- Home

- »

- Automotive & Transportation

- »

-

U.S. Armored Vehicle Market Size And Share Report, 2030GVR Report cover

![U.S. Armored Vehicle Market Size, Share & Trends Report]()

U.S. Armored Vehicle Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Combat Vehicles), By Vehicle Type, By Mobility, By Mode of Operation, By Point of Sale, By System, And Segment Forecasts

- Report ID: GVR-4-68040-156-6

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Armored Vehicle Market Size & Trends

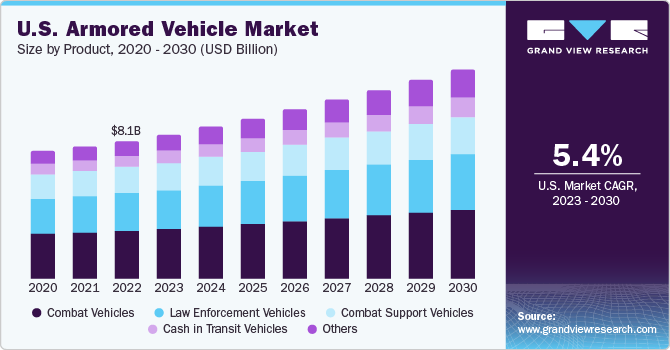

The U.S. armored vehicle market size was valued at USD 8.09 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. This growth is primarily driven by increased military spending by the U.S. government, driven by rising geopolitical tensions, and the need for armed forces modernization. Additionally, law enforcement and security agencies are increasingly investing in armored vehicles to address various threats, including terrorism and organized crime. Technological advancements, such as improved armor materials and advanced sensors, are enhancing the effectiveness and versatility of armored vehicles. For instance, in October 2022, the U.S. Army collaborated with BAE Systems to accelerate the production of the Armored Multi-Purpose Vehicle (AMPV). AMPV is a tracked vehicle derived from the Bradley Fighting Vehicle (BFV), engineered for increased survivability, mobility, and firepower compared to the aging M113. It offers versatility by adapting various mission configurations, such as troop transport, medical evacuation, and command and control, which depicts its adaptability to meet a range of military operational needs.

The U.S. armored vehicle market is experiencing significant growth owing to the increasing need to enhance Intelligence, Surveillance, Reconnaissance (ISR), and target acquisition capabilities in the defense sector. These capabilities are paramount for the growth of modern military operations and armored vehicles, which provide essential platforms for housing advanced ISR and target acquisition systems. The U.S. military is making substantial investments in the development of new armored vehicles equipped with state-of-the-art ISR and target acquisition technologies. Programs such as the Army's Next Generation Combat Vehicle (NGCV) and the U.S. Marine Corps Amphibious Combat Vehicle (ACV) are supporting the development of armored vehicles with a wide range of ISR and target acquisition systems, such as radar, electro-optical/infrared sensors, and electronic warfare systems.

Armored vehicle manufacturers are choosing weapon technology over armor technology owing to its cost-effectiveness. They are also focusing on key areas such as mobility and protection of the armored vehicles used in the defense sector. Furthermore, they are installing sensors, systems, and high-tech armor, among others in armored vehicles to enhance their productivity. Technologies such as Radio Detection and Ranging (RADAR), laser, sonar ranging, and anti-lock brakes are used in manufacturing technologically advanced defense armored vehicles. RADAR systems provide targeting and ranging information for armored vehicle weapons by locating threats and targets. Furthermore, manufacturers are focused on incorporating autonomous systems that offer driving assistance for armored defense vehicles.

The U.S. military is making significant investments in replacing its aging fleet of armored vehicles to maintain technological superiority over rivals. This modernization is vital because of evolving threats such as Improvised Explosive Devices (IEDs) and roadside bombs in asymmetric warfare. Next-generation armored vehicles are designed to protect crews and withstand these threats effectively. The need for greater mobility and firepower is driving the development of modern armored vehicles with more powerful engines, improved suspension systems, and advanced weapon systems. These enhancements enable crews to operate effectively across diverse terrains.

System Insights

The engines segment held the significant revenue share of over 18% in 2022. The segment's growth can be attributed to the heightened demand for advanced, high-performance engines in armored vehicles, which can enhance their combat capabilities and maneuverability. Furthermore, environmental concerns are leading to a growing emphasis on the development and deployment of hybrid-electric and electric armored vehicles that offer better fuel efficiency and produce lower emissions.

Increased investments in research and development are also contributing to the development of new engine technologies for armored vehicles. For instance, in October 2023, Rolls-Royce Motor Cars Limited announced that its Aiken, South Carolina plant would manufacture engines for the U.S. Army's M10 Booker armored fighting vehicle program. The mtu 8V 199 PowerPack engine would power the M10 Booker, which is designed by General Dynamics Land Systems, delivering 800 horsepower and serving as a complete propulsion system for the vehicle, including the engine, transmission, and cooling system.

The navigation systems segment is estimated to grow significantly over the forecast period. Navigation systems play a pivotal role in a range of developments in U.S. armored vehicle, ensuring safe and efficient maneuverability in various environments, including those with GPS disruption or jamming. These systems are indispensable for armored vehicles as they allow them to navigate swiftly and accurately, which is a critical aspect of combat effectiveness. In addition, navigation systems provide improved situational awareness by offering real-time location and environmental data to operators, aiding in hazard avoidance and decision-making during combat.

Product Insights

The combat vehicles segment led the market in 2022, accounting for over 34% share of the revenue. The segment is anticipated to retain its dominance throughout the forecast period. The constantly evolving threat environment has made the use of these vehicles more critical in security and military operations. The scenario draws attention to the need to develop new technologies and capabilities, such as weapon systems, advanced armor, and electronic warfare capabilities. As an increasing number of market players focus on designing products that offer these capabilities, combat vehicles are becoming increasingly versatile, with the ability to perform various missions and tasks. This includes the development of vehicles that can operate in multiple environments, such as amphibious vehicles that can operate on land and in water.

The cash in transit vehicles segment is predicted to foresee significant growth in the forecast perioddriven by the vital role these vehicles play in the security and financial sectors. The continued popularity of cash transactions, despite the growth of digital payments, continues to necessitate the secure and efficient transportation of physical currency. Furthermore, the rising concerns over security and the need to protect valuable assets have prompted financial institutions and CIT service providers to invest in technologically advanced and fortified vehicles. These vehicles are equipped with state-of-the-art security systems, including advanced surveillance and tracking mechanisms, tamper-evident compartments, and communication systems, to ensure the safeguarding of cash and precious cargo against various threats, such as robbery and theft.

Vehicle Type Insights

The conventional armored vehicles segment led the market in 2022, accounting for over 95% share of the revenue. Conventional armored vehicles have proven their worth in a wide range of military and security applications owing to the stability and reliability offered. These vehicles are trusted for their battle-hardened design, robust construction, and proven track record in protecting military personnel and crucial assets in high-threat environments. Moreover, while there is a growing interest in technologically advanced armored vehicles, the conventional segment remains appealing due to its cost-effectiveness. Upgrading and modernizing existing fleets of conventional armored vehicles is often more budget-friendly than procuring entirely new, cutting-edge platforms. This makes them a suitable option for military forces and security agencies looking to maintain operational readiness without incurring excessive expenses.

The electric armored vehicles segment is expected to showcase significant growth over the forecast period. As concerns over climate change and air pollution continue to grow, there is an increasing demand for environmentally friendly solutions such as Electric Vehicles (EVs) across various industries, including the military and security sectors. Advances in battery technology have made it possible to develop armored electric vehicles with sufficient power and range to meet the needs of military and security applications. Over the long term, armored electric vehicles offer cost savings over their conventional counterparts due to lower operating costs and maintenance requirements. Electric armored vehicles also offer advantages such as quieter operation and immediate torque, making them increasingly attractive for security and military applications.

Mobility Insights

The wheeled segment led the market in 2022, accounting for over 81% of revenue. Wheeled armored vehicles offer superior mobility compared to tracked vehicles, particularly on highways and roads, making them well-suited for swift deployment in a wide range of environments, including urban areas. These vehicles are known for their relatively lower maintenance requirements, resulting in reduced long-term operating costs. With ongoing advancements in technology and design, wheeled armored vehicles are expected to become increasingly advanced and capable, thereby becoming a more critical asset in military and security operations across various landscapes.

The tracked segment will witness significant growth in the coming years. Tracked vehicles are typically used for military or security applications such as armored reconnaissance, combat operations, and logistical support. These vehicles are often developed to offer robust heavy armor protection, which makes them particularly well-suited for high-risk conditions and combat operations. Their tracked configuration offers a low center of gravity, enhancing stability and diminishing the risk of tipping over, a crucial advantage in challenging terrains. Moreover, the heavy armor plating on tracked vehicles serves as a formidable shield, safeguarding both the vehicle and its occupants against threats such as small arms fire, shrapnel, and other hazards commonly encountered on the battlefield.

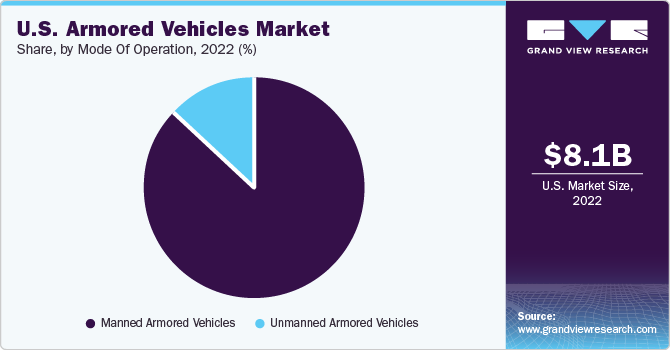

Mode of Operation Insights

The manned armored vehicles segment led the market in 2022, accounting for over 85% of the revenue. The high share can be attributed to their effectiveness in protecting the occupants against a wide range of threats, including small arms fire and Improvised Explosive Devices (IEDs), which make them essential for personnel safety in high-risk environments. Armored vehicle manufacturers provide customization options, making them ideal for military forces, government agencies, and private security firms, thus driving segment growth. These vehicles are designed to transport personnel safely in high-threat environments. They are equipped to handle missions that span reconnaissance, troop transport, fire support, and command and control, making them essential assets in today's dynamic security landscape.

The unmanned armored vehicles segment will witness significant growth in the coming years. Unmanned armored vehicles, also known as Unmanned Ground Vehicles (UGVs), are a type of armored vehicle that can operate without a human operator on board. These vehicles are remotely controlled or can operate autonomously. They are equipped with various sensors and other advanced technology that allow them to perform various tasks, including logistics, surveillance, and combat operations. Unmanned armored vehicles are designed to operate in a wide range of environments and conditions and can be customized to meet specific mission requirements. They offer several advantages, including reduced risk to personnel, increased efficiency & cost savings, and improved performance & capabilities.

Point of Sale Insights

The OEM segment led the market in 2022, accounting for over 82% of the revenue. The growth can be attributed to OEMs serving as the primary manufacturers and suppliers of armored vehicles to governments and militaries worldwide. Their product portfolios include a diverse range of armored vehicles, encompassing main battle tanks, infantry fighting vehicles, armored personnel carriers, and mine-resistant ambush-protected vehicles. With the increasing demand for armored vehicles, OEMs are capitalizing on opportunities to expand their offerings and cater to clients in the military, security, and law enforcement sectors. These companies are actively investing in cutting-edge technologies and capabilities to develop more advanced and effective armored vehicles, ensuring they remain at the forefront of the market's growth and innovation.

The retrofit segment will witness significant growth in the coming years.This growth is driven by the aging armored vehicle fleet within the U.S. military, where upgrading and retrofitting these vehicles proves to be a more cost-effective option compared to procuring new ones. In addition, continuous technological advancements, such as active protection systems, enhanced situational awareness systems, and new weaponry, provide opportunities to improve the performance and survivability of existing armored vehicles. Furthermore, the evolving threat landscape necessitates constant upgrades to armored vehicles to ensure their effectiveness and adaptability to emerging challenges and risks, making the retrofit segment a key driver of market expansion.

Key Companies & Market Share Insights

The major players are aiming to expand their market presence, seeking opportunities in both domestic and international markets. They establish partnerships, joint ventures, or subsidiaries in untapped regional markets to serve local customers with improved channel reach and enhance their market position. They continue to invest heavily in innovation, which enables them to stay at the forefront of the market. For instance, in May 2023, the Richmond Police Department introduced its new armored vehicle. This new vehicle, the Pit-Bull VX Special Edition, was created by Alpine Armoring, Inc., a company headquartered in Chantilly, Virginia. The acquisition of this vehicle focused on enhancing the safety of both police officers and innocent members of the community during emergency responses to various tragic and unfortunate events occurring across THE COUNTRY.

Key U.S. Armored Vehicles Companies:

- BAE Systems

- BMW AG

- Mercedes-Benz Group AG

- Elbit Systems Ltd.

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- Iveco Group N. V

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Navistar, Inc.

- Oshkosh Defense, LLC

- Rheinmetall AG

- STAT, Inc.

- Textron, Inc.

- Thales Group.

U.S. Armored Vehicle Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 12.26 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Vehicle Type, Mobility, Mode of Operation, Point of Sale, and System

Country scope

U.S.

Key companies profiled

BAE Systems; BMW AG; Benz Group AG; Elbit Systems Ltd.; Ford Motor Company; General Dynamics Corporation; INKAS Armored Vehicle Manufacturing; International Armored Group; Iveco Group N. V; Krauss-Maffei Wegmann GmbH & Co. (KMW); Lenco Industries, Inc.; Lockheed Martin Corporation; Navistar, Inc.; Oshkosh Defense, LLC; Rheinmetall AG; STAT, Inc.; Textron, Inc.; Thales Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Armored Vehicle Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. armored vehicles market report based on product, vehicle type, mobility, mode of operation, point of sale, and system.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Combat Vehicles

-

Armored Personnel Carrier (APC)

-

Infantry Fighting Vehicles (IFV)

-

Light Protected Vehicles (LPV)

-

Main Battle Tanks (MBT)

-

Mine-resistant Ambush Protected (MRAP)

-

Tactical Vehicle

-

Others

-

-

Combat Support Vehicles

-

Armored Supply Trucks

-

Armored Command & Control Vehicles

-

Repair & Recovery Vehicles

-

Unmanned Armored Ground Vehicles

-

-

Cash in Transit Vehicles

-

Law Enforcement Vehicles

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Electric Armored Vehicles

-

Conventional Armored Vehicles

-

-

Mobility Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wheeled

-

Tracked

-

-

Mode of Operation Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manned Armored Vehicles

-

Unmanned Armored Vehicles

-

-

Point of Sale Outlook (Revenue, USD Billion, 2017 - 2030)

-

OEM

-

Retrofit

-

-

System Outlook (Revenue, USD Billion, 2017 - 2030)

-

Engines

-

Drive Systems

-

Ballistic Armor

-

Fire Control Systems (FCS)

-

Navigation Systems

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. armored vehicle market size was estimated at USD 8.09 billion in 2022 and is expected to reach USD 8.47 billion in 2023.

b. The global U.S. armored vehicle market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 12.26 billion by 2030.

b. The combat vehicles segment led the market in 2022, accounting for 35.1% share of the revenue. The constantly evolving threat environment has made the use of these vehicles more critical in security and military operations. The scenario draws attention to the need to develop new technologies and capabilities, such as weapon systems, advanced armor, and electronic warfare capabilities.

b. Some key players operating in the U.S. armored vehicle market include BAE Systems, BMW AG, Benz Group AG, Elbit Systems Ltd., Ford Motor Company, General Dynamics Corporation, INKAS Armored Vehicle Manufacturing, International Armored Group, Iveco Group N. V, Krauss-Maffei Wegmann GmbH & Co. (KMW), Lenco Industries, Inc., Lockheed Martin Corporation, Navistar, Inc., Oshkosh Defense, LLC, Rheinmetall AG, STAT, Inc., Textron, Inc., Thales Group.

b. Key factors that are driving the U.S. armored vehicle market growth include enhancing intelligence, surveillance, reconnaissance (isr), and target acquisition capabilities within the defense sector, and growing demand for next-generation military vehicles equipped with advanced weapon systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.