- Home

- »

- Advanced Interior Materials

- »

-

Unidirectional Tapes Market Size And Share Report, 2030GVR Report cover

![Unidirectional Tapes Market Size, Share & Trends Report]()

Unidirectional Tapes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Thermoplastic, Thermoset), By Fiber (Carbon, Glass, Other Fiber), By End Use (Aerospace & Defense, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-767-4

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Unidirectional Tapes Market Size & Trends

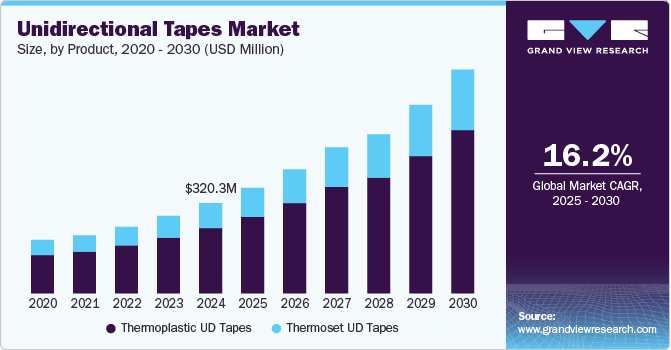

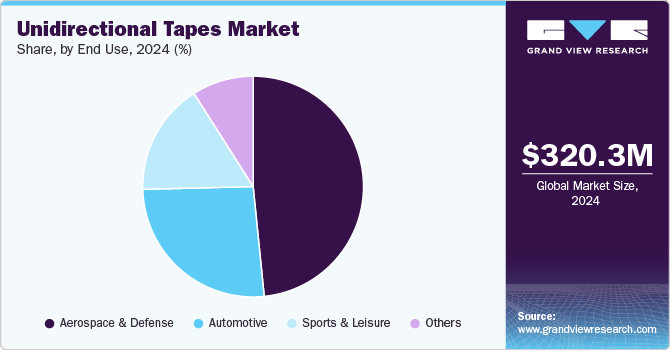

The global unidirectional tapes market size was valued at USD 320.3 million in 2024 and is projected to grow at a CAGR of 16.2% from 2025 to 2030. The growing requirement for lightweight components in the automotive and aerospace industries is likely to fuel demand for unidirectional tapes throughout the forecast period. Furthermore, the rising use of lightweight components across several manufacturing industries is expected to contribute to market growth.

The increased use of unidirectional tapes (UD) in high-end automobiles and e-vehicles is predicted to boost their adoption in the automotive sector. The usage of a product in a car is helpful to reduce its weight, which further improves its economy and speed. Their use in e-vehicles helps to extend the range of vehicles on a single charge. Several governments, like India, Australia, and Canada, are launching steps to promote the use of e-vehicles, which will boost the need for unidirectional tapes.

The U.S. is expecting a positive trend over the forecast period as the country is witnessing investments in various automotive and aerospace industries. Major manufacturers operating in the country, including General Motors, Ford Motor Company, Chevrolet, Tesla, Inc., and others, have set up their manufacturing plants in the U.S. owing to the rise in demand. In addition, growing demand for lightweight vehicles coupled with ascending trends for electric vehicles in the country is expected to increase production and, thereby, is likely to have a positive impact on the market.

Manufacturers are adopting technologies such as automated tape laying, advanced fiber placement, and spread tow technology to refine, fasten, and control the manufacturing process of unidirectional fibers. The production of these fibers and their qualities are regulated according to standards set by the International Organization of Standards (ISO) and the American Society of Testing Materials (ASTM).

Product Insights

Thermoplastic UD tapes led the market in 2024 with a revenue share of 72.4%. The product offers flexibility, durability, and exceptional strength for autoclave manufacturing processes, in-situ consolidation, and press molding. In addition, these tapes have high chemical and fire resistance, which makes them suitable for applications such as rockets, model boats, launch vehicles, and Formula 1 racing cars.

Thermoset UD tapes revenue is anticipated to grow at a CAGR of 15.8% over the forecast period. These tapes are resistant to heat and solvents, offer exceptional adhesion, and protect against corrosion. The product also exhibits high elasticity and fatigue strength, making it suitable for various end-use markets, including military vests and helmets, airplane wing spars, satellite mold joining, and radome (a structural weatherproof enclosure that protects a radar antenna).

Fiber Insights

Carbon fibers dominated the market with a share of 81.0% in 2024 as it is used in chassis & door panels of automotive vehicles, reinforcements inserted in protective equipment including helmets and vests, containers & winding pipes in other utility services. Furthermore, carbon fiber is primarily 15% lighter than glass fiber, 40% lighter than aluminum, and approximately 70% lighter than steel, which makes it a very light, strong, and rigid reinforced material.

Glass fiber is projected to be the fastest growing segment in terms of revenue from 2025 to 2030, with a CAGR of 17.0%. Glass fibers are used to make structural composites as well as a wide range of specialty items such as frame and mold connecting sections for watercraft, airplanes, unmanned aerial vehicles, and rockets. When compared to steel wires of the same diameter, glass fiber has a higher tensile strength and a lower weight, making it an ideal choice for the production of unidirectional tapes.

Glass fiber is highly preferable where a large amount of flexibility is required. As a result, glass fiber-based unidirectional tapes are preferred in inserts for injection molding, tailored blanks, pipe/cylinder winding of varying cross-sectional profiles, and backpack straps. One of the primary advantages of using glass fiber for unidirectional tapes is their high performance per cost ratio owing to the easy processability of glass fiber strands when compared to carbon fibers.

Other fibers that can be used to manufacture unidirectional tapes include aramid fibers, boron fibers, basalt fibers, and ultra-high-molecular-weight (UHMW) polyethylene (PE) fibers. Boron is a commonly used fiber for making unidirectional tapes. It offers excellent impact resistance to heat and chemicals, as fibers are formed by a chemical vapor deposition technique over a tungsten filament at around 1000°C.

End Use Insights

The aerospace & defense industry accounted for the largest share of the market in 2024 and is further expected to grow at a CAGR of 17.0% over the forecast period. One of the major factors that are propelling product growth in aerospace applications is that the structures and components made with UD tape take less time to produce. As a result, it decreases the production time to manufacture structural components of an aircraft, including aircraft seat frames, business jet wings, and sandwich panels for light aircraft.

The automotive segment accounts for a substantial share of the unidirectional tapes market as it finds applications in the rear wall of the car, interiors, body & chassis, battery compartment, and other lightweight elements for electric vehicle and high-performance vehicle designs. In addition, UD tapes are 70% lighter than metals with an equal amount of durability and product sustainability.

The sports & leisure segment accounts for a small share of unidirectional tapes compared to the aerospace, defense, and automotive segments, which is primarily attributed to their low volume usage in sports and leisure equipment. One of the major uses of unidirectional tapes is in bicycle frames and recreational equipment such as hockey, lacrosse, and hiking sticks for winding purposes and to increase stiffness.

Other industries that use unidirectional tapes include oil and gas, medical, and warehousing and logistics. Fiber reinforcements using a range of polymer matrices, including polyamide, polyphenylene sulfide, polyethylene, and polypropylene, offer structural rigidity and strength to the tape used in the aforementioned sectors, thereby increasing the product demand.

Regional Insights

North America unidirectional tapes market accounted for a revenue of USD 126.4 million in 2024. The robust aerospace and automobile manufacturing industries in the U.S., coupled with the growing demand for lightweight vehicles, are expected to increase the demand for unidirectional tapes over the forecast period.

U.S. Unidirectional Tapes Market Trends

The unidirectional tapes market in the U.S. dominated the North American region for the year 2024 with a revenue share of 64.6%. The Corporate Average Fuel Economy (CAFE) standards introduced in the U.S. to improve fuel economy support the utilization of light bonding materials that can reduce the bonding materials’ weight by nearly 70%, thereby supporting the demand for unidirectional tapes.

Canada unidirectional tapes market is expected to progress at an estimated CAGR of 17.9% over the forecast period. According to the Canadian Aerospace Union reports, the country ranks fourth in civil aircraft production and third in civil engine production, owing to the presence of manufacturers such as Airbus and Boeing. These factors are expected to increase the production of Canadian facilities, which is likely to positively influence the market for unidirectional tapes.

Europe Unidirectional Tapes Market Trends

The unidirectional tapes market in Europe is expected to be the fastest-growing region during the forecast period. The rapid development in the production of electric vehicles in the region is likely to increase product demand. Moreover, sports goods manufacturing in Europe is gaining traction as the demand for sports apparel increased post-COVID impact in communities, thus positively impacting the product demand.

Germany unidirectional tapes market accounted for a revenue of USD 33.0 million in 2024. A rise in demand for defense aircraft from leading nations has influenced the operations of aircraft manufacturers operating in Germany. Moreover, rising trends for electric vehicles are expected to offer growth prospects to the tape market in the upcoming period.

Asia Pacific Unidirectional Tapes Market Trends

The unidirectional tapes market in Asia Pacific is expected to progress at a CAGR of 16.6% over the forecast period. Companies such as Honda Motor Company, Ltd., Suzuki Motor Corporation, Hyundai Motor Company, and Tata Motors are operating large production facilities in China, India, and Japan and are incorporating lightweight technology for vehicles; thus, they are estimated to upscale the utilization of unidirectional tapes in automobile manufacturing.

India unidirectional tapes market is expected to witness significant growth due to the recent joint venture between the Boeing Company and Tata Group. In addition, the “digitization of manufacturing” program by the government of India is likely to ascend the manufacturing applications by monitoring assembly process, design, shipping, and repair operations by the industries. Hence, unidirectional tapes market revenue in India is growing at a CAGR of 12.0% over the forecast period of 2025 to 2030.

Central & South America Unidirectional Tapes Market Trends

The unidirectional tapes market in Central & South America is expected to grow. Increasing investments in the automobile manufacturing industry in Central & South America are likely to support the demand for automotive components and assembly operations. Major car manufacturers such as General Motors, Volkswagen, and Groupe PSA announced an expansion of their existing manufacturing facilities to increase production to cater to the growing demand, which is expected to stimulate the Central and South American unidirectional tapes market growth over the forecast period.

Key Unidirectional Tapes Company Insights

Some of the key players operating in the market include BASF SE, SABIC, Evonik Industries AG, TEUIN LIMITED, Celanese Corporation:

-

BASF SE operates through 11 divisions which are grouped into six segments, namely chemicals (petrochemicals and intermediates), materials (performance materials and monomers), industrial solutions (dispersions & Pigments, and performance chemicals), surface technologies (catalysts and coatings), nutrition & care, and agricultural solutions

-

Evonik Industries AG is classified into four business units: specialty additives, nutrition and care, smart materials, and performance materials. Its specialty additives division combines the businesses of versatile additives and high-performance crosslinkers. This segment is further classified into five sub-segments: coating additives, comfort and insulation, crosslinkers, interface and performance, and oil additives.

Hexcel Corporation, SGL Carbon, Victrex plc, Eurocarbon B.V., and Cristex Composite Materials are some of the emerging participants in the unidirectional tapes market.

-

Hexcel Corporation was established in 1948 and is headquartered in Connecticut, U.S. The company operates through two business segments: composite materials and engineered products. Moreover, it serves international economies through manufacturing facilities and sales offices located in the Americas, Asia Pacific, Europe, and Africa.

-

Victrex plc. operates through two business segments: industrial and medical. Its products include polymers (PEEK polymers), PEEK (Polyether ether ketone) forms (composite tapes, fibers & filaments, and films), and PEAK (Polyaryle ether ketone) parts (aerospace composite solutions, gear solutions, medical device components, piping solutions).

Key Unidirectional Tapes Companies:

The following are the leading companies in the unidirectional tapes market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- SABIC

- Solvay. S.A.

- Hexcel Corporation

- Toray Industries, Inc.

- SGL Group

- Teijin Ltd.

- BASF SE

- Celanese Corporation

- Victrex plc.

- Cristex Composite Materials

- Eurocarbon B.V.

- Plastic Reinforcement Fabrics Ltd.

- TCR Composites, Inc.

- Barrday Inc.

Recent Developments

-

In January 2023, Victrex plc. announced that the National Centre for Advanced Materials Performance (NCAMP) had approved a new unidirectional tape (UDT) - VICTREX AETM 250-AS4 - for use in the aerospace industry. The combination of HexTow carbon fiber and Victrex plc's new thermoplastic resin technology is used to create composite materials that minimize energy usage and aircraft weight, and increase aircraft longevity.

Unidirectional Tapes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 374.6 million

Revenue forecast in 2030

USD 793.6 million

Growth rate

CAGR of 16.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in million square meters; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, fiber, end-use, region

Region scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina

Key companies profiled

Evonik Industries AG, SABIC, Solvay. S.A. Hexcel Corporation, Toray Industries, Inc., GL Group, Teijin Ltd., BASF SE, Celanese Corporation, Victrex plc., Cristex Composite Materials, Eurocarbon B.V., Plastic Reinforcement Fabrics Ltd., TCR Composites, Inc., Barrday Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unidirectional Tapes Market Report Segmentation

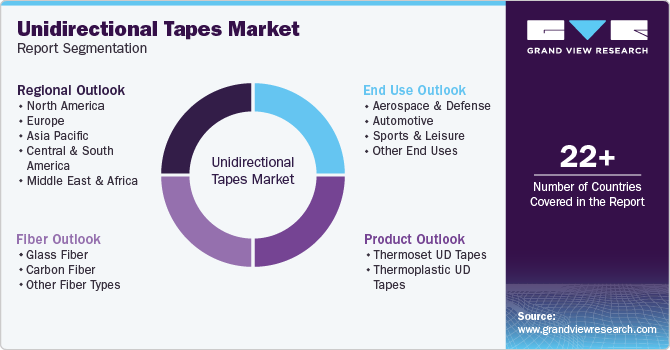

This report forecasts volume & revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global unidirectional tapes market report based on product, fiber, end-use, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Thermoset UD Tapes

-

Thermoplastic UD Tapes

-

-

Fiber Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Glass Fiber

-

Carbon Fiber

-

Other Fiber Types

-

-

End Use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Sports & Leisure

-

Other End Uses

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global unidirectional tapes market size was estimated at USD 320.3 million in 2024 and is expected to reach USD 374.6 million in 2025.

b. The unidirectional tapes market is expected to grow at a compound annual growth rate of 16.2% from 2025 to 2030 to reach USD 793.6 million by 2030.

b. Aerospace & defense accounted for the largest revenue share of 48.8% in 2024 of the unidirectional tapes market owing to its high adoption in the production of aircraft interiors and structures such as wings, lavatory modules, and fuselage.

b. Some of the key players operating in the unidirectional tapes market include Toray Industries, Inc., Evonik Industries AG, BASF SE, TCR Composites, Inc., and Hexcel Corporation.

b. The key factors that are driving the unidirectional tapes market include the rising awareness of lightweight materials for the production of automotive and aerospace components around the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.