- Home

- »

- Pharmaceuticals

- »

-

U.S. Antibiotic Resistance Market Size, Industry Report, 2030GVR Report cover

![U.S. Antibiotic Resistance Market Size, Share, & Trends Report]()

U.S. Antibiotic Resistance Market (2025 - 2030) Size, Share, & Trends Analysis Report By Disease (cUTI, CDI), By Pathogen, By Drug Class, By Mechanism of Action, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-664-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Antibiotic Resistance Market Summary

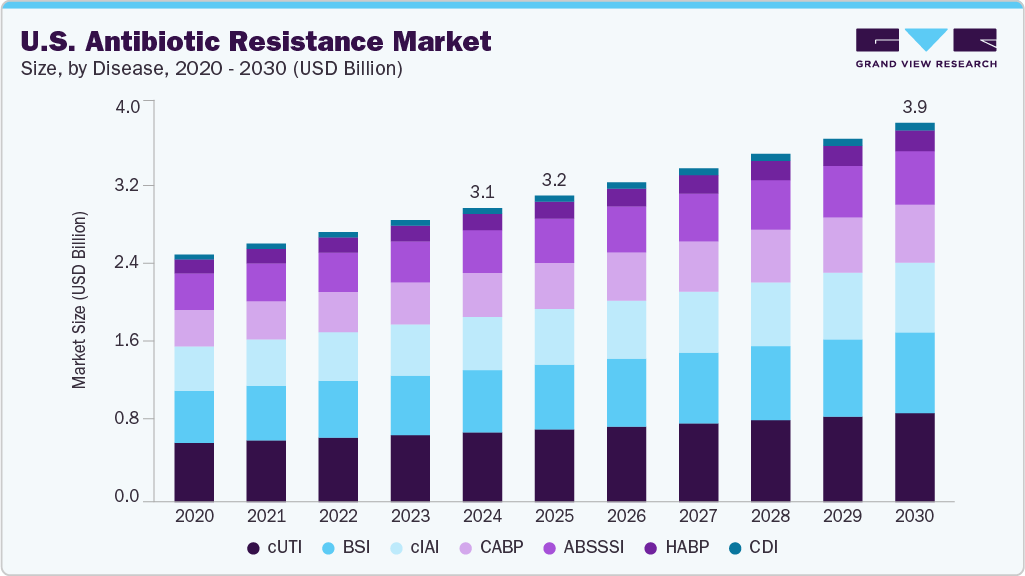

The U.S. antibiotic esistance market size was estimated at USD 3.09 billion in 2024 and is projected to reach USD 3.99 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The market is expected to grow, driven by the rising misuse and overuse of antibiotics.

Key Market Trends & Insights

- By disease, the cUTI segment held the largest revenue share of 23.7% in 2024.

- By pathogen, the Klebsiella pneumoniae segment accounted for the largest revenue share in 2024.

- By drug class, oxazolidinones held the largest revenue share in 2024.

- By mechanism of action, the cell wall synthesis inhibitors segment held the largest revenue share in 2024.

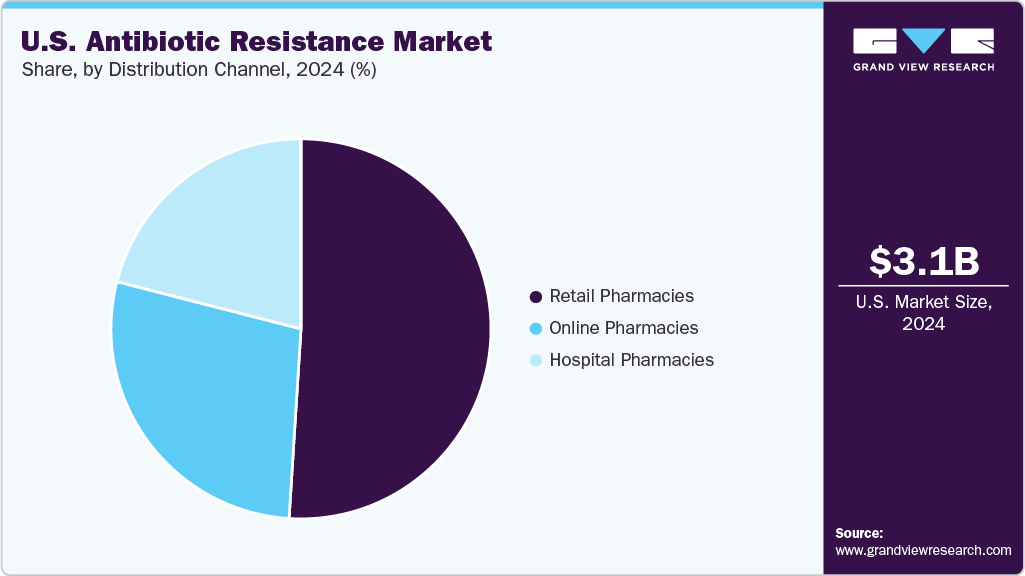

- By distribution channel, the hospital pharmacies segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.09 Billion

- 2030 Projected Market Size: USD 3.99 Billion

- CAGR (2025-2030): 4.4%

According to the CDC, more than 2.8 million antimicrobial-resistant infections are reported every year in the U.S., leading to 35,000 deaths. Moreover, the rise of public health concerns and the need for new antibiotic therapies are expected to drive market growth. According to the WHO, the overuse and misuse of antibiotics in animals, humans, and plants are the main reasons for the development of drug-resistant pathogens. Antibiotic resistance makes infections hard to treat and makes medical treatments, including cancer chemotherapy and surgeries such as cesarean sections and hip replacements, riskier. The market for antibiotic therapies is witnessing strong growth, driven by the urgent demand for treatments that can counteract rising resistance to existing drugs.

When a person contracts an infection caused by antibiotic-resistant bacteria, managing the illness becomes more challenging because fewer antibiotics can effectively treat the infection. In addition, these resistant bacteria can be transmitted to others, increasing the risk of wider spread. There are some rare instances where very few treatment options may be available.

Disease Insights

The cUTI segment held the largest revenue share of 23.7% in 2024. Complicated Urinary Tract Infections (cUTIs) are common in elderly patients, hospitalized individuals, and people with catheters, diabetes, or anatomical abnormalities, all of which are increasingly prevalent in the U.S. According to the National Library of Medicine, among 3,010,997 ED visits with cUTI, 43.3% were female and 59.0% patients were age 65 years or older. In August 2017, the FDA approved meropenem/vaborbactam to treat adults with cUTIs, including kidney infections. It works well against certain hard-to-treat bacteria, especially those resistant to common antibiotics, and is generally safe and well tolerated.

The CDI segment is expected to witness the fastest CAGR of 4.7% over the forecast period. C diff, a gram-positive, spore-forming, rod-shaped bacterium that thrives in environments without oxygen, produces potent toxins that can trigger diarrhea, particularly after antibiotic exposure, by disrupting the normal gut flora. As per the University of Rochester Medical Center, U.S., it is estimated that CDI infects 165,000 individuals annually, resulting in USD 1.3 billion in excess cost and 9,000 deaths.

Pathogen Insights

The Klebsiella pneumoniae segment accounted for the largest revenue share in 2024, as it is a resistant Gram-negative bacterium with significant treatment challenges. Klebsiella pneumoniae bacteria move from the gut into other areas such as the lungs, bloodstream, or urinary tract and can trigger serious infections. The WHO has defined klebsiella as a “priority pathogen” or “superbug.” It poses a major threat to health because it has evolved against the most potent antibiotics.

The CDI segment is expected to witness the fastest CAGR over the forecast period. In April 2024, as per the National Library of Medicine, C difficile is increasingly diagnosed in community settings. The emergence of the North American pulsed-field gel electrophoresis type 1 (or NAP1) strain has increased the severity of infections over the last two decades. Its severity spans a broad range from carrying the bacteria without symptoms to life-threatening conditions such as pseudomembranous colitis and toxic megacolon, sometimes with fatal outcomes, as it is a major cause of healthcare-associated colitis. Due to its high transmission rate and serious health effects, C. difficile remains a critical public health concern.

Drug Class Insights

Oxazolidinones held the largest revenue share in 2024. These are antibiotics with a distinct mechanism of action. Linezolid, a synthetic oxazolidinone antimicrobial drug, is often employed in treating pneumonia, skin infections, and certain drug-resistant strains. They are highly effective against susceptible and resistant Gram-positive bacteria, including Methicillin-resistant Staphylococcus aureus (MRSA), methicillin-sensitive S. epidermidis, Vancomycin-resistant Enterococcus (VRE), and penicillin-resistant S. pneumoniae. In addition, oxazolidinones are well tolerated and can be administered intravenously or orally. They are a crucial component in the market, offering a substitute in the face of growing bacterial resistance.

The combination therapies segment is estimated to grow at the fastest CAGR over the forecast period. Combination therapy is used as a strategy to deal with multidrug‐resistant bacteria. It can also improve antibiotic efficiency and reduce antibacterial resistance through various activities. Combination therapy is popularly used to treat viral and mycobacterial infections and cancerous conditions.

Mechanism of Action Insights

The cell wall synthesis inhibitors segment held the largest revenue share in 2024. Cell wall synthesis inhibitors are a vital class of antibiotics that hinder the bacterial production of peptidoglycan, the structural component of the cell wall. Examples include penicillin and cephalosporins that disrupt cell wall assembly and weaken the bacterial structure, ultimately causing cell death.

The RNA synthesis inhibitors segment is expected to grow at the fastest CAGR over the forecast period. These inhibitors form a key category of antibiotics that specifically interrupt bacterial RNA production. Rifampin, for instance, binds to and blocks bacterial RNA polymerase, halting the transcription of genetic material and stopping bacterial growth, making it particularly effective against infections such as tuberculosis. Although critical in treating diseases, the growing resistance highlights the need for continued research and innovation to maintain their potential in managing antibiotic-resistant infections.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share in 2024. These pharmacies are a key part of healthcare facilities. They ensure that antibiotics are available and given to patients in the hospital without any delay. By monitoring prescriptions, they help prevent overuse or misuse of antibiotics, which supports better patient care and mitigates antibiotic resistance.

The retail pharmacies segment is estimated to be the fastest-growing segment over the forecast period. The convenience and accessibility of antibiotics contribute to this segment's expected growth. The ease of access contributes to self-medication practices, which results in increased antibiotic usage, potentially fostering the development and spread of antibiotic-resistant strains. These pharmacies can help regulate antibiotic usage through patient education, surveillance and reporting, awareness campaigns, pharmacist training, and collaboration with healthcare providers.

Key U.S. Antibiotic Resistance Company Insights

Some key players in the U.S. antibiotic resistance market include Merck & Co., Inc., Melinta Therapeutics LLC, Theravance Biopharma, and others. These companies are working toward combating antibiotic resistance.

-

Melinta Therapeutics is a publicly traded American biopharmaceutical company. It specializes in designing and developing innovative broad-spectrum antibiotics specifically tailored for treating antibiotic-resistant infections within hospital settings.

Key U.S. Antibiotic Resistance Companies:

- Melinta Therapeutics

- Merck & Co., Inc.

- Melinta Therapeutics LLC

- Theravance Biopharma.

- Paratek Pharmaceuticals, Inc.

- Seres Therapeutics

- AbbVie Inc.

Recent Developments

-

In May 2025, Paratek Pharmaceuticals completed the acquisition of Optinose, Inc. This acquisition broadened Paratek's portfolio, including its flagship antibiotic, NUZYRA (omadacycline), and Optinose's product, XHANCE (fluticasone propionate).

U.S. Antibiotic Resistance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.99 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends.

Segments covered

Disease, pathogen, drug class, mechanism of action, distribution channel

Key companies profiled

Melinta Therapeutics; Merck & Co., Inc.; Melinta Therapeutics LLC; Theravance Biopharma; Paratek Pharmaceuticals, Inc.; Seres Therapeutics; AbbVie Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Antibiotic Resistance Market Report Segmentation

This report forecasts revenue at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Antibiotic Resistance Market report based on disease, pathogen, drug class, mechanism of action, and distribution channel:

-

Disease Outlook (Revenue in USD Million, 2018 - 2030)

-

cUTI

-

CDI

-

ABSSSI

-

HABP

-

CABP

-

cIAI

-

BSI

-

-

Pathogen Outlook (Revenue in USD Million, 2018 - 2030)

-

E. coli

-

klebsiella pneumoniae

-

P. aeruginosa

-

S. aureus

-

baumannii

-

Strep. Pneumoniae

-

H. influenzae

-

CDI

-

Enterococcus fecium

-

-

Drug Class Outlook (Revenue in USD Million; 2018 - 2030)

-

Oxazolidinones

-

Lipoglycopeptides

-

Tetracyclines

-

Combination therapies

-

Cephalosporins

-

Others

-

-

Mechanism of Action Outlook (Revenue in USD Million; 2018 - 2030)

-

Protein Synthesis Inhibitors

-

Cell Wall Synthesis Inhibitors

-

RNA Synthesis Inhibitors

-

DNA Synthesis Inhibitors

-

Others

-

-

Distribution Channel Outlook (Revenue in USD Million; 2018 - 2030)

-

Retail Pharmacies

-

Hospital Pharmacies

-

Online Pharmacies

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.