- Home

- »

- Consumer F&B

- »

-

U.S. Ashwagandha Supplements Market Size Report, 2033GVR Report cover

![U.S. Ashwagandha Supplements Market Size, Share & Trends Report]()

U.S. Ashwagandha Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Capsules, Tablets & Pills, Powder, Liquid), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), And Segment Forecasts

- Report ID: GVR-4-68040-746-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ashwagandha Supplements Market Summary

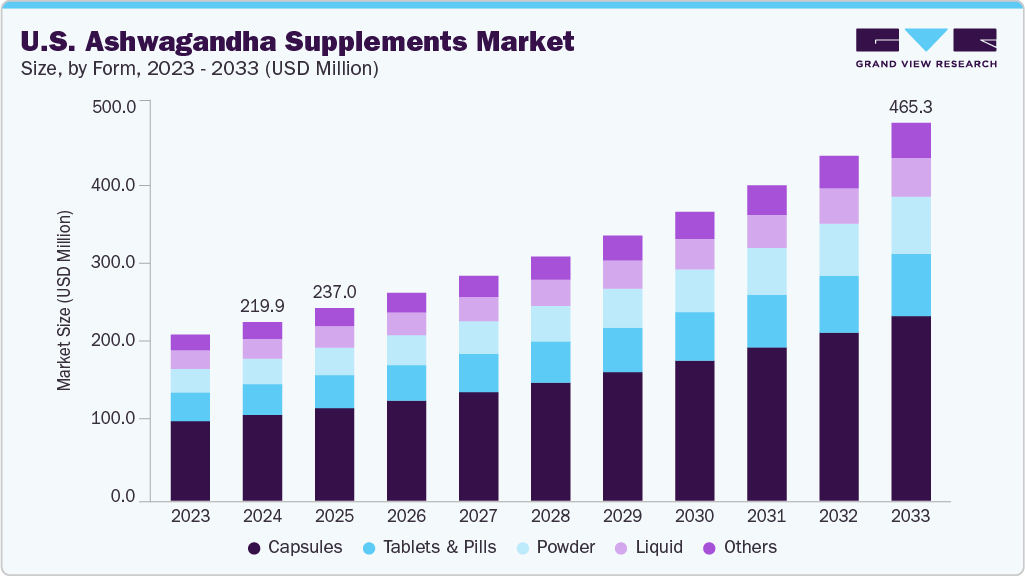

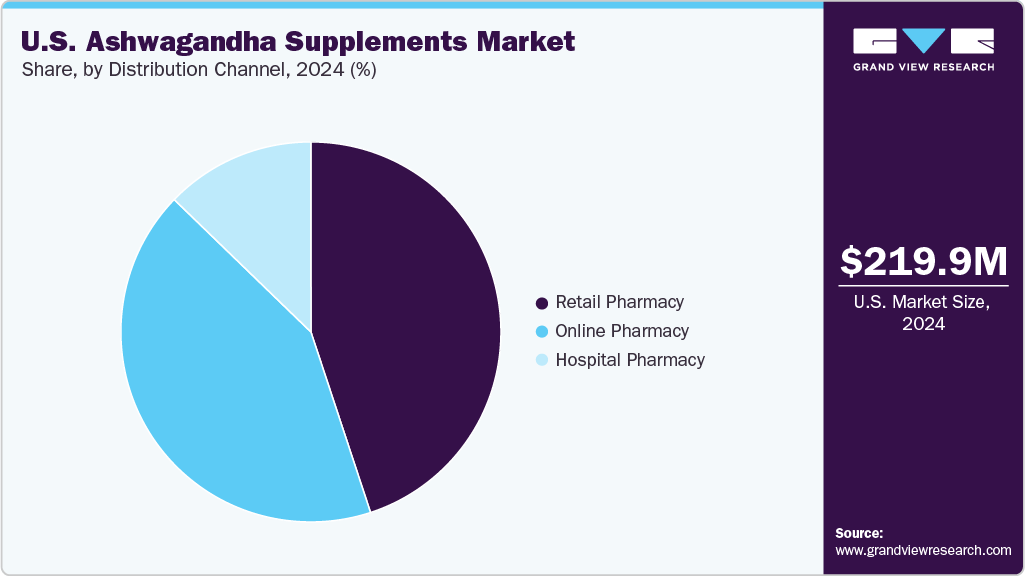

The U.S. ashwagandha supplements market size was estimated at USD 219.9 million in 2024 and is projected to reach USD 465.3 million in 2033, growing at a CAGR of 8.8% from 2025 to 2033. This can be attributed to the rising consumer demand for natural remedies for sleep, stress, immunity, and overall wellness.

Key Market Trends & Insights

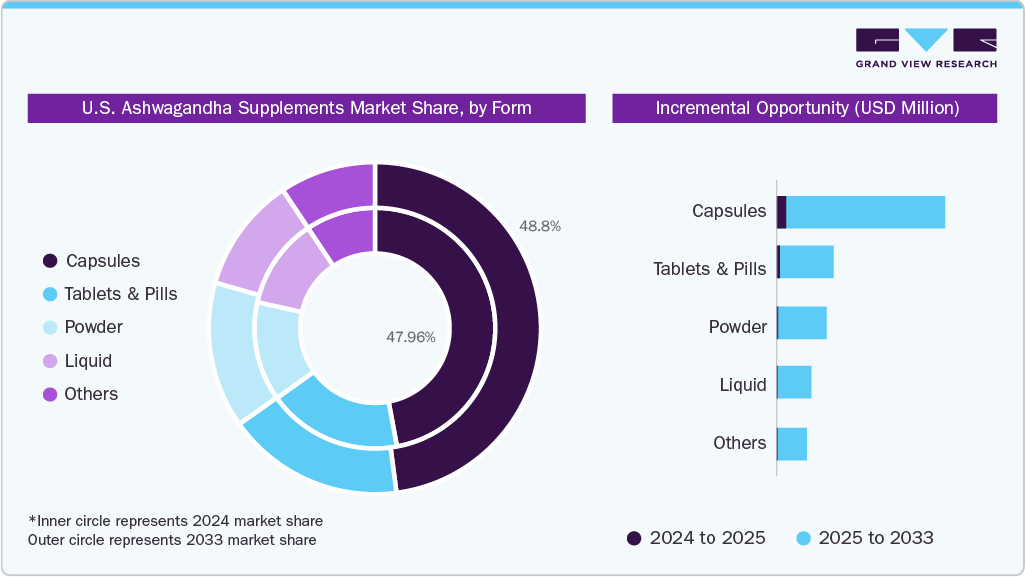

- By form, ashwagandha capsule supplements led the market and accounted for a share of 47.96% in 2024.

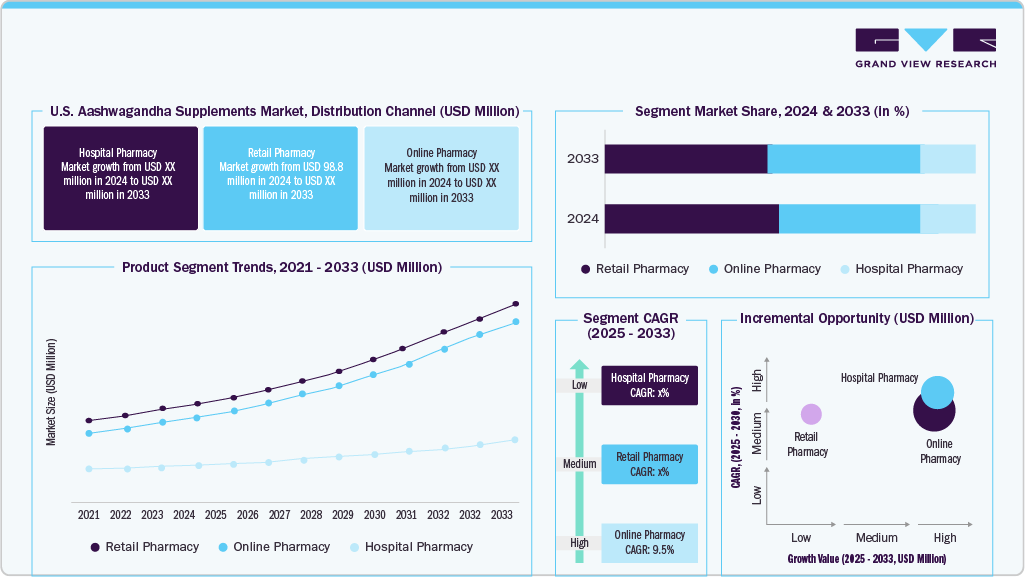

- By distribution channel, the sale of ashwagandha supplements through retail pharmacy held the largest market share of 44.92% in 2024.

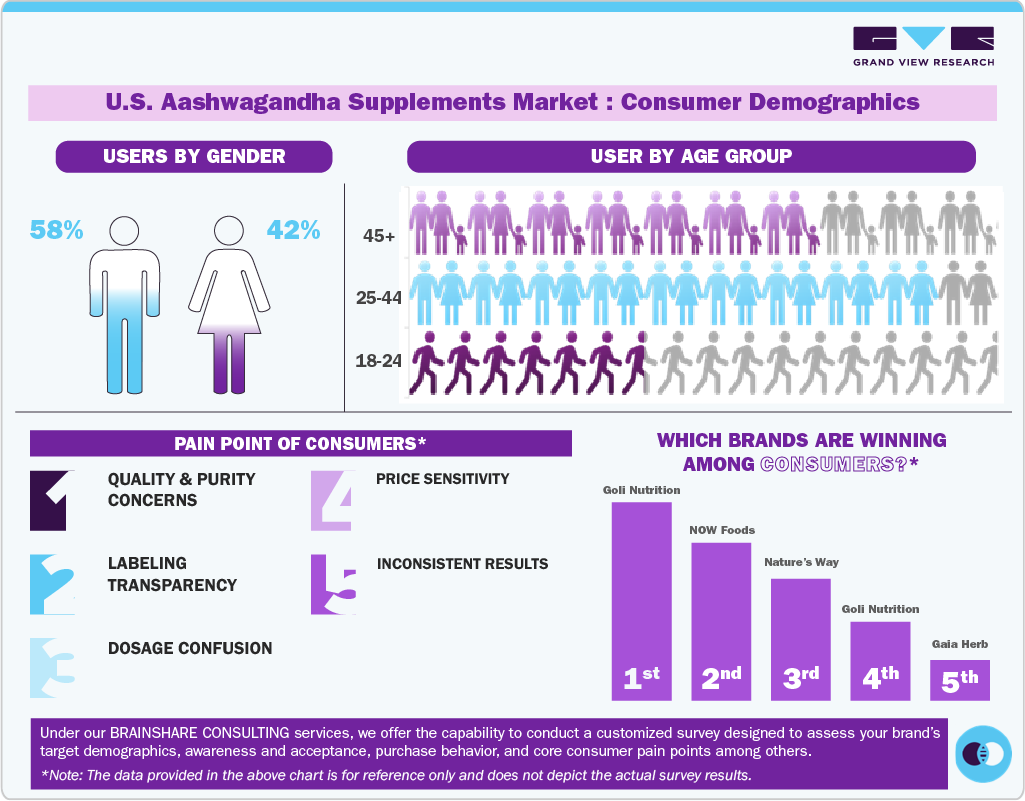

- The U.S. market for ashwagandha supplements leans slightly male, with about 58% of users being men and 42% women.

Market Size & Forecast

- 2024 Market Size: USD 219.9 Million

- 2033 Projected Market Size: USD 465.3 Million

- CAGR (2025-2033): 8.8%

In the U.S., the ashwagandha market price has steadily increased, fueled by growing demand for premium forms such as gummies, functional beverages, and concentrated extracts. While standard capsules and powders stay relatively affordable, newer and high-potency products tend to carry higher price points.The U.S. ashwagandha supplements industry is driven by rising consumer concern over anxiety, stress, and insomnia issues. Rising work-life pressures, hybrid work fatigue, and broader awareness of mental health have led many Americans to seek non-pharmaceutical options for relief. Clinical studies showing that ashwagandha may help lower cortisol levels and improve stress resilience have reinforced consumer trust and provided companies with evidence to support stress-relief claims, making the herb one of the most recognized adaptogens in the U.S. wellness space. The Office of Dietary Supplements (NIH) highlights ashwagandha (Withania somnifera), a traditional Ayurvedic herb, as an adaptogen, with research suggesting it may help reduce stress and anxiety while also promoting improved sleep.

Moreover, there is a growing wellness trend among American consumers. They are increasingly preferring natural, plant-based, and Ayurveda-inspired remedies. This has pushed Ashwagandha beyond niche herbal channels and into mainstream retail as it aligns with solutions like boosting cognitive performance, sustaining energy, and supporting restful sleep. Its positioning as an adaptogen fits the U.S. gradual shift toward preventive health and holistic wellness. It draws in older adults wanting resilience and younger demographics seeking natural ways to improve performance and balance.

In the U.S., distribution and product innovation have become key factors behind the growth of the ashwagandha market. The herb is no longer limited to capsules or powders found in health stores. It is available in gummies, protein mixes, functional drinks, and even sleep aids through major retailers and online platforms. The rise of e-commerce and direct-to-consumer brands has made these products far more accessible. At the same time, influencer marketing, online reviews, and social media trends continue to draw in new users. This wider availability across formats has encouraged trial and repeat purchases, further fueling market expansion.

Consumer Insights

The U.S. market for ashwagandha supplements leans slightly male, with about 58% of users being men and 42% women. Men are generally attracted to the herb for stress relief, fitness recovery, and testosterone-related benefits, while women-an increasingly significant segment-tend to use it for overall wellness, sleep support, and holistic health. Compared to other supplement categories, this relatively balanced gender mix suggests broad mainstream acceptance.

Ashwagandha’s main consumer base falls within the 25-44 age range, with a significant portion of users aged 45 and above, and a smaller but noticeable presence among 18-24-year-olds. The strong uptake in the 25-44 group reflects high stress levels, busy work lives, and a focus on wellness spending. Older adults often use the supplement for healthy aging, better sleep, and adaptogenic benefits, while younger consumers are drawn to modern formats like gummies and functional drinks.

Pain points remain in the market. Many potential buyers hesitate due to concerns about product quality, unclear labeling, and uncertainty around proper dosage. Price sensitivity and inconsistent outcomes also affect repeat purchase. This shows that while awareness is high, trust and clarity around product effectiveness remain key barriers.

In terms of popularity, brands such as Goli Nutrition lead by appealing to younger audiences through strong retail presence, gummy products, and influencer marketing. NOW Foods follows, leveraging its reputation for affordability, availability, and reliability. Nature’s Way benefits from its established herbal credibility, and Gaia Herbs caters to a smaller but loyal premium segment.

The ranking of brands favored by consumers highlights a delicate balance between heritage credibility and innovative product formats, shaping consumer choices in the growing market, where Ashwagandha market price considerations continue to influence purchase decisions.

Form Insights

The capsules segment accounted for a revenue share of 47.96% in 2024, owing to their convenience, easy dosage, and wide availability at various pharmacies, health stores, and online. In addition, they are favored by busy professionals due to its simplicity and consistency compared with powders or other formats. This familiarity and ease of use is a key factor in maintaining a strong revenue share.

The powder segment is anticipated to witness a growth rate of 9.5% from 2025 to 2033. This can be attributed to health-conscious consumers increasingly seeking customizable ways to incorporate ashwagandha into beverages such as smoothies, shakes, and other functional drinks. Powders appeal to fitness enthusiasts and younger consumers who value versatility and the ability to combine supplements with other wellness products, driving higher growth rates than more traditional formats.

Distribution Channel Insights

The retail pharmacy segment accounted for a revenue share of 44.92% in 2024. Retail pharmacies, such as CVS, Walgreens, and independent drugstores, represent a significant and accessible distribution channel for Ashwagandha supplements in the U.S. These establishments leverage their broad geographic reach, consumer trust, and the perceived credibility associated with pharmacist recommendations to drive sales. Consumers often purchase supplements here due to convenience, the ability to consult with a healthcare professional (pharmacist), and a selection of trusted brands, positioning retail pharmacies as a critical touchpoint for mainstream consumers seeking natural health solutions.

The online pharmacy segment is expected to grow at a CAGR of 9.5% from 2025 to 2033, driven by the increasing convenience of home delivery, a wider range of products and formats, and considerations around competitive ashwagandha market pricing. Increased digital literacy, direct-to-consumer brands, and influencer-driven awareness have made e-commerce an attractive channel for Gen Z and tech-savvy consumers.

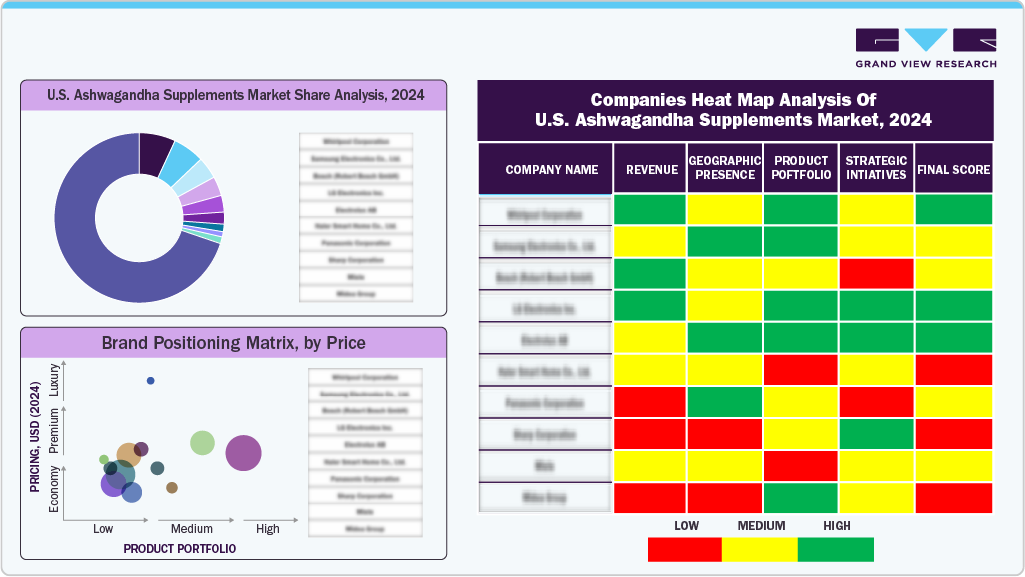

Key U.S. Ashwagandha Supplements Company Insights

In the U.S. ashwagandha supplements industry, leading players such as Goli Nutrition, NOW Foods, Nature’s Way, Gaia Herbs, Himalaya Wellness, among others operate in a highly competitive environment.

Key players in the market are focusing on product development to cater to evolving consumer demands and preferences. They are introducing new formulations, such as organic, vegan, and sugar-free supplements, to meet the needs of health-conscious consumers. In addition, mergers and acquisitions are shaping the market landscape, with larger companies acquiring smaller players to diversify their product portfolios and consolidate their market position.

Key U.S. Ashwagandha Supplements Companies:

- Goli Nutrition

- NOW Foods

- Nature’s Way

- Gaia Herbs

- Himalaya Wellness

- Organic India

- KSM-66 (Ixoreal Biomed)

- NutraHerbals

- Solaray

- Pure Encapsulations

Recent Developments

-

In August 2025, Black Girl Vitamins introduced "Calm Girl," a daily supplement designed to support stress relief and hormonal balance in women of color. The formula combines ashwagandha, an ancient adaptogen, with zinc, spinach powder, and vitamin D3.

-

In June 2025, Natural Remedies introduced Ashwa.30, a new Ashwagandha extract developed to support stress relief, boost energy, and enhance endurance. Standardized to 15% withanolides, it also includes a proprietary ATP-active component designed to aid cellular energy production.

U.S. Ashwagandha Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 237.0 million

Revenue forecast in 2033

USD 465.3 million

Growth rate (Revenue)

CAGR of 8.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel

Key companies profiled

Goli Nutrition; NOW Foods; Nature’s Way; Gaia Herbs; Himalaya Wellness; Organic India; KSM-66 (Ixoreal Biomed); NutraHerbals; Solaray; Pure Encapsulations

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ashwagandha Supplements Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. ashwagandha supplements market report based on form and distribution channel.

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets & Pills

-

Powder

-

Liquid

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

Frequently Asked Questions About This Report

b. The U.S. ashwagandha supplements market size was estimated at USD 219.9 million in 2024 and is expected to reach USD 237.0 million in 2025.

b. The U.S. ashwagandha supplements market is expected to grow at a compound annual growth rate (CAGR) of 8.8% from 2025 to 2033 to reach USD 465.3 million by 2033.

b. The capsules segment accounted for a revenue share of 47.96% in 2024, owing to their convenience, easy dosage, and wide availability at various pharmacies, health stores, and online.

b. Some key players operating in the U.S. ashwagandha supplements market include Goli Nutrition; NOW Foods; Nature’s Way; Gaia Herbs; Himalaya Wellness; Organic India; KSM-66 (Ixoreal Biomed); NutraHerbals; Solaray; Pure Encapsulations

b. The U.S. ashwagandha supplements market is driven by rising consumer concern over anxiety, stress, and insomnia issues. Rising work-life pressures, hybrid work fatigue, and broader awareness of mental health have led many Americans to seek non-pharmaceutical options for relief.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.