U.S. Anatomic Pathology Market Summary

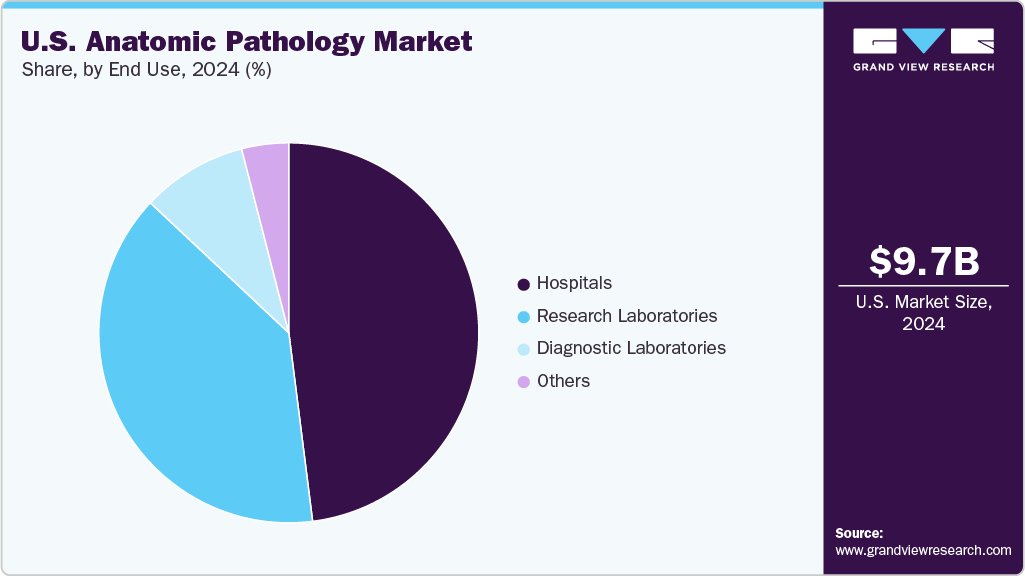

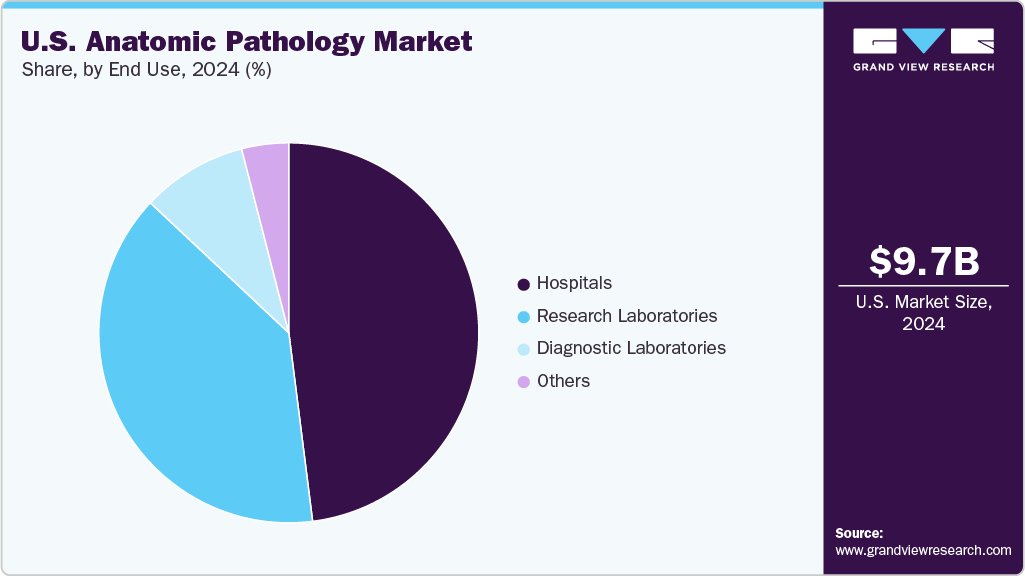

The U.S. anatomic pathology market size was estimated at USD 9.71 billion in 2024 and is projected to reach USD 15.35 billion by 2030, growing at a CAGR of 7.1% from 2025 to 2030. This market is experiencing robust growth driven by technological innovation and growing clinical demands.

Key Market Trends & Insights

- By product & services, the consumables segment held the highest market share of 68.9% in 2024.

- Based on application, the disease diagnosis segment held the highest market share in 2024.

- By end use, the hospital segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.71 Billion

- 2030 Projected Market Size: USD 15.35 Billion

- CAGR (2025-2030): 7.1%

Integrating automation and digital solutions across all phases, such as pre-analytical, analytical, and post-analytical, is key to enhancing diagnostic accuracy, efficiency, and patient outcomes. The growing integration of advanced pathology equipment, such as gross imaging systems, digital microscopes, and automated staining platforms, is poised to enhance anatomic pathology practices.

Digital imaging technologies, in particular, deliver notable improvements in diagnostic specificity and accuracy over traditional methods. Consequently, the market for anatomic pathology is witnessing a surge in the adoption of these digital solutions, fueled by rising demand for diagnostic services that offer greater precision and reliability. In March 2023, PathAI, Inc. launched its AISight digital pathology platform and AIM-PD-L1 NSCLC RUO algorithm. Thirteen leading health systems, academic medical centers, and independent pathology organizations and reference laboratories participated in AISight Early Access Program.

The growth of personalized and precision medicine in the U.S. significantly fuels demand for anatomic pathology services. Accurate and detailed tissue analysis has become essential as more treatments become tailored to a patient’s individual genetic and molecular profile. Anatomic pathologists play a central role by performing specialized testing on biopsy and surgical specimens-including immunohistochemistry (IHC), in situ hybridization, and next-generation sequencing (NGS)-to detect key biomarkers such as HER2, EGFR, KRAS, and PD-L1. These results directly guide the selection of targeted therapies in breast, lung, and colorectal cancers.

Product & Services Insights

The consumables segment accounted for the largest share of 68.9 % in 2024. Technological advancements and healthcare needs drive the increasing demand for consumables. Clinical laboratories and research institutions are increasingly adopting next-generation sequencing (NGS) and other molecular pathology techniques, driving the need for high-quality reagents, kits, and other consumables. Its dominance can also be attributed to multiple factors, including widespread availability and affordability of pathology consumables.

The instruments segment is projected to witness the fastest CAGR from 2024 to 2030. Rising demand for advanced diagnostic tools that offer high precision, efficiency, and consistency. As pathology laboratories increasingly adopt automation to handle larger workloads and improve diagnostic accuracy, instruments such as microtomes have grown significantly. Microtomes, essential for preparing thin tissue sections for examination, are widely used in histology labs and benefit from technological advancements that enhance sectioning quality and workflow efficiency. In January 2025, Solmedia Limited reported the growing use of fully automatic microtomes in pathological laboratories worldwide. These high-precision cutting instruments, traditionally manually operated, are now available in semi-automatic and fully automatic versions.

Application Insights

The disease diagnosis segment held the largest market share in 2024. The growing burden of chronic diseases, including cancer, infectious diseases, and autoimmune disorders, continues to drive the demand for advanced diagnostic solutions. According to the American Cancer Society, approximately 1.9 million new cancer cases were diagnosed in the U.S. in 2022 alone, underscoring the urgent need for early and accurate detection methods. This rising disease prevalence and increasing awareness regarding timely diagnosis and personalized treatment fuel innovations in disease diagnostics.

Drug discovery and development is expected to register the fastest CAGR during the forecast period. Advancements in diagnostic technologies have driven the market, and a deeper understanding of disease mechanisms at the cellular level has led to significant innovations across the healthcare landscape. This progress has directly contributed to the increasing demand for drug discovery and development in anatomic pathology, as precise tissue analysis and molecular insights are essential for identifying novel therapeutic targets.

End Use Insights

The hospital segment held the largest market share in 2024, primarily due to the high hospitalization rates of cancer patients and the frequent readmissions associated with their treatment. Advanced healthcare infrastructure and skilled personnel within hospital-based pathology laboratories further support this dominance. In addition, ongoing initiatives by public and private organizations to promote and enhance advanced healthcare systems are expected to strengthen this segment's growth further.

The diagnostic laboratories segment is projected to grow at the fastest CAGR over the forecast period. The rising prevalence of non-communicable diseases has significantly contributed to the increasing demand for diagnostic laboratory services in the U.S. Concurrently, ongoing digital pathology solutions have enhanced the capabilities and efficiency of diagnostic labs, further fueling industry growth. According to the Pan American Health Organization’s 2025 report, non-communicable diseases (NCDs) were responsible for 6 million deaths in the Americas in 2021. This represented a 43% increase from 4.2 million deaths in 2000.

Key U.S. Anatomic Pathology Company Insights

Some key companies in the U.S. anatomic pathology industry include Danaher, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, Agilent Technologies, Inc., and Cardinal Health.

-

Danaher Corporation is a globally diversified science and technology company. The company operates across various segments, including life sciences, diagnostics, biotechnology, and environmental solutions.

-

Labcorp is a global life sciences and diagnostics company specializing in comprehensive laboratory services and diagnostics. The company’s portfolio in anatomic pathology includes advanced histology, cytology, and molecular pathology solutions, enabling accurate diagnosis and personalized treatment planning for various diseases, especially cancer.

Key U.S. Anatomic Pathology Companies:

- Danaher Corporation

- Quest Diagnostics Incorporated

- Labcorp

- Agilent Technologies, Inc.

- Cardinal Health

- Sakura Finetek USA, Inc.

- NeoGenomics Laboratories, Inc.

- BioGenex

- Bio SB

Recent Developments

-

In May 2025, Labcorp announced an agreement to acquire select assets of Incyte Diagnostics’ clinical and anatomic pathology testing businesses.

-

In March 2024, StatLab Medical Products acquired Poly Scientific R&D, a U.S. manufacturer of pathology stains, reagents, and tissue controls.

-

In December 2022, Labcorp announced the opening of its new anatomic pathology and histology (APH) laboratory in Los Angeles. It expanded its global central laboratory capabilities.

-

In January 2022, PathGroup announced the acquisition of Pathology Consultants, one of the leading pathology services providers based in Greenville, S.C.

U.S. Anatomic Pathology Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 10.6 billion

|

|

Revenue forecast in 2030

|

USD 15.34 billion

|

|

Growth rate

|

CAGR of 7.1% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product & services, application, end use

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Danaher Corporation; Quest Diagnostics Incorporated; Labcorp; Agilent Technologies, Inc.; Cardinal Health; Sakura Finetek USA, Inc.; NeoGenomics Laboratories, Inc.; BioGenex; Bio SB.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Anatomic Pathology Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. anatomic pathology market report based on product & services, application, and end use.

-

Product & Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Consumables

-

Reagents & Antibodies

-

Probes & Kits

-

Others

-

Services

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Research Laboratories

-

Diagnostic Laboratories

-

Others