- Home

- »

- Biotechnology

- »

-

U.S. Automated Liquid Handling Technologies Market, Industry Report, 2030GVR Report cover

![U.S. Automated Liquid Handling Technologies Market Size, Share & Trends Report]()

U.S. Automated Liquid Handling Technologies Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Bioprocessing/Biotechnology), By End-user (Academic & Research Institutes), By Product, And Segment Forecasts

- Report ID: GVR-4-68040-244-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

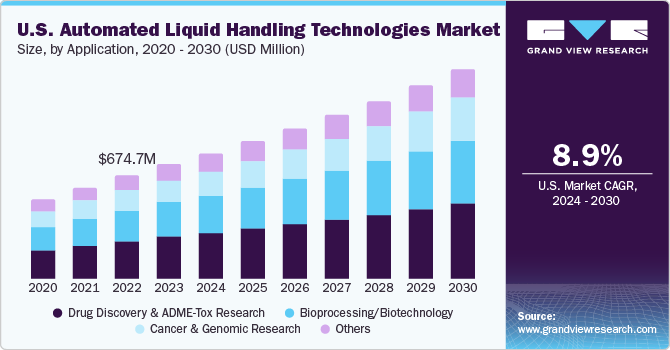

The U.S. automated liquid handling technologies market size was estimated at USD 741.97 million in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. The introduction of robotics & automation has revolutionized workflow processing in clinical research and drug discovery. Rising investments in R&D and increasing competition in the pharmaceutical sector will likely boost the adoption of automated liquid-handling workstations. Although high cost & complexity in operability restrict market growth, rising demand for rapid processing and the need to eliminate human errors is expected to overcome this limitation over the coming years. Furthermore, the high wages of employees add up to the manufacturing or processing cost. These expenses can be eliminated by using advanced automated liquid handlers, which are, therefore, being adopted by major pharmaceutical & biotechnology companies.

The U.S. automated liquid handling technologies market accounted more than 35.5% of the global automated liquid handling technologies market in 2023. Incorporating machine learning (ML) and artificial intelligence (AI) has unlocked new possibilities for automated liquid handling systems. These technologies allow remote interaction with handlers, control over different procedure stages, and advanced error control. They can also adjust to new situations, such as defects in disposable tips or nozzle blockages during sample handling. Moreover, manufacturers have developed workstations using ultrasound, piezoelectric, and solenoid mechanisms to dispense droplets, overcoming surface adhesion. For instance, Eco acoustic liquid handling technology is used by LABCYTE INC. for non-contact dispensing in its products. The miniaturization of assay platforms has led to cost savings by reducing workflow expenses and minimizing the use of expensive reagents. These compact platforms are designed for precise liquid handling in various processes, including bulk dispensing, plate washing, and liquid transfer.

The COVID-19 pandemic has underscored the need for the safe, precise, and rapid gathering and processing of virus samples. This has placed a burden on laboratories to fulfill the need for high-volume and large-scale testing. In situations where it’s crucial to preserve samples and reduce the risk of contamination, automated liquid handling systems have become the norm. These systems function with minimal oversight, guaranteeing verifiable and repeatable outcomes. Notably, solutions such as PIPETMAX are excellent at managing large volumes for various uses, including cell-based assays and qPCR, making it an essential lab aid. PIPETMAX is known for its small size and comes with validated, pre-established protocols for increased efficiency.

Even with the advancements in sequencing technologies, significant challenges remain in the human-involved stages of this process. In clinical and research genomics labs, sample preparation poses a barrier to experiments, particularly in high-throughput NGS. The steps involved in sample preparation in research labs are often laborious, repetitive, and time-consuming. A study examining the link between genomic analysis and cancer diagnosis found that manual laboratory handling for next-generation sequencing can result in a turnaround time (TAT) of up to 6 days, considerably longer than automated systems. The advantages of automation have prompted many genomics labs to embrace liquid handling automation to enhance the cost-effectiveness and efficiency of sequencing workflows, thus propelling market growth.

Furthermore, a cost analysis for genome sequencing revealed that in conventional clinical labs, 15% of the overall cost is allocated to lab personnel. Labs that have implemented a Hamilton Microlab STARlet for automated sample preparation have seen a reduction in staff salaries after transitioning to automated methods. Besides cost factors, robots are superior in executing repetitive and monotonous tasks with accuracy and endurance, providing a substantial benefit over manual procedures.

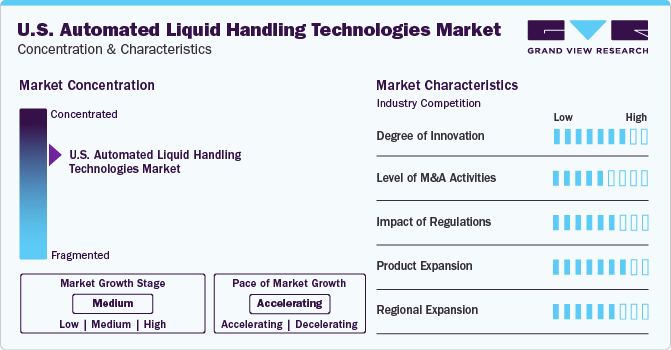

Market Characteristics & Concentration

The U.S. automated liquid handling technologies industry is concentrated, with a few key players dominating the industry. Major companies like Analytik Jena AG, Hamilton Company, and Agilent Technologies hold significant market shares, contributing to the industry's consolidation. They actively participate in product innovation, mergers and acquisitions, and regional expansion to fortify their position. This consolidation is driven by well-established distribution networks, advanced technologies, and a higher level of market penetration by these leading companies. The industry is characterized by a high degree of innovation with the integration of advanced robotics, artificial intelligence, and precision engineering.

The industry is highly innovative, with firms consistently creating sophisticated solutions to cater to the changing needs of the industry. Developments such as automated liquid-handling workstations for high-throughput testing, the incorporation of artificial intelligence for error management, and the launch of state-of-the-art technologies like Revvity’s Fontus Automated Liquid Handling Workstation exemplify the market’s inventive spirit. This intense innovation is crucial for firms to remain competitive, improve efficiency, and satisfy the growing requirements for precision and rapidity in liquid handling procedures.

Moderate mergers and acquisitions indicate consolidation and strategic partnerships within the industry. For example, in May 2023, Hamilton, a global leader in automated liquid handling workstations and laboratory automation technology, and Biosero, Inc., a prominent innovator in laboratory automation solutions, announced a strategic co-marketing alliance. The collaboration aims to streamline and improve automated liquid handling processes in labs, providing researchers with a comprehensive solution for easy automation. These acquisitions and strategic partnerships are designed to enrich product offerings, extend market penetration, and leverage synergies to strengthen competitive positions. These strategic initiatives show a trend of cooperation and consolidation to drive market growth and innovation.

Regulations on medical devices significantly impact automated liquid handling technologies manufacturers in the U.S. Regulations such as those for FDA approvals and compliance requirements significantly impact the market landscape and the manufacturers' operations. These regulations are crucial in shaping the market and influencing manufacturers' operations. Compliance with regulatory standards is essential for industry entry, product approval, and patient safety. Manufacturers must invest in meeting these stringent regulations, which can impact product development timelines, costs, and market access. Adhering to regulatory requirements is paramount for manufacturers to maintain credibility, ensure quality, and navigate the complex landscape of medical device regulations in the U.S.

The industry is primarily experiencing product expansion, with companies focusing on developing innovative solutions and expanding their product lines to meet diverse customer needs. For instance, introducing new products like the Fontus Automated Liquid Handling Workstation by Revvity demonstrates a clear emphasis on product expansion to offer cutting-edge solutions to the market. While service expansion is also essential, the current trend in the industry leans more towards product development, technological advancements, and the introduction of new automated liquid handling systems to cater to the evolving demands of laboratories and research facilities.

Companies in the industry are expanding across different parts of the world, driven by factors such as market demand, growth opportunities, and strategic positioning. Many countries offer a lucrative market for automation solutions in sectors like pharmaceuticals and biotechnology, prompting companies to expand their presence in various states to capitalize on these opportunities. For instance, with the rapidly growing biopharmaceutical industry and supportive government initiatives, companies are targeting regions like California, Massachusetts, and Texas to expand into the thriving life sciences sector and establish a stronger foothold in key markets.

Application Insights

In 2023, Drug discovery and ADME-Tox research were the most dominant areas in the market, contributing to the largest revenue share of 36.05%. These experiments typically involve screening over 1 million compounds to find potential drug candidates. Microarray technology is well-suited for these experiments due to its high throughput, low volume, and high precision. Automated liquid handling workstations play a vital role in this process by performing tasks such as serial dilution, compound selection and transfer for retesting, and further analysis. For example, plate replications, plate-to-plate dilutions, and plate reformatting are some of the key applications. Using automated liquid handling platforms in drug discovery has the advantage of integrating various types of liquid handlers and stackers, thereby increasing overall throughput.

Cancer and genomic research are projected to have the fastest CAGR of 10.1% during the forecast period. Precise dispensing of proteins or DNA onto substrates or microwells is crucial in this field, highlighting the crucial role of automated liquid handling systems. The synthesis and analysis phases in this area are complex, requiring the addition of various solutions, making manual methods impractical for these processes. Thus, precision dispensing is essential, emphasizing the significance of advanced technologies in enabling accurate and efficient procedures throughout cancer and genomic research experiments. The addition of various solutions renders manual methods impractical for these processes. This emphasis on precision dispensing underscores the significance of advanced technologies in enabling accurate and efficient procedures throughout cancer and genomic research experiments.

Product Insights

Automated liquid handling workstations dominated the market and held the largest revenue share of 56.06% in 2023. These workstations are categorized based on their assembly into standalone and integrated types and their functionality into pipetting workstations, specialized liquid handlers, multipurpose workstations, and workstation modules. The growing competition in the pharmaceutical industry and the pursuit of effective disease treatments have driven the demand for these automated workstations. Standalone pipettors have gained popularity due to their compact size and ability to integrate smoothly with other devices, especially those with nanoliter capabilities.

Reagents and consumables are expected to grow at the fastest CAGR of 9.4% during the forecast period. This growth is driven by the increasing use of automated liquid handling systems in the pharmaceutical, biotechnology, and research sectors, leading to a surge in demand for compatible reagents and consumables. These critical components, such as specialized pipette tips, plates, and liquid handling cartridges, are vital in maintaining the precision and dependability of automated procedures.

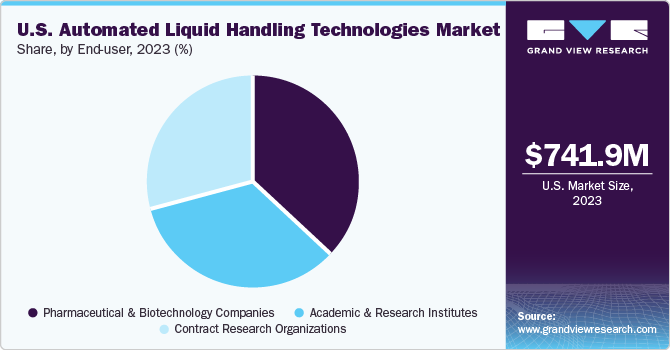

End-user Insights

Pharmaceutical and biotechnology companies dominated the market and held the largest revenue share of 37.39% in 2023. Automated liquid handlers, originally designed for drug discovery labs, are becoming increasingly popular in drug development and manufacturing due to their ability to consistently dispense samples onto different substrates and transfer them into various container sizes. As the dependence on automation for drug screening and development grows, these companies are expected to maintain their market dominance in the coming years.

Contract research organization (CRO) research is estimated to register the fastest CAGR of 9.1% during the forecast period. Capacity shortfalls, ability gaps, focus on core strength, cost control, resource flexibility, and market intelligence are key factors that have increased the significance of CROs in the healthcare industry in recent years. The presence of major unmet needs in oncology, central nervous system, infectious, and rare diseases has led to increased R&D investment by the biopharmaceutical industry. The introduction of cutting-edge technology, such as NGS and gene editing, further contributes to the growth of CROs.

Key U.S. Automated Liquid Handling Technologies Company Insights

The U.S. automated liquid handling technologies market is highly competitive. Major companies are adopting strategies such as partnerships, product and service expansion, mergers & acquisitions, and R&D investments to gain a competitive edge. These strategies aim to develop advanced applications and user-friendly interfaces. Market players are launching new products and collaborating with biotechnology & pharmaceutical companies to integrate their platforms for applications like tumor screening or drug discovery, contributing to revenue growth. For instance, in February 2022, PT Labtech launched an apricot DC1, a 4-in-1 automated pipetting platform, at the SLAS 2022 in Boston.

Key U.S. Automated Liquid Handling Technologies Companies:

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Aurora Biomed, Inc.

- AUTOGEN, INC.

- Danaher

- BioTek Instruments, Inc.

- Analytik Jena AG

- Corning Incorporated

- Eppendorf AG

- Formulatrix, Inc.

- Gilson, Inc.

- Hamilton Company

- Hudson Robotics

- LABCYTE INC.

- Lonza

- PerkinElmer, Inc.

- QIAGEN

- Tecan Trading AG

- METTLER TOLEDO

Recent Developments

-

In June 2023, Agilent Technologies Inc. introduced InfinityLab GPC/SEC. This comprehensive system for gel permeation chromatography and size exclusion chromatography enhances the capabilities of laboratories in separating and analyzing complex mixtures based on molecular size. Implementing this solution can streamline and improve the efficiency of liquid handling processes, especially in research areas requiring precise separation and analysis of molecules.

-

In February 2023, Analytik Jena and Biosero declared a joint marketing agreement. This partnership aims to enhance their laboratory automation technologies and promote their applications. The objective is to expedite and refine future scientific research for their customers. They will showcase these processes at the SLAS2023 International Conference and Exhibition in San Diego, emphasizing on the CyBio Felix. The CyBio FeliX platform enables automated liquid handling in laboratory settings and is adaptable to various applications.

-

In February 2022, Thermo Fisher Scientific, Inc. debuted its novel automated sample handling system with robotics technology at the Society for Laboratory Automation and Screening (SLAS) 2022 conference. The system is designed to support research involving genetic testing and infectious diseases.

U.S. Automated Liquid Handling Technologies Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.36 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Aurora Biomed, Inc.; AUTOGEN, INC.; Danaher; BioTek Instruments, Inc.; Analytik Jena AG; Corning Incorporated; Eppendorf AG; Formulatrix, Inc.; Gilson, Inc.; Hamilton Company; Hudson Robotics; LABCYTE INC.; Lonza; PerkinElmer, Inc.; QIAGEN; Tecan Trading AG; METTLER TOLEDO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automated Liquid Handling Technologies Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automated liquid handling technologies market based on product, application, and end-user:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Liquid Handling Workstations

-

By Assembly

-

Standalone Workstations

-

Integrated Workstations

-

-

By Type

-

Multipurpose Workstation

-

Pipetting Workstation

-

Specialized Liquid Handler

-

Workstation Modul

-

-

-

Reagents & Consumables

-

Reagents

-

Accessories

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & ADME-Tox Research

-

Cancer & Genomic Research

-

Bioprocessing/Biotechnology

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Frequently Asked Questions About This Report

b. Automated liquid handling workstations dominated the market and held the largest revenue share of 56.06% in 2023. These workstations are categorized based on their assembly into standalone and integrated types.

b. Some prominent players in the U.S. automated liquid handling technologies market include Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Aurora Biomed, Inc.; AUTOGEN, INC.; Danaher; BioTek Instruments, Inc.; Analytik Jena AG; Corning Incorporated; Eppendorf AG; Formulatrix, Inc.; Gilson, Inc.; Hamilton Company; Hudson Robotics; LABCYTE INC.; Lonza; PerkinElmer, Inc.; QIAGEN; Tecan Trading AG; METTLER TOLEDO

b. Rising investments in R&D and increasing competition in the pharmaceutical sector will likely boost the adoption of automated liquid-handling workstations.

b. The U.S. automated liquid handling technologies market size was estimated at USD 741.97 million in 2023.

b. The U.S. automated liquid handling technologies market is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2030 to reach USD 1.36 billion by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.