and it has become one of the most crucial trends in the UK. The growing number of music festivals in the region is anticipated to boost the product demand. Glamping is available as an upgrade option on the original ticket especially if the festival is a multiday event.Majority of people prefer camping out at the site within a luxurious tent and the facilities offered.

Glamping offers an outdoor travel experience without bringing or buying equipment. It offers luxury services and amenities typical of a hotel. Rise in disposable and high spending capacity of the population in this region is anticipated to create market growth opportunities. Several key players in the market are more inclined towards collaborating with major restaurants and hotels, musicians and bands, software companies for high technology-related appliances, culinary services, andmore to increase their service footprint and boost their revenues.

Vacations are several types’ international trips, within the country trips, road trips, long weekend trips, and even weekend trips. However, due to hectic lifestyle the above-mentioned trend is changing among millennials. Such busy lifestyles andlong working hours have caused a lack in vacation days for long trips which influenceuse of even smallest weekend for nearby holidays. Thus, referred to as a staycations. Growing trend of de-stressing and relaxation are key factors that are probable to thrust the glamping market

Rising need for unique experiences and an increase in eco-tourism as well as the need for a healthy lifestyle is estimated to have a positive impact on the industry. For instance,the average spending for a staycation in the UK has increased over the years. In 2011, a consumer would spend close to GBP 422.7 on a staycation, however, in 2019 a millennial or a consumer spends about GBP 874 on a staycation, that’s almost doubled. Most people in the UK prefer spending on staycations to get away from normal routine and the daily stress of life.

Market Concentration & Characteristics

The UK glamping market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. The glamping service providers has creative guest engagement strategies, sustainable practices, and investing in cutting-edge technologies is likely to gain a strategic advantage over competitors. The degree of innovation plays a key role in determining a competitive edge. Innovation in outdoor experience, innovative design, and eco-friendly amenities can significantly impact market positioning.

The UK glamping market is subject to various regulations such as environmental regulations, compliance with local zoning laws, and safety standards to create and maintain glamping sites. These regulations can influence operational practices. Furthermore, construction permits,government policies regarding land use, and waste management can significantly impact the profitability and feasibility of market players operating in this industry.

This business has been on the rise in the U.K. over the past decade. It started out as a niche segment, however, has been gaining traction over the past few years on account of rising consumer awareness related to the benefits of glamping. Glamping offers a unique experience to trekkers which is far from soggy campsites, unkempt bathrooms and showers, and draughty tents. Soggy surroundings for traditional campers are on account of the changing weather conditions in the country. Looking at these shortcomings and inconveniences related to camping, glamping has become a short-term holiday rental trend among consumers, and this is expected to continue over the forecast period.

Accommodation Type Insights

The cabin and pods segment dominated the market with a revenue share of 46.23% in 2023, owing to the safety features provided by accommodation such as large living space and kitchen, lockable windows, and private bathrooms. The rising importance of travelers to experience luxury camping accommodations such as cabins and pods. Furthermore, the ultimate choice of eco-tourism among campers is due to increased penetration of eco podsowing to the usage of natural, local, and recycled resources, which also help protect from rain and wind while sustaining a cozy feel of a home.

The tents segment is anticipated to grow at a CAGR of 10.9% from 2024 to 2030. Presence of huge wildlife and national parks boost the popularity and acceptance of tents. Furthermore, majority of outdoor tourism offers a rough experience with luxe amenities in tents such as luxury beds, TV, Wi-Fi,indoor bathrooms, and portable toilets, and among others. Presence of high quality tents and growing adoption of booking systems has made it easier for consumers to select the appropriate tents that meet their needs.

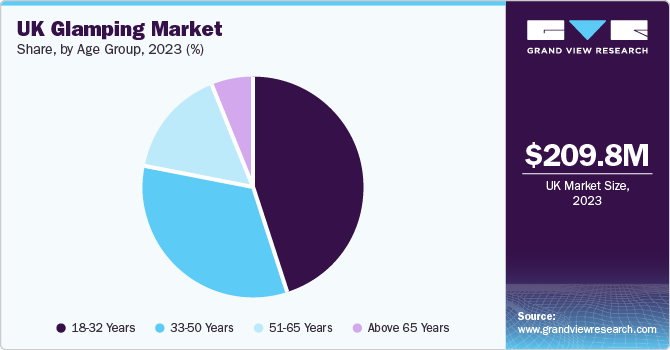

Age Group Insights

Travelers in the age group of 18-32 years dominated the market with a revenue share of 45.16% in 2023. The glamping popularity is high among the young generation and rise in trend wedding glamping is significantly increasing the market growth.A survey conducted by Glampitect in 2020 on a sample of 150 people aged 18-40 in the U.K. showed that 41% of the people would choose to stay in a glamping accommodation.

The 33-50 years segment is expected to grow at a CAGR of 10.9% from 2024 to 2030. High demand for weekend getaways and high disposable income is projected to boost segment growth. In this age group, people are mostly married and are henceeither escorted by their family or spouse during such glamping trips.

Key UK Glamping Company Insights

Some of the key players operating in the market includeSawday’s Canopy & Stars Ltd., Wigwam Holidays Ltd, Bond Fabrications, and The Glamping Orchard.

-

The Glamping Orchard is the perfect retreat in which couples and families can explore the great outdoors. The pods have fully equipped underfloor heating, kitchen and bathroom, and hot water. All bedding and towels are included along with a TV, firepit, free Wi-Fi, and built in BBQs.

-

Bond Fabrications is a leading manufacturer of glamping tents and luxury safari.Bond has spent several years working with structural engineers to design the furthermost robust safari tents. Range of safari tents come in a variety of sizes with the option to customize.

Long Valley Yurts, Loose Reins, and YURTCAMP DEVON are some of the emerging market participants in the glamping market in the UK

-

Long Valley Yurts offers 4 luxury 18ft yurts for up to 6 people (March to November). It offers the perfect base for an array of activities and excursions. It is fully furnished withtwinkling fairy lights, thick woolen rugs, solar lighting, bright colorful throws, and large skylight lanterns.

-

Loose Reins is one of the luxurious glamping lodges that offer warm comfort in crafted pioneer cabins surrounded by forests, hills, andacross the Blackmore Vale.

Key UK Glamping Companies:

The following are the leading companies in the UK glamping market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these UK glamping companies are analyzed to map the supply network.

- Sawday’s Canopy & Stars Ltd.

- Wigwam Holidays Ltd

- Bond Fabrications

- The Glamping Orchard

- Long Valley Yurts

- Loose Reins

- YURTCAMP DEVON

- The Forge

- Middle Lypiatt Glamping

- Crafty Camping

Recent Developments

- In January 2023, Bond Fabrications announced a big move into a fabulous factory in GLOUCESTERSHIRE, located in the beautiful Cotswolds town of Nailsworth. The new shift offers more space for design & development for their skilled labors.

UK Glamping Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 449.5 million

Growth rate

CAGR of 10.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, age group

Country scope

UK

Key companies profiled

Sawday’s Canopy & Stars Ltd.; Wigwam Holidays Ltd; Bond Fabrications; The Glamping Orchard; Long Valley Yurts; Loose Reins; YURTCAMP DEVON; The Forge; Middle Lypiatt Glamping; Crafty Camping

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Glamping Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK glamping market report based on the accommodation type, and age group:

-

Accommodation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cabins & Pods

-

Tents

-

Yurts

-

Treehouses

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-32 Years

-

33-50 Years

-

51-65 Years

-

Above 65 years

-

Frequently Asked Questions About This Report

b. The UK glamping market size was estimated at USD 209.8 million in 2023 and is expected to reach USD 243.7 million in 2024.

b. The UK glamping market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 449.5 million by 2030.

b. Cabins & pods dominated the UK glamping market with a share of more than 46.2% in 2023. This is mainly attributed to he the safety features provided by accommodations such as large living spaces and kitchens, lockable windows, and private bathrooms. The rising importance of travelers to experience luxury camping accommodations such as cabins and pods.

b. Some key players operating in the UK glamping market include Sawday’s Canopy & Stars Ltd.; Wigwam Holidays Ltd; Bond Fabrications; The Glamping Orchard; Long Valley Yurts; Loose Reins; YURTCAMP DEVON; The Forge; Middle Lypiatt Glamping; Crafty Camping

b. Key factors that are driving the UK glamping market growth include the rising number of concerts and music festivals every other week across the globe is one of the primary key factors to drive market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.