- Home

- »

- Next Generation Technologies

- »

-

U.S. 5G Radio Access Network Professional Services Market Report 2030GVR Report cover

![U.S. 5G Radio Access Network Professional Services Market Size, Share & Trends Report]()

U.S. 5G Radio Access Network Professional Services Market (2023 - 2030) Size, Share & Trends Analysis Report By End-user (Enterprises, Telecom Operators), By Deployment Mode (On-premise, Cloud), By Service Type, And Segment Forecasts

- Report ID: GVR-4-68040-139-4

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

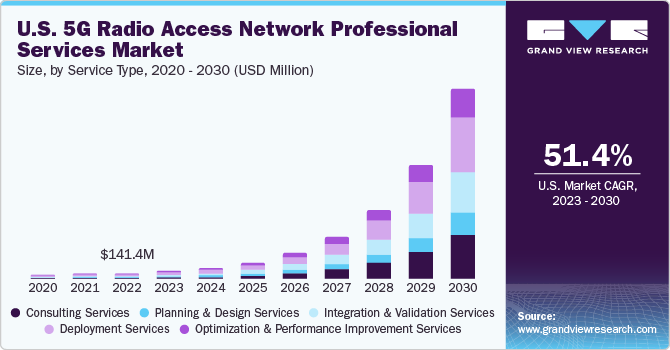

The U.S. 5G radio access network professional services market size was estimated at USD 141.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 51.4% from 2023 to 2030. The market size comprises a mix of consulting, planning & design, integration & validation, and optimization & performance improvement services. Increasing demand for 5G network services and the growing implementation of Open RAN (O-RAN) across the country are the major factors driving the market growth. The growing demand for low latency and superior bandwidth connectivity for smart city applications, drone connectivity, and vehicle-to-everything (V2X) applications, among others, is expected to propel the growth of the U.S. 5G radio access network (RAN) professional services market.

The market thrives on the demand for expert guidance and specialized assistance in deploying and managing 5G RAN infrastructure. These services are vital in enabling efficient 5G network operations, meeting the increasing demand for high-speed, low-latency connectivity in the U.S.The market primarily aims to assist telecommunication service providers and enterprises in effectively adopting and integrating 5G RAN into their existing or evolving network infrastructure. These services ensure seamless network operations, optimal performance, and achieving desired business outcomes.

COVID-19 Impact on the U.S. 5G Radio Access Network Professional Services Market

The pandemic accelerated the urgency for digital transformation across industries. Businesses, including telecom operators, expedited their 5G RAN integration plans to accommodate the increased demand for remote work, online education, telemedicine, and virtual events, necessitating more professional services for rapid deployment and optimization. With a substantial surge in remote activities, network traffic soared. Telecom operators had to bolster their 5G RAN infrastructure to meet the heightened demand for high-speed, reliable connectivity.

This resulted in a surge in the demand for professional services to optimize existing networks and expedite 5G deployments. The COVID-19 pandemic has acted as a catalyst for the market, expediting digital transformation, increasing demand for robust networks, altering work paradigms, and emphasizing the criticality of seamless and efficient 5G RAN integration and optimization. Despite challenges, the pandemic has underlined the significance of advanced telecommunication infrastructure and the services that support its deployment and management.

Service Type Insights

In terms of service, the market is classified into consulting services, planning & design services, integration & validation services, deployment services, and optimization & performance improvement services. The consulting services segment dominated the market and accounted for a share of more than 28% in 2022. It is expected to grow at a CAGR of 47.9% over the forecast period. Consultation helps businesses and firms to be aware of new and upcoming technologies and services, such as 5G Open RAN, IoT, and Edge Computing. Furthermore, consulting offers flexible support to businesses.

For instance, Grandmetric offers 5G consultation services that advise on the recent developments in the mobile network industry. The deployment services segment is anticipated to grow at the fastest CAGR of 54.2% over the forecast period. As the deployment services are challenging & complex, the demand for efficient & effective 5G RAN deployment service providers is increasing across the U.S. Companies are launching new products that help provide deployment services. For instance, Viavi Solutions Inc. launched OneAdvisor 800, a cell site tool for the verification of field deployment of O-RAN radios.

Deployment Mode Insights

In terms of deployment mode, the market is classified into on-premises and cloud. The on-premises deployment mode segment dominated the market and accounted for the largestshare of more than 51% in 2022. It is expected to grow at a CAGR of 46.9% over the forecast period. Security and safety are inherently strong with on-premise deployment as 5G device information and user data inside the firm are always processed and stored in the local area. In addition, communication among enterprise 5G devices, edge computing, and the existing intranet takes place within the enterprise, minimizing latency and driving the segment's growth.

The cloud segment is expected to grow at the fastest CAGR of 55.4% during the forecast period. Implementing the cloud-based 5G network enables broader ecosystem innovation, continuous software updates, and rapid scaling for on-demand responsiveness, improving resiliency and security. Enterprises can benefit from deploying a 5G network on a cloud to take advantage of the infrastructure, ecosystem, and partnerships. Furthermore, the cloud-based 5G network architecture can be deployed on hybrid cloud and public cloud, offering businesses and enterprises the freedom and flexibility driving the segment’s growth.

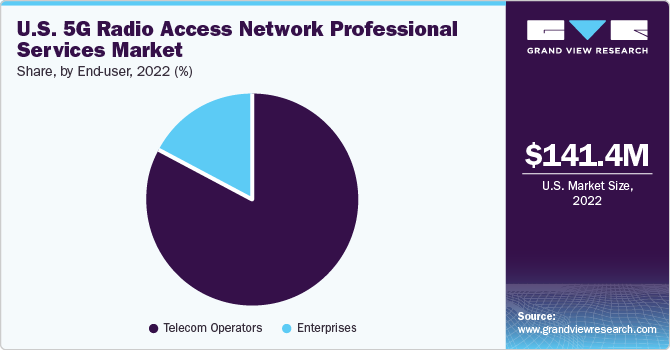

End-user Insights

In terms of end-users, the market is classified into telecom operators and enterprises. The telecom operators segment has dominated the market, gaining a market share of more than 80% in 2022, and is expected to register a CAGR of 48.4% during the forecast period. It offers telecommunication operators a larger bandwidth of the mid-band to deliver unmatched consumer experiences. Moreover, such services enable telecommunication operators to identify new businesses and expand 5G coverage faster. Capacity and coverage are critical components for enhanced 5G user experience. Carrier aggregation is the base for better 5G, an effective tool for extending mid- and high-band coverage, which leads to increased capacity.

The enterprise segment is anticipated to witness the fastest CAGR of 61.8% over the forecast period. The growing demand for IoT deployment among enterprises is fueling the market demand. For instance, according to the latest GVR analysis, roughly one-third of the 950 enterprises had more than 1,000 connected devices in their IoT deployments. Furthermore, large-scale investment in 5G networks is another factor fueling the market demand. Moreover, various market players pursue key strategies, such as partnerships and collaborations, to offer enterprises enhanced 5G solutions.

Key Companies & Market Share Insights

The market is fragmented with numerous local and international players and is likely to witness high competition. Key players are adopting strategies, such as acquisition, to gain a competitive edge. In August 2023, Samsung Electronics Co., Ltd. announced extending its collaboration with Intel Corporation. This extension marks a significant stride in advancing virtualized Radio Access Network (vRAN) solutions, delivering heightened performance and capacity to meet the evolving needs of the telecommunications industry. Some of the prominent players in the U.S. 5G radio access network professional services market include:

-

Telefonaktiebolaget LM Ericsson

-

Nokia Corporation

-

Infovista

-

Tech Mahindra USA

-

Tata Consultancy Services

-

Nominos USA Inc

-

Link Consulting Services

-

GRANDMETRIC

-

Dell EMC

-

Intel Corporation

U.S. 5G Radio Access Network Professional Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3,897.6 million

Growth rate

CAGR of 51.4% from 2023 to 2030

Base year for estimation

2022

Historical year

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, deployment mode, end-user

Country scope

U.S.

Key companies profiled

Telefonaktiebolaget LM Ericsson; Nokia Corp.; Infovista; Tech Mahindra USA; Tata Consultancy Services; Nominos USA Inc.; Link Consulting Services;Grandmetric; Dell EMC; Intel Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. 5G Radio Access Network Professional Services Market Report Segmentation

This report forecasts revenue growth at a country level and provides a qualitative and quantitative analysis of the latest trends for each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. 5G radio access network professional services market report based on service type, deployment mode, and end-user:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Consulting Services

-

Planning & Design Services

-

Integration & Validation Services

-

Deployment Services

-

Optimization And Performance Improvement Services

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom Operators

-

Enterprises

-

Frequently Asked Questions About This Report

b. The U.S. 5G radio access network (RAN) professional services market size was estimated at USD 141.4 million in 2022 and is expected to reach USD 178.6 million in 2023.

b. The U.S. 5G radio access network (RAN) professional services market is expected to grow at a compound annual growth rate of 51.4% from 2023 to 2030 to reach USD 3,897.6 million by 2030.

b. The consulting services segment has dominated the market, gaining a significant market share of more than 28% in 2022. It is expected to grow at a CAGR of 47.9% throughout the forecast period. Consultation helps businesses and firms to be aware of new and upcoming technologies and services such as 5G Open Ran, IoT, and Edge Computing.

b. Some prominent players in the market include Telefonaktiebolaget LM Ericsson, Nokia Corporation, Infovista, Tech Mahindra USA, Tata Consultancy Services, Nominos USA Inc, Link Consulting Services, GRANDMETRIC, Dell EMC, and Intel Corporation among others

b. The growing demand for low latency and superior bandwidth connectivity for smart city applications, drone connectivity, and vehicle-to-everything (V2X) applications, among others, is expected to propel the growth of the U.S. 5G RAN professional service market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.