- Home

- »

- Next Generation Technologies

- »

-

U.S. AI Vision Market Size & Trends, Industry Report, 2033GVR Report cover

![U.S. AI Vision Market Size, Share & Trends Report]()

U.S. AI Vision Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Service Type (Behavioural Analysis, Image Recognition), By Technology (Machine Learning, Generative AI), By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-782-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. AI Vision Market Size & Trends

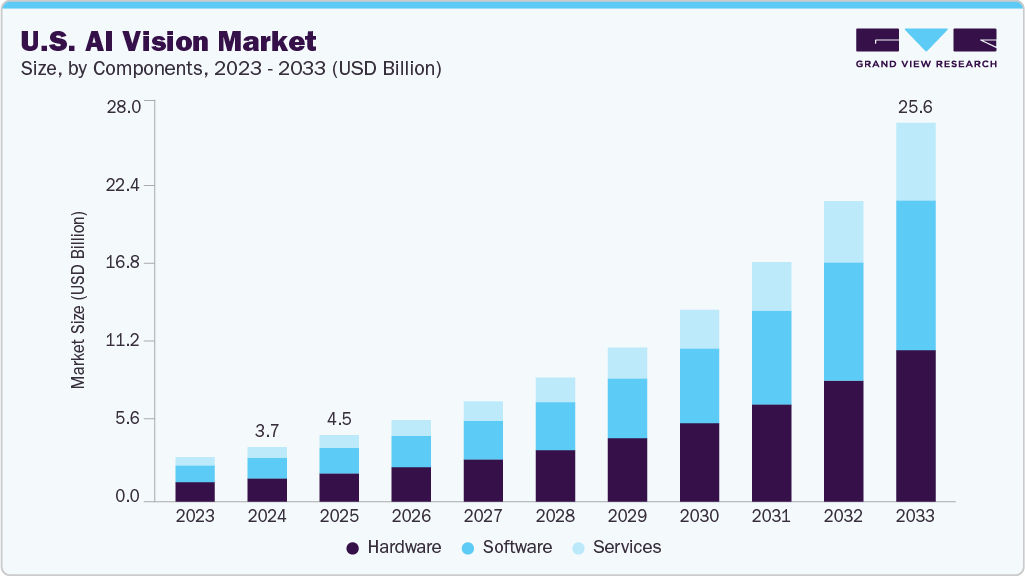

The U.S. AI vision market size was valued at USD 3,669.1 million in 2024 and is expected to reach USD 25,565.5 million by 2033, growing at a CAGR of 24.3% from 2025 to 2033. The growth is largely driven by the widespread adoption across key sectors such as retail, healthcare, manufacturing, and automotive. Increasing automation requirements for visual inspection and quality control are primary factors enhancing operational efficiency and accuracy. The availability of vast amounts of image and video data from IoT devices further accelerates AI vision capabilities, enabling more analysis and insights.

Advancements in deep learning algorithms and neural network development significantly improve the precision and speed of AI vision systems. Integration with edge computing platforms supports real-time data processing at the source, reducing latency and bandwidth burdens. This technological synergy expands applications into autonomous vehicles, smart city infrastructure, and augmented reality, broadening market scope and use cases in both industrial and consumer domains. Scalable cloud-based AI vision platforms also facilitate broader accessibility, allowing organizations of various sizes to integrate advanced visual intelligence solutions cost-effectively.

Furthermore, sustainability considerations influence increasing deployment of AI vision solutions aimed at optimizing resource consumption and minimizing waste. Investment flows from both private enterprises and government initiatives contribute substantially to market growth. Federal support for AI research and ethical deployment frameworks fosters innovation while addressing data privacy and security considerations. The focus on predictive maintenance and personalized customer experiences reinforces enterprise decisions to adopt AI-driven visual analytics. The overall ecosystem reflects a dynamic interplay between technology innovation, regulatory support, and expanding application demand in the U.S. market.

Component Insights

The hardware segment accounted for the highest revenue share of 43.0% in 2024. The market is driven by the evolution of specialized GPUs, TPUs, and edge AI devices, which significantly enhance processing speed and efficiency in visual data analysis. AI cameras, sensors, and optics have improved real-time image and video processing capabilities, enabling precise identification and deep neural network training. The adoption of edge computing hardware in U.S. industries facilitates on-site AI inference, reducing dependency on cloud processing and enhancing responsiveness in applications such as autonomous vehicles, manufacturing quality control, and security systems. For instance, in January 2025, Intel Corporation launched the Intel Core Ultra (Series 2) processors, delivering advanced AI enhancements, improved efficiency, and significant performance gains across mobile computing, gaming, and edge applications. It offers enhanced business productivity and IT management with AI-driven features, while the 200HX and H series incorporate integrated neural processing units and Intel Arc graphics for creators and gamers. Additionally, Intel introduced edge-optimized processors that provide scalability and superior performance in AI workloads, notably surpassing previous generations in media processing and AI analytics performance.

The service segment is expected to register a CAGR of 25.2% from 2025 to 2033. The market is driven by the growing demand for integrated solutions encompassing system design, consulting, deployment, and ongoing maintenance. Rising adoption across sectors and manufacturing supports with custom AI vision service offerings enable personalized implementations aligned with client objectives. Managed services and cloud-based AI vision platforms facilitate scalability and flexible access to sophisticated vision algorithms and analytics without heavy upfront capital expenditure. Service providers increasingly focus on delivering interpretability, regulatory compliance, and data privacy features within AI vision solutions to meet stringent governance requirements. The service segment also benefits from continuous advances in AI algorithms, fostering enhanced support, training, and system integration expertise. For instance, in May 2025, Google introduced advancements in AI vision, highlighting the integration of generative AI across its products, such as Gmail and Google Workspace. New AI-powered features, such as "Help me write" in Gmail and enhanced capabilities in Google Bard, were introduced to improve productivity and creativity. Additionally, developments in models such as Gemini and collaborations to enhance AI-driven imaging and coding tools underscored Google's commitment to delivering practical AI solutions for developers and users alike.

Service Type Insights

The image recognition segment accounted for the largest market revenue share in 2024. Image recognition in the market advances through integration with machine learning and neural network models that elevate accuracy and speed in object, face, and pattern identification. Diverse sectors, including healthcare, automotive, retail, and security, adopt image recognition to automate diagnostics, enable autonomous navigation, enhance product management, and strengthen surveillance systems. The proliferation of high-resolution imaging devices alongside cloud and edge-based processing platforms fuels large-scale data utilization for more nuanced recognition tasks. This segment's growth is further supported by increasing demands for real-time analytics and personalized user interactions across digital and physical environments. Hybrid infrastructures, offering both on-demand and long-term access to GPU computing power. For instance, in September 2025, NVIDIA introduced a CUDA-accelerated implementation of the SMPTE VC-6 codec designed to optimize vision AI pipelines by addressing GPU data starvation. The VC-6 codec enables hierarchical, multi-resolution, and selective decoding that reduces I/O, bandwidth, and memory use while facilitating efficient parallel processing on GPUs. Benchmarks show up to 13x faster performance over CPU and improvements compared to previous GPU implementations, with direct integration into AI frameworks such as PyTorch, allowing decoded images to be consumed by models without CPU synchronization.

The behavioral analysis segment is projected to grow significantly over the forecast period. In the U.S., behavioral analysis within AI vision is increasingly utilized to enhance security, retail analytics, and customer experience management. Its capability to interpret subtle human actions and predict outcomes supports applications in smart surveillance and personalized marketing. Improved algorithmic accuracy and real-time processing facilitate better decision-making in environments ranging from physical stores to public safety. The adaptation of edge computing reduces latency, enabling immediate responses to detected behaviors. Additionally, the demand for fraud detection and compliance monitoring across finance and healthcare sectors contributes to market expansion in this segment. Ongoing innovation in multi-modal AI systems enriches behavioral insights, driving deeper understanding of user intent and contextual significance. For instance, in July 2024, NVIDIA introduced Metropolis microservices and Isaac Sim to streamline the development and deployment of scalable, cloud-native vision AI applications. The platform supports multi-camera tracking, behavior analytics, and anomaly detection through modular microservices, enhancing real-time monitoring across large spaces such as warehouses and airports. Isaac Sim enables synthetic data generation to improve AI model training, while tools such as the TAO Toolkit and PipeTuner facilitate model fine-tuning and pipeline optimization, accelerating vision AI solutions from edge to cloud.

Technology Insights

Machine learning accounted for the largest market revenue share in 2024. The market is driven by providing the foundational capability for visual data analysis and pattern recognition essential to real-time image processing. Advances in architectures such as Vision Transformers enable more effective feature extraction from images compared to traditional convolutional networks, improving tasks such as classification, segmentation, and object detection. Increasing deployment of edge AI for real-time processing on devices such as cameras and drones enhances privacy and reduces latency, expanding AI vision use in smart cities, healthcare, and autonomous transportation. For instance, in January 2025, NVIDIA announced AI Foundation Models running locally on NVIDIA RTX AI PCs, enabled by the new GeForce RTX 50 Series GPUs with advanced FP4 compute architecture that doubles AI inference performance. These AI models, available as NVIDIA NIM microservices, support a broad range of uses, including large language models, vision language models, image generation, speech, PDF extraction, and computer vision. The models integrate with popular AI frameworks and development tools on Windows 11, enabling enhanced digital humans, content creation, and productivity on personal computers.

The generative AI segment is projected to grow significantly over the forecast period. The market is driven by the Generative AI is significantly shaping the U.S. AI vision market by overcoming data scarcity and improving dataset diversity through synthetic image and video generation. This enhances model accuracy and reduces bias, which is crucial for sectors such as medical imaging and autonomous driving, where acquiring labeled data is costly. Additionally, generative AI expands application use cases by enabling virtual environment creation and personalized content, thereby broadening the functional scope of AI vision technologies. The integration of generative AI into core workflows and enterprise software boosts productivity and accelerates adoption in business environments, supported by strong investment and innovation ecosystems in the U.S. For instance, in January 2025, NVIDIA launched the Cosmos platform, a generative function model solution offering advanced tokens, railings, and a video processing pipeline to support the development of physical AI systems, including autonomous vehicles and robots. The platform enables developers to generate photorealistic synthetic data, customize models with specific datasets, and efficiently process and curate vast amounts of video data, significantly reducing the time and cost associated with training and testing physical AI models.

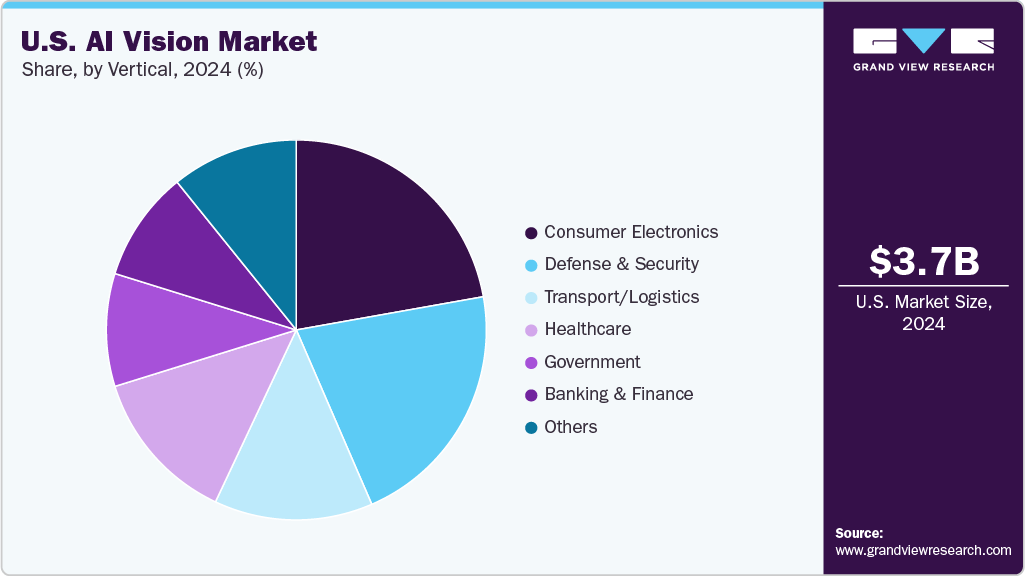

Vertical Insights

Consumer electronics accounted for the largest market revenue share in 2024. The consumer electronics sector leads AI vision integration with widespread deployment in devices such as smartphones, smart TVs, wearables, and home security systems. Key applications include facial recognition for secure device unlocking, gesture-based control interfaces, and augmented reality features enhancing user interaction. Frequent innovation cycles and consumer demand for intelligent and personalized products support the ongoing embedding of advanced AI vision capabilities. The proliferation of connected devices generates massive visual data streams, further fueling the development and adoption of AI vision technologies to enhance device functionality and security in this vertical.

The banking and finance segment is projected to grow significantly over the forecast period. The adoption of AI vision technologies in banking and finance is accelerating due to increasing demands for enhanced security and streamlined customer interactions. Document verification systems automate identity authentication, reducing fraud and ensuring compliance with regulations. Behavioral analytics, powered by AI vision, monitors transactional patterns to identify anomalies and potential financial crimes. Additionally, AI vision facilitates customer service automation through intelligent kiosks and biometric access controls, enabling more secure and efficient banking operations. The digitization efforts across financial institutions are prioritizing trust, operational resilience, and seamless customer experiences, driving rapid AI vision uptake in this sector.

Key U.S. AI Vision Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the AI vision industry are IBM Corporation, Google LLC, Amazon Web Services, Inc., and Microsoft.

-

IBM Corporation offers advanced AI-powered computer vision solutions that simplify and accelerate visual recognition tasks across industries. Its PowerAI Vision platform enables businesses to build, train, and deploy deep learning models for image and video classification and object detection without requiring extensive coding or AI expertise. This platform supports applications such as quality inspection in manufacturing, safety monitoring, and automated visual analysis, helping organizations improve efficiency and reduce operational risks.

-

Microsoft develops innovative computer vision technologies through its Azure AI Vision services, which provide powerful image and video analysis capabilities for diverse retail applications. These services include optical character recognition (OCR), object detection, facial recognition, and real-time video analytics, enabling retailers to automate shelf audits, enable cashierless checkout, and analyze customer behavior. Microsoft’s research-driven approach uses large-scale deep learning models and cloud infrastructure to deliver scalable, customizable AI solutions.

Key U.S. AI Vision Companies:

- Amazon Web Services, Inc.

- Basler AG

- Clarifai, Inc.

- Everseen Limited

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft

- NVIDIA Corporation

- Cognex Corporation

Recent Developments

-

In May 2025, NVIDIA released its AI Blueprint for Video Search and Summarization (VSS), a solution integrating vision language models, large language models, and retrieval-augmented generation to enable efficient analysis of long-form video content. The update introduces multi-live stream and burst clip modes, single-GPU deployment, customizable computer vision pipelines, and audio transcription capabilities, enhancing real-time video understanding and scalability. Optimizations in retrieval and processing reduce latency and improve performance, positioning VSS as a versatile tool for applications such as smart space monitoring, warehouse automation, and procedural validation.

-

In May 2024, Google introduced a new AI agent named Mariner, leveraging the Gemini 2.0 large language model to autonomously navigate web services, including spreadsheets and shopping platforms, while performing user-directed actions. This innovation enables more seamless integration of AI into everyday tasks through enhanced understanding and interaction with digital environments. The deployment reflects broader advancements in AI agent technology aimed at improving automation across various cloud applications and services.

-

In May 2023, Cognex Corporation launched the Advantage 182 vision system, designed for OEMs in the life sciences industry to automate complex location, classification, and inspection tasks. The system integrates advanced machine vision, barcode reading, and AI-powered edge learning technology to enhance applications such as test tube detection, blood phase measurement, and pathology sample identification. It offers software flexibility with rule-based and AI tools, as well as modular hardware for quick integration and long-term revision control, supporting scalable and accurate inspection processes.

U.S. AI Vision Market Report Scope

Report Attribute

Details

Market size in 2025

USD 4,485.4 million

Revenue forecast in 2033

USD 25,565.5 million

Growth rate

CAGR of 24.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, service type, technology, vertical

Key companies profiled

Amazon Web Services, Inc.; Basler AG; Clarifai, Inc.; Everseen Limited; Google LLC; IBM Corporation; Intel Corporation; Microsoft; NVIDIA Corporation; Cognex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI Vision Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. AI vision market report based on component, service type, technology, and vertical.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Behavioural Analysis

-

Optical Character Recognition

-

Spatial Analysis

-

Image Recognition

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Generative AI

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Banking and Finance

-

Consumer Electronics

-

Healthcare

-

Transport/ Logistics

-

Defense & Security

-

Others

-

Frequently Asked Questions About This Report

b. .The global U.S. AI Vision market size was estimated at USD 3.67 billion in 2024 and is expected to reach USD 4.49 billion in 2025.

b. .The global U.S. AI Vision market is expected to grow at a compound annual growth rate of 24.3% from 2025 to 2033 to reach USD 25.57 billion by 2033.

b. Hardware dominated the U.S. AI Vision market with a share of 43.0% in 2024. The market is driven by the evolution of specialized GPUs, TPUs, and edge AI devices, which significantly enhance processing speed and efficiency in visual data analysis.

b. .Some key players operating in the U.S. AI Vision market include Amazon Web Services, Inc.; Basler AG; Clarifai, Inc.; Everseen Limited; Google LLC; IBM Corporation; Intel Corporation; Microsoft; NVIDIA Corporation; Cognex Corporation

b. .Key factors that are driving the market growth include Advancements in deep learning algorithms and neural network development significantly improve the precision and speed of AI vision systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.