- Home

- »

- Advanced Interior Materials

- »

-

U.S. Air Purifier Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Air Purifier Market Size, Share & Trends Report]()

U.S. Air Purifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Activated Carbon, Ionic Filters, Electrostatic Precipitator), By Sales Channel (Online, Offline), By Type, By Coverage Range, By Application (Commercial), By State, And Segment Forecasts

- Report ID: GVR-4-68038-616-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Air Purifier Market Size & Trends

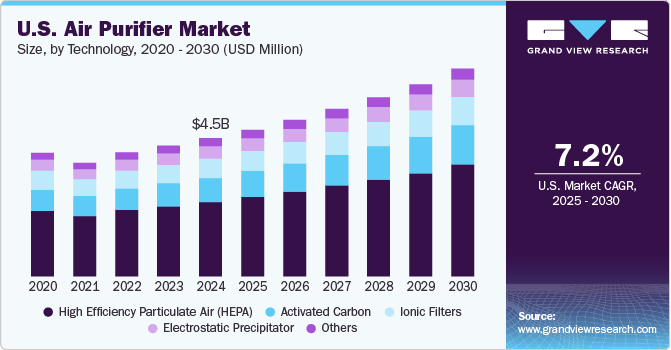

The U.S. air purifier market size was estimated at USD 4,545.7 million in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The rising demand for air purifiers in the U.S. can be attributed to the rising health awareness and the increasing importance of indoor air quality in residential, commercial, and industrial facilities. The COVID-19 outbreak has fueled the demand for air purifiers to maintain high indoor air quality as per the environmental guidelines, which is expected to remain one of the key factors driving this market.

In the U.S. ensuring optimal indoor air quality within schools, offices, and other workplaces is paramount for the well-being and comfort of students and employees alike. Substandard indoor air quality can lead to fatigue, headaches, and irritation of the eyes, throat, lungs, and nose, thereby hindering workers' productivity. Certain air pollutants have the potential to induce diseases like asthma, while prolonged exposure to substances such as asbestos and radon can increase the risk of cancer. Hence, to filter the harmful air particulates and supply the purified air the demand for air purifiers is likely to remain high in the U.S.

Moreover, dust from renovation or construction activities, cleaning supplies, pesticides, or other airborne chemicals may also contribute to poor indoor air quality. To tackle all these problems pertaining to indoor air quality, the U.S. Occupational Safety and Health Administration has set standards related to ventilation and air contaminants, which can help improve the overall indoor air quality. The establishment of such standards is likely to drive the demand for air purifiers to supply clean air.

For instance, California and New Jersey have regulations for indoor air quality. The New Jersey Indoor Air Quality Standard, N.J.A.C. 12:100-13 (2007) sets guidelines and standards related to indoor air quality during working hours in public employee-occupied buildings. In addition, the California state-level indoor air quality program focuses on identifying and studying public health problems associated with indoor environments and promotes healthy indoor environments in the state.

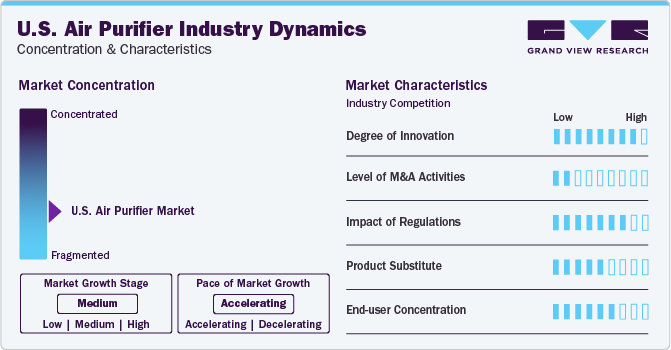

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of the industry growth is accelerating. The air purifier industry is characterized by a high degree of competition owing to the continuous emphasis on research and new product innovations. The next-generation air purifiers are developed with multi-stage air purification and enabled with smart sensor technology and smart air quality display. The smart sensor technology enables effective monitoring and quick-response features, while the smart air quality display offers customers an interactive LED display. For instance, in October 2023, AirDoctor announced the launch of its next-generation air purifiers, which are enabled with a Wi-Fi connection. The smart air purifier provides real-time air quality updates and alerts regarding the replacement of the filter. The incorporation of such technologies is driving the air purifier market in the U.S.

The impact of regulations on this industry is likely to remain high over the forecast period. The proactive measure adopted by the federal government is to reduce the impact of contaminated air with suspended particles on health and maintain a supply of high-quality products to consumers. For instance, the U.S. Department of Energy has established standards for quality assurance and specifications related to HEPA filters. Similarly, the Association of Home Appliance Manufacturers (AHAM) has established the Clean Air Delivery Rate (CADR), which is a standard used to measure the effectiveness of air purifiers, thereby enabling consumers to compare the performance of air purifiers in eliminating dust, pollen, and tobacco smoke.

Moreover, in the U.S., key industry players adopted strategies like acquisitions and regional expansion. Strategic acquisitions can lead to increased industry penetration for an industry player by entering new segments and expanding its customer base. In January 2021, Lasko Products, LLC Company completed the acquisition of Guardian Technologies, LLC (Guardian), with the strategic objective of expanding the reach of Lasko Products, LLC in the industry for air purifier products. This acquisition further helped the company to improve its air purifier solutions.

Drivers, Opportunities & Restraints

The growth of the air purifier market in the U.S. is being significantly driven by increasing concerns over air quality and its direct impact on health. With rising pollution levels, particularly in urban areas, and growing awareness about the harmful effects of airborne allergens, dust, smoke, and volatile organic compounds (VOCs), consumers are becoming more proactive in investing in air purification solutions.

The industry is also restrained moderately by DIY activities by the consumers in the market. These DIY activities involve the use of air filters, such as multiple furnace filters with MERV 13 and above equipped with a large box fan. This type of arrangement is expected to offer a cost-effective and quick solution for air purification in settings such as offices, homes, small cafes, etc., compared to the more expensive air purifiers on the market.

An opportunity for growth in the U.S. air purifier industry lies in the increasing demand for smart, connected devices. As consumers become more tech-savvy, there is a growing interest in air purifiers that integrate with home automation systems, allowing users to monitor and control air quality via smartphone apps, voice assistants, or other IoT-enabled devices. This trend is driven by the broader movement toward smart homes and the desire for more personalized, efficient solutions.

Technology Insights

The activated carbon segment is anticipated to witness the highest growth over the forecast period, owing to its ability to absorb gases and odors emanating from cooking, mold, chemicals, pets, and smoke. These filters consist of small carbon pieces in granular form that undergo a special treatment with oxygen, opening the pores of carbon atoms. This process increases the surface area of carbon, enhancing its capacity to absorb airborne particles.

The high-efficiency particulate air (HEPA) segment is expected to dominate the market by holding a 53.6% market share in 2024. High-efficiency particulate Air (HEPA) filters, primarily composed of submicron glass fibers, represent a category of extended surface mechanical filters with a texture resembling blotter paper. These filters boast a substantial surface area, facilitating the removal of approximately 99.7% of particles equal to or larger than 0.3 microns. Their efficiency in filtering particles of varying sizes is noteworthy, making them highly effective in enhancing air quality.

Sales Channel Insights

The online segment is anticipated to witness the highest CAGR over the forecast period, as more and more consumers choose to purchase air purifiers through e-commerce platforms. Online sales channels mainly involve the sale of products through company retail websites and third-party e-commerce channels. With the advancement in technology in recent years, the penetration of online sales channels is likely to grow over the forecast period.

The offline segment dominated the market in 2024, accounting for 57.6% market share. The offline sales channel is an important channel through which market players can improve their product penetration, with many consumers preferring to ensure product quality by physical examination in person before making a purchase. The offline sales channel includes hypermarkets/supermarkets, retail stores, specialty stores, departmental stores, discount stores, and others.

Type Insights

Standalone or portable air purifiers are designed to filter air and remove airborne particles, such as bacteria, viruses, and dust particles. Standalone or portable air purifiers are independent air purifier units that can be placed in a room or moved around easily.

The In-duct/fixed segment accounted for a considerable market share in 2024 and is expected to continue to expand over the forecast period. It benefits HVAC systems, such as air conditioners or furnaces, by neutralizing dust, pollen, dirt, and germs that may damage the components of the HVAC systems. These air purifiers are equipped with UV lamps and air ionization systems to enhance air purification.

Coverage Range Insights

The below 250 Sq. Ft. segment is anticipated to witness the highest growth over the forecast period. These air purifiers are portable, compact, and lightweight, making them easy to move from room to room as needed. Some models come with activated carbon filters that can remove odors from the air, making them a good choice for small homes with pets or smoking individuals to purify the air. They are effective against pollutants, such as dust, pollen, and pet danger, from the air, making them a good choice for people with allergies or respiratory issues.

The 250-400 Sq. Ft. segment is expected to dominate the market in 2024 with a market share of 37.3%. These air purifiers are a suitable choice for large rooms, open-concept spaces, and offices. These air purifiers are naturally larger and more powerful than models that cover smaller areas, making them effective at removing pollutants from the air in large spaces. These air purifiers have advanced features such as Wi-Fi connectivity, real-time air quality monitoring, and multiple fan speeds.

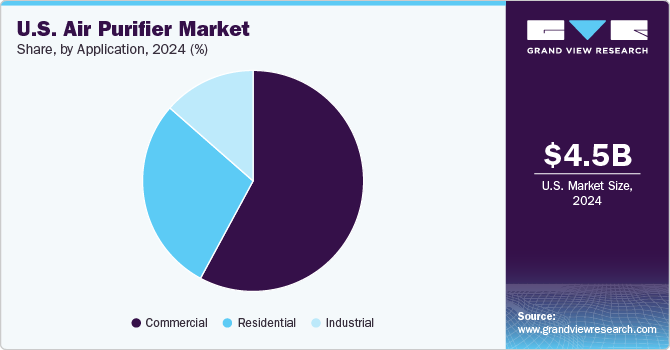

Application Insights

The commercial segment is expected is anticipated to witness the highest growth over the forecast period. Air purifiers have witnessed a significant surge in adoption within commercial applications, driven by a growing awareness of indoor air quality and its impact on the health and well-being of occupants. Moreover, commercial spaces, including healthcare facilities, schools & educational institutions, offices, retail establishments, and hospitality venues, are recognizing the importance of providing clean and healthy air for employees, customers, and visitors.

The residential segment accounted for a market share of 28.6% in 2024 and is expected to expand considerably over the forecast period. Many residential properties, including small-sized homes and large-sized homes, are facing the issue of deteriorating air quality. The increasing population and urbanization have contributed to this problem, leading to the entry of dust, gases, and other harmful contaminants into indoor spaces. The use of air purifiers has become widespread to combat this issue and ensure clean air within homes.

Regional Insights

In the U.S., California dominated the market in 2024 accounting for a market share of 11.1%. The high rate of urbanization is driving the demand for transportation and infrastructure construction. The transportation sector contributes to the emission of air toxins, such as diesel particulate matter, which is suspected to cause cancer or other serious health issues. In addition, the growing pollution levels in California, due to growing industrialization and urbanization, are driving the demand for a contaminant-free air supply.

The market in Florida is expected to expand at a significant CAGR over the forecast period. The state has been witnessing the growth of construction and infrastructure development activities. The construction of new infrastructure projects is likely to release more particulate matter into the air. This particulate matter can affect respiratory health, thereby reducing pulmonary function and increasing airway inflammation across various age groups. Hence, to supply particulate-free air, the demand for air purifiers is rising in Florida.

Key U.S. Air Purifier Company Insights

Some of the key players operating in the market include Honeywell International, Inc., Daikin Industries, Ltd., LG Electronics, Panasonic Corporation, and IQAir.

-

Daikin Industries, Ltd. offers air-conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings. It also provides low and medium air conditioning systems, water chillers, air purifiers, humidity-adjusting air processing units, marine-type container refrigeration systems, and air handling units.

-

Honeywell International Inc. is a technology and manufacturing company that caters to a wide range of industries including aerospace, commercial buildings, energy, life sciences, healthcare, and manufacturing. The company operates through four segments, namely aerospace technologies, building technologies, performance materials and technologies, and safety & productivity solutions. It has been focusing on sustainability, digitalization, and continuous growth.

Some of the emerging players operating in the market include AprilAire, Unilever (Blueair), SharkNinja, and Vesync Co., Ltd.

-

AprilAire offers various HVAC and HVAC-related products & services. Its product portfolio includes various systems such as humidifiers, dehumidifiers, air purifiers, air filters, and others. The company caters to the Northeast, Southeast, Midwest, Northwest, and Southwest areas of the U.S.

-

SharkNinja company offers household appliances and has two brands, namely SHARK and NINJA. Through the SHARK brand, the company offers a wide range of products, including hair care, vacuums, floor & carpet cleaners, air purifiers, and fans. Through its NINJA brand, the company offers drink systems, countertop appliances, kitchenware, and outdoor cooking products. It operates in North America, Europe, and Asia Pacific.

Key U.S. Air Purifier Companies:

The following are the leading companies in the U.S. air purifier market. These companies collectively hold the largest market share and dictate industry trends.

- Daikin Industries, Ltd.

- Sharp Electronics Corporation

- Honeywell International, Inc.

- Panasonic Corporation

- AprilAire

- LG Electronics

- Koninklijke Philips N.V.

- Samsung Electronics Co., Ltd.

- Unilever (Blueair)

- Dyson

- Hamilton Beach Brands, Inc.

- SharkNinja

- Lasko Products, LLC (Germ Guardian)

- Vesync Co., Ltd (Arovast Corporation)

- COWAY CO., LTD.

- PuroAir

- IQAir Group

Recent Developments

-

In January 2024, Daikin Industries, Ltd. introduced UV LED air purifiers with the aim of attaining superior disinfection efficacy. These purifiers initially trap viruses and other harmful particles from the air using a filter, followed by exposure to UV radiation to deactivate the trapped viruses. UV light irradiation disrupts the genetic material of the viruses, resulting in quicker and more dependable inactivation than traditional techniques.

-

In February 2024, SharkNinja introduced a new range of products tailored for the EMEA market, encompassing its four distinct business divisions: Ninja Kitchen, Ninja Outdoor, Shark Clean, and Shark Beauty. This launch encompasses a total of 20 new products, including seven additions to the Shark lineup and 13 from Ninja. Among the highlights is the new range of Double Stack Air Fryers, a cutting-edge robot vacuum cleaner, and the innovative NEVER CHANGE 5 air purifier.

U.S. Air Purifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,825.3 million

Revenue forecast in 2030

USD 6,823.4 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, sales channel, type, coverage range, application, region

Region scope

Alabama; Alaska; Arizona; Arkansas; California; Colorado; Connecticut; Delaware; Florida; Georgia; Hawaii; Idaho; Illinois; Indiana; Iowa; Kansas; Kentucky; Louisiana; Maine; Maryland; Massachusetts; Michigan; Minnesota; Mississippi; Missouri; Montana; Nebraska; Nevada; New Hampshire; New Jersey; New Mexico; New York; North Carolina; North Dakota; Ohio; Oklahoma; Oregon; Pennsylvania; Rhode Island; South Carolina; South Dakota; Tennessee; Texas; Utah; Vermont; Virginia; Washington; West Virginia; Wisconsin; Wyoming

Key companies profiled

Daikin Industries, Ltd.; Sharp Electronics Corporation; Honeywell International, Inc.; Panasonic Corporation; AprilAire; LG Electronics; Koninklijke Philips N.V.; Samsung Electronics Co., Ltd.; Unilever (Blueair); Dyson; Hamilton Beach Brands, Inc.; SharkNinja; Lasko Products, LLC (Germ Guardian); Vesync Co., Ltd (Arovast Corporation); COWAY CO., LTD.; PuroAir; IQAir Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Air Purifier Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. air purifier market report based on technology, sales channel, type, coverage range, application, and region.

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

High Efficiency Particulate Air (HEPA)Activated Carbon

-

Ionic Filters

-

Electrostatic Precipitator

-

Others

-

-

Sales Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Retail Stores

-

Specialty Stores

-

Others

-

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030

-

Standalone/Portable

-

In-duct/Fixed

-

-

Coverage Range Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Below 250 Sq. Ft.

-

250-400 Sq. Ft.

-

401-700 Sq. Ft.

-

Above 700 Sq. Ft.

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Retail Shops (Mercantile)

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport

-

Others

-

-

Residential

-

Industrial

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

-

Frequently Asked Questions About This Report

b. The U.S. air purifier market size was estimated at USD 4,545.7 million in 2024 and is expected to be USD 4,825.3 million in 2025.

b. The U.S. air purifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 6,823.4 million by 2030

b. California region dominated the market and accounted for 11.1% market share in 2024, owing to the prevalence of high pollution level in California. The high level of pollution can be attributed to the growing urbanization and industrialization.

b. Some of the key players operating in the U.S. air purifier market include Daikin Industries, Ltd., Sharp Electronics Corporation, Honeywell International, Inc., Panasonic Corporation, AprilAire, LG Electronics, Koninklijke Philips N.V., Samsung Electronics Co., Ltd., Unilever (Blueair), Dyson, Hamilton Beach Brands, Inc., SharkNinja, Lasko Products, LLC (Germ Guardian), Vesync Co., Ltd (Arovast Corporation), COWAY CO., LTD., PuroAir, and IQAir Group.

b. The key factors that are driving the U.S. air purifier market include the rising health problems associated with air pollution and stringent regulations and laws to maintain an adequate level of air quality inside indoor spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.