- Home

- »

- Digital Media

- »

-

U.S. Anime Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Anime Market Size, Share & Trends Report]()

U.S. Anime Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (TV, Movie, Video, Music, Live Entertainment, Internet Distribution), By Genre (Action & Adventure, Sci-Fi & Fantasy, Romance & Drama, Sports), And Segment Forecasts

- Report ID: GVR-4-68040-191-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Anime Market Size & Trends

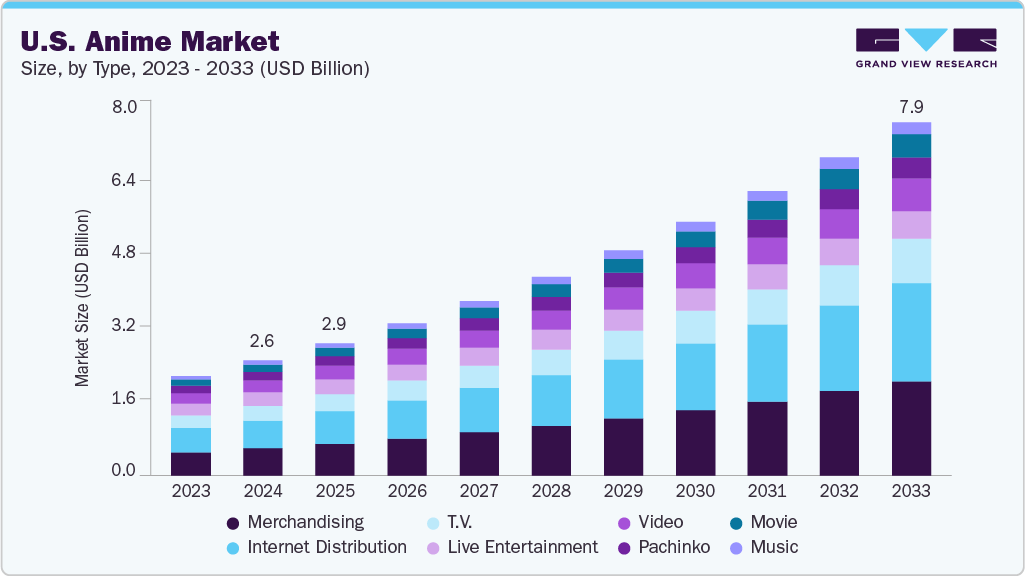

The U.S. anime market size was estimated at USD 2,587.0 million in 2024 and is projected to reach USD 7,932.9 million by 2033, growing at a CAGR of 13.0% from 2025 to 2033. This growth is largely driven by the increasing demand for anime content across streaming platforms, growing popularity among diverse age groups, expansion of anime-related merchandise and events, and rising investments from major entertainment companies in original anime productions. In the U.S., platforms such as Crunchyroll and Netflix have democratized access to anime, allowing viewers to explore a vast library of titles and genres at their convenience, which has significantly boosted viewer engagement and loyalty, further fueling the U.S. anime industry expansion.

The ability of streaming platforms to reach regional audiences has significantly contributed to the U.S. anime industry’s growth. With platforms operating in multiple countries, anime content is no longer restricted to Japanese or niche U.S. markets but is accessible worldwide. This regional reach helps build international fan bases for U.S. anime distributors and enhances the visibility of anime titles. In addition, the availability of subtitled and dubbed versions of anime in multiple languages increases the accessibility of anime for non-Japanese-speaking viewers, widening the audience base and making anime more approachable for casual and mainstream viewers.

The rising popularity of anime merchandising is expected to significantly fuel the growth of the U.S. anime industry, driven by a combination of increasing fan engagement, the diversity of products available, and the role of merchandise in extending the anime experience beyond the screen. The anime community is known for its highly engaged and passionate fanbase, which is deeply connected to the characters, stories, and universes depicted in anime series. This strong emotional attachment creates a high demand for physical products that allow fans to express their love for specific anime. Whether it’s through action figures, apparel, posters, or other collectibles, merchandise allows fans to take a piece of their favorite series into their everyday lives, strengthening their connection to anime.

In addition, the integration of Virtual Reality (VR) and Augmented Reality (AR) experiences is expected to fuel the growth of the U.S. anime industry by revolutionizing how fans engage with anime content, creating immersive experiences that deepen fan loyalty, and offering new monetization opportunities for studios and distributors. The most significant impact of VR and AR technologies on the U.S. market is their ability to create immersive fan experiences that go beyond traditional anime consumption.

Moreover, the increasing integration of anime into mainstream media and cultural events, enhancing its visibility and acceptance among broader audiences, is boosting the U.S. anime industry expansion. Collaborations between anime franchises and major brands across sectors such as fast food and fashion are introducing anime characters to consumers who might not typically engage with the genre. In addition, anime-themed conventions and festivals celebrate the culture, featuring panels, screenings, and cosplay competitions that immerse fans in the experience. This distinctive trend is expected to drive market growth in the coming years.

Type Insights

The merchandising segment held the largest market share of over 24% in 2024. The surging demand for anime-themed products, including figures, clothing, and accessories, is significantly driving growth in the U.S. anime industry. Collaborations between anime franchises and mainstream brands to produce exclusive merchandise that appeals to both fans and collectors have become a key strategy among major players in the industry. In addition, the emergence of pop-up shops at conventions and events tailored specifically for anime enthusiasts offers unique shopping experiences, further contributing to segment growth in the coming years.

The internet distribution segment is expected to witness the fastest CAGR of over 14% from 2025 to 2033, primarily owing to the ongoing shift towards digital consumption of media. As streaming platforms are expanding their libraries and enhancing user experiences, they are making anime more accessible to a broader audience. This accessibility is further amplified by the increasing use of mobile devices and high-speed internet, allowing fans to watch their favorite series anytime and anywhere. In addition, the growing trend of exclusive content production and localization efforts tailored for Western audiences is expected to attract new viewers, driving subscriptions and engagement. The combination of these factors positions internet distribution as a pivotal growth driver in the U.S. market, reflecting changing consumer preferences toward on-demand viewing experiences.

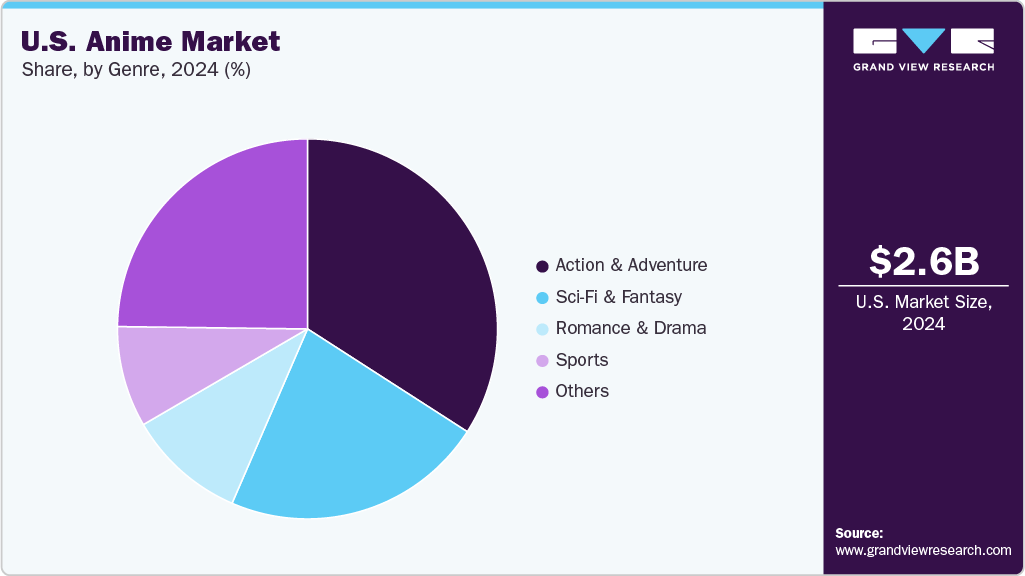

Genre Insights

The action & adventure segment held the largest market share in 2024, owing to its widespread appeal and enduring popularity among anime fans. This genre captivates audiences with dynamic storytelling, intense action sequences, and intricate character development, making it a favorite for both seasoned viewers and newcomers. The success of high-profile series and films, such as "Demon Slayer" and "My Hero Academia," has further solidified the genre's dominance, as these titles showcase visually stunning animation and compelling narratives that resonate with a broad demographic. In addition, the accessibility of action and adventure anime through streaming platforms has allowed fans to easily discover and engage with a diverse range of titles, reinforcing its position as the leading revenue contributor in the U.S. market.

The sci-fi & fantasy segment is expected to register the fastest CAGR from 2025 to 2033. driven by a growing interest in imaginative worlds and complex narratives that challenge conventional storytelling. As audiences increasingly seek out unique and innovative content, sci-fi and fantasy anime are appealing to viewers with their rich world-building, intricate plots, and creative character designs. The rise of original programming in this genre, coupled with advancements in animation technology that enhance visual storytelling, is attracting a new wave of fans. Furthermore, collaborations between anime studios and game developers are creating cross-media experiences that further engage audiences, positioning the sci-fi and fantasy segment for significant growth in the coming years.

Key U.S. Anime Company Insights

Some of the key players operating in the market include Crunchyroll (Sony Pictures Entertainment), Latham & Watkins LLP.

-

Crunchyroll (Sony Pictures Entertainment Inc.) operates as an independent joint venture formed by U.S.-based Sony Pictures Entertainment and Japan's Aniplex, a subsidiary of Sony Music Entertainment (Japan) Inc. This streaming platform specializes in anime, manga, and Asian media, primarily focusing on the U.S. market. It boasts an extensive library of titles, including simulcasts of popular series, enabling fans to watch episodes shortly after their release in Japan.

-

Bioworld Merchandising, Inc. specializes in licensed apparel and accessories, offering a diverse range of products linked to popular culture, including anime. The company plays a vital role in producing and distributing merchandise that enhances fan engagement and reflects the growing mainstream acceptance of anime, thereby supporting a thriving fan culture and driving demand for anime-related products.

Atomic Flare and Eleven Arts are some of the emerging participants in the market.

-

Atomic Flare is a company focused on providing hard-to-find video games, anime, and pop culture merchandise at competitive prices. The store features a diverse selection of officially licensed products from popular franchises such as Final Fantasy, Pokémon, and My Hero Academia. Emphasizing local shipping and personalized customer service, Atomic Flare aims to create a memorable shopping experience for its customers.

-

Eleven Arts is a film distribution company dedicated to bringing anime and live-action films to North American audiences. Initially concentrating on theatrical releases, Eleven Arts has broadened its scope to include all aspects of film distribution, such as translation, localization, home video, and merchandise. By working closely with studios and producers in Japan, Eleven Arts strives to enhance the overall experience for anime fans in North America, delivering compelling stories and high-quality content.

Key U.S. Anime Companies:

- Crunchyroll (Sony Pictures Entertainment Inc.)

- Discotek Media

- Sentai Film Works (AMC Networks)

- Viz Media, LLC

- Atomic Flare

- Bandai Namco Filmworks Inc.

- The Walt Disney Company

- Toei Animation Inc.

- Lionsgate Entertainment Corp.

- Eleven Arts

- Good Smile Company, Inc.

- Bioworld Merchandising, Inc.

Recent Developments

-

In January 2025, Crunchyroll announced at Sony Group Corporation's CES press conference that it will launch a new digital manga application called Crunchyroll Manga later this year. This app will serve as a premium add-on for Crunchyroll subscribers and will be available as a standalone application on iOS and Android, with plans for web browser support in the future.

-

In October 2024, Crunchyroll (Sony Pictures Entertainment, Inc.) announced its plan to launch on YouTube Primetime Channels, distributing over 40 anime titles across the U.S., UK, Germany, and Australia by the end of the year. This new service will feature popular series such as Dragon Ball Daima, One Piece, BLUE LOCK, Re:Zero, and Shangri-La Frontier Season 2.

-

In July 2024, Bioworld Merchandising, Inc. announced its acquisition of Packed Party, a Texas-based manufacturer specializing in lifestyle and party accessories. This partnership is expected to enhance product innovation and growth for both companies by leveraging Bioworld's global presence and infrastructure to expand Packed Party's distribution channels and product offerings.

U.S. Anime Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,977.8 million

Revenue forecast in 2033

USD 7,932.9 million

Growth Rate

CAGR of 13.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, genre

Country Scope

U.S.

Key companies profiled

Crunchyroll (Sony Pictures Entertainment Inc.); Discotek Media; Sentai Film Works (AMC Networks); Viz Media, LLC; Atomic Flare; Bandai Namco Filmworks Inc.; The Walt Disney Company; Toei Animation Inc.; Lionsgate Entertainment Corp.; Eleven Arts; Good Smile Company, Inc.; Bioworld Merchandising, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Anime Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. anime market report based on type and genre:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

T.V.

-

Movie

-

Video

-

Internet Distribution

-

Merchandising

-

Music

-

Pachinko

-

Live Entertainment

-

-

Genre Outlook (Revenue, USD Million, 2021 - 2033)

-

Action & Adventure

-

Sci-Fi & Fantasy

-

Romance & Drama

-

Sports

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. anime market size was valued at USD 2,587.0 million in 2024 and is expected to reach USD 2,977.8 million in 2025.

b. The U.S. anime market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2033 and is expected to reach USD 7,932.9 million by 2033.

b. The internet distribution type segment held the largest market share of over 24% in 2024, owing to the increasing use of video distribution services like Amazon.com, Inc., Netflix, and other streaming platforms that considerably aid the internet distribution of anime content.

b. Some key players operating in the U.S. anime market include Crunchyroll (Sony Pictures Entertainment Inc.), Discotek Media, Sentai Holdings, LLC (AMC Networks), Viz Media, LLC, Atomic Flare, Bandai Namco Filmworks Inc., The Walt Disney Company, Toei Animation USA, Lions Gate Entertainment Inc., Eleven Arts, Good Smile Company, Inc., Bioworld Merchandising, Inc.

b. The growth of the U.S. anime market is attributed to the advances in the latest technologies, including virtual reality (VR), artificial intelligence (AI), the Internet of Things (IoT), and augmented reality (AR), associated with increasing levels of disposable income.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.