Market Size & Trends

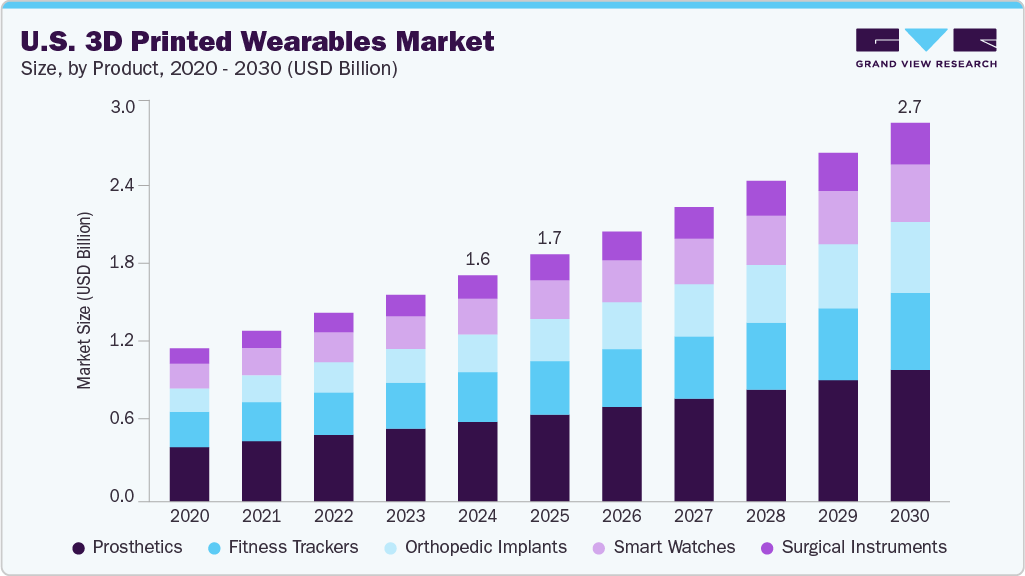

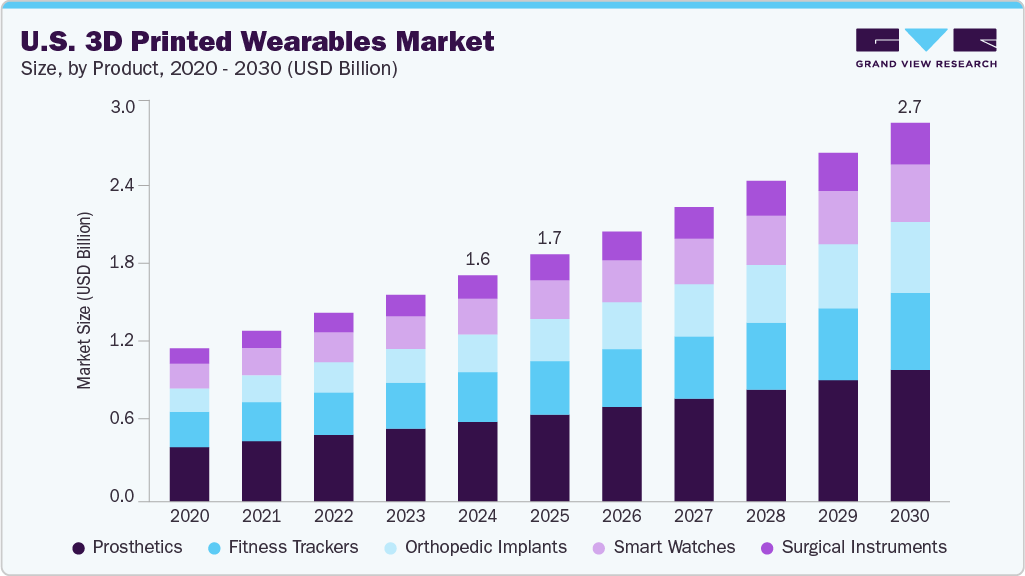

The U.S. 3D printed wearables market size was valued at USD 1.60 billion in 2024 and is projected to reach USD 2.67 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Personalization & precision medicine, growing chronic diseases, technological advancements, cost efficiency & faster turnaround and an aging population are the key market growth drivers. 3D printing allows custom-fit devices tailored to an individual’s anatomy and is valuable in orthopedic implants and prosthetics. It enhances comfort, functionality, and patient satisfaction.

The U.S. 3D printed wearables market in healthcare is growing significantly due to new technology, rising demand for personalized medical care, and strong regulatory support. This market includes prosthetic limbs, orthopedic implants, surgical tools, and wearable medical devices. A major benefit of 3D printing is that it can create custom-fit products for each patient, which improves comfort and performance, which is especially important for joint replacements and prosthetics.

According to a report by the FDA in December 2023, medical devices produced by 3D printing include orthopedic and dental restorations, cranial implants, surgical instruments, and external prosthetics. The FDA has provided guidance on technical considerations for additive-manufactured medical devices, emphasizing the importance of ensuring device safety and effectiveness.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. 3D printed wearables market is characterized by high innovation due to rapid advancements in additive manufacturing, AI integration, and personalized healthcare solutions. U.S.-based companies and healthcare institutions are leveraging 3D printing to develop patient-specific prosthetics, orthopedic implants, and anatomical models with customization.

The U.S. 3D printed wearables industry is experiencing moderate Merger and Acquisition (M&A) activity among leading players. According to a report published by Business Standard in June 2022, Meta acquired Luxexcel, a Netherlands-based company specializing in 3D-printed prescription lenses for augmented reality (AR) glasses.

The U.S. 3D printed wearables market is subject to the high impact of regulations, as the FDA plays an important role in ensuring the safety and effectiveness of these medical devices. The FDA regulates 3D printed medical devices through the same pathways as traditional devices, evaluating them based on safety and effectiveness information submitted by manufacturers.

Product Insights

The prosthetics segment accounted for the largest revenue share of around 35.0% in 2024. This segment is attributed to personalized and patient-specific products tailored to an individual's unique anatomy, enhancing comfort and functionality. In addition, government initiatives to adopt 3D printing technologies are increasing the demand for 3D printed wearables. A US-based firm called LIMBER Prosthetics & Orthotics makes prosthetic limbs that are reasonably priced. The process used by the startup scans amputee limbs and creates custom prostheses from them. Its manufacturing process includes imaging, modeling, simulation, testing, digital design, and 3D printing to dramatically lower production costs. Along with offering lower prices, the firm also caters to the demands of each user to better help amputees and people with disabilities.

The orthopedic implants segment is expected to register a CAGR of 11.0% over the forecast period. These implants provide advantages such as extra comfort, efficiency, relative abundance, and a long shelf life. However, the increasing prevalence of musculoskeletal disorders is expected to drive the growth of the 3D-printed wearable industry.

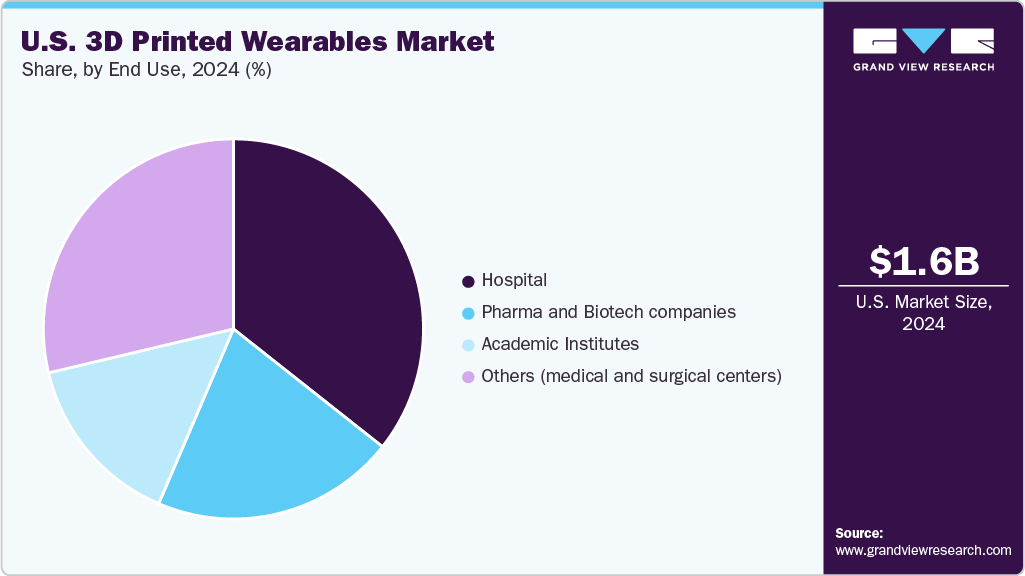

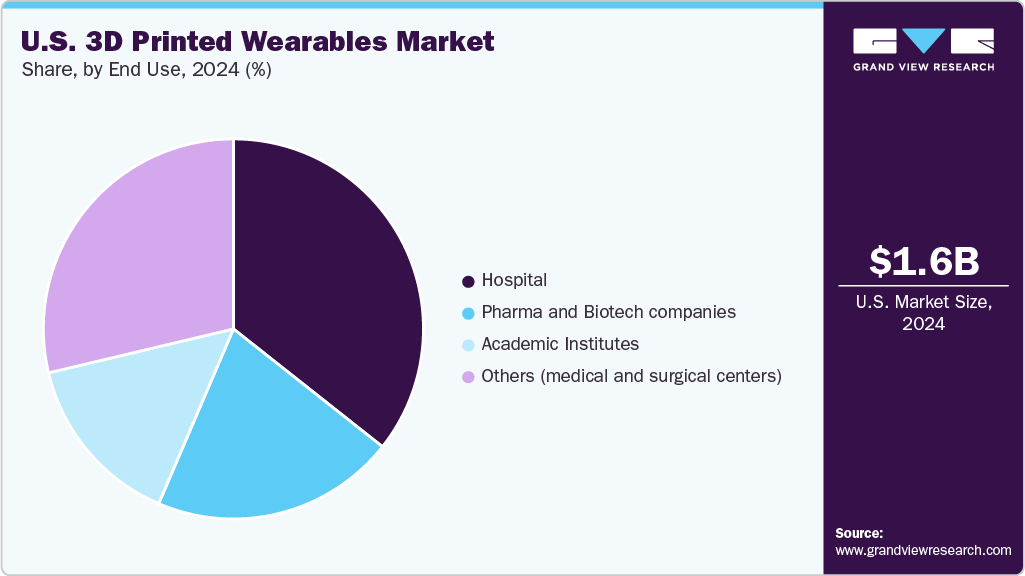

End Use Insights

The hospital segment accounted for the largest revenue share in 2024 due to the sharp rise in patient admissions, an increase in chronic health conditions, and greater investment in R&D for these devices. Hospitals need these wearables in large numbers across various departments such as nurse stations, operating rooms, emergency areas, outpatient clinics, and ambulatory services, which is boosting overall market demand. The NIH/National Library of Medicine article published in December 2023 highlights the importance of centralized 3D printing within hospitals to support personalized patient care. It also highlights the successful integration of 3D printing into surgical guides and clinical workflows, enabling the production of patient-specific anatomical models and implants.

The pharma and biotech companies segment is expected to grow at the fastest CAGR over the forecast period. Wireless 3D-printed devices are likely to help maintain patient records more systematically. Increasing focus on 3D-printed wearables and growing R&D spending are major factors responsible for this segment's growth.

Key U.S. 3D Printed Wearables Company Insights

The key companies engage in partnerships, mergers, and acquisitions, aiming to strengthen their product portfolio, expand their manufacturing capacities, and provide competitive differentiation.

-

3D Systems provides a comprehensive suite of additive manufacturing solutions tailored for the wearable technology market, enabling scalable mass customization with high precision and superior surface finishes.Its integrated offerings, including hardware, software, and production-grade materials, support rapid prototyping and efficient production of biocompatible, durable wearable components, helping businesses accelerate innovation and reduce time-to-market

-

Stratasys Direct provides ISO 13485-certified 3D printing services tailored for the medical industry, enabling the production of patient-specific wearable components with complex geometries that traditional manufacturing methods cannot achieve. Its advanced additive manufacturing technologies and engineering-grade materials facilitate rapid production of customized medical wearables, enhancing innovation and reducing time-to-market for healthcare providers and device manufacturers.

Key U.S. 3D Printed Wearables Companies:

- 3D Systems, Inc

- ENVISIONTEC US LLC

- Stratasys

- GENERAL ELECTRIC

- CYFUSE BIOMEDICAL K.K.

- Koninklijke Philips N.V.

- Zephyr Technologies & Solutions Pvt. Ltd

- OMRON Corporation

- Everist Health, Inc.

- BioTelemetry

Recent Developments

-

In January 2025, Ortho Solutions, a global leader in foot and ankle medical devices, signed a definitive agreement to acquire Meshworks. This acquisition will strengthen Ortho Solutions’ position and accelerate its global mission to advance foot and ankle care.

-

In June 2024, Ricoh USA announced the launch of RICOH 3D for Healthcare Innovation Studio, its flagship Point of Care 3D medical device manufacturing facility. This on-site center enables clinicians to access patient-specific, 3D-printed anatomic models for patient education and surgical planning.

U.S. 3D Printed Wearables Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 2.67 billion

|

|

Growth rate

|

CAGR of 8.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, end use

|

|

Key companies profiled

|

3D Systems, Inc; ENVISIONTEC US LLC; Stratasys; GENERAL ELECTRIC; CYFUSE BIOMEDICAL K.K.; Koninklijke Philips N.V.; Zephyr Technologies & Solutions Pvt. Ltd; OMRON Corporation; Everist Health, Inc.; BioTelemetry

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. 3D Printed Wearables Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. 3D printed wearables market based on product and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prosthetics

-

Orthopedic Implants

-

Surgical Instruments

-

Smart Watches

-

Fitness Trackers

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)