- Home

- »

- Next Generation Technologies

- »

-

AI Vision Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![AI Vision Market Size, Share & Trends Report]()

AI Vision Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type, By Technology (Machine Learning, Generative AI), By Component (Hardware, Software, Services), By Vertical (Consumer Electronics, Banking & Finance), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-619-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Vision Market Summary

The global AI vision market size was estimated at USD 15.85 billion in 2024 and is projected to reach USD 108.99 billion by 2033, growing at a CAGR of 24.1% from 2025 to 2033. This growth is driven by increasing demand for automation, deep learning, and edge computing advancements, expanding applications across industries, and supportive government initiatives promoting digital transformation and sustainability.

Key Market Trends & Insights

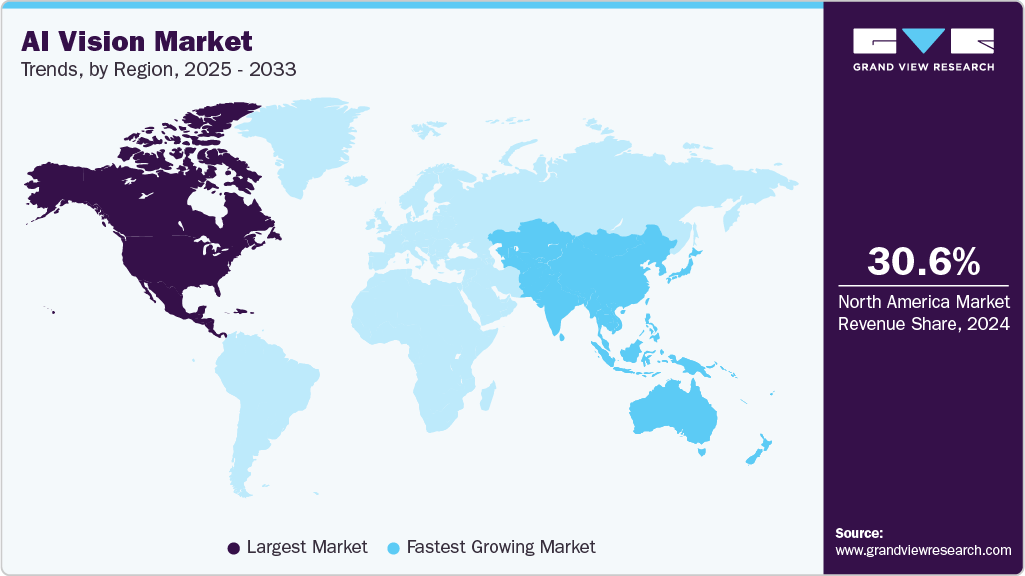

- North America dominated the global AI vision market with the largest revenue share of 30.6% in 2024.

- The AI vision market in the U.S. led the North America market and held the largest revenue share in 2024.

- By technology, the machine learning segment led the market, holding the largest revenue share of 63.8% in 2024.

- By vertical, the consumer electronics segment held the dominant position in the market and accounted for the leading revenue share of 25.0% in 2024.

- By vertical, the banking and finance segment is expected to grow at the fastest CAGR of 30.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 15.85 Billion

- 2033 Projected Market Size: USD 108.99 Billion

- CAGR (2025-2033): 24.1%

- North America: Largest market in 2024

The AI vision market is experiencing significant growth due to its broad adoption across industries such as retail, healthcare, manufacturing, and automotive. Organizations are increasingly implementing AI vision technologies to automate processes, improve accuracy, and enhance operational efficiency. The advancement of deep learning algorithms and the availability of extensive visual data from IoT devices enable more effective image and video analysis. These factors combine to drive demand for AI vision solutions that support applications such as quality inspection, security monitoring, and customer behavior analysis.

Moreover, the market expands as innovations in AI models and hardware improve the speed and precision of visual data processing. Integrating AI vision with edge computing allows real-time analytics directly at the source, reducing latency and network load. Emerging use cases in autonomous vehicles, smart city infrastructure, and augmented reality broaden the scope of AI vision applications. In addition, increasing interest in personalized customer experiences and predictive maintenance encourages organizations to invest in AI vision systems that enhance decision-making and operational agility.

Furthermore, growth is supported by government initiatives and increased industry investment focused on digital transformation and ethical AI deployment. Policies promoting data privacy and responsible AI help build confidence among businesses and consumers. Cloud-based AI platforms offer scalable and cost-effective access to AI vision capabilities, enabling wider adoption across enterprises of varying sizes. Moreover, the emphasis on sustainability drives the use of AI vision to optimize energy consumption and reduce waste, reinforcing the market’s long-term expansion and technological advancement.

Service Type Insights

The image recognition segment led the market with a revenue share of over 41% of global revenue in 2024 due to its extensive use across multiple industries, including retail, healthcare, and security. This technology enables precise identification and classification of objects, faces, and scenes, which supports applications such as product authentication, surveillance, and medical diagnostics. Continuous improvements in deep learning algorithms and access to large-scale datasets enhance the accuracy and speed of image recognition systems. As organizations prioritize automation and real-time decision-making, image recognition remains fundamental to unlocking value from visual data, driving its market position.

The behavioural analysis segment is expected to grow at the highest CAGR during the forecast period as businesses seek to extract actionable insights from customer interactions and movement patterns. AI vision systems analyze video feeds to monitor engagement, detect anomalies, and interpret emotional responses, which helps optimize retail layouts, improve security, and personalize marketing efforts. The growing emphasis on understanding consumer behavior and ensuring safety in public spaces elevates the importance of this segment. By providing deeper contextual awareness, behavioral analysis enables organizations to enhance operational efficiency and customer satisfaction.

Technology Insights

The machine learning segment accounted for the largest revenue share in 2024, driven by providing adaptive algorithms that improve performance through continuous data exposure. Its ability to handle vast and diverse datasets allows for complex visual recognition tasks such as object detection, classification, and anomaly detection. The flexibility of machine learning models enables customization for industry-specific challenges, from manufacturing defect detection to traffic monitoring. Advances in supervised, unsupervised, and reinforcement learning techniques contribute to more accurate and efficient AI vision systems, reinforcing machine learning’s position as the backbone of AI vision technologies.

The generative AI segment is expected to grow at the highest CAGR over the forecast period, driven by addressing one of the key challenges in AI vision: data scarcity and diversity. Generative models augment training datasets by creating synthetic images and videos, improving model strength and reducing bias. This capability is particularly valuable in sectors where acquiring labeled data is costly or impractical, such as medical imaging or autonomous driving. Beyond data augmentation, generative AI enables creative applications, including virtual environment generation and content personalization, expanding the functional scope of AI vision. Its role in enhancing model training and enabling novel use cases drives its rapid market growth.

Component Insights

The hardware segment accounted for the prominent revenue share in 2024, driven by providing the essential processing power and sensory inputs required for complex visual computations. High-performance GPUs, AI accelerators, and edge computing devices enable real-time processing of high-resolution images and videos with minimal latency. Advances in sensor technology, including high-definition cameras and 3D depth sensors, improve data quality and expand AI vision capabilities. The demand for low-power, compact hardware solutions supports deployment in mobile devices, autonomous vehicles, and industrial robots, making hardware innovation a key driver of AI vision adoption.

The services segment is anticipated to grow at the highest CAGR during the forecast period as organizations increasingly seek specialized expertise to implement and maintain AI vision solutions. Consulting services assist in identifying appropriate use cases and designing tailored AI models. Integration services ensure seamless deployment within existing IT infrastructures, while managed services provide ongoing monitoring and optimization. Training programs enable internal teams to operate AI vision systems effectively. The complexity of AI vision projects and the need for continuous adaptation to evolving business requirements drive demand for comprehensive service offerings, enhancing solution effectiveness and user satisfaction.

Vertical Insights

The consumer electronics segment accounted for the largest revenue share in 2024 due to the widespread integration of AI vision in devices such as smartphones, smart TVs, wearables, and home security systems. Features like facial recognition for device unlocking, gesture-based controls, and augmented reality applications enhance user interaction and security. Rapid innovation cycles and high consumer demand for intelligent, personalized devices encourage manufacturers to embed advanced AI vision capabilities. The proliferation of connected devices also generates vast amounts of visual data, further fueling AI vision development and adoption in this sector.

The banking and finance segment is anticipated to grow at the highest CAGR during the forecast period. The banking and finance sector is increasingly adopting AI vision technologies to strengthen security and streamline customer interactions. Facial recognition and document verification automate identity authentication processes, reducing fraud and regulatory compliance risks. Behavioral analytics monitors transactional patterns to detect anomalies and prevent financial crimes. AI vision supports customer service automation through intelligent kiosks and biometric access controls. AI vision enhances trust and operational resilience as financial institutions digitize operations and prioritize secure, seamless experiences.

Regional Insights

North America AI vision market dominated with a revenue share of over 30% in 2024, driven by the concentration of technology innovators and substantial investments in AI research and development. The region benefits from advanced digital infrastructure, a mature startup ecosystem, and strong collaboration between academia and industry. Government initiatives promoting AI ethics and data privacy create a supportive regulatory environment that encourages innovation while addressing societal concerns. Wide adoption across sectors such as automotive, healthcare, retail, and defense sustains North America’s position and accelerates the commercialization of AI vision technologies.

U.S. AI Vision Market Trends

The U.S. AI vision market is expected to grow significantly in 2024 as leading corporations and government agencies implement AI vision to enhance automation, security, and customer engagement. Investments focus on autonomous vehicles, smart retail environments, and advanced surveillance systems. The country’s strong innovation ecosystem and high consumer acceptance of AI-driven applications facilitate rapid deployment. Federal programs supporting AI research, ethical guidelines, and infrastructure development further strengthen the market in the U.S.

Europe AI Vision Market Trends

The AI vision market in Europe is expected to grow significantly over the forecast period, driven by stringent data protection laws and a strong emphasis on responsible AI use. Investments in automotive manufacturing, healthcare, and industrial automation drive the adoption of AI vision for safety, diagnostics, and quality control. Collaborative initiatives among governments, research institutions, and private companies promote transparency, accountability, and innovation. The region’s focus on balancing technological progress with ethical considerations ensures sustainable growth and fosters public trust in AI vision applications.

Asia Pacific AI Vision Market Trends

The AI vision market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period due to rapid urbanization, expanding digital infrastructure, and government support for AI innovation. Countries such as China, India, Japan, and South Korea invest heavily in smart city projects, manufacturing automation, and healthcare modernization. The large and diverse consumer base creates strong demand for AI-enhanced retail, security, and transportation services. Strategic partnerships between local companies and global technology providers accelerate technology transfer and deployment, driving dynamic market expansion across the region.

Key AI Vision Company Insights

Some key companies in the AI vision industry are IBM Corporation, Google LLC, Amazon Web Services, Inc., and Microsoft.

-

IBM Corporation offers advanced AI-powered computer vision solutions that simplify and accelerate visual recognition tasks across industries. Its PowerAI Vision platform enables businesses to build, train, and deploy deep learning models for image and video classification and object detection without requiring extensive coding or AI expertise. This platform supports applications such as quality inspection in manufacturing, safety monitoring, and automated visual analysis, helping organizations improve efficiency and reduce operational risks.

-

Microsoft develops cutting-edge computer vision technologies through its Azure AI Vision services, which provide powerful image and video analysis capabilities for diverse retail applications. These services include optical character recognition (OCR), object detection, facial recognition, and real-time video analytics, enabling retailers to automate shelf audits, enable cashierless checkout, and analyze customer behavior. Microsoft’s research-driven approach leverages large-scale deep learning models and cloud infrastructure to deliver scalable, customizable AI solutions.

Key AI Vision Companies:

The following are the leading companies in the AI vision market. These companies collectively hold the largest market share and dictate industry trends.

- Intel Corporation

- Amazon Web Services, Inc.

- Clarifai, Inc.

- Google LLC

- IBM Corporation

- Basler AG

- Everseen Limited

- Microsoft

- NVIDIA Corporation

- Cognex Corporation

Recent Developments

-

In June 2025, LuminX AI, a company specializing in artificial intelligence models, AI vision technology, and hardware for warehouse inventory automation, secured USD 5.5 million in seed funding. This capital injection is intended to accelerate the development and commercialization of its advanced logistics solutions, which leverage AI-powered computer vision to enhance inventory accuracy, streamline warehouse operations, and improve supply chain efficiency through real-time, automated monitoring and data analysis.

-

In June 2025, Made4net, a provider of cloud-based warehouse management systems and supply chain execution software, entered into a strategic partnership with Flymingo, a Vision AI platform specializing in logistics control and monitoring. This collaboration aims to revolutionize warehouse operations by integrating AI-powered tools that enhance accuracy and ensure strict compliance with standard operating procedures (SOPs). By combining Made4net’s expertise in supply chain software with Flymingo’s advanced computer vision technology, the partnership seeks to deliver improved operational efficiency, real-time visibility, and greater automation across logistics processes.

-

In March 2025, Samsung unveiled its updated “AI Home” vision and a new range of innovative appliances at its launch event, Welcome to Bespoke AI, in Seoul, South Korea. The refreshed AI Home concept emphasizes enhanced security and intuitive user interaction by integrating advanced artificial intelligence capabilities across a broader selection of screen-enabled household devices. This initiative reflects Samsung’s commitment to creating a seamlessly connected smart home ecosystem that leverages AI to improve convenience, personalization, and overall user experience.

AI Vision Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.69 billion

Revenue forecast in 2033

USD 108.99 billion

Growth rate

CAGR of 24.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, vertical, technology, service type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Intel Corporation; Amazon Web Services, Inc.; Clarifai, Inc.; Google LLC; IBM Corporation; Basler AG; Everseen Limited; Microsoft; NVIDIA Corporation; Cognex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Vision Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI vision market report based on service type, technology, component, vertical, and region:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Behavioural Analysis

-

Optical Character Recognition

-

Spatial Analysis

-

Image Recognition

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Generative AI

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Banking and Finance

-

Consumer Electronics

-

Healthcare

-

Transport/Logistics

-

Defense & Security

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI vision market size was estimated at USD 15.85 billion in 2024 and is expected to reach USD 23.69 billion in 2025.

b. The global AI vision market is expected to grow at a compound annual growth rate of 24.1% from 2025 to 2033 to reach USD 108.99 billion by 2033.

b. North America dominated the AI vision market with a share of 30.6% in 2024, driven by the concentration of technology innovators and substantial investments in AI research and development.

b. Some key players operating in the AI vision market include Intel Corporation; Amazon Web Services, Inc.; Clarifai, Inc.; Google LLC; IBM Corporation; Basler AG; Everseen Limited; Microsoft; NVIDIA Corporation; Cognex Corporation

b. Key factors that are driving the market growth include rising demand for automated visual inspection, enhanced customer experience, and real-time decision-making across sectors such as retail, manufacturing, and healthcare, fueled by advancements in AI vision technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.