- Home

- »

- Next Generation Technologies

- »

-

U.S. Audiobooks Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Audiobooks Market Size, Share & Trends Report]()

U.S. Audiobooks Market (2024 - 2030) Size, Share & Trends Analysis Report By Genre, By Preferred Device (Laptops & Tablets, Personal Digital Assistants), By Distribution Channel (One-time Download, Subscription-based), By Target Audience (Kids, Adults), And Segment Forecasts

- Report ID: GVR-4-68040-226-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Audiobooks Market Size & Trends

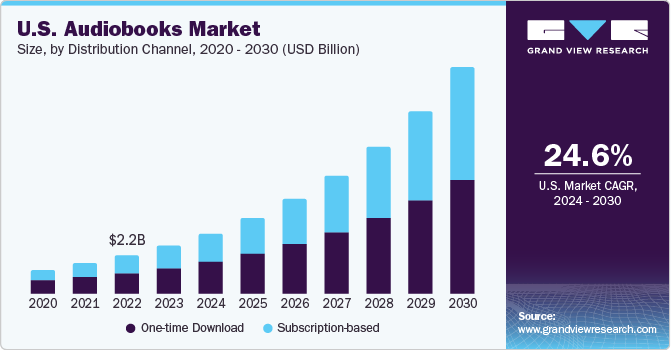

The U.S. audiobooks market size was valued at USD 2.75 billion in 2023 and is expected to grow at a CAGR of 24.6% from 2024 to 2030. The flexibility and versatility features of audiobooks to make content easily accessible on electronic devices, irrespective of time and place, are main factors behind their growing usage. The availability of the internet and the rising number of smartphone users are expected to boost the growth of the market.

In 2023, the U.S. accounted for over 44% of the audiobook market. Audiobooks are gaining popularity due to numerous benefits provided by them. Audiobooks are accessible as digital voice-version files and can be listened to on personal computers, smartphones, tablets, and any other consumer electronic device that supports audio streaming. Moreover, they cover a wide range of applications, from educational to leisure and entertainment uses, which has also resulted in a larger customer base.

Technological advancements are also anticipated to spur innovation in the audiobooks market. It is now easier for customers to purchase audiobooks due to the integration of cutting-edge technologies such as IoT and AI. Publishers have also benefited from such technologies, enabling them to transform their physically written manuscripts into audio files. The penetration of the internet has also bolstered increasing traction among users. The widespread use of smart home technologies has opened abundant opportunities for the market.

Authors, narrators, and publishers can make reasonable quality audiobooks and establish a career in the audiobook creation profession with the help of any regular IoT device and free version of the program. Key market participants are deploying AI to offer customized results to their users based on their listening history. Other AI capabilities, such as automating narrations of recorded materials to improve text-to-speech technologies and providing file summaries with key takeaways, are expected to drive the market.

Market Concentration & Characteristics

Key companies in the market are offering new subscription-based packages to users to gain a competitive edge in the market over other competitors. They are also modernizing their websites and app-based platforms to provide a more user-friendly experience to their audiences and expand their consumer base. They continue to hold dominance in this market, as their product portfolios have been updated to include a diverse range of content.

The adoption of text-to-speech technology is playing a vital role in shaping the audiobooks market. For instance, in March 2021, Google launched its Play Books teaching assistant program, which was aimed at enabling AI to read books, turn pages automatically, and access a dictionary. Advances in AI can take text-to-speech technology to the next level. With artificial voice matching the natural voice, listeners may get oblivious to the fact that they are hearing synthetic voices.

The companies are also entering into mergers and acquisitions to strengthen their portfolios and offerings. For instance, in February 2022, Spotify acquired Chartable, a podcast analytics platform and Podsights, a podcast measuring service. This move is expected to help the company to level up the measurement for podcast advertising.

Moreover, Data protection laws govern the storage and utilization of personal data. As such, audiobook companies managing customer data must abide by the relevant privacy rules, such as the California Consumer Privacy Act (CCPA).

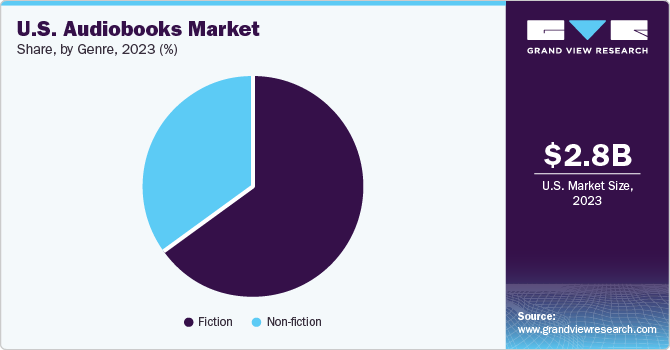

Genre Insights

The fiction segment dominated the market and accounted for the largest revenue share in 2023. As per the Audio Publishers Association report published in 2022, the science fiction segment was one of the most popular categories in the audiobook market. This can be attributed to the ease of availability of audiobooks via mobile phones or other compatible devices.

The non-fiction genre includes book categories such as autobiographies, memoirs, self-help books, travel guides, academic textbooks, and biographies. Non-fiction audiobooks are commonly used by scientists, philosophers, and students to learn more about a subject. This segment is growing due to the extensive deployment of audiobooks by parents as educational material for their kids.

Preferred Device Insights

Based on preferred devices, the market is divided into smartphones, laptops and tablets, personal digital assistants or voice-enabled assistants, and other devices. The smartphone segment dominated the market and accounted for the largest revenue share of around 45.0% in 2023. The ability to access recorded book versions while doing another course of work and the convenience of downloading audio box sets are expected to drive this segment.

The increasing adoption of laptops and tablets among specialists and professionals to access high-quality content is expected to drive the growth of the segment further. Other devices include portable MP3 players, CDs, and Bluetooth-connected speakers. This segment is expected to grow considerably as an increasing number of libraries, associations, educational institutions, and other organizations prefer to keep their collections of audible paperbacks on CDs.

Distribution Channel Insights

The one-time download segment dominated the market and accounted for the largest revenue share in 2023. People fond of reading and listening to audiobooks prefer to buy a single high-quality audiobook. Sometimes, companies offer discounts and special price packages to entice users to purchase recorded content outright. The growth of the segment can be attributed to a rise in customer demand for single high-quality audiobooks.

The subscription-based segment gives consumers the liberty to access a variety of relatable content from a single platform and fresh content in the form of audiobooks. This segment also benefits from the several acquisitions and partnerships in the market. For instance, in July 2022, Flipkart Internet Private Limited, an e-commerce company, partnered with Pocket FM, an audio streaming platform, to enter the audiobooks category. Through the partnership, Flipkart is expected to offer licensed and exclusive audiobooks via Pocket FM to its customer base of over 400 million users.

Target Audience Insights

Based on target audience, the adults segment dominated the market and accounted for the largest revenue share in 2023. The growth of this segment is fueled by the trend of companies releasing audiobooks that are particular to a community or location to draw customers and create a competitive edge in the market. The wide range of audiobooks offered that includes brain stimulation and relaxation exercises is also expected to boost the growth of the market.

Audiobooks are also being used extensively for educational purposes, which is acting as a major driver for the kids’ segment growth. There has been a significant increase in the number of audiobooks produced for the entertainment and amusement of children. Numerous benefits of audiobooks for kids in terms of cognitive mind development, including eloquent vocabulary, fostered narrative structure, and improved visualization, are expected to provide lucrative growth opportunities to the segment.

Key U.S. Audiobooks Company Insights

Some of the leading companies in the U.S. audiobooks market include Amazon.com, Inc., Apple Inc., and Google.

- Google Play Books, earlier known as Google eBooks, is a digital eBook distribution service by Google, which is a part of the company’s Google Play product line. Google Play Books and audiobooks are available in 75 countries and can be accessed via the Google Play Books application by Google Inc.

- Apple offers a wide range of products and services, such as phones, desktops, iPads, iPods, and Apple Books. Apple’s development to narrate audiobooks can be beneficial to publishers and authors, and it can also reignite existing feuds between major companies.

Barnes & Noble Booksellers, Inc. and Downpour.com are other companies operating in the U.S. audiobooks market.

- Downpour offers chapter tracking, offline listening, variable speed playback (1.25x, 1.5x, and 2x), built-in sleep timer, and in-app book purchases or in-app purchases with Downpour Credits.

Key U.S. Audiobooks Companies:

- Amazon.com, Inc.

- Apple Inc.

- Audible, Inc.

- Barnes & Noble Booksellers, Inc.

- Blackstone Audio

- Brilliance Publishing

- Downpour.com

- Google LLC

- PLAYSTER (SOFTONIC INTERNATIONAL S.A.)

- Podium Publishing

- Rakuten Group, Inc.

- Storytel AB

Recent Developments

-

In January 2023, Apple Inc. launched AI-powered audio narration for selected titles on Apple Books. Users can figure out if the audiobook is AI-powered by checking ‘Apple Books’ in the narrator section for those specific titles.

-

In January 2023, Google LLC partnered with Bookwire, a digital publishing company, to offer auto-narrated audiobooks using its text-to-speech technology. This technology is expected to help the company cater to the needs of a larger customer base with complete production and quality assurance.

U.S. Audiobooks Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.75 billion

Revenue forecast in 2030

USD 12.88 billion

Growth rate

CAGR of 24.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Genre, preferred genre, distribution channel, target audience

Regional scope

U.S.

Key companies profiled

Amazon.com, Inc.; Apple Inc.; Audible, Inc; Barnes & Noble Booksellers, Inc.; Downpour; Google LLC; PLAYSTER (SOFTONIC INTERNATIONAL S.A.); Rakuten Group, Inc.; Storytel AB; Blackstone Audio; Brilliance Publishing; Podium Publishing

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Audiobooks Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. audiobooks market report on the basis of genre, preferred genre, distribution channel, and target audience:

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiction

-

Non-Fiction

-

-

Preferred Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Laptops & Tablets

-

Personal Digital Assistants

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

One-time download

-

Subscription-Based

-

-

Target Audience Outlook (Revenue, USD Million, 2018 - 2030)

-

Kids

-

Adults

-

Frequently Asked Questions About This Report

b. The global U.S. audiobooks market size was valued at USD 2.75 billion in 2023 and is expected to reach USD 3.45 billion in 2024.

b. The global U.S. audiobooks market is expected to grow at a compound annual growth rate (CAGR) of 24.6% from 2024 to 2030 to reach USD 12.88 billion by 2030.

b. The smartphone segment dominated the market and accounted for the largest revenue share of around 45.0% in 2023. The ability to access recorded book versions while doing another course of work and the convenience of downloading audio box sets are expected to drive this segment.

b. Some key players operating in the U.S. audiobooks market include Amazon.com, Inc., Apple Inc., Audible, Inc., Barnes & Noble Booksellers, Inc., Blackstone Audio, Brilliance Publishing, Downpour.com, Google LLC, PLAYSTER (SOFTONIC INTERNATIONAL S.A.), Podium Publishing, Rakuten Group, Inc., Storytel AB

b. The flexibility and versatility features of audiobooks to make content easily accessible on electronic devices, irrespective of time and place, are main factors behind their growing usage. Furthermore, the availability of the internet and the rising number of smartphone users are expected to boost the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.