- Home

- »

- Animal Health

- »

-

UK Pet Insurance Market Size & Share, Industry Report, 2030GVR Report cover

![UK Pet Insurance Market Size, Share & Trends Report]()

UK Pet Insurance Market (2025 - 2030) Size, Share & Trends Analysis Report By Coverage Type (Accident & Illness, Accident only), By Animal Type (Dogs, Cats), By Sales Channel (Agency, Broker, Direct, Banc assurance), And Segment Forecasts

- Report ID: GVR-4-68040-595-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Pet Insurance Market Size & Trends

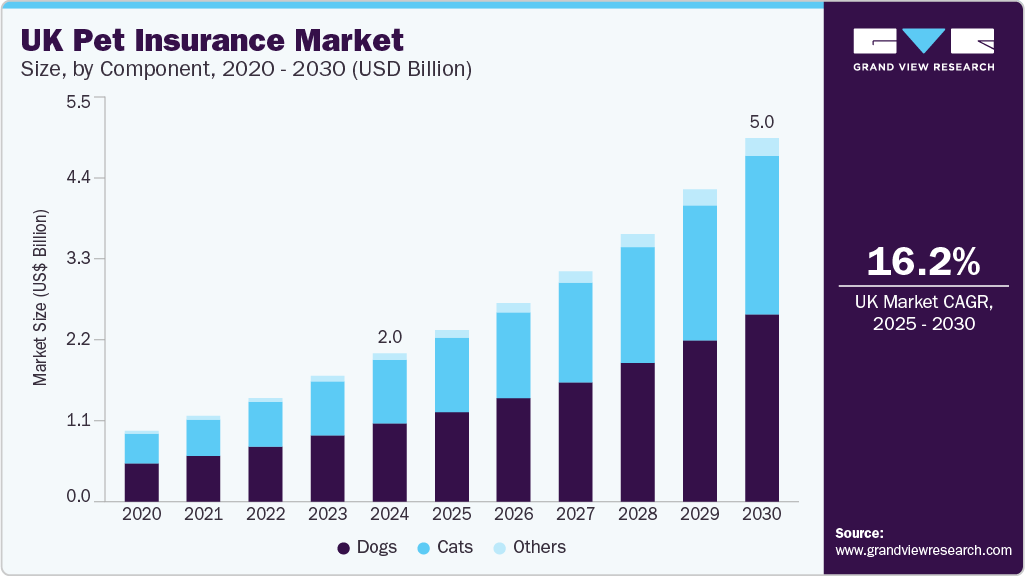

The UK pet insurance market size was estimated at USD 2.04 billion in 2024 and is projected to grow at a CAGR of 16.2% from 2025 to 2030. The market is affected by multiple market dynamics. Some of the leading market drivers include the growing importance of pet insurance, increasing standard of veterinary care, growing regulatory oversight, and growing awareness & marketing efforts by industry participants. Furthermore, some leading factors that might affect the market negatively are emerging fraudulent activities and a rise in pet insurance premiums.

One of the primary drivers in the market is the growing importance of pet insurance in the country. A recent study published in May 2025 by Agria Pet Insurance highlighted an increasing awareness among UK pet owners about the importance of being prepared for emergencies, both with first aid knowledge and comprehensive insurance. It is estimated that 1 in 7 UK adults (14%) face a pet emergency without knowing how to respond, while 32% worry about their lack of pet first aid knowledge. Even more concerning, 20% have never considered pet first aid. With risks for complications like heatstroke, allergic reactions, and poisoning on the rise in the UK, this gap in knowledge and preparedness can prove to be fatal.

Experienced veterinarians from the country emphasize that being prepared can make a life-saving difference. Beyond basic emergency training, having access to immediate, high-quality veterinary care is crucial-something pet insurance can ensure. The study highlights the growing role of lifelong pet insurance in offering peace of mind and access to prompt treatment during emergencies. Insurance is increasingly seen as a financial safety net and a key part of responsible pet ownership. With more pet owners turning to providers such as Agria for 24/7 vet support and first aid resources, the importance of pet insurance in the UK is clearly on the rise, driven by a need for better preparedness and comprehensive care.

Another crucial factor contributing to market growth is the increasing efforts made by industry participants to increase pet insurance adoption and expand their business. For instance, Napo Pet Insurance partnered with Metro and dmg ventures in January 2025 to launch a high-visibility campaign targeting commuters. Featuring a quirky character named Mr. McPickleface, the campaign used cover wraps, digital out-of-home (OOH) advertising, and social media to promote the importance of holistic pet care and insurance that goes beyond the basics.

Meanwhile, Animal Friends Insurance utilized a playful yet practical approach with a stop-motion animated TV advert. Featuring a humorous pet race representing different personalities and conditions, the ad boosted the company’s new business by 155% and response rates by 80%, helping solidify the brand's inclusive and approachable identity. These campaigns collectively reflect a growing trend in the UK pet insurance sector of using storytelling, humor, and real-life scenarios to connect with pet owners and emphasize the necessity of being prepared for pet health emergencies.

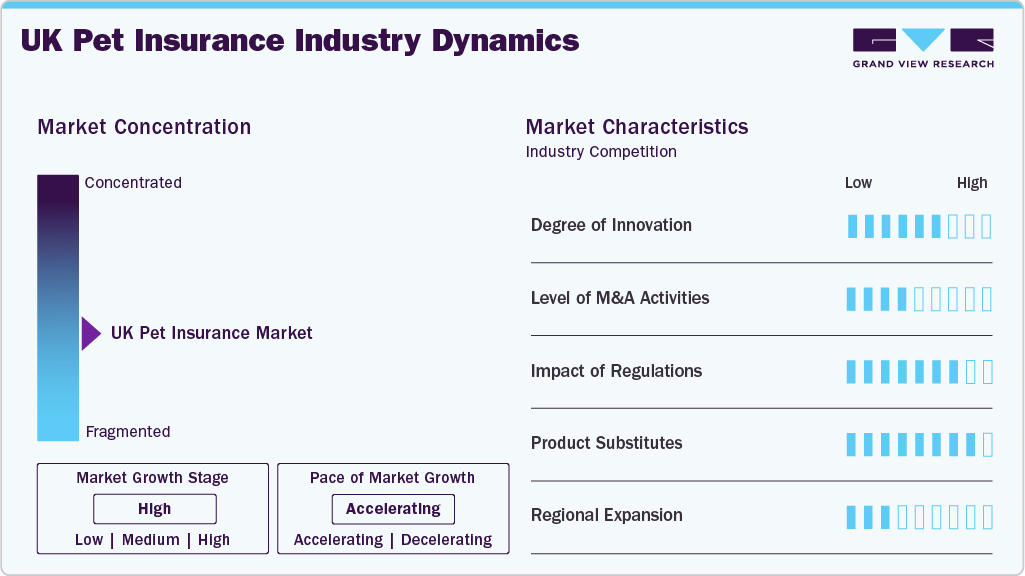

Market Concentration & Characteristics

The UK pet insurance industry shows a moderate but growing innovation. Insurers and other participants are addressing affordability challenges, as rising annual premiums have led to increased policy cancellations. In response, insurers invest in emotionally engaging marketing strategies, such as animated campaigns, to enhance brand connection and consumer education. Strategic collaborations, like those between insurers and pet tracking databases, reflect a push toward integrated pet care ecosystems. These efforts showcase an industry striving to remain relevant and accessible amid cost pressures and changing consumer expectations.

The UK pet insurance industry is witnessing a low-to-moderate level of mergers and acquisitions, but is slowly gaining traction. These activities aim to boost market share, broaden customer bases, and expand service offerings. The trend indicates increasing competition and a maturing industry landscape. For instance, in February 2025, Tedaisy Insurance Group acquired pet-tech company Perro to enhance its digital capabilities and expand service offerings.

The dynamic nature of the country's regulatory sector is driving greater transparency and fairness, with the Financial Conduct Authority (FCA) addressing policy clarity and consumer complaints. The Competition and Markets Authority (CMA) is probing veterinary industry consolidation, which may raise treatment costs and premiums. Consumers are becoming increasingly price-sensitive, often switching insurers for better value. Furthermore, the UK government recently clarified that tenants will not be restricted to a single pet insurance provider under the Renters (Reform) Bill. Instead, they will be free to choose from various insurance policies, ensuring market competition and consumer choice.

The UK pet insurance industry is increasingly challenged by substitutes like self-insurance, where many pet owners still prefer to rely on personal savings for veterinary costs. Vet clinics also offer subscription-based care plans that cover routine treatments without requiring full insurance. Credit options like buy-now-pay-later services help owners manage unexpected medical expenses. Furthermore, charities and low-cost veterinary services support individuals with lower incomes. These alternatives are gaining traction among budget-conscious consumers, particularly as insurance premiums rise and coverage remains limited.

The UK pet insurance industry is witnessing limited regional expansion, with many key players prioritizing their domestic sectors. For instance, ManyPets exited the U.S. market in January 2025 to concentrate on its core operations in the UK. This shift reflects a broader trend where dominant companies focus on strengthening their domestic presence rather than pursuing aggressive international growth. This trend is in contrast with the previous trend where in firms like JAB Holdings were on an aggressive international expansion across the U.S, Europe, and APAC in the recent past. Consequently, expansion efforts remain cautious and localized, driven by market-specific strategies. Overall, regional growth in pet insurance is slower as firms optimize resources within familiar territories.

Coverage Type Insights

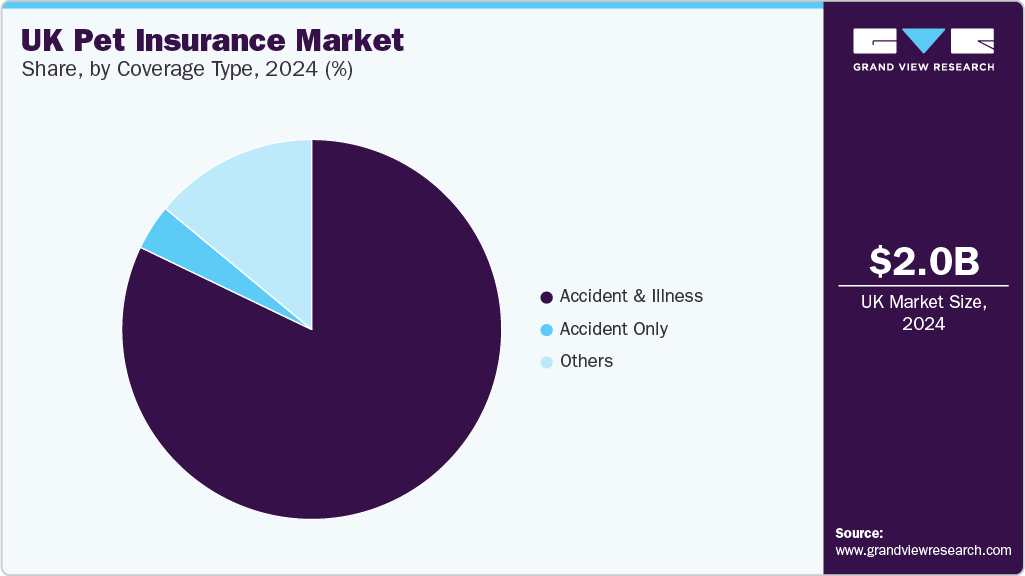

The accident & illness segment led the market with the largest revenue share of 82.12% in 2024. Pet owners prefer this coverage in the UK because it offers comprehensive protection against both basic and unexpected health issues. These plans cover various conditions, from complications due to accidents to illnesses, including infections, chronic diseases, and hereditary conditions. They provide financial support, allowing owners to focus on their pet's well-being without the burden of high treatment costs. In addition, such coverage often includes options for advanced treatments and surgeries, enhancing the overall care available to pets.

The other segment is expected to grow at the fastest CAGR over the forecast period. This segment comprises other pet insurance coverage, such as liability, lifetime coverage, surgery, etc. This can be due to a recent increase in demand for liability insurance due to increasing incidents of attacks by pets like dogs and property damage. For instance, in 2023, there were 16 fatalities and over 1,100 hospital admissions related to dog bites in England and Wales. A notable case involved an 11-year-old girl left with facial scars after a dog attack, highlighting the financial and emotional toll on victims. Pet insurance, including liability coverage, is not mandatory, leaving victims to seek compensation from dog owners voluntarily. This gap has led to a surge in demand for compulsory pet insurance, similar to car insurance, to ensure financial protection for victims and promote responsible pet ownership.

Animal Type Insights

The dog segment led the market with the largest revenue share of 52.70% in 2024. This dominance can be attributed mainly to multiple factors like high dog ownership, higher insurance adoption for dogs compared to cats, and recent market developments increasing demand for stricter insurance coverage around dogs. As of 2024, approximately 36% of UK households own at least one dog, totaling around 13.5 million pet dogs nationwide, according to a London Daily article from January 2025. This high ownership rate and the fact that dogs are more prone to accidents and illnesses requiring costly treatments drive the demand for insurance. According to July 2023 reports by the Association of British Insurers (ABI), canine insurance claim payouts rose by over 23% to reach GBP 800 million (USD 1,071 million) in just three-quarters. In addition, the rising number of dog attacks and associated liabilities has increased interest in liability insurance, further boosting the overall insurance uptake among dog owners.

The other animal segment is expected to grow at the fastest CAGR during the forecast period. This segment includes animals like rabbits, horses, pet birds, etc. Insurance adoption among these animals is rising in the UK due to increasing veterinary costs and awareness of animal welfare. Common and costly conditions like gastric ulcers in animals like horses, with over 42% of related claims exceeding GBP 3,000 (around USD 4,030), are partly driving the demand. British Equestrian’s new October 2024 partnership with Agria aims to educate owners and promote preventive care. Agria, which introduced lifetime pet insurance to the UK, supports long-term animal health planning. These developments reflect a broader trend toward proactive, financially protected animal care across species, including horses, rabbits, birds, and reptiles.

Sales Channel Insights

The direct segment led the market with the largest revenue share of 34.98% in 2024. In the UK, pet owners prefer direct sales channels for pet insurance due to the convenience, simplicity, and transparency that they offer. Buying directly allows customers to compare different tiers of policies more easily, identify potential cost savings, and access insurer-specific discounts. Many also trust well-known brands more and value the personalized support available through direct contact. With high digital literacy, especially among younger owners, online direct purchases align with their expectations.

The other sales channels segment is expected to grow at the fastest CAGR of 17.1% during the forecast period. Pet owners in the country are increasingly adopting alternative channels to procure pet insurance. Veterinary clinics, pet stores, animal care centers, etc., are becoming popular avenues, offering convenience and trusted recommendations. These channels provide pet owners immediate access to insurance options during routine visits, enhancing the overall pet care experience. Furthermore, insurers also approach these institutions to forge partnerships to enhance the market access of their offerings. For instance, in April 2025, Agria Pet Insurance entered a strategic partnership with the Irish Kennel Club (IKC) to enhance canine health and welfare. This collaboration aims to provide IKC members with tailored insurance solutions, ensuring their dogs receive optimal veterinary care by aligning their shared values. Agria and the IKC plan to drive progress in dog health through joint initiatives and knowledge exchange. The insurer also has a longstanding partnership with the Royal Kennel Club of England.

Key UK Pet Insurance Company Insights

The UK pet insurance industry is rapidly evolving and highly competitive, fueled by rising vet fees, increased pet ownership, and growing awareness of the need for financial protection during pet health emergencies. Leading insurers like Animal Friends, Petplan, Agria, ManyPets, and Napo focus on customer service excellence, brand trust, and creative marketing to attract and retain clients. Companies are also leveraging digital campaigns, strategic partnerships, and product innovation, including flexible, feature-rich policies, to stand out. Alternative distribution through veterinary clinical institutions, pet stores, and care centers is gaining traction, reflecting a shift in pet owners' access to these insurance offerings.

While some companies are consolidating or refocusing their operations (e.g., ManyPets exiting the U.S. to focus on the UK business), others are raising significant capital to scale up the market reach with the help of aggressive fundraising initiatives (Napo Limited). Despite cost-driven policy cancellations, demand for coverage remains strong, especially with growing demand for compulsory liability insurance and increasing investment in pet healthcare.

Key UK Pet Insurance Companies:

- Petgevity

- Agria Pet Insurance Ltd.

- ManyPets Ltd. (EQT Group)

- Waggel Limited

- Petplan Limited (Allianz Insurance plc)

- Tesco Insurance

- Pinnacle Pet Group (JAB Holdings)

- Admiral Group plc

- Napo Limited

- NCI Insurance Services Ltd (4Paws)

- Argos Limited

- Purely Pets

Recent Developments

-

In February 2025, Pet insurance platform Napo secured GBP12 million (USD 16 million) in a Series B funding. The investment is aimed at enhancing the company’s AI and automation capabilities, internal workforce expansion, and geographical growth.

-

In October 2024, Animal Friends Pet Insurance was awarded "Pet Insurer of the Year 2024/25" by Defaqto, a leading financial product ratings provider in the country.

-

As per an August 2024 article published by ABI, in 2023, 4.4 million UK pet owners insured their pets, marking a 1.7 million increase over the past decade.

-

In February 2023, Waggel partnered with Vet-AI to provide its pet insurance customers unlimited access to Joii Pet Care's 24/7 digital vet consultations, vet nurse consultations, and a symptom checker. This collaboration simplified pet insurance and enhanced pet health through innovative, convenient online veterinary care.

UK Pet Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.36 billion

Revenue forecast in 2030

USD 5.00 billion

Growth rate

CAGR of 16.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage type, animal type, sales channel

Country scope

UK

Key companies profiled

Petgevity; Agria Pet Insurance Ltd.; ManyPets Ltd. (EQT Group); Waggel Limited; Petplan Limited (Allianz Insurance plc); Tesco Insurance; Pinnacle Pet Group (JAB Holdings); Admiral Group plc; Napo Limited; NCI Insurance Services Ltd (4Paws); Argos Limited; Purely Pets

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Pet Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK pet insurance market report based on coverage type, animal type, and sales channel:

-

Coverage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Accident & Illness

-

Accident only

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Agency

-

Broker

-

Direct

-

Bancassurance

-

Others

-

Frequently Asked Questions About This Report

b. The UK pet insurance market size was estimated at USD 2.04 billion in 2024 and is expected to reach USD 2.36 billion in 2025.

b. The UK pet insurance market is expected to grow at a compound annual growth rate of 16.2% from 2025 to 2030 to reach USD 5.00 billion by 2030.

b. Based on animal type, the dog segment dominated the market with more than 52% share in 2024. This can be attributed to high dog ownership and greater insurance adoption for dogs versus cats. Dogs' higher risk of accidents and illnesses leads to costly claims, with canine insurance payouts rising over 23% in the country. Additionally, growing concerns over dog attacks and related liabilities have driven demand for liability coverage, further boosting insurance uptake among dog owners

b. Some key players operating in the UK pet insurance market include Petgevity, Agria Pet Insurance Ltd., ManyPets Ltd. (EQT Group), Waggel Limited, Petplan Limited (Allianz Insurance plc), Tesco Insurance, Pinnacle Pet Group (JAB Holdings), Admiral Group plc, Napo Limited, NCI Insurance Services Ltd (4Paws), Argos Limited, and Purely Pets.

b. Key factors that are driving the market growth include growing importance of pet insurance, increasing standard of veterinary care, growing regulatory oversight, and growing awareness & marketing efforts by industry participants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.