- Home

- »

- Medical Devices

- »

-

Urinary Catheters Market Size, Share, Industry Report, 2033GVR Report cover

![Urinary Catheters Market Size, Share & Trends Report]()

Urinary Catheters Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Intermittent Catheters, External Catheters), By Application, By Type (Coated Catheters, Uncoated Catheters), By Gender, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-381-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Urinary Catheters Market Summary

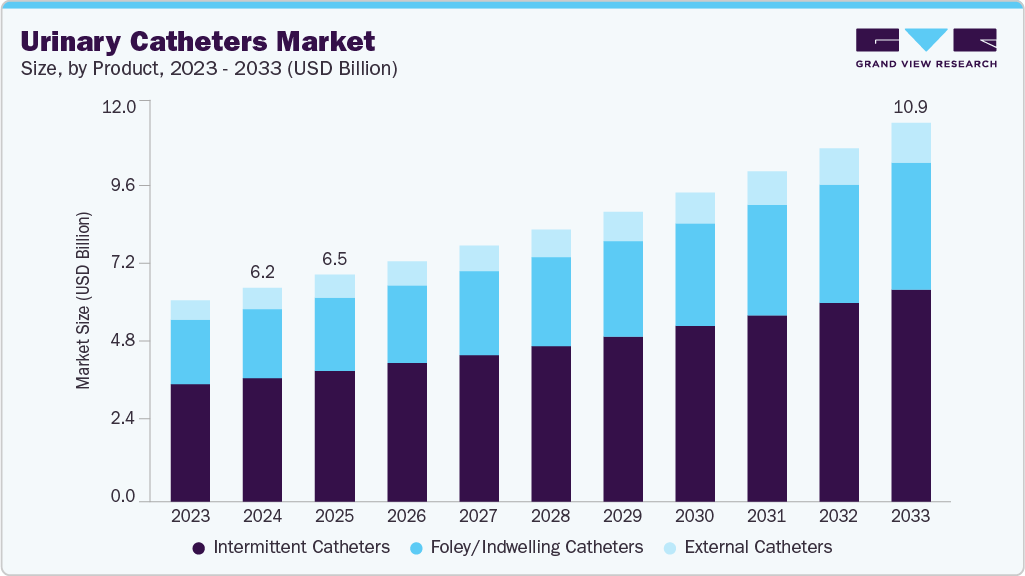

The global urinary catheters market size was estimated at USD 6.17 billion in 2024 and is projected to reach USD 10.93 billion by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The growth of the market is attributed to the rising prevalence of urological disorders such as urinary incontinence, benign prostatic hyperplasia (BPH), and spinal cord injuries, which necessitate long-term catheterization.

Key Market Trends & Insights

- North America dominated the urinary catheters market with the largest revenue share of 34.97% in 2024.

- The urinary catheters market in the U.S. accounted for the largest market revenue share of 82.27% in North America in 2024.

- Based on product, the intermittent catheters segment led the market with the largest revenue share of 57.91% in 2024.

- Based on application, the urinary incontinence segment led the market with the largest revenue share of 37.29% in 2024.

- Based on type, the coated catheters segment led the market with the largest revenue share of 61.06% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.17 Billion

- 2033 Projected Market Size: USD 10.93 Billion

- CAGR (2025-2033): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing aging population and increasing number of surgical procedures and hospitalizations further fuel product demand. In addition, the expanding adoption of home healthcare and the rising preference for minimally invasive and non-invasive urinary management solutions, such as external and intermittent catheters, are accelerating market growth. Technological advancements, including antimicrobial coatings and silicone-based materials that enhance patient comfort and reduce infection risk, along with greater awareness among patients and caregivers about urinary management options, are expected further to support the market’s expansion over the forecast period.

The increasing burden of urologic disorders, such as urinary incontinence (UI), benign prostatic hyperplasia (BPH), and spinal cord injury (SCI), is emerging as a significant contributor to the rising demand for urinary catheters. According to data published by the National Center for Biotechnology Information (NCBI) in August 2024, an estimated 13 million individuals in the U.S. are directly affected by urinary incontinence. Similarly, data from Continence Health Australia in March 2024 indicates that urinary incontinence affects up to 10% of Australian men and as many as 38% of Australian women. This substantial and growing burden of urinary incontinence is fueling increased demand for urinary catheters, particularly external urinary catheters used in the management of the condition.

Furthermore, the rising prevalence of benign prostatic hyperplasia (BPH) is projected to significantly boost the demand for urinary catheters in the coming years. Urinary catheters are vital in managing BPH by providing immediate relief from urinary retention and improving patients’ overall quality of life. For individuals affected by BPH, catheters facilitate urine drainage by bypassing the obstruction caused by an enlarged prostate. Given their critical role in symptom management and patient care, the increasing incidence of BPH is expected to drive sustained growth in the urinary catheters market.

The increasing demand for external catheters designed for home care settings is anticipated to be a major growth driver for the urinary catheters market over the forecast period. With rising awareness of non-invasive urinary management solutions, healthcare providers and caregivers are increasingly favoring safer and more comfortable alternatives to traditional indwelling catheters. Industry feedback has been highly positive, underscoring the strong market potential for these products. A key instance is BD’s PureWick System, which has garnered consistent support from patients, caregivers, and healthcare professionals. As of August 2024, more than 50 million PureWick Female External Catheters and over 5 million PureWick Male External Catheters had been utilized across acute and home care environments, reflecting the growing adoption of external catheter solutions.

Technological Advancements

Company Name

Product Launch

KOLs

InnoCare Urologics

In August 2024, InnoCare Urologics received U.S. FDA approval for its InnoCare Specialty Foley Catheter.

" We saw a clear need to innovate a catheter design that has seen minimal advancement since its introduction over 80 years ago,” said Bryan Pinchuk, CEO and founder of InnoCare Urologics. “The creation of this new classification code validates the need to provide a safer alternative to traditional Foley catheters. We are excited to bring a technology to market for millions of high-risk patients, and this milestone is a critical step in achieving that goal.”

Urotronic (Laborie)

In July 2023, Urotronic announced that it had received FDA approval for the Optilume BPH Catheter System, marking a breakthrough in next-generation minimally invasive solutions designed to effectively relieve symptoms for patients with an enlarged prostate.

“There’s nothing else like Optilume BPH that’s currently available, it’s the only treatment option that requires no cutting, burning, steaming or implants,” said Urotronic President and CEO David Perry. “This advancement, backed by strong clinical outcomes, has the potential to improve the quality of life for millions of patients looking for a solution for BPH and its associated lower urinary tract symptoms. Drug-coated balloons are the future of interventional u

Source: Johnson & Johnson MedTech, Establishment Labs Holdings Inc., Grand View Research

Market Concentration & Characteristics

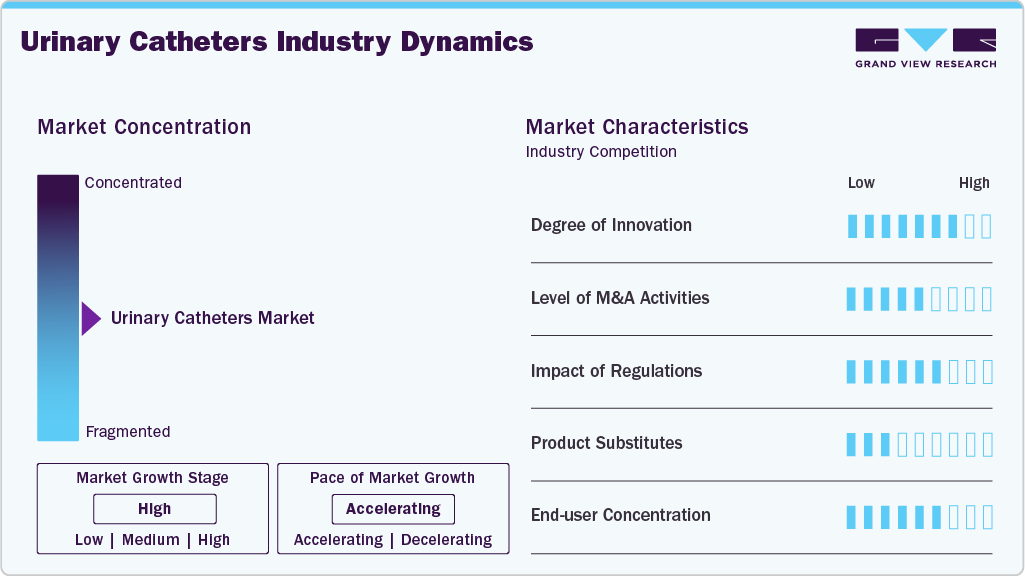

The urinary catheters industry is witnessing a high degree of innovation, driven by continuous advancements in material science, infection control, and device design to improve patient comfort and safety. Recent regulatory approvals highlight this innovation trend. For instance, InnoCare Urologics’ FDA approval for the InnoCare Specialty Foley Catheter in August 2024 and Urotronic’s (Laborie) FDA approval for the Optilume BPH Catheter System in June 2023 demonstrate the industry’s focus on addressing unmet clinical needs and enhancing treatment outcomes. Innovations such as antimicrobial and hydrophilic coatings, silicone-based and latex-free materials, and innovative catheter systems with sensors for real-time monitoring are transforming urinary management practices. These developments collectively indicate a strong momentum toward safer, more efficient, and patient-centric catheter solutions.

Regulations play a critical role in shaping the urinary catheter market, as stringent standards ensure product safety, efficacy, and quality, which are essential for patient care. Regulatory approvals from authorities such as the U.S. FDA and the European CE marking influence market entry, product design, and adoption rates. Compliance with guidelines for materials, sterilization, and infection control not only safeguards patients but also drives innovation, as manufacturers develop advanced catheters that meet regulatory requirements. While these regulations can increase development timelines and costs, they ultimately enhance market credibility, boost healthcare provider confidence, and support the growth of safe and effective urinary catheter solutions globally.

The level of mergers and acquisitions (M&A) activity is moderate, reflecting ongoing efforts by companies to expand their product portfolios, access advanced technologies, and strengthen market presence. For instance, in October 2023, Laborie Medical Technologies Corp. (Laborie) announced the successful acquisition of Urotronic, Inc. (Urotronic), a privately held medical device company. Urotronic is known for developing the Optilume drug-coated balloon technology, which is used in interventional urology to treat urethral strictures and benign prostatic hyperplasia (BPH), also known as enlarged prostate conditions. Such strategic acquisitions enable companies to integrate innovative solutions, enhance clinical offerings, and accelerate growth, underscoring the importance of M&A as a key driver for market consolidation and technological advancement.

The urinary catheters market faces moderate risk from product substitutes, as several alternative urinary management solutions are available that can reduce the reliance on traditional catheterization. These substitutes include external collection devices such as condom catheters and intermittent self-catheterization kits. Additionally, medications that manage urinary retention or alleviate symptoms of benign prostatic hyperplasia (BPH) and incontinence can reduce the immediate need for catheter use in certain patients. While these alternatives offer advantages in comfort, reduced infection risk, and ease of use, catheters remain essential for patients requiring continuous or long-term drainage, surgical care, or acute hospital interventions. The presence of substitutes encourages manufacturers to innovate and improve catheter designs, materials, and patient-centric features to maintain market relevance.

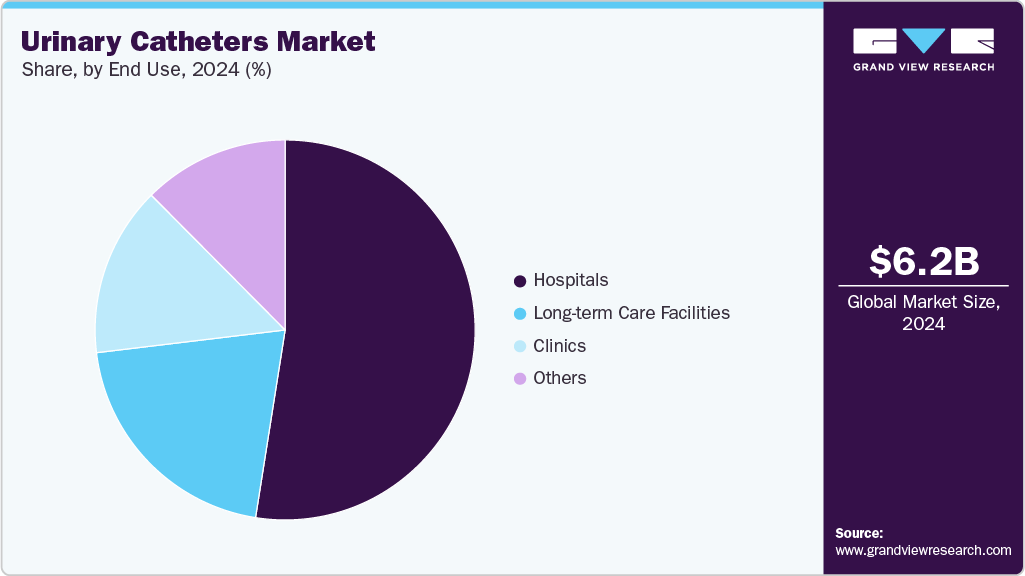

The industry exhibits a diversified end-user concentration, with demand spread across hospitals, long-term care facilities, and home healthcare settings. Hospitals and surgical centers represent the largest segment, driven by high patient volumes, the need for perioperative and acute care catheterization, and stringent infection control protocols. Long-term care facilities also contribute significantly, as residents often require chronic catheterization for mobility or health-related issues. Meanwhile, the home healthcare segment is growing rapidly due to the increasing preference for self-care, non-invasive urinary management solutions, and rising awareness among patients and caregivers. This varied end-user base ensures that market demand is well-distributed, supporting steady growth across multiple healthcare settings.

Product Insights

On the basis of product, the intermittent catheters segment held the largest share in 2024. The growth is attributed to a greater preference for silicone implants owing to their widespread adoption across hospitals, long-term care facilities, and home healthcare settings. Intermittent catheters are preferred for their reduced risk of urinary tract infections, ease of use, and suitability for self-catheterization, which empowers patients to manage their condition independently. The growing awareness among patients and caregivers about safe urinary management practices and advancements in catheter materials, such as hydrophilic and silicone options, further contributed to the segment’s dominance.

The external catheters segment is expected to witness the significant growth over the forecast period, driven by increasing demand for non-invasive and comfortable urinary management solutions. External catheters, including condom and female external devices, are favored in home care and outpatient settings due to their ease of application and lower infection risk than indwelling catheters. Rising awareness of external catheter options, coupled with technological innovations such as improved adhesion, leak-proof designs, and enhanced patient comfort, is anticipated to accelerate adoption and propel market growth in this segment.

Application Insights

In terms of application, the urinary incontinence segment registered the largest share in 2024. The growth is due to the high prevalence of incontinence across all age groups, particularly among the elderly population. The increasing incidence of chronic conditions such as diabetes, neurological disorders, and mobility impairments further drives the need for catheterization to manage urinary leakage effectively. Furthermore, growing awareness among patients and caregivers about safe and hygienic urinary management solutions and the availability of advanced intermittent and external catheters contributed to the segment’s market dominance.

The benign prostate hyperplasia segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to the rising prevalence of prostate enlargement among aging men. Catheters play a critical role in providing immediate relief from urinary obstruction and associated symptoms, enhancing patient comfort and quality of life. Increasing awareness about minimally invasive treatments and the adoption of specialized BPH catheter systems, such as the FDA-approved Optilume BPH Catheter, are further fueling growth, positioning the segment for rapid expansion in the urinary catheters market.

Type Insights

On the basis of type, the coated catheters segment dominated the market in 2024 and is expected to witness the fastest CAGR over the forecast period. This growth is primarily driven by its ability to reduce urinary tract infections and enhance patient comfort, with antimicrobial and hydrophilic coatings widely preferred across hospitals, long-term care facilities, and home healthcare settings. Growing awareness among healthcare providers and patients about infection prevention and the ease of use and improved safety offered by these catheters reinforced their market dominance. Moreover, rising adoption of advanced catheter technologies, increasing prevalence of chronic urological conditions, expanding home healthcare services, and ongoing innovations in coating materials and antimicrobial properties have fueled the demand for coated catheters.

Gender Insights

On the basis of gender, the male segment dominated the market for urinary catheters in 2024. This growth is primarily driven by the higher prevalence of urological conditions such as benign prostatic hyperplasia (BPH) and urinary retention among men. Male catheters, including intermittent and indwelling types, are extensively used across hospitals, long-term care facilities, and home healthcare settings, contributing to the segment’s substantial market share. The established adoption of male catheter solutions and the need for effective management of male-specific urinary disorders have reinforced this dominance.

The female segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to the increasing awareness of urinary incontinence management and the rising adoption of female-specific catheter designs. The demand for comfortable, easy-to-use, and non-invasive catheter solutions is growing among female patients, particularly in home care and outpatient settings, which is expected to propel rapid growth in this segment. Innovations tailored for female anatomy and patient-centric designs further support the expansion of the female catheter market.

End Use Insights

On the basis of end use, the hospitals segment dominated the urinary catheters market in 2024. This growth can be attributed to the high number of patients requiring catheterization for acute care, surgical procedures, and perioperative management. Hospitals remain the primary setting for short-term and long-term catheter use, supported by skilled healthcare professionals, strict infection control protocols, and ready access to a wide range of catheter types, including intermittent, indwelling, and coated catheters. The demand is further driven by the prevalence of urological disorders, chronic diseases, and post-operative care requirements, making hospitals the largest end-user segment in the urinary catheters market.

The long-term care facilities segment is projected to witness the fastest growth rate over the forecast period. This can be attributed to the increasing number of elderly and chronically ill patients requiring continuous urinary management. Residents in nursing homes and assisted living facilities often need long-term or intermittent catheterization due to age-related conditions, mobility limitations, and chronic urological disorders. Besides, the rising focus on improving patient comfort, infection prevention, and quality of care in these settings is fueling the adoption of advanced catheter solutions, including coated and external catheters, accelerating market growth in the long-term care segment.

Regional Insights

The North America urinary catheters industry dominated with the largest revenue share of 34.97% in 2024. The growth is driven by a combination of demographic, clinical, and technological factors. A key driver is the rising prevalence of urological conditions such as urinary incontinence, benign prostatic hyperplasia (BPH), and bladder dysfunction, particularly among the aging population. According to the U.S. Census Bureau, the number of individuals aged 65 and older is increasing rapidly, fueling demand for long-term catheterization and specialized urological care. The region’s well-established healthcare infrastructure, strong reimbursement systems, and efficient distribution networks ensure broad accessibility of urinary catheters across hospitals, nursing homes, and home healthcare settings. Moreover, growing awareness of urological health and self-catheterization techniques has supported the adoption of intermittent catheters, enabling patients to manage their conditions with greater autonomy and improving overall quality of life.

U.S. Urinary Catheters Market Trends

The U.S. urinary catheters industry is primarily driven by the technological advancements, changing patient preferences, and evolving healthcare practices. There is a growing shift toward intermittent and external catheters, which are perceived as safer, more comfortable, and suitable for home care settings. Innovations such as antimicrobial coatings, hydrophilic surfaces, and drug-eluting catheters enhance patient safety by reducing infection risks and improving usability. Besides, increased adoption of minimally invasive urological procedures and rising awareness of self-catheterization techniques empower patients to manage their conditions independently. The market is also seeing integration of smart technologies, such as sensors and connectivity features, enabling real-time monitoring and better clinical outcomes. These trends indicate a strong focus on patient-centric, innovative, and technology-driven solutions in the U.S. market.

Europe Urinary Catheters Market Trends

The Europe urinary catheters industry is witnessing steady growth, driven by a combination of demographic, clinical, and policy-related factors. A key contributor is the region’s aging population, which is leading to an increased prevalence of age-related urological conditions, including urinary incontinence, benign prostatic hyperplasia (BPH), and prostate cancer. Additionally, the rising incidence of chronic diseases such as diabetes, along with neurological disorders like multiple sclerosis and spinal cord injuries, is driving higher demand for long-term catheterization. As of 1 January 2024, the EU population was estimated at 449.3 million, with more than one-fifth (21.6%) aged 65 years and older, underscoring the growing need for urological care and catheter solutions in the region.

The urinary catheters industry in the UK is evolving with a focus on patient-centric care, technological innovation, and home healthcare adoption. There is an increasing preference for intermittent and external catheters, driven by their safety, comfort, and suitability for self-catheterization at home. Technological advancements, including antimicrobial coatings, hydrophilic materials, and drug-eluting catheters, are helping reduce infection risks and enhance patient outcomes. The market is also influenced by the growing aging population and rising prevalence of urological conditions such as urinary incontinence, benign prostatic hyperplasia (BPH), and bladder dysfunction. Additionally, awareness campaigns and training programs promoting self-catheterization empower patients to manage their conditions independently, supporting the adoption of innovative catheter solutions across hospitals, care facilities, and home settings.

Asia Pacific Urinary Catheters Market Trends

The Asia Pacific urinary catheters industry is experiencing the fastest CAGR of 7.27% from 2025 to 2033. Fueled by combination of demographic and clinical factors, including a rapidly aging population, the rising prevalence of chronic diseases such as diabetes and neurological disorders, and an increasing burden of urological cancers. Countries like Japan, China, and South Korea are experiencing significant growth in their elderly populations, leading to higher incidences of urinary incontinence and bladder dysfunction. Additionally, the rising number of diabetes cases contributes to complications such as neurogenic bladder, further increasing the demand for catheters. The growing prevalence of prostate, bladder, and kidney cancers in the region also necessitates catheterization during post-operative care, collectively accelerating market growth.

The urinary catheters industry in China is witnessing significant growth, driven by an aging population, rising prevalence of urological disorders, and increasing awareness of advanced urinary management solutions. The growing number of elderly individuals is leading to higher rates of urinary incontinence, benign prostatic hyperplasia (BPH), and bladder dysfunction, fueling demand for both intermittent and long-term catheterization. Technological advancements, such as antimicrobial coatings, hydrophilic materials, and patient-friendly designs, are improving safety and comfort, encouraging wider adoption. Additionally, the expansion of home healthcare services and government initiatives to improve access to urological care are supporting market growth.

Latin America Urinary Catheters Market Trends

The urinary catheter industry in Latin America is primarily driven by the rising prevalence of chronic diseases such as diabetes, stroke, and spinal cord injuries, all of which contribute to urinary complications requiring catheterization. The region is witnessing a demographic shift with a growing elderly population, particularly in countries such as Brazil and Argentina, where age-related urological conditions such as benign prostatic hyperplasia and incontinence are becoming more common. The increasing number of surgical procedures, especially in urology, gynecology, and orthopedics, further boosts short-term demand for catheters in perioperative care.

Middle East and Africa Urinary Catheters Market Trends

The urinary catheter industry in the Middle East and Africa (MEA) is witnessing steady growth, driven by rising disease prevalence, demographic shifts, and expanding healthcare infrastructure. A significant increase in chronic conditions such as diabetes, prostate cancer, urinary incontinence, and spinal cord injuries is fueling the need for catheter-based urological care. The region's aging population, particularly in GCC countries and South Africa, further contributes to the demand for long-term and intermittent catheterization.

Key Urinary Catheters Company Insights

The industry is fragmented, with both major and local market competitors. Due to the current market players stepping up to grab the majority share, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many industry participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the urinary catheters industry is predicted to grow during the forecast period.

Key Urinary Catheters Companies:

The following are the leading companies in the urinary catheters market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Coloplast Corp

- B.Braun SE

- Medline Industries, LP.

- Hollister Incorporated

- Cook

- Teleflex Incorporated

- Optimum Medical Limited

- Convatec

- Boston Scientific Corporation

- Ur24Technology, Inc.

- Stryker

- InnoCare Urologics

- Boehringer Laboratories, LLC

- Consure Medical

- TillaCare Ltd.

- Medtronic

- Urotronic, Inc. (Laborie)

- Silq Technologies

- Wellspect HealthCare, a Dentsply Sirona Company

- GHC German Health Care GmbH

- Sterimed Group

Recent Developments

-

In April 2025, Silq Technologies Corporation, a privately owned leader in advanced materials science, secured a national group purchasing agreement and received the Technology Breakthrough Designation from Premier, Inc. The agreement has reportedly enabled Premier’s members to access pre-negotiated pricing and terms for ClearTract catheters.

-

In April 2024, Medline and Consure Medical announced a new agreement granting Medline exclusive distribution rights for the QiVi MEC male external urine management device. This device is designed to help prevent catheter-associated urinary tract infections (CAUTI) and incontinence-associated dermatitis (IAD).

-

In August 2024, InnoCare Urologics received U.S. FDA approval for its InnoCare Specialty Foley Catheter.

Urinary Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.54 billion

Revenue forecast in 2033

USD 10.93 billion

Growth rate

CAGR of 6.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, type, gender, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

BD; Coloplast Corp; B.Braun SE; Medline Industries, LP.; Hollister Incorporated; Cook; Teleflex Incorporated; Optimum Medical Limited; Convatec; Boston Scientific Corporation; Ur24Technology, Inc.; Stryker; InnoCare Urologics; Boehringer Laboratories, LLC; Consure Medical; TillaCare Ltd.; Medtronic; Urotronic, Inc. (Laborie); Silq Technologies; Cardinal Health; Wellspect HealthCare, a Dentsply Sirona Company; GHC German Health Care GmbH; Sterimed Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urinary Catheters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global urinary catheters market report on the basis of product, application, type, gender, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Intermittent Catheters

-

Foley/ Indwelling Catheters

-

External Catheters

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Benign Prostate Hyperplasia

-

Urinary Incontinence

-

Spinal Cord Injury

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Coated Catheters

-

Uncoated Catheters

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinics

-

Long-term Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global urinary catheters market size was estimated at USD 17 billion in 2024 and is expected to reach USD 6.54 billion in 2024.

b. The global urinary catheters market is expected to grow at a compound annual growth rate of 6.62% from 2025 to 2033 to reach USD 10.93 billion by 2033.

b. North America dominated the urinary catheter market with a share of 34.97% in 2024. This is attributable mainly to the rising incidence of targeted diseases, such as Urinary Incontinence (UI), bladder obstruction, urinary retention, Benign Prostate Hyperplasia (BPH), and bladder cancer.

b. Some key players operating in the urinary catheters market include BD, Coloplast Corp, B.Braun SE, Medline Industries, LP., Hollister Incorporated, Cook, Teleflex Incorporated, Optimum Medical Limited, Convatec, Boston Scientific Corporation, Ur24Technology, Inc., Stryker, InnoCare Urologics, Boehringer Laboratories, LLC, Consure Medical, TillaCare Ltd., Medtronic, Urotronic, Inc. (Laborie), Silq Technologies, Cardinal Health, Wellspect HealthCare, a Dentsply Sirona Company, GHC German Health Care GmbH, Sterimed Group.

b. Key factors that are driving the urinary catheters market growth include the rising prevalence of urologic diseases, an increasing number of surgical procedures across the globe, rising elderly population, and favorable reimbursement policies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.