- Home

- »

- IT Services & Applications

- »

-

U.K. High Performance Computing Market Size Report, 2030GVR Report cover

![U.K. High Performance Computing Market Size, Share & Trends Report]()

U.K. High Performance Computing Market Size, Share & Trends Analysis Report By Component (Servers, Storage, Networking Devices), By Deployment, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-139-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

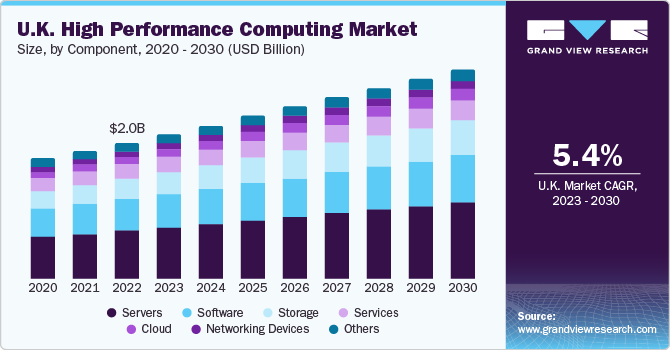

The U.K. high performance computing market size was estimated at USD 2.01 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. A high-performance computing system is essential for solving the scientific and industrial challenges of analyzing complex datasets. Growing adoption of artificial intelligence (AI), Internet of Things (IoT), and 3D imaging has emerged the need for the system to analyze highly complex or data-driven issues in a shorter period. HPC systems enable end-users to process a large volume of data and rapidly perform complex calculations.

Deployed in the cloud, on-premises, or at the edge, high performance computing systems are applicable for multiple purposes across industries such as chemicals & materials, weather & climate modeling, financial services, engineering & product development, defense, and others. The HPC system in the defense sector provides simulation and modeling capabilities to analyze mission effectiveness through campaign models. Also, HPC is used to analyze internet traffic, which helps to identify and prevent outages, design more efficient computing infrastructure, and defend against cyberattacks.

The U.K. is one of the global leaders in several computing domains, including computational modeling, cybersecurity, software development, AI, data analytics, and machine learning. As of November 2020, according to the Government Office for Science, 12 of the world’s 500 highly powerful supercomputers were distributed in the U.K. The growing penetration of supercomputers for scientific research and development (R&D) is expected to drive the demand for high-performance computing systems in the UK. For instance, in April 2021, a new high-performance computing system worth USD 1.30 million was launched at Loughborough University. Around 200 Ph.D. students, researchers, and academics are currently using the system for studying multiple projects, including quantum physics, fluid dynamics, next-generation battery modeling, and motorsport aerodynamics.

Several vendors in the market are focused on developing advanced and innovative HPC systems to enhance the efficiency and operation of the systems, which is expected to fuel market growth. Integrating artificial intelligence (AI) in HPC aids researchers in delivering quicker results for extremely complex models and large datasets. For instance, in March 2021, two of the leading supercomputing facilities in the UK, namely, the Science and Technology Facilities Council Hartree Centre (STFC) and Edinburgh Parallel Computing Centre (EPCC), collaborated to leverage the use of AI in HPC to create a national computing competence center. The collaboration supported Europe’s need for industry, academia, and the public sector.

In June 2021, the U.K. government announced a five-year partnership with IBM worth USD 297.5 million (Euro 210 million), aiming to produce innovative discoveries through quantum computing and AI in environmental sustainability and materials development. The growing advancements in AI and HPC are forcing academics, IT decision-makers, and scientists to recognize new use cases and re-evaluate traditional HPC practices to provide enhanced benefits via technology integrations. High-performance computing systems require a large amount of energy to process data and for system cooling. The growing power demand for HPC systems can significantly strain the country’s energy grid. To overcome this issue, HPC systems will require close integration with grids across geographies to fulfill power requirements.

The availability and generation of new data are driving the emergence of new use cases and applications for large-scale computing systems. Development of smart cities, upgradation of IT and telecom infrastructure, increasing use of technology in healthcare, and digital twins, among others, are some of the fields that are expected to drive the adoption of HPC in the U.K. Further, the increasing adoption of cloud computing by SMEs is anticipated to fuel the demand for HPC systems in the country.

Component Insights

Based on component, the servers segment accounted for the largest market share of 34.9% in 2022. The segment growth can be attributed to high-capacity and speed storage solutions, such as parallel file systems and solid-state drives (SSDs). Fast storage is required for rapid retrieving and storing massive datasets. HPC servers run specific software stacks aimed at processing in parallel, such as MPI (Message Passing Interface) and OpenMP. These servers can additionally implement virtualization and containerization technologies, allowing computers to execute multiple tasks consecutively. Incorporating artificial intelligence (AI) and machine learning (ML) capabilities into high-performance computing servers will grow increasingly prevalent in the forecasted period. These AI/ML accelerators will aid in the optimization of HPC workloads and enable more advanced simulations and data processing.

The storage segment is anticipated to witness significant growth at a CAGR of 6.7% during the forecast period.Storage solutions must be highly adaptable to meet the growing demands of larger datasets and more powerful computer clusters. HPC systems' scalability ensures they can extend their data storage and computing power as needed. Storage solutions must be highly adaptable to cope with the increasing need for larger datasets and more powerful computer clusters. Furthermore, as quantum computing progresses, it may impact storage by bringing innovative encryption and data security technologies to secure important HPC data.

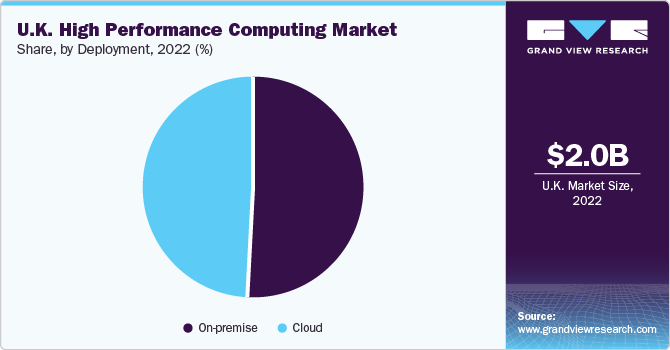

Deployment Insights

Based on deployment, the on-premises segment accounted for the largest market share of 51.3% in 2022. The segment growth can be attributed to organizations that adjust their software, hardware, and networking components to meet workload requirements owing to significant adaptability. This level of personalization can result in enhanced efficiency for specialized applications. Organizations often favor on-premises solutions with tight information residency requirements or precise geographic preferences for data center sites to ensure data remains inside selected regions. On-premises HPC can enable faster data access and processing than cloud-based solutions for applications that require ultra-low latency. It is crucial for providing real-time simulations and financial trading applications.

The cloud segment is anticipated to grow at a CAGR of 6.4% during the forecast period. The segment growth can be attributed to access to innovative hardware technology such as graphics processing units (GPUs), high-performance CPUs, tensor processing units (TPUs), and customized processors. Users can make use of cutting-edge technology without making major hardware investments. Cloud providers run data centers in several countries across the globe, allowing enterprises to deploy high-performance computing resources closer to their users or data sources. For geographically distributed applications, this mitigates latency and improves performance. Furthermore, cloud providers invest extensively in security and compliance certifications, assisting enterprises in meeting specific industry laws and regulations and safeguarding sensitive data.

End-use Insights

The government & defense segment accounted for the largest market share of 26.2% in 2022. HPC optimizes resource allocation in force deployment, logistical planning, and supply chain management. This enables effective resource utilization and cost savings. AI and machine learning algorithms operating on high-performance computing platforms improve intelligence and military capabilities. These technologies analyze data, recognize images, and parse natural language. HPC is utilized for complicated simulations and scenario modeling, such as combat simulations, nuclear weapon testing, and threat assessments. These simulations aid strategic planning and decision-making.

The manufacturing segment is anticipated to grow at a CAGR of 6.3% during the forecast period. Sensors, IoT devices, and industrial equipment generate massive amounts of data in the manufacturing industry. High-performance computing, combined with modern data analytics and machine learning, enables manufacturers to extract important insights from this data for process enhancement and decision-making. The implementation of 5G networks and edge computing in the forecasted period will improve the capabilities of HPC in manufacturing. Real-time data processing and low-latency connections will enable more rapid decision-making, and more responsive manufacturing procedures are anticipated to drive the high-performance computing market in the forecast period.

Key Companies & Market Share Insights

The key players operating in the market include Atos SE; Amazon Web Services, Inc.; Advanced Micro Devices, Inc.; Cisco Systems, Inc.; Dell Inc.; Fujitsu to broaden their product offering, companies utilize a variety of inorganic growth tactics, such as regular mergers acquisitions, and partnerships. In June 2022, Atos SE partnered with OVH SAS, a cloud computing solution provider. The partnership is focused on providing the Atos SE quantum emulator as a service through OVHcloud. This solution is expected to increase the accessibility of quantum emulation technologies, which will expand the quantum technology ecosystem. Some prominent players in the U.K. high-performance computing market include:

-

Atos SE

-

Amazon Web Services, Inc.

-

Advanced Micro Devices, Inc

-

Cisco Systems, Inc.

-

Dell Inc.

-

Fujitsu

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd.

-

Intel Corporation

-

IBM

-

Microsoft

-

Numerical Algorithms Group Ltd

-

Oracle

-

Red Hat, Inc.

-

Teradata corporation

U.K. High Performance Computing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.09 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end-use

Key companies profiled

Atos SE; Amazon Web Services, Inc.; Advanced Micro Devices, Inc; Cisco Systems, Inc.; Dell Inc.; Fujitsu; Hewlett Packard Enterprise Development LP; Huawei; Technologies Co., Ltd.; Intel Corporation; IBM; Microsoft; Numerical Algorithms Group Ltd; Oracle; Red Hat, Inc., and Teradata corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.K. High Performance Computing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.K. high-performance computing market report based on component, deployment, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Servers

-

Storage

-

Networking Devices

-

Software

-

Services

-

Cloud

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Gaming

-

Media & entertainment

-

Retail

-

Transportation

-

Government & Defense

-

Education & research

-

Manufacturing

-

Healthcare & bioscience

-

Others

-

Frequently Asked Questions About This Report

b. The U.K. High Performance Computing market size was estimated at USD 2.01 billion in 2022 and is expected to reach USD 2.14 billion by 2023.

b. The U.K. High Performance Computing market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 3.09 billion by 2030.

b. Servers dominated the U.K. High Performance Computing market with a share of 34.9% in 2022. The segment growth can be attributed to high-capacity and speed storage solutions, such as parallel file systems and solid-state drives (SSDs). Fast storage is required for rapid retrieving and storing massive datasets. HPC servers run specific software stacks aimed at processing in parallel, such as MPI (Message Passing Interface) and OpenMP.

b. Some key players operating in the U.K. High Performance Computing include Atos SE; Amazon Web Services, Inc.; Advanced Micro Devices, Inc; Cisco Systems, Inc.; Dell Inc.; Fujitsu; Hewlett Packard Enterprise Development LP; Huawei; Technologies Co., Ltd.; Intel Corporation; IBM; Microsoft; Numerical Algorithms Group Ltd; Oracle; Red Hat, Inc., and Teradata corporation

b. Key factors driving the market growth include U.K. High Performance Computing growing adoption of artificial intelligence (AI), IoT, and 3-D imaging has emerged the need for the system to analyze highly complex or data-driven issues in a shorter period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."