- Home

- »

- Medical Imaging

- »

-

U.S. 3D Imaging Distance Service Market Size Report, 2030GVR Report cover

![U.S. 3D Imaging Distance Service Market Size, Share & Trends Report]()

U.S. 3D Imaging Distance Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Model (Per-case Image Processing Services, Subscription-based 3D Planning Platforms), By Application, By Sales Method, And Segment Forecasts

- Report ID: GVR-4-68040-595-0

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. 3D Imaging Distance Service Market Trends

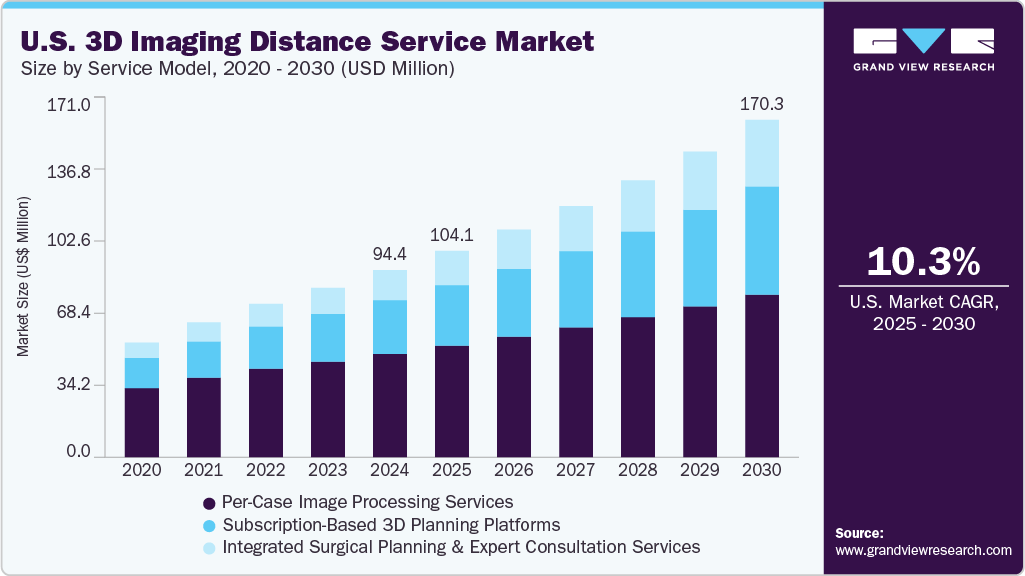

The U.S. 3D imaging distance service market size was estimated at USD 94.4 million in 2024 and is expected to grow at a CAGR of 10.34% from 2025 to 2030. The major factors attributed to the growth include the rising demand for personalized and minimally invasive surgeries, integration of AR/VR and AI in pre-surgical 3D planning, and increasing focus of healthcare facilities to reduce operational cost by outsourcing 3D imaging services. Moreover, the increasing patient pool in the U.S. healthcare facilities is increasing the burden on providers, further fueling the adoption of 3D imaging distance services in the U.S.

The adoption of minimally invasive surgical procedures has witnessed a significant increase in prevalence. This trend is primarily driven by the significant benefits of these techniques, which include reduced postoperative pain, shorter hospital stays, quicker recovery times for patients, and minimal scarring compared to traditional open surgery. These advantages have resulted in a higher implementation rate of minimally invasive surgery across various surgical specialties, such as gynecology, urology, and orthopedics. The growing preference for these less invasive approaches is a key factor stimulating the demand for advanced imaging solutions, including 3D imaging, which are crucial for enhancing the efficacy and safety of these surgical procedures.

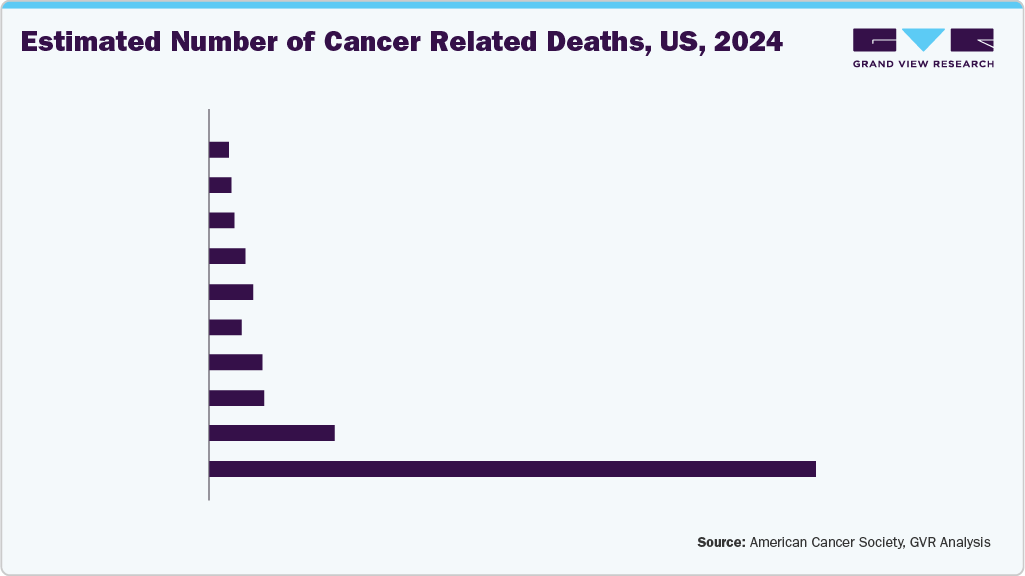

In 2025, the U.S. is estimated to witness around 2,041,910 new cases of cancer and approximately 618,120 deaths due to cancer. Lung, colorectal, and pancreatic cancers continue to be the primary contributors to cancer-related fatalities. The significant incidence and mortality rates associated with these types of cancer highlight the critical necessity for improved diagnostic and surgical technologies. Thus, 3D imaging services are crucial as they enhance early detection and support tailored treatment strategies, both of which are crucial for increasing survival rates and reducing pressure on the healthcare system.

The market is also witnessing a significant transformation driven by the integration of augmented reality (AR), virtual reality (VR), and artificial intelligence (AI). These technological advancements improve pre-surgical planning by providing highly detailed anatomical visualizations, enhancing the precision of surgical procedures, and reducing potential complications. Surgeons can now perform virtual simulations, map out operative pathways, and collaborate with specialists using real-time, patient-specific 3D data. These technologies' emergence sets new standards in surgical care and enables remote consultations and planning, which is critical for both urban centers and underserved areas. This evolution is fueling market growth and enhancing a digital transformation across healthcare networks, particularly within telemedicine, academic institutions, and advanced tertiary care centers.

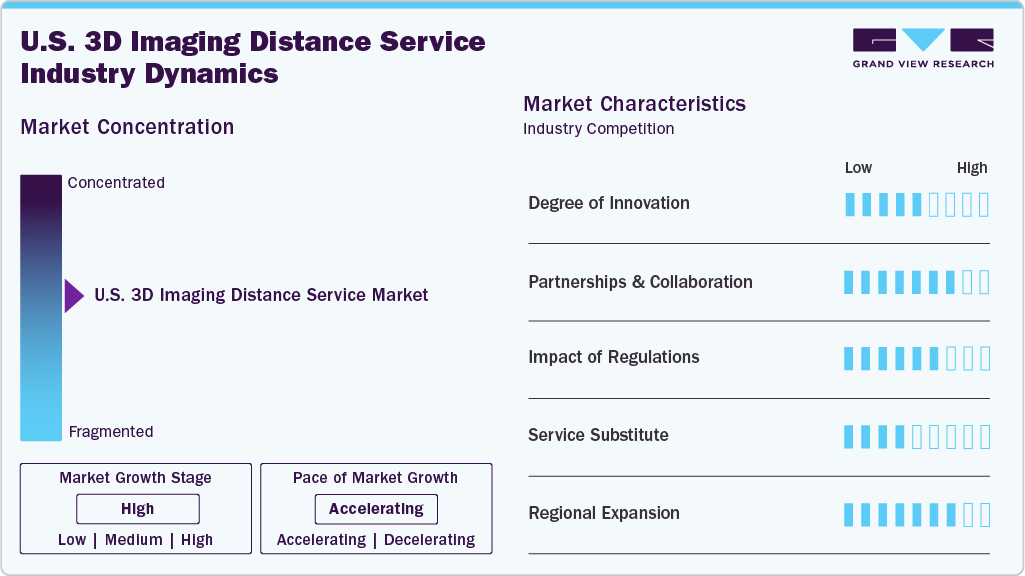

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of growth is accelerating. The U.S. 3D imaging distance service industry is characterized by moderate growth. Key driving factors include the rising demand for personalized and minimally invasive surgeries, the integration of AR/VR and AI technologies in pre-surgical 3D planning, and healthcare facilities’ increasing focus on reducing operational costs through outsourcing 3D imaging services.

The U.S. 3D medical imaging distance service industry is witnessing a high degree of innovation, driven by the inclusion of cloud computing, AI-based technologies, and advanced imaging hardware. Many hospitals and surgical centers are starting to use services that allow them to send patient scans to outside specialists who create detailed 3D images remotely. These services help surgeons plan operations more accurately, even if their facility doesn’t have advanced imaging teams or equipment. Some services also help hospitals by offering tools that make the images easier to understand, such as highlighting key areas of interest before surgery. Such innovations make imaging more accessible, faster, and easier for everyday surgical teams.

As the demand for high-quality 3D imaging increases among hospitals and surgical centers, more companies are exploring strategic partnerships to fill capability gaps and expand service reach. Imaging system manufacturers are expected to collaborate more with software companies to offer integrated platforms that deliver 3D reconstructions directly to surgical teams. Additionally, regional healthcare networks may partner with centralized imaging providers to improve access to expert-level image processing without investing in internal resources. These collaborations can help standardize service quality, reduce turnaround times, and streamline surgical workflows.

Regulation is crucial in the U.S. 3D medical imaging distance service industry. Since these services often involve patient data sharing and remote processing, they must comply with HIPAA and other data protection laws, which can influence how platforms are designed and operated. Moreover, providers need to ensure their technologies meet general FDA requirements for medical imaging software, especially when outputs are used in surgical planning. This adds complexity to new entrants and smaller players. Thus, in the short term, regulatory requirements can act as a barrier. Still, in the long term, they could support market growth by ensuring quality, safety, and accountability across providers and partners.

The threat of substitutes in the U.S. 3D medical imaging distance service industry is moderate but evolving. Traditional in-house imaging teams and on-premises 3D reconstruction tools can be primary alternatives. Larger hospitals with advanced radiology departments often prefer internal solutions, which give them greater control over data, faster turnaround times, and alignment with existing workflows. Some surgical planning software platforms also offer built-in 3D imaging features that reduce the need for external services. However, these substitutes come with high infrastructure and staffing costs, which many smaller or mid-sized facilities cannot sustain. As a result, remote services still offer a more affordable and scalable option for many providers.

Regional expansion in the U.S. 3D medical imaging distance service industry is expected to accelerate, especially in underserved and mid-tier healthcare regions. As awareness of the benefits of remote 3D imaging grows, the demand for these technologies in community hospitals, ambulatory surgical centers (ASCs), and rural networks is further expected to rise. These providers often lack in-house 3D imaging expertise or infrastructure and can benefit significantly from outsourced, cloud-based services. Improvements in digital health infrastructure, including secure data-sharing platforms, are also driving regional expansion. Companies that can build reliable service networks, offer flexible pricing, and ensure regulatory compliance are expected to drive regional expansion in the market.

Service Model Insights

Per-case image processing services accounted for the largest revenue share of 55.3% in 2024. This can be attributed to technological advancements and increasing demand for personalized imaging solutions. This service model allows healthcare providers to access high-quality imaging on a case-by-case basis, which is beneficial for facilities that may not have the resources to maintain extensive imaging capabilities in-house. The flexibility of per-case services enables hospitals and clinics to optimize their operational costs while ensuring that patients receive timely and accurate diagnoses. Moreover, the rise of artificial intelligence (AI) and machine learning technologies has enhanced the capabilities of image processing services. These technologies allow faster analysis and interpretation of complex imaging data, allowing radiologists to make informed decisions quickly.

Integrated surgical planning & expert consultation services is expected to witness the fastest CAGR of 14.2% over the forecast period. As healthcare providers adopt 3D imaging tools, such as cone-beam CT, MRI, and intraoperative imaging, the need for interpretive and planning support is growing rapidly, especially in smaller practices and community hospitals that lack in-house specialists. As hospitals and surgical centers face challenges related to imaging accuracy and patient outcomes, integrated services that combine advanced imaging technologies with expert consultations can address these issues effectively, as these services can enable providers to reduce diagnostic uncertainty, minimize pre-surgical planning errors, and enhance patient outcomes. Similarly, this service model allows healthcare providers to leverage 3D imaging capabilities remotely, facilitating real-time collaboration between surgeons and radiologists, further fueling the segment growth.

Application Insights

The general surgery segment accounted for the largest revenue share in 2024 and is expected to witness the fastest growth owing to the rising demand for advanced surgical technologies in a wide range of general surgery applications, such as liver, pancreas, esophagus, stomach, rectal, colorectal, gynecology, and others. Moreover, the rising prevalence of diseases in these applications further increases the surgical volumes, thereby fueling the segment growth.

Category

Statistics

Liver Disease (2023)

Over 100 million Americans have some form of liver disease

Diagnosed Liver Disease (2023)

4.5 million U.S. adults (1.8%) have been diagnosed with liver disease

Liver Cancer Cases (2023)

41,210

Pancreatic Cancer Estimated New Cases (2023)

64,050

Pancreatic Cancer Estimated Deaths (2023)

50,550

Rectal & Colorectal Cancer (CRC) Estimated New Cases (2024)

152,810 (106,590 colon; 46,220 rectal)

Rectal & Colorectal Cancer (CRC) Estimated Deaths (2024)

53,010

Source: Pancreatic Cancer Action Network, American Cancer Society, SEER Cancer Stat Facts

Cardiovascular & thoracic surgery is also expected to witness significant growth over the forecast period as 3D imaging distance services have become increasingly integral to cardiovascular and thoracic surgery in the U.S., enhancing both diagnostic accuracy and surgical planning. Advanced imaging modalities such as 3D CT angiography, MRI, and echocardiography capture detailed views of the heart, lungs, and vascular structures. These high-resolution images can be transmitted remotely to specialized cardiovascular centers where expert surgeons and radiologists analyze them for complex cases such as congenital heart defects, aneurysms, and lung tumors. This remote collaboration enables precise preoperative assessment and personalized surgical strategies, improving patient outcomes and reducing the need for multiple hospital visits.

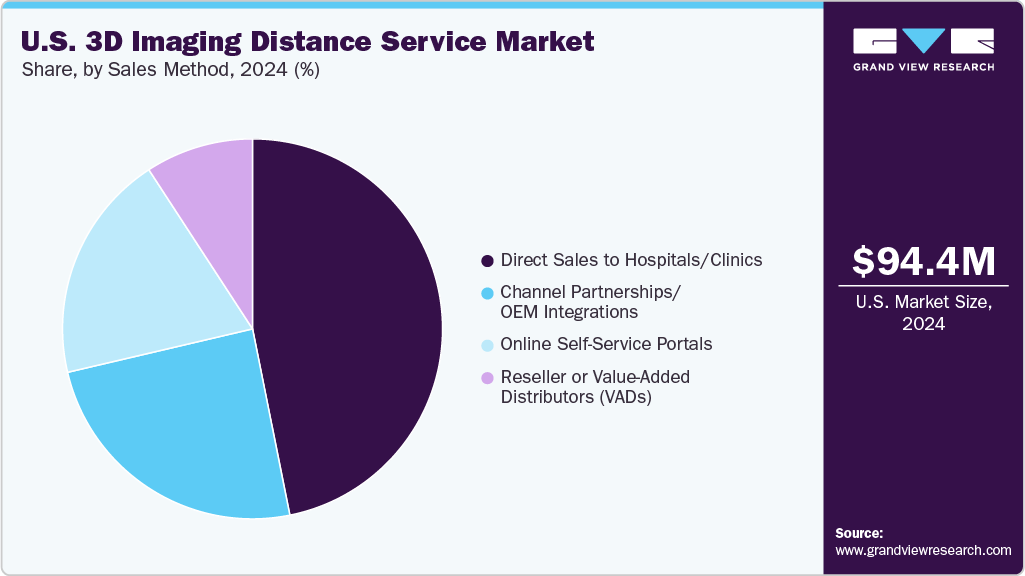

Sales Method Insights

The direct sales to hospitals/clinics segment dominated the market in 2024 owing to the increasing preference of healthcare facilities for vendor-managed, customized imaging solutions. This method eliminates third-party distributors, allowing providers of 3D imaging services to establish relationships with medical institutions. Hospitals and clinics benefit from direct access to customized service agreements, dedicated support, and pricing models that align with their specific imaging volumes and clinical demands. Moreover, through direct engagement, vendors can also better align imaging protocols with each facility's clinical workflow, enhancing the efficiency and utility of 3D reconstructions. This personalized engagement is expected to drive the adoption of direct sales in this market.

The reseller or Value-Added Distributors (VADs) is expected to witness the fastest growth owing to the complexity of advanced technology and the specialized needs of healthcare providers adopting remote imaging solutions. Vendors recognize that direct sales models can be inefficient for penetrating a diverse and geographically dispersed market with less understanding of distance service benefits. VADs with deep technical expertise in medical imaging, IT infrastructure, and regulatory compliance are addressing the challenges of healthcare providers in procuring distance 3D imaging service benefits. Moreover, this sales method offers service providers a scalable channel for market access, providing pre-sales technical support, conducting product demonstrations customized to clinical workflows, and enhancing the procurement processes within healthcare organizations. This reliance on VADs accelerates market penetration and facilitates the initial adoption phase for several imaging service providers.

Key U.S. 3D Imaging Distance Service Company Insights

The U.S. 3D imaging distance service market is competitive and has several key players. The major market players are focused on forming partnerships and collaborations, introducing new technologies, taking advantage of important cooperation activities, and exploring mergers and acquisitions.

Key U.S. 3D Imaging Distance Service Companies:

- Medannot

- Ceevra, Inc.

- Visible Patient (VP)

- EDDA Technology, Inc.

- Materialise NV

- MeVis Medical Solutions AG

- 3D Systems, Inc.

- Innersight Labs Ltd.

- Precision Image Analysis, Inc.

- 3DR Labs, LLC

Recent Development

-

In September 2024, 3D Systems received FDA 510(k) clearance for its TOTAL ANKLE Patient-Matched Guides, developed in collaboration with Smith+Nephew. These guides integrate 3D Systems’ Virtual Surgical Planning (VSP) technology with patient-specific 3D-printed instruments, designed for use with Smith+Nephew’s SALTO TALARIS and CADENCE Total Ankle Systems. This advancement enhances surgical precision by enabling accurate implant sizing & alignment, potentially reducing procedural steps, operating room time, and intraoperative radiation exposure.

-

In April 2024, 3D Systems received FDA clearance for its 3D-printed PEEK cranial implants. This innovative technology allows for customized, patient-specific implants that enhance surgical outcomes and recovery. The approval marks a significant advancement in cranial reconstruction, providing neurosurgeons with new tools to improve patient care.

-

In January 2024,KARL STORZ, a leading MedTech company, acquired British AI specialist Innersight Labs Ltd. (ISL), known for its Innersight3D software that transforms CT and MRI scans into interactive, patient-specific 3D models accessible via web links. This acquisition enhances KARL STORZ's portfolio by integrating AI-driven 3D imaging solutions, facilitating more accurate preoperative assessments, reducing operation times, and minimizing surgical complications.

U.S. 3D Imaging Distance Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 104.1 million

Revenue forecast in 2030

USD 170.3 million

Growth rate

CAGR of 10.34% from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service model, application, sales method

Key companies profiled

Medannot; Ceevra, Inc.; Visible Patient (VP); EDDA Technology, Inc.; Materialise NV; MeVis Medical Solutions AG; 3D Systems, Inc.; Innersight Labs Ltd.; Precision Image Analysis, Inc.; 3DR Labs, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. 3D Imaging Distance Service Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. 3D imaging distance service market report based on service model, application, and sales method:

-

Service Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Per-case Image Processing Services

-

Subscription-based 3D Planning Platforms

-

Integrated Surgical Planning & Expert Consultation Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urological Surgery

-

Oncological

-

Non-Oncological

-

-

Neurosurgery

-

Oncological

-

Non-Oncological

-

-

Cardiovascular & Thoracic Surgery

-

Oncological

-

Non-Oncological

-

-

General Surgery

-

Liver

-

Pancreas

-

Esophagus

-

Stomach

-

Rectal & Colorectal

-

Gynecology

-

Other

-

-

Other Applications

-

-

Sales Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales to Hospitals/Clinics

-

Online Self-service Portals

-

Channel Partnerships / OEM Integrations

-

Reseller or Value-added Distributors (VADs)

-

Frequently Asked Questions About This Report

b. The U.S. 3D imaging distance service market size was valued at USD 94.4 million in 2024 and is expected to reach a value of USD 104.1 million in 2025.

b. The U.S. 3D imaging distance service market is expected to grow at a compound annual growth rate of 10.34% from 2025 to 2030 to reach USD 170.3 million by 2030.

b. The general surgery segment accounted for the largest revenue share in 2024 and is expected to witness the fastest growth owing to the rising demand for advanced surgical technologies in a wide range of general surgery applications such as liver, pancreas, esophagus, stomach, rectal & colorectal, gynecology, and others.

b. Some key players operating in the U.S. 3D imaging distance service market includes Medannot; Ceevra, Inc.; Visible Patient (VP); EDDA Technology, Inc.; Materialise NV; MeVis Medical Solutions AG; 3D Systems, Inc.; Innersight Labs Ltd.; Precision Image Analysis, Inc.; 3DR Labs, LLC

b. Key factors driving the growth of the U.S. 3D imaging distance service market include the rising demand for personalized and minimally invasive surgeries, integration of AR/VR and AI in pre-surgical 3D planning, and increasing focus of healthcare facilities to reduce operational cost by outsourcing 3D imaging services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.