- Home

- »

- Next Generation Technologies

- »

-

U.S. Automatic Content Recognition Market, Industry Report, 2030GVR Report cover

![U.S. Automatic Content Recognition Market Size, Share & Trends Report]()

U.S. Automatic Content Recognition Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Content, By Platform, By Technology, By Industry Vertical, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-247-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

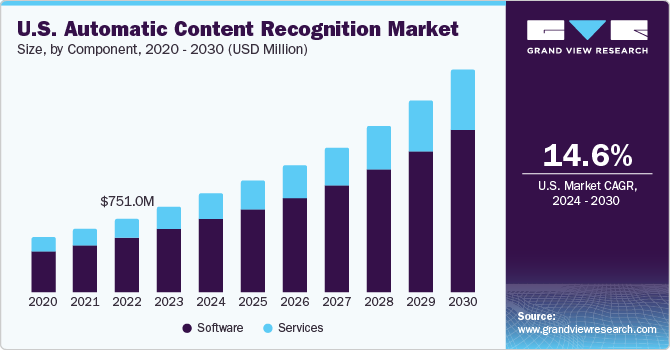

The U.S. automatic content recognition market size was valued at USD 866 million in 2023 and is expected to grow at a CAGR of 14.6% from 2024 to 2030. The growing need for personalized content on digital platforms, such as social media, streaming services, and online video-sharing platforms, is a major driver of the market growth. The proliferation of on-demand video services, such as Amazon Prime, Netflix, and Disney+, further creates lucrative growth opportunities for the market growth.

In 2023, the U.S. accounted for over 28% of the global automatic content recognition market. ACR helps in enabling several smart TV features, such as the convenience of voice control, personalized viewing experiences, and integration with other smart devices. Thus, the demand for ACR is increasing with the increasing adoption of smart TVs. According to Leichtman Research, in 2022, more than 70% of homes with TVs in U.S. had a connected smart TV. These TVs can identify the content that is being played and can provide relevant information and recommendations to the viewers. So, the data received from smart TVs' content recognition can enhance the viewing experience. Users can easily discover new shows or movies based on their preferences with the help of this technology.

The media and entertainment industry has a significant demand for ACR technology as the need for more personalized viewing experiences are creating the demand for automatic content recognition (ACR) in this industry. The personalization feature offered by ACR leads to higher engagement rates and comparatively more effective advertising campaigns than traditional models. Advancements in ML and AI are also contributing to the growth of the ACR industry, allowing companies to analyze vast amounts of data and identify trends and patterns that were previously difficult to detect.

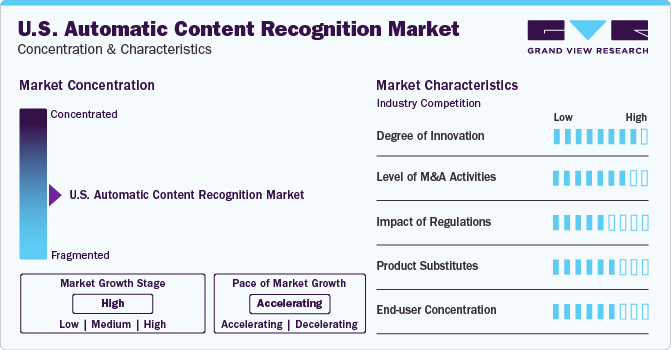

Market Concentration & Characteristics

The market for automatic content recognition in the U.S. is highly innovative. The integration of AI and deep learning techniques are enhancing ACR’s ability to analyze images, text, audio, and video even in complex and unstructured data. ACR systems are now being integrated with IoT devices also, which enables smart home devices to recognize and respond to the content in the ecosystem, enhancing the overall user experience.

The impact of regulations is also high on the market due to the growing awareness among content developers and rights holders about protecting the content in light of stringent regulations pertaining to intellectual property. Data is the backbone of automatic content recognition industry, and its mishandling or breach can cause huge harm to the companies.

The market is also characterized by frequent merger and acquisition activities. For instance, in January 2022, Digimarc Corporation acquired EVRYTHNG Ltd. This strategic move is expected to help the Digimarc provide a complete solution to the customers, combining efficient identification and cloud capabilities for gaining and managing the identification of objects.

End-use concentration is also high in the market as ACR solutions are used across a wide range of industries to utilize the insights obtained from content to provide enhanced user experience. For instance, ACR provides personalized content recommendations in media & entertainment. It allows to effectively place their advertisements to the targeted audience.

Component Insights

Based on components, the software segment dominated the market with the largest revenue share of over 74% in 2023. This is due to the growing demand for ACR software to identify and gather TV viewership data. ACR software identifies and analyzes audio, video, or other content in real-time, which instigates its usage across various industries, especially in broadcasting stations (TV and Radio), film production companies, marketing and advertising agencies, gaming, and media & entertainment. ACR software is also being used in the AdTech industry to provide insights on engagement metrics, ad viewability, and conversion rates.

The services segment is anticipated to grow with the highest CAGR over the forecast period. ACR services play an important role in facilitating content identification in real-time. Viewers can use smartphones or tablets to access supplementary information about the content, audience measurement and analytics, targeted advertising, content monitoring, and enhancement of the overall viewing experience. Key companies provide various services such as music recognition, music monitoring, cover song identification, second screen synchronization, live channel detection, speech to text conversion, etc.

Content Insights

Based on contents, the audio segment dominated the market with the largest revenue share in 2023. This can be attributed to the wide adoption of audio content across various devices. ACR allows the identification of audio content such as tracking copyrighted content for licensing and royalty payments. It also enhances user experience by providing context-aware content recommendations. Music streaming services use ACR to suggest songs or playlists based on what the user is currently listening to.

The video segment is anticipated to grow with the highest CAGR over the forecast period. The increasing preference for video content for entertainment and branding/marketing purposes is contributing to the growth of this segment. Majority of consumers prefer to see online video content from the brands, which leads to the proactive production of video content. Major industries include telecom, healthcare, BFSI, etc. Moreover, it also helps target ads to specific audiences, thereby improving the effectiveness of advertising campaigns.

Platform Insights

Based on platforms, the smart TVs segment dominated the market with the largest revenue share in 2023. This is due to the rising adoption of ACR technology in smart TVs. ACR tracks all the content users watch, which create lucrative opportunities for advertisers. ACR can serve relevant advertisements by identifying the content, improving the Ad campaigns' efficiency by increasing viewer engagement. Many smart TV manufacturers are now introducing this technology in their offerings.

The OTT segment is anticipated to grow with the highest CAGR over the forecast period. The rising trend of smart devices and content streaming services is driving the growth of this segment. Companies are manufacturing smart devices that are equipped with built-in streaming apps. The growth of video streaming industry is also expected to play a significant role in the demand for ACR technology in OTT applications. ACR software helps identify TV shows and movies, even when they are being streamed from sources such as Netflix or Hulu.

Technology Insights

Based on technology, the audio & video fingerprinting segment dominated the market with the largest revenue share in 2023. The growing demand for content fingerprinting technology to identify video, images, or audio content with high accuracy is driving the growth of the segment. The technology is used in data loss prevention, second screen synchronization and content verification, audience measurement and analysis, and enforcing and managing copyright. The integration of AI with fingerprinting technology to understand the content is further projected to create growth opportunities for the segment.

The speech recognition segment is anticipated to grow with the highest CAGR over the forecast period. The increased adoption of smart devices and technological advancements in artificial intelligence is favoring the segmental growth. Voice-activated systems and virtual assistants such as Siri, Google Assistant, and Alexa make it convenient to perform tasks such as sending messages, setting reminders, or surfing the internet.

Industry Vertical Insights

The media & entertainment segment dominated the market with the largest revenue share in 2023. The growing use of innovative technology solutions, the rise of video-on-demand (VOD), over-the-top (OTT), and subscription-based streaming services, and the integration of analytics and artificial intelligence are the major factors behind the growth of the segment. The proliferation of mobile TV and multi-screen services for content viewing has created a demand for media and entertainment companies to use ACR technology solutions to meet customer requirements of the content.

The healthcare segment is expected to witness the highest CAGR over the forecast period. ACR helps streamline documentation workflow, improve patient care, and reduce administrative burdens by identifying and sorting medical documents and patient data. It also helps the healthcare professional to focus on patient care more efficiently. The technology brings together advanced speech recognition and voice-enabled workflow capabilities to reduce errors and time-consuming tasks.

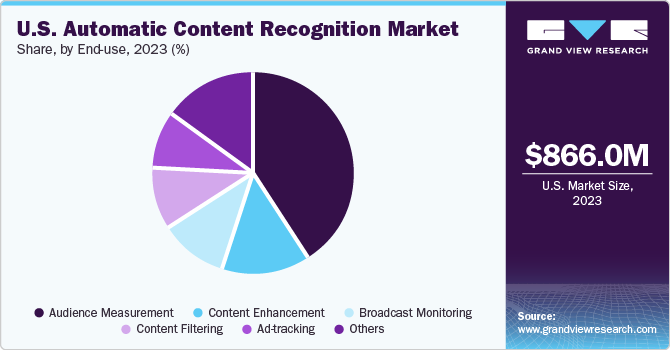

End-use Insights

Based on end-use, the audience measurement segment dominated the market with the largest revenue share in 2023. ACR collects data from the Smart TVs and identifies and analyzes TV viewership data. The technology offers personalized content recommendations and advertisements, and enhances the overall viewing experience by providing content aligning with the individual's preference. Content producers and broadcasters can also assess their shows' performance by analyzing this data. ACR optimizes the audience measurement by combining content recognition with demographic data.

The ad-tracking segment is expected to witness the highest CAGR over the forecast period. ACR helps in delivering more targeted and relevant advertisements to viewers. This increases consumer engagement and conversion rate as ads can align with the interests and preferences of the audience. It also allows advertisers and marketers to analyze the performance of their ad campaigns in various content environments. With the help of ACR they can analyze which types of content or genres yield best results, and allocate the advertising budget accordingly.

Key U.S. Automatic Content Recognition Company Insights

Some of the leading companies in the market include Apple In., Google LLC, IBM, Microsoft, etc.

-

Google is an industry leader in the ACR market. The company focuses on business areas such as web-based search and internet-associated products and services, which include search engine, cloud computing, hardware, online advertising technologies, and software.

-

IBM Corporation is primarily engaged in providing data storage products for various commercial applications. It provides industrial IoT solutions through its GBS vertical and focuses on being a cognitive and cloud-based company and delivering industry-specific cognitive solutions and cloud platform.

Clarifai Inc. and Digimarc Corporation are some of the emerging companies in the U.S. automatic content recognition market.

-

Digimarc Corporation is involved in product digitization, delivering business value across industries through unique identifiers and cloud-based solutions as industrial, commercial, residential and consumer markets.

-

Clarifai specializes in computer vision, natural language processing, and audio recognition. Clarifai provides an AI platform for unstructured image, video, text, and audio data. Its platform supports the full AI lifecycle for data exploration, data labeling, model training, evaluation, and inference around images, video, text, and audio data.

Key U.S. Automatic Content Recognition Companies:

- ACRCloud LIMITED

- Apple Inc.

- Audible Magic Corporation

- Clarifai Inc.

- Digimarc Corporation

- Google LLC (Alphabet Inc.)

- Gracenote

- IBM Corporation

- KT Corporation

- Kudelski Group

- Microsoft Corporation

- Nuance Communications Inc.

Recent Development

-

In August 2023, Microsoft launched spatial audio for Teams to enhance communication and minimize meeting fatigue in audio and video conferences. It aims to mimic an in-person conversation by spatially separating the voices of individual meeting participants, which results in a more natural listening experience.

-

In June 2021, Clarifai signed a cooperative research and development agreement with the U.S. Army to work on a large-scale electro-optical/infrared data labeling effort.

U.S. Automatic Content Recognition Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.24 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, content, platform, technology, industry vertical, end-use

Country Scope

U.S.

Key companies profiled

ACRCloud LIMITED, Apple Inc., Audible Magic Corporation, Clarifai Inc., Digimarc Corporation, Google LLC (Alphabet Inc.), Gracenote, IBM Corporation, KT Corporation, Kudelski Group, Microsoft Corporation, and Nuance Communications Inc.

Pricing and purchase options

Free re Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automatic Content Recognition Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automatic content recognition market report based on component, content, technology, platform, technology, industry vertical, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Content Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio

-

Video

-

Text

-

Image

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart TVs

-

Linear TVs

-

Over-The-Top (OTT)

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio & Video Watermarking

-

Audio & Video Fingerprinting

-

Speech Recognition

-

Optical Character Recognition (OCR)

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Entertainment

-

IT & Telecommunication

-

Automotive

-

Retail & E-commerce

-

Audience Measurement

-

Content Filtering

-

IT & Telecommunication Electronics

-

Government & Defense

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Audience Measurement

-

Content Enhancement

-

Broadcast Monitoring

-

Content Filtering

-

Ad-tracking

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. automatic content recognition market size was estimated at USD 866 million in 2023 and is expected to reach USD 991 million in 2023.

b. The U.S. automatic content recognition market is expected to grow at a compound annual growth rate of 14.6% from 2024 to 2030 to reach USD 2.24 billion by 2030.

b. The smart TVs segment held the largest market share of 69.6% in 2023, owing to the rising adoption of ACR technology to track all the content users watch, which creates lucrative opportunities for advertisers.

b. Some key players operating in the U.S. automatic content recognition market include ACRCloud LIMITED, Apple Inc., Audible Magic Corporation, Clarifai Inc., Digimarc Corporation, Google LLC (Alphabet Inc.), Gracenote, IBM Corporation, KT Corporation, Kudelski Group, Microsoft Corporation, and Nuance Communications Inc.

b. Key factors that are driving U.S. automatic content recognition market growth include the increased demand for personalized content and an upsurge in the popularity of digital platforms, including social media, streaming services, and online video-sharing platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.