- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Anhydrous Hydrogen Fluoride Market Size Report, 2030GVR Report cover

![U.S. Anhydrous Hydrogen Fluoride Market Size, Share & Trends Report]()

U.S. Anhydrous Hydrogen Fluoride Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Fluoropolymers, Fluorogases, Pesticides, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-002-8

- Number of Report Pages: 56

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

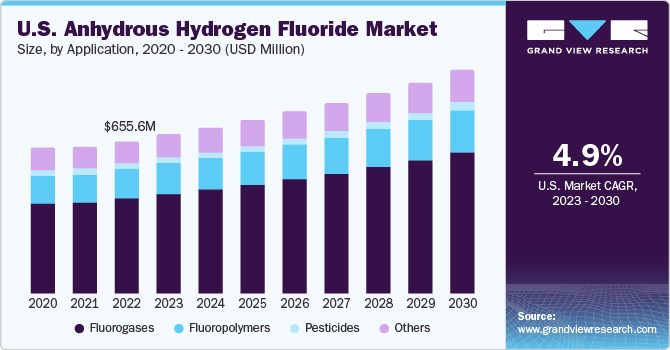

The U.S. anhydrous hydrogen fluoride market size was valued at USD 655.6 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. This is attributable to the growing utilization of anhydrous hydrogen fluoride in fluorine chemistries such as fluorogases and fluoropolymers as they are used in consumer goods, semiconductors, and automobiles. Growing demand for consumer goods like air conditioners, refrigerator gases, electronics products, and automobiles are anticipated to trigger market growth during the forecast period. Furthermore, the demand for the product is anticipated to be driven by the growing chemical industry in the U.S. region and growing manufacturing units, subsidiaries, and several mergers and acquisitions in the region. For example, Arkema partnered with the giant fertilizer producer Nutrien Ltd. for the supply agreement of anhydrous hydrogen fluoride.

The U.S. has emerged as one of the fastest-growing markets for anhydrous hydrogen fluoride in the world. It has been dominating the anhydrous hydrogen fluoride market over the past few years owing to the rapid growth of the chemicals industry in the region. Moreover, the U.S. has been witnessing surged demand for chemicals that are used in metal extraction and metallurgical applications. This is anticipated to eventually contribute to the growth of the anhydrous hydrogen fluoride industry in the U.S. over the forecast period. The growth of the market in the U.S. is supported by a significant rise in fluorochemical production in the country owing to the easy and adequate availability of large volumes of raw materials such as fluorite. Thus, manufacturers of anhydrous hydrogen fluoride are shifting and expanding their production units to the U.S.

The surging demand for electronic goods such as refrigerators and air conditioners in the country is fueling the growth of the U.S. anhydrous hydrogen fluoride market. The key players operating in the market are involved in extensive research and development activities to offer highly efficient products to maintain their position in the market.

Anhydrous hydrogen fluoride is witnessing a surged demand from the chemicals industry in the U.S., as it is a primary building block in the production of several fluorine-containing chemicals. These chemicals produced are widely used in automobiles, household utensils, etc. For instance, Teflon, a fluoropolymer is used widely in several applications such as electrical appliances, household cookware, fabrics, semiconductors, and automobiles owing to its high thermal stability, good chemical resistance, and effective electrical properties.

Application Insights

The fluorogases segment accounted for the largest revenue share of 62.8% in 2022 and is expected to grow at the fastest CAGR of 5.0% over the forecast period. Its high share of the segment is attributable to its wide range of industrial applications including commercial refrigeration, air-conditioning systems, and industrial refrigeration.

The fluoropolymerse segment is expected to grow at a CAGR of 4.8% over the forecast period. Fluoropolymers are fluorocarbon-based polymers, which contain a group of plastics comprising carbon and fluorine. Fluoropolymers are widely used in the automotive, semiconductors, and electronics industries, as well as in common household appliances owing to their unique, non-adhesive, and low-friction properties. Moreover, fluoropolymers also offer superior heat, chemical, and weather resistance and better electrical properties than other polymers.

Fluorine-based polymers are grouped because they have several useful properties from an industrial and commercial perspective because of the addition of fluorine. Fluoropolymers offer high resistance to solvents, acids, and bases. The best-known fluoropolymer is polytetrafluoroethylene, also known as Teflon. It is synonymous with being non-stick and not reacting with other chemicals. It can withstand high temperatures.

Regional Insights

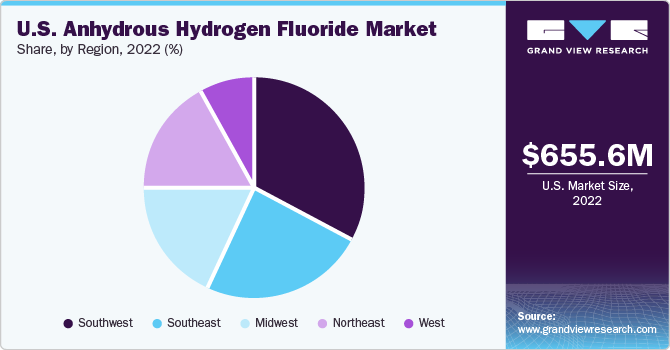

Southwest region dominated the market and accounted for the largest revenue share of 32.8% in 2022 and is expected to grow at the fastest CAGR of 5.3% during the forecast period. This is attributed to the presence of multiple chemical manufacturing companies in the region. Southwest, Texas accounts for the largest production of anhydrous hydrogen fluoride owing to the presence of a well-established chemicals industry and the enhanced production capacities of leading players such as Solvay S.A. in the region.

The growth of the anhydrous hydrogen fluoride market in Southwest of the U.S. can also be attributed to a high penetration rate of U.S. consumer goods brands and an increase in demand for electronics and automobiles in the region owing to technological awareness among the population in Southwest.

Southeast accounted for a revenue share of 23.7% in 2022. The chemicals industry in this region of the country is expected to grow at a rapid pace over the forecast period due to increasing demand for chemicals from North America and the APAC region. This is anticipated to lead to a surged demand in Southeast of the U.S. A number of manufacturers of anhydrous hydrogen fluoride, including Honeywell International, have their manufacturing plants in the Southeast U.S.

Louisiana, Florida, North Carolina, and South Carolina, are some of the key producers of chemicals in this region owing to increasing the presence of chemical manufacturers and subsidiaries in these states. The rising demand for air conditioners and other electronic appliances such as refrigerators in Southeast of the U.S. is also contributing to the consumption of anhydrous hydrogen fluoride in this region.

Key Companies & Market Share Insights

The manufacturers are more focused on increasing the production capacity of anhydrous hydrogen fluoride to meet the increasing demand from the end-use industries. These manufacturers are engaged in continuous R&D activities to develop various product ranges of high quality.

Multiple manufacturers are constantly aiming to increase their production capacities by merger and acquisition or partnering with local producers. For instance, In June 2020, Arkema announced its partnership with an agricultural company, Nutrien Ltd to supply anhydrous hydrogen fluoride to the former at Calvert City to meet the demand. As a part of this partnership, Arkema aims at investing USD 150 million in a 40 KT/year anhydrous hydrogen fluoride (AHF) production plant of Nutrien in Aurora, North California. In January 2022, Honeywell International Inc. and Navin Fluorine International Limited, a division of the Padmanabh Mafatlal Group, officially joined forces in a strategic partnership. This collaboration aimed to produce Honeywell's exclusive Solstice line of hydrofluoroolefins (HFO) within India.

Key U.S. Anhydrous Hydrogen Fluoride Companies:

- Honeywell International Inc.

- Solvay

- Linde plc

- Arkema

- LANXESS

U.S. Anhydrous Hydrogen Fluoride Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 958.4 million

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilo Tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

U.S.

Country scope

Northeast, Southwest, West, Southeast, Midwest

Key companies profiled

Honeywell International Inc.; Solvay; Linde plc; Arkema; LANXESS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Anhydrous Hydrogen Fluoride Market Report Segmentation

This report forecasts revenue growth at the U.S. and its regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. anhydrous hydrogen fluoride market based on application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Fluoropolymers

-

Fluorogases

-

Pesticides

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

U.S.

-

Northeast

-

Southwest

-

West

-

Southeast

-

Midwest

-

-

Frequently Asked Questions About This Report

b. The U.S. anhydrous hydrogen fluoride market size was valued at USD 655.6 million in 2022 and is expected to reach USD 683.2 million in 2023.

b. The U.S. anhydrous hydrogen fluoride market is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030 to reach USD 958.37 million by 2030.

b. The fluorogases application segment of anhydrous hydrogen fluoride dominated the segment with the highest revenue share of 62.8% in 2022. Its high share is attributable to its wide range of industrial applications including commercial refrigeration, air-conditioning systems, and industrial refrigeration.

b. Some prominent players in the U.S. anhydrous hydrogen fluoride market include Honeywell International Inc., Solvay, Linde plc, Arkema, Laxnxess

b. The factors driving market are growing utilization of anhydrous hydrogen fluoride in the fluorine chemistries such as fluorogases and fluoropolymers as they are used in as consumer goods, semiconductors, and automobiles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.