- Home

- »

- Electronic & Electrical

- »

-

UK Household Appliances Market Size, Industry Report 2030GVR Report cover

![UK Household Appliances Market Size, Share & Trends Report]()

UK Household Appliances Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances) By Distribution Channel (Hypermarkets & Supermarkets, Electronic Stores, Exclusive Brand Outlets, Online), And Segment Forecasts

- Report ID: GVR-4-68040-615-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Household Appliances Market Trends

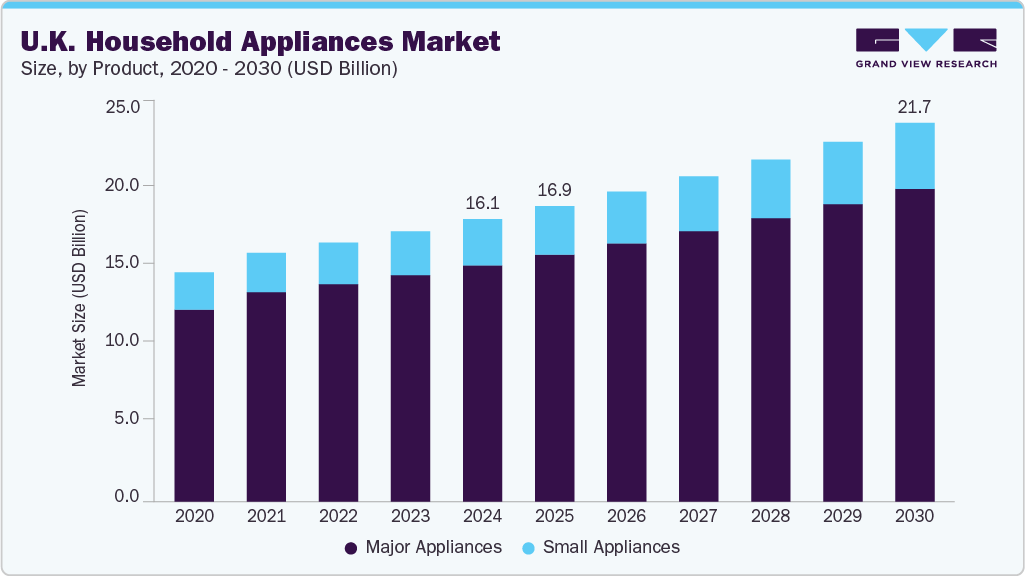

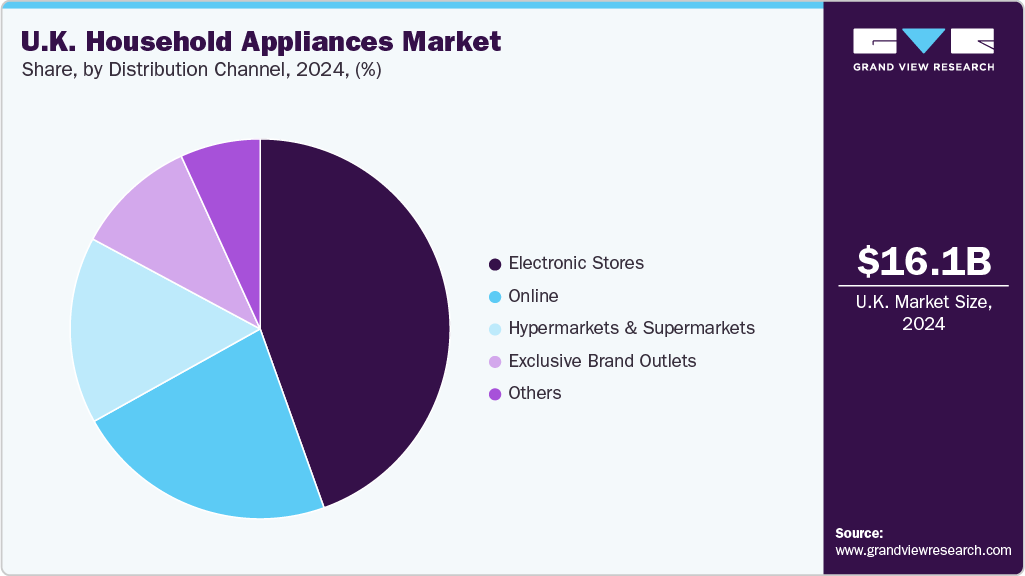

The UK household appliances market size was estimated at USD 16.15 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. The market is driven by increasing consumer demand for energy-efficient, smart, and sustainable appliances amid rising environmental awareness and regulatory pressures. Growth is also driven by a surge in home renovations and remote work trends, which have elevated the importance of well-equipped home environments.

In addition, advancements in appliance technology, rising disposable incomes, and the expansion of e-commerce platforms are making premium and connected appliances more accessible, further boosting market demand across the UK. The market growth can be attributed to the increasing adoption of smart technologies. Consumers are increasingly investing in appliances that offer automation, remote control, and energy monitoring-features that enhance convenience and align with the growing popularity of smart homes. Advancements in the Internet of Things (IoT) and AI enable appliances to become more intuitive and efficient, driving consumer interest across categories such as washing machines, refrigerators, and kitchen appliances.

Environmental awareness and regulatory pressures are also accelerating market growth. UK consumers are becoming more conscious of energy consumption and carbon footprints, prompting a shift toward energy-efficient appliances. The government’s support through incentives and regulations, such as those enforced by the Energy Saving Trust, encourages manufacturers and consumers to prioritize sustainable choices. This has led to a surge in demand for appliances with higher energy ratings and eco-friendly features, especially as long-term savings and environmental impact become central to purchase decisions.

For instance, A+++ rated refrigerators from brands like Siemens and energy-saving dishwashers from Miele are gaining popularity for their lower electricity and water consumption. Government-backed programs like the Energy Saving Trust offer guidance and incentives for purchasing eco-friendly appliances, encouraging upgrades and first-time buyers to make sustainable choices.

Furthermore, shifting demographics and lifestyle changes are contributing to increased demand. With more single-person households, urban living, and hybrid work models, there is a greater need for compact, multifunctional, and time-saving appliances. At the same time, the rise in home improvement activities has led consumers to upgrade or replace outdated appliances with newer, more efficient models. The ease of purchasing through online channels, flexible financing options, and the presence of well-established brands offering localized customer support further fuel this growth trend in the UK market.

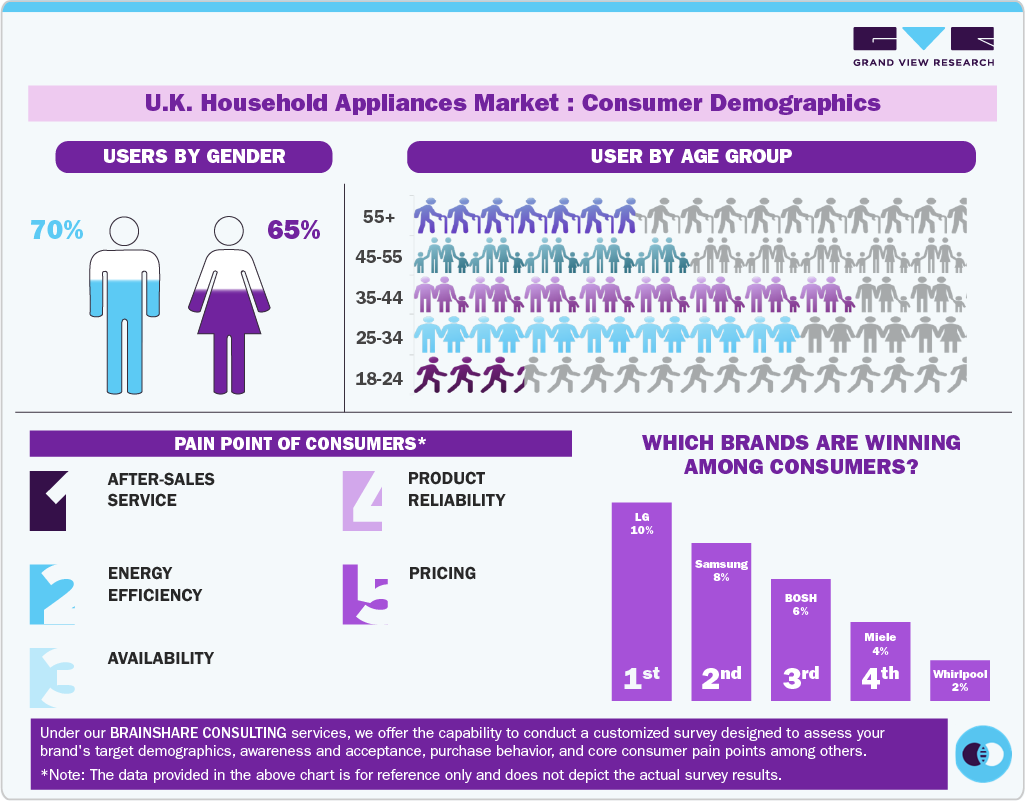

Consumer Insights

Consumers in the UK market face several pain points that impact their purchasing decisions and satisfaction. One of the primary concerns is inadequate after-sales service, with many consumers reporting delays, lack of responsiveness, and poor technician training. This issue is especially critical in Tier 2 and Tier 3 cities, where less-developed service networks exist. In addition, inconsistent product reliability and performance often lead to frustration, especially when appliances fail shortly after purchase or do not meet advertised standards.

Another significant pain point is the high cost of energy-efficient or smart appliances, which can deter budget-conscious consumers. While there is growing awareness about the benefits of such products, the upfront investment remains a barrier for many. Consumers also express dissatisfaction with limited product availability in rural areas, complex user interfaces for older users, and confusing warranty or return policies. These challenges highlight the need for brands to improve product quality, pricing accessibility, and customer service to meet better evolving consumer expectations.

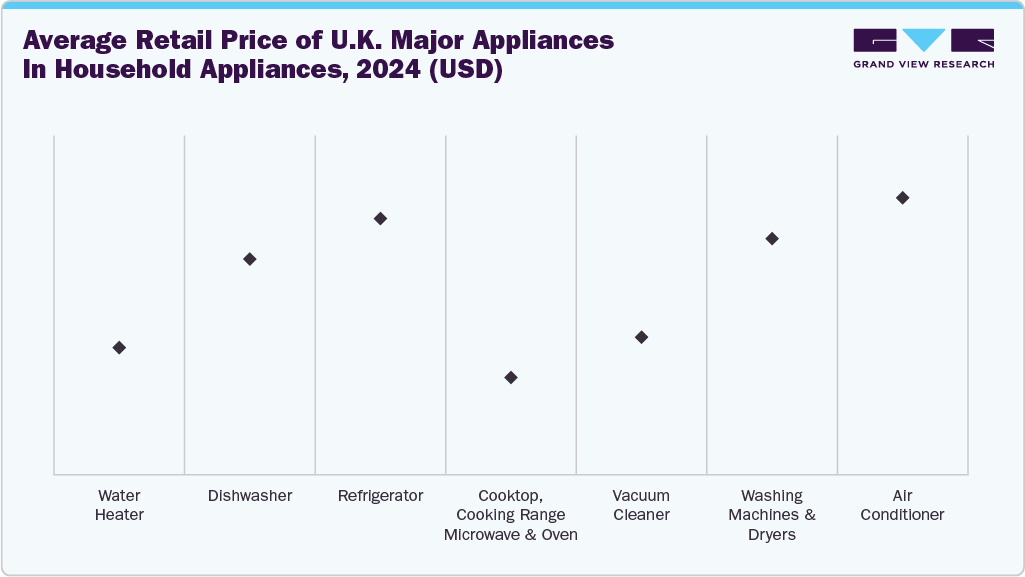

Pricing Analysis

The pricing analysis of major appliances in the UK indicates that these products vary significantly in cost depending on energy ratings, features, and brand positioning. Refrigerators and air conditioners, especially models with frost-free technology and smart connectivity, are generally at the higher end of the pricing spectrum. Washing machines and dryers are priced at a premium, particularly those offering eco-friendly wash cycles, large drum capacities, and quiet operation. Dishwashers fall within the mid-to-high price range, with factors like compact sizing, energy efficiency, and quick-wash programs influencing cost. Smaller appliances such as microwaves, ovens, and hobs tend to occupy the lower price range, though built-in or convection models may be more expensive. Vacuum cleaners and water heaters are moderately priced, with variations based on power, design, and features such as multi-surface cleaning or rapid heating.

Product Insights

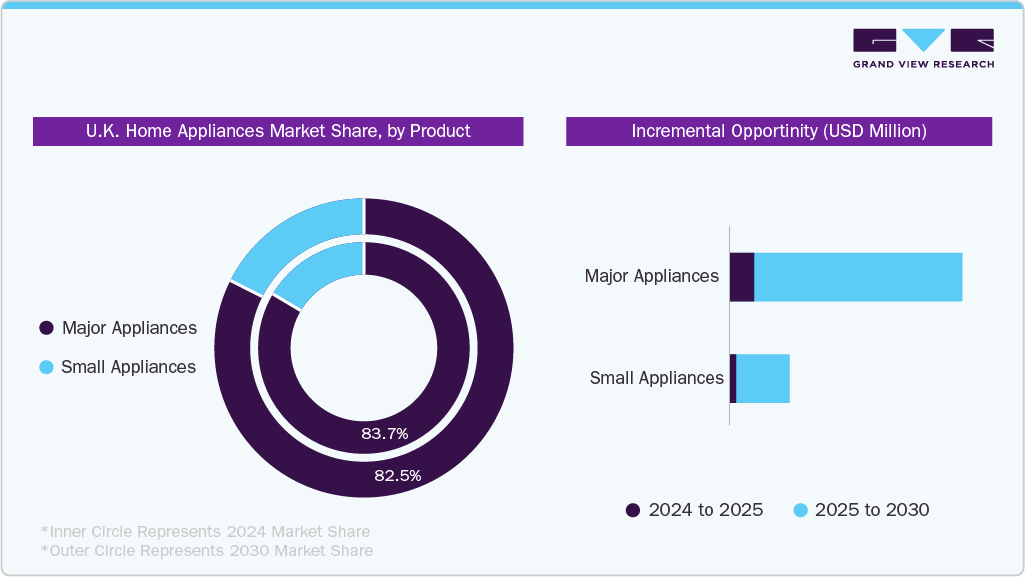

In 2024, the major appliances market accounted for a dominant 83.7% share of the UK’s appliance revenue, as these high-value products, such as refrigerators, washing machines, and dishwashers, represent essential, long-term household investments. Consumers prioritize quality, durability, and energy efficiency in these purchases, often opting for premium brands that offer advanced features and lower operating costs, which justifies higher price points. Moreover, ongoing trends like home renovations and increased focus on sustainable living have led many to replace older, inefficient appliances with newer models, further boosting sales in the major appliances segment compared to smaller, lower-cost items.

The smaller appliances market is projected to grow at a CAGR of 6.3% from 2025 to 2030, due to rising consumer demand for convenience, portability, and multifunctionality in everyday household tasks. As urban living spaces become more compact, especially in cities worldwide, there is a growing preference for space-saving and easy-to-use appliances like air fryers, coffee makers, and handheld vacuum cleaners. Technological advancements, including smart features and energy efficiency, make smaller appliances more attractive. The increased adoption of online retail channels and affordable pricing further enhances accessibility, driving steady growth in this segment.

Distribution Channel Insights

The sales of household appliances through electronic store channels accounted for a share of 44.54% of the UK revenue in 2024, primarily because they allow customers to examine products physically and test products, which helps build trust and confidence in their purchases. These stores also offer expert guidance, installation, and after-sales support, which are important factors for buyers investing in costly appliances. Furthermore, attractive promotions and bundle offers make electronic stores competitive against online retailers. Despite the growth of e-commerce, many consumers continue to prefer the hands-on experience and personalized service provided by brick-and-mortar stores, maintaining their significant market share.

Home appliance sales through online channels are projected to grow at a CAGR of 5.9% from 2025 to 2030, due to increasing consumer preference for convenience, wide product selection, and competitive pricing offered by e-commerce platforms. Busy lifestyles and the rise of remote work have made online shopping more appealing, allowing customers to easily compare models, read reviews, and access detailed product information from home. Major retailers like Amazon and Best Buy invest heavily in user-friendly websites, fast delivery, and flexible return policies, further boosting consumer confidence in purchasing large appliances online. In addition, the growing integration of augmented reality (AR) tools helps buyers visualize appliances in their homes before purchase, enhancing the online shopping experience.

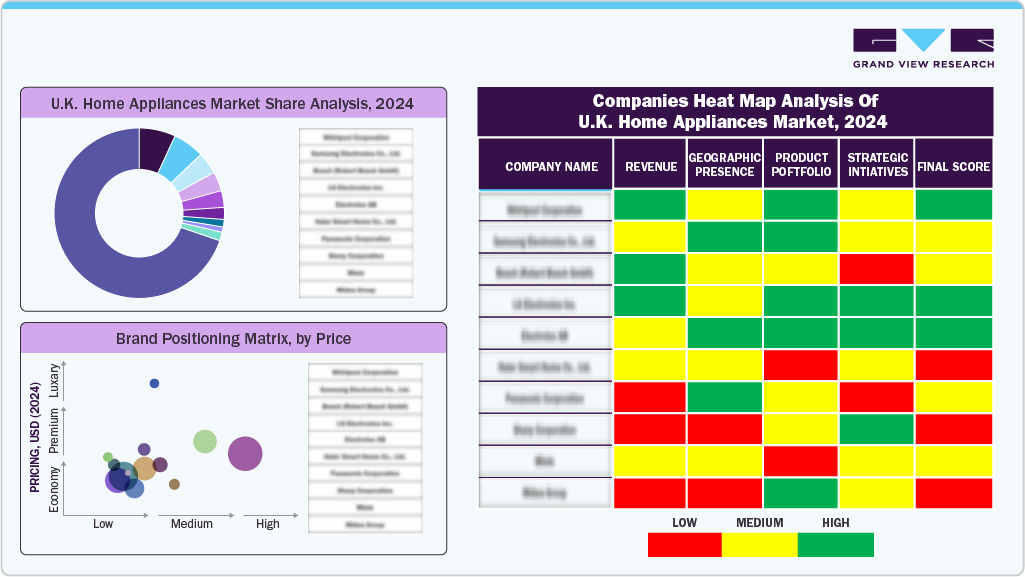

Key UK Household Appliances Company Insights

Key companies in the UK market employ diverse strategies to sustain competitiveness, focusing on continuous innovation in smart, energy-efficient, and connected appliances that cater to evolving consumer demands. They emphasize sustainability by incorporating eco-friendly materials and designs to align with increasing environmental awareness. These companies also invest heavily in expanding their distribution networks, combining traditional retail and e-commerce channels to enhance accessibility and customer convenience. Strategic collaborations with technology firms enable them to integrate IoT and automation features into products, improving the user experience. In addition, they prioritize after-sales services and warranty programs to strengthen customer loyalty and differentiate themselves in a fragmented and competitive market.

Key UK Household Appliances Companies:

- Samsung

- LG

- Bosch

- Whirlpool

- Miele

- Beko

- Hotpoint

- Siemens

- Hoover

- AEG

- Indesit

- Electrolux

- Zanussi

- Russell Hobbs

- Dyson

Recent Developments

-

In April 2024, at the Bespoke AI Global Launch Event, Samsung unveiled its latest home appliance lineup, enhanced connectivity, and advanced AI capabilities, aiming to deliver hyper-connected and energy-efficient home experiences.

-

In April 2025, Hisense launched its largest capacity combi fridge freezer in the UK market, offering 413L storage space. This new model is designed to transform modern kitchens with advanced space-optimising engineering, providing a smarter way to store groceries and ingredients.

UK Household Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.91 billion

Revenue forecast in 2030

USD 21.67 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in thousand units, revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Samsung; LG; Bosch; Whirlpool; Miele; Beko; Hotpoint; Siemens; Hoover; AEG; Indesit; Electrolux; Zanussi; Russell Hobbs; Dyson

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

UK Household Appliances Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK household appliances market report based on product and distribution channel:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders, and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.K. household appliances market size was estimated at USD 16.15 billion in 2024.

b. The U.K. household appliances market is expected to grow at a CAGR of 5.1% from 2025 to 2030.

b. In 2024, the major appliances market accounted for a dominant 83.7% share of U.K.’s appliance revenue, as these high-value products—such as refrigerators, washing machines, and dishwashers represent essential, long-term investments for households.

b. Some prominent players in the U.K. home appliances market include Samsung; LG; Bosch; Whirlpool; Miele; Beko; Hotpoint; Siemens; Hoover; AEG; Indesit; Electrolux; Zanussi; Russell Hobbs; Dyson

b. The U.K. household appliances market is driven by increasing consumer demand for energy-efficient, smart, and sustainable appliances amid rising environmental awareness and regulatory pressures. Growth is also driven by a surge in home renovations and remote work trends, which have elevated the importance of well-equipped home environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.